A general issue regarding the mismatch in names occurring in the PAN card and Aadhaar card has been surging day by day as in the common process to link the Aadhaar card to the tax return file, the issue of name mismatch recurs in every taxpayer application.

As the government has mandated the linking of Aadhaar cards while filing income tax returns, the issue has been stagnant if you are unable to link PAN with Aadhaar for a while and to revoke the issue, the government has summed up solutions regarding the name mismatch problem and has ordered that if any name mismatch occurrence persists, the taxpayer can have the option to attach a scanned copy of his her PAN card with the file.

Latest Update

- Individual PAN registration on the official e-filing portal is now mandatory, with Aadhaar-based OTP verification. View more

- The income tax department issued a reminder notification regarding linking PAN with Aadhaar by May 31, 2024, to taxpayers who have not yet done so. Consequences of not linking PAN with Aadhaar within 31st May 2024 lead to the deduction of TCS/TDS at a higher rate under Sections 206AA and 206CC of the Income Tax Act due to having an inoperative PAN for the transaction done before 31 March 2024.

Free Demo for Best ITR Filing Software

These are the following Important Steps to Link Aadhaar with PAN Card

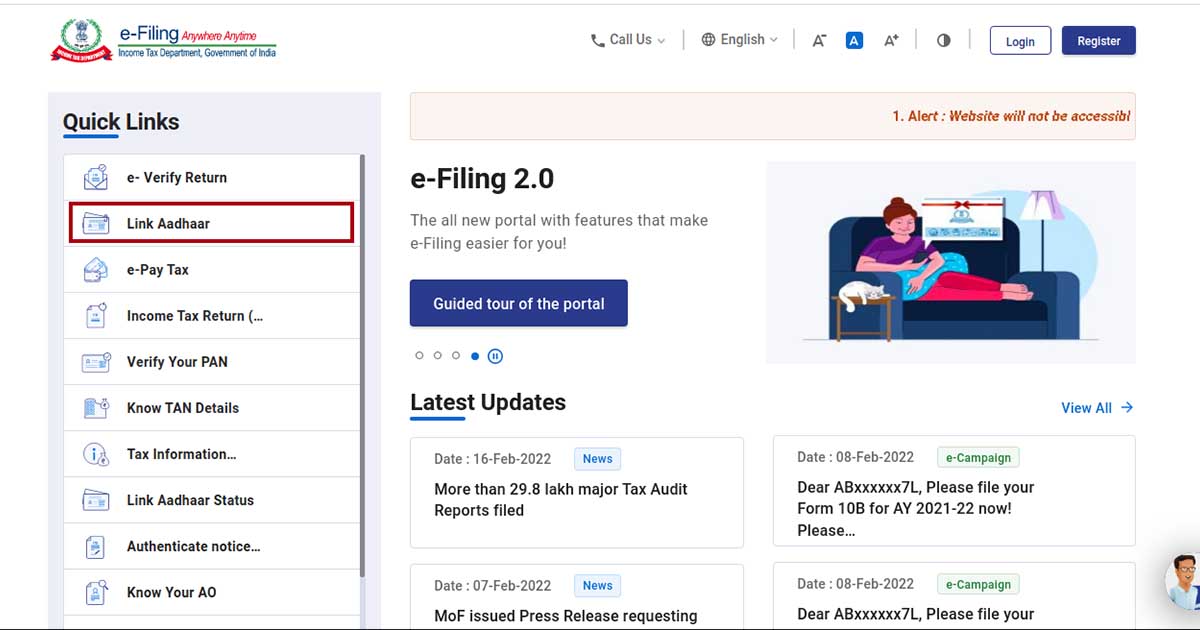

The Income Tax Department has disclosed how to Link PAN with Aadhaar in just simple steps. In fact, it doesn’t require login or registration at the e-filing website. Anyone can avail of this facility and link their Aadhaar with their PAN. Just follow the simple steps given below and link your Aadhaar with your PAN:-

Step 1: Visit www.incometaxindiaefiling.gov.in and click on the left-hand side of the website under the Services menu> Link Aadhaar.

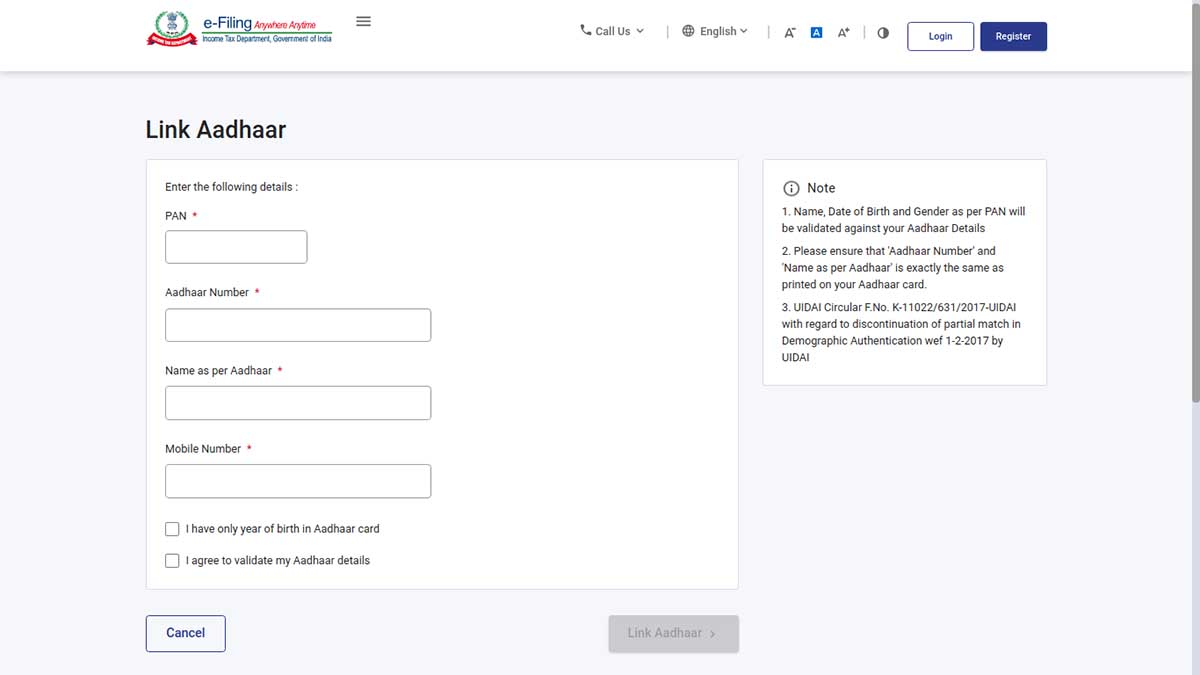

Step 2: Mentioned the required details, PAN number, Aadhaar number, and name, must ensure that you have to ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

UIDAI is the government website for Aadhaar. After the verification from UIDAI, the linking will automatically be confirmed.

Step 3: If in a case there is any slight difference between the Aadhaar name provided by the taxpayer as compared to the actual name in Aadhaar. A One-Time Password (Aadhaar OTP) will be sent to the registered mobile number with Aadhaar. Taxpayers or candidates must be sure that the date of birth and gender in PAN and Aadhaar are exactly the same.

If in a case, the Aadhaar name must ensure that you have ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

Apart from this, the government authority has also proposed to include a column on the official website of the tax department in which a link will be provided to link the Aadhaar card by which an OTP will be generated in any name mismatch scenario occurs.

The OTP will come through the text message on the registered mobile number of the taxpayer and after entering the received OTP on the portal, the linking will be established between the Aadhaar card and the PAN card. The only condition which will fulfil this service is that the birth date must be the same on both cards in order to finalise the linking process.

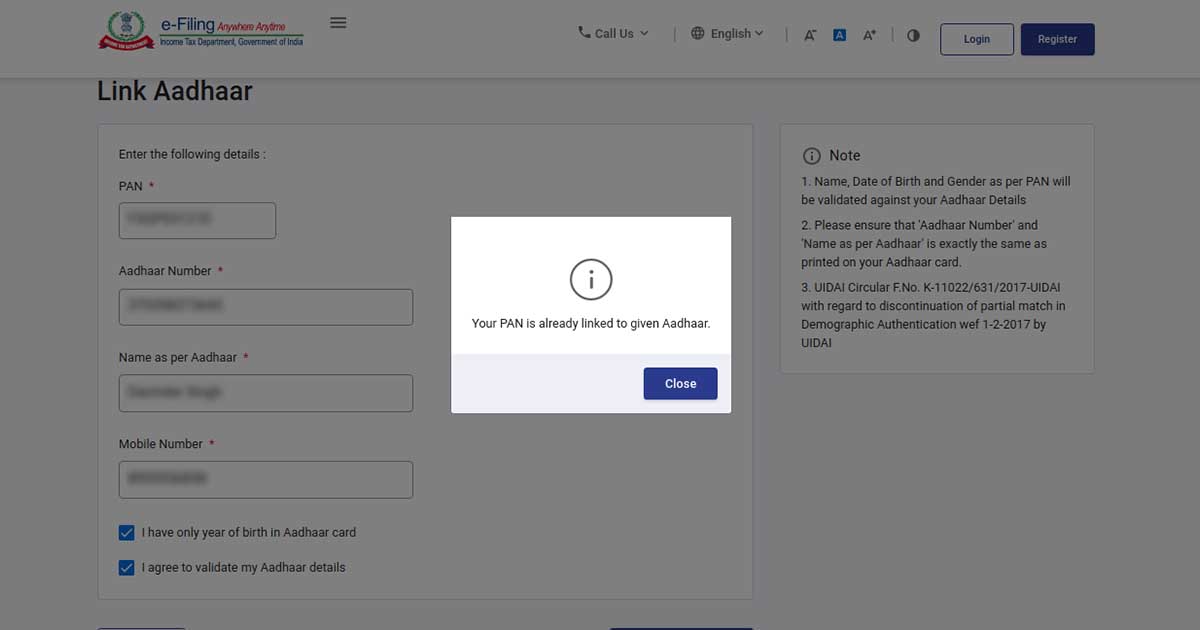

Step 4: After filling out all the details and the Aadhaar number, the system will show the message if in case your Aadhaar is linked with the PAN.

Read Also: Simple Steps for Filling New PAN Card Application Online

The name mismatch issue was persistent after the union minister Arun Jaitley proposed in the financial bills of GST to mandate the linking of Aadhaar cards in every filing of tax returns. Some of the common issues regarding the linking of the PAN card to the Aadhar card are, special character recognition, in which the Aadhaar card is unable to recognize any special while on the same side PAN card is able to recognize special characters.

The second issue in the row comes as the initial recognition in which the Aadhaar card is unable to recognize the initials whereas the PAN card takes the initials. Finally, the point of the middle name is also prevalent in the mismatch issue, as the Indian community changes the surname after marriage especially females, which in turn gives rise to the name mismatch.

One must remember, that the linking of both an Aadhaar card and a PAN card is only eligible in the case of name mismatch, which is when the birth date of the individual is mentioned the same on both government IDs. This has been mandated by the government as it will help in identifying the taxpayer’s identity on a firm basis.

Who all are Exempted from Linking Aadhaar Card and PAN

According to the central government and supreme court orders, there is a necessity for the linking of Aadhaar and PAN as also notified in the income tax department rules and regulations. Section 139AA was held by the court while the central board of Excise and Customs also released a notification mentioning all the exempted entities for the linking.

The following list specifies the exempted individuals on which section 139AA is not applicable:

- Those categorised as Non-resident Indians as per the Income Tax Laws

- Not a citizen of India

- Is of age 80 years or more at any time during the tax year

- Residents of the states of Assam, Meghalaya and Jammu and Kashmir

Most Important Reasons to Link Your PAN Card with Aadhaar

The Government of India has made it mandatory to link your Aadhaar with your other identities. Taxpayers who do not link their PAN card with their Aadhaar will be liable for all penalties under the Act for failing to link their PAN, and their PAN will no longer be valid after that.

But the thought may have struck your mind that you have been using your PAN card and suddenly need to link it with your Aadhaar. Well, here are the top 10 reasons why you should link your PAN with your Aadhaar.

Abide by the Law

The Government of India has made it mandatory to link your PAN card with an Aadhaar card under Section 139AA of the Income Tax Act, 1961.

Avoid Tax Penalties

If you do not link your Permanent Account Number (PAN) card with an Aadhaar card, you may be imposed with several charges and penalties like deactivation of your PAN card and a penalty of up to Rs. 1,000.

Makes the Verification Process Easy

Aadhaar is every Indian citizen’s unique identity, and it is accepted at all government portals. Tax authorities can easily verify the authenticity of the taxpayer if his or her PAN is linked with Aadhaar.

Helps Authorities Stop Tax Evasion

Having taxpayers’ PAN cards linked with their Aadhaar cards helps authorities prevent tax evasion by evaders. It makes certain that all taxpayers have their unique identification number, and it will be easy for them to track who is not paying the tax.

Speed up Your KYC Process

KYC is mandatory to avail of various financial services, like online transactions, UPI transactions, or personal loans. Linking your PAN with your Aadhaar makes the process of KYC updation easy and fast.

Make Tax Filing Easy

Linking your PAN card with an Aadhar card can ease the process of tax filing for you. Because it will pre-file your details in the Income Tax Return form or fetch details automatically.

Avail Various Governmental Services Easily

Government schemes and services require an Aadhar card to avail. It may make it necessary for all other services to have your PAN card linked with your Aadhaar card down the line. If you meet this prerequisite by linking your PAN card with your Aadhaar card, you can easily access various government services.

Easy to Make All Financial Transactions

After linking your PAN card with your Aadhaar, you can easily carry out various financial transactions. You are always asked to provide your PAN card when opening a bank account, making investments, and applying for loans.

Helps in Authenticating Identity

You can authenticate your identity easily, and you can also prevent identity theft by linking your PAN card with your Aadhar card.

Avoiding Duplication

It has happened so many times that a PAN with the same details has been mistakenly provided to two individuals. It’s a common problem brought on by many people possessing duplicate PAN cards. The misuse can be prevented by linking your PAN card to your Aadhar card.

My name is Yashas P how to type my last name and the first name in pan card application thought it is not allowing single letter P

Please contact to department

Well I have followed the instructions, but while checking into e-filling website it says updated but does not match to the database.

Is there any time period for it to be updated?

if there is any alternative method to approach this scenario?

Please contact to department.

My name in all education certificates, bank, PF, voter id, Licence etc is “RAMESH BABU J P”, However, while applying for PAN, which did not allow to mention initials, here is the first time in my life I expanded the initials for applying PAN, which is “RAMESH BABU JAYA PRAKASH”.

Now when I want to claim PF only, I was unable to link PAN because of initials in PF, Hence I ended up providing the full name to link PAN in PF account.

when I try to link Aadhaar to PF it was not successful because Aadhaar had Initials. Hence I updated my Aadhaar from “RAMESH BABU J P” to “RAMESH BABU JAYA PRAKASH”. Now Aadhaar & PAN linking is successful in UAN account.

after all this I put for Online claim of my pf amount, it came back rejected saying Name in Bank records(RAMESH BABU J P) is not matching with UAN(RAMESH BABU JAYA PRAKASH) records.

Now I am fed up with all these complications? Should I need to change the name in bank records as well? If I end up expanding name in all the records,

will I face any issue as my school certificates, Voter ID, Licence will have the name with Initials only? does all this still be valid?

Hereafter which name I need to quote for future. the one with Initial or the full name as per Aadhaar.

Please apply for the correction of your PAN.

Ramesh Sir,

I have the same issue. Could you please help me how did you resolve it. Appreciate your help.

I have a name mismatch in pan card then I have changed my name as per Aadhaar card still I can’t able link it. Same error

https://youtu.be/nuC1ox4oTMQ

Watch this to resolve the error

In IT my PAN & Aadhar is linked, but in PF portal PAN shows demographic errors and not verified.

Please contact to PF department.

In Addhar it Shiva Kumar P A but in UAN it is mentioned SHIVA KUMAR PA. Does it have a problem? I am facing while updating EKyc

CONTACT DEPARTMENT FOR ASSISTANCE.

My Aadhaar card ID is already linked with my PAN card on UIDAI. Income-tax site status shows as “linked”. But I have recently made corrections in my name on Aadhar card. How shall I update this on already linked Aadhaar card?

Please please help. Struggling for this since past few days. Need to withdraw my PF urgently.

Contact epfo department’s helpdesk.

Hi Manasi, did you get the solution?

Aadhaar name sivaraman pan SIVARAMAN date of birth 03/01l1985 seem but not matching name details

Please check Surname in Both Aadhar card as well as PAN Card.

My Aadhaar card is linked to my PAN card years ago but my epfo portal still shows “Name in EPFO doesn’t match with income tax records”. I have reached out to support teams of epfo and income tax regarding this and both are saying it’s not an issue with their systems and everything looks good on their side

My name on Pan card is different from my name on Aadhaar, on my pan card its first name and last name whereas on my Aadhaar its last name first name. I have corrected my name on my pan card and applied for a new card. I already got a message that my pan card is dispatched and is in transit. Assuming my income tax records are updated, I tried it again this morning but still shows the same error.

I don’t live in India and no longer work for the firm which had my epfo account. This has become a heck of a hassle since last 4 months.

Any help in fixing this issue would be highly appreciated .Pan card update on my epfo is also failing for some reason but linkage to Aadhaar was successful

Hi Naveen,

I have the same issue. Could you please help me how did you resolve it. Appreciate your help.

HI Naveen and Pavan,

Same issue here, Please guys let me know if you people found solution on same

Hi Naveen,

I too did the same. I don’t have any clue regarding it. If anyone finds any solution, please let us know.

Thanks,

Clive Mark

Hi,

I’m facing the same issue with linking my EPFO with PAN Card; The problem is that my Middle Name on the Income Tax Department Account seems to be expanded and on all my other documents it is abbreviated (Even on the PAN Card it is printed abbreviated).

I had my PAN card taken with the help of an agency and I only had provided them with my Aadhar card and photos for it, When I contacted them they were telling me that all the details are filled on the PAN Card based on the details collected from the Aadhar database.

Please Help

After the PAN is allotted. need to wait for one or two days to synch.

Hi,

In my UAN profile, PAN Verification shows failed. My name in Aadhar, UAN and bank account are all same.

It all has my name followed by fathers name. In my PAN card too, the first line has my name and the second line has my fathers name. Not sure why in KYC (UAN) has my Fathers name followed by my name.

When I tried to change the name in PAN in KYC it gives me the below error,

Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department)

How do I rectify this error?

My pan card name and income tax database name do not match but pan card name and Aadhaar card name is same.

my pan card name – T UDAYAKUMAR

Income database name -THOTI UDAYAKUMAR

Aadhaar card name -T UDAYAKUMAR and banks are also name is T UDAYAKUMAR

Please help me and give me some suggestions.

REGARD

T UDAYAKUMAR

I have the exact same problem. I realized that the PAN database last name criteria do not allow initials. So the initials have been expanded. I am not sure how to get this corrected. Please let me know if you have a lead.

Getting this error

Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department)

Name on Pancard: PATEL HARSH DINESHKUMAR

NAME ON EPF UAN PORTAL: HARSH PATEL

My Aadhaar card is verified

how can I withdraw my pf online. Please guide me, What to do next.?

You have to apply for either “change in PAN” or “aadhar” so as to match names in both databases.

Well, the UDAI system should match the Aadhaar number and PAN card number if it is rightly linked on filing site. If the names are different on both cards, it should verify the person by its numbers linked at the tax department. The UDAI systems should talk tax department system rightly. rather than, matching names, it should match the pan number and Aadhaar number. All, this I am saying to save our job to change the name on PAN or Adhaar. Since the IT systems have already linked PAN CARD and Aadhar card.

Hi Team,

Name on the pan card and income tax database in India are same.

I am getting an error like below

(Pan verification failed ->> Name against UAN does not match with the NAME in Income Tax Department)

I am trying to update my KYC details in UAN site

Please help how to resolve this issue.

I had paid 1.5 L in NPS. At 60 age this can be withdrawn. When I enroll for with drawl, the system says Mismatch between Aadhaar and PAN. Why not this mismatch is verified at the time of opening the NPS account?

Contact department’s helpdesk regarding this issue.

The government can modify the PAN data (name, father name, DOB etc) in line with Aadhaar data with OTP or thump impression verification. This will solve the problem of the public.

Hello friends please help me

My pan card is not working on paytm wallet and it is saying “error” and when I logged in e -filing income tax department. I filled up the details and its saying “PAN is Active but the details are not matching with PAN Database” Anyone who knows about this kindly let me know and help me to solve this issue thanks to you.

Please contact customer support to resolve the issue

My PAN card name printed in R KARTHIKEYAN My AADHAR card name printed in KARTHIKEYAN R pan active successful but data mismatch problem how to solve this problem. Aadhaar pan linked successful but UAN not linked. Please help.

Please contact department for such error.

Which department? Is it Income tax department? Please provide the contact details.

Contact details are available on the official website of income tax.

Spelling only matters or case sensitivity also matters between pan card & Aadhaar card names?

Hi Subhodh,

Am getting “Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department)” when I tried to update PAN in EPFO site.

Kindly suggest what to do next to update the PAN.

as per Traces- sai pradeep chilakapati

as per PAN- chilakapati sai pradeep

as per Aadhar-chilakapati sai pradeep

Check for the spelling difference if any in the name as mentioned in PAN card and Aadhar card. You need to apply for Aadhar card correction by mentioning the exact name as appearing in PAN card.

My name is printed on PAN Card is HEMRAJ but as per database it is showing HEM RAJ and My name is printed on AADHAR is HEMRAJ. Is this the reason that my PAN is not getting Link with AADHAR ? how i can resolve this problem.

You can file a correction application of pan.

My Name is different on PAN Card, different in pan card database and Aadhaar database, So from where I need to start to make my name same in everywhere.

Nowadays, PAN number has been linked with Aadhar. Then why do we need to update PAN number in KYC details? Please reply me

I have updated pan card to match with UAN name and got pan card with matching name with UAN. but here twist is I did not see any record in” know your pan site” after providing proper details… please site developers resolve this minor issues to ensure belief in hassle-free digitization of this site to make ppl feel more attached to govt in digital initiatives without raising finger by referring this issues……

Thanks!!! hopping early resolve of this issues by every taxpayers..

Hi

My name in PAN CARD been mentioned as SUNDARA MARIKUMAR K but in an income tax filing site it has been updated as SUNDARA MARIKUMAR so that when I try to update my PAN details in UAN it getting error “name against UAN does not match with the name in income tax department”.

My name in UAN and AADHAR been mentioned as SUNDARA MARIKUMAR K, Kindly help

Kindly somebody helps me,

I was updating my pan details in my EPFO MEMBER portal but I got an error “Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department) ..

So I went to e-login income tax portal to know my PAN NAME there I was shocked to see that First Name is displayed with my Father name and my name is displayed under Surname. but it is not printed the same on my PAN CARD, here it is printed correctly my name and my father name.

plz plz…. help me with the solution what I can do next

You need to contact income tax helpdesk regarding updation of a name on the portal.

My name is Md Muzaffar Iqbal as per all the documents like educational qualification, driving licence, voter ID, Aadhar card, Bank accounts etc. I tried to apply for pan card but it doesn’t accept MD or says initials not allowed. kindly suggest me what to do now.

Hello Team,

Even after changing the names correctly in both PAN & UAN database, Still getting the same error (PAN Verification Failed – Name mismatch in UAN & IT Dept) while saving the KYC details in EPFO site

Kindly do the needful

In this case, you have to speak with helpdesk of IT dept.

Hi Sowmya

You need to visit to the nearest PAN Centre and get it corrected…Need to take Aadhar Card and a Fee of 101/- and 2 photographs…it will take around 10 days and they will be sending you the new card with the changes.

Hi Sowmya,

Did you get any solution? If yes kindly post it here.

Thanks, & Regards,

Naveen

Hi Sir,

I need your help in understanding the Name format that is displayed on AADHAAR, PAN and UAN?

Is it the Surname/last name and then First name (or) First name and then Surname/last name is displayed? What is the format that govt(AADHAAR, PAN, UAN) follow to display the names on cards and in stores databases?

My name is displayed at ATHELLY RAJESH in all the 3 cards.

When I logged into efillings portal, there I can see my First name as Rajesh and Surname as Athelly, which is correct but on the card it displayed as Athelly Rajesh.

When I am trying to Link my PAN with UAN in EPF portal, the error ”

Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department)”

Kindly help.

Thank you.

Same problem I have. Did you got any solution

We are unable to proceed with your online PAN application due to following reason: Mismatch in any one or more of the following fields as per PAN application with the details available in UIDAI database. Name/ Gender/ Date of Birth/ Name as per Aadhaar. Kindly visit designated TIN-FC /PAN Centre and submit your PAN application using Biometric (fingerprint) facility. Your Online PAN application fee will be refunded within seven working days. The List of designated TIN-FC /PAN Centre is available at URL https://www.tin-nsdl.com/tin-pan-center.html

Apply date 12/05/2018

Token number: 0022825748

Same for me too. Don’t know what is the error? Can any one help?

Sir, My Aadhar and IT /PAN is linked and My Aadhar and UAN is linked…But my UAN and PAN are not getting linked…Any suggestions…Maybe because in the IT site it takes the surname first and displays…Any solution to this

I have linked my aadhaar card with pan card on e-filing. When I am trying to link my aadhaar card on epfo, I am getting an error that there is a mismatch of the name, date of birth or gender. If my aadhaar & pan are already linked on e-filing and there is no mismatch in the name on both the cards, how is it possible that I am unable to link my aadhaar on epfo.

How to find out what is the actual mismatch

My Aadhaar and PAN details are same but could not link, tried many times but receive mail as the mismatch. Where to write?

Contact to ITD helpdesk.

HI,

My parents have taken LIC under my name, but they have paid the premium as an investment, I have linked those lics with my aadhaar & my PAN, hope this is fine?

This is fine. Aadhar and pan can be yours as LIC is in your name too.

My wife name was Nitika Tripathi, after marriage she becomes Nitika Mishra. Do I need to match the surname to like PAN with Aadhar?

Yes you have to.

Hi,

When it is mandatory to match Aadhar name and Pancard name, Is it not wise enough to have the same nomenclature format for both databases?. My name in Aadhar is Babu.K where initials are allowed for Last name. In Pan card, it is Name as Babu , Father’s name as Karthikeyan . In New Income tax portal, it is mentioned as Karthikeyan Babu . Why is it so confusing ? Can’t we have the same format for all these 3 databases so that the user doesn’t have to break their heads like what is happening at present? Request to look in to this and do the needful as the portal is in the development stage only.

black

Hi,

I have my initial and name printed on the PAN card (eg:- A JOHN SMITH) and in my Adhaar it is printed as JOHN SMITH A.

In UAN it is mentioned as my PAN is not verified, and I tried to make investments in Mutual funds, and it was rejected as name mismatch in PAN &

Adhaar.

Only one mutual fund accepted my purchase, but I have received the statement as Albert John Smith, Albert is my father’s name, but I have no clue how it came there?

How to correct them? And do I have to have my initial on PAN & Adhaar?

Could you please how to sort this?

You have to update the document containing the wrong details and then you have to link your PAN with the Aadhar.

My name is Md Muzaffar Iqbal as per all the documents like educational qualification, driving licence, voter ID, Aadhar card, Bank accounts etc. I tried to apply for pan card but it doesn’t accept MD or says initials not allowed. kindly suggest me what to do now.

My Adhar card and PAN card details are same and correct, still, when I try to link message received, it fails due to mismatch information.

I checked so many times all the details i.e. my name, father’s name, surname, even the sequence of names, DOB, Gender all same and correct still it’s unable to link.. how to resolve.

Contact to department.

Check your name in the database of Income tax. As the name on the PAN card was displayed name which may differ from database name. Example: A K Ramu on PAN Card & Aadhar but Anil Karthik Ramu in the database of Income tax department. The same situation has happened to me. I called Income tax helpline so many times for this. At last, I find it. Helpline customer care person was not responding properly.

In case of technical errors, only helpdesk can resolve such issues.

Hi Krishna, Even I have the same issue. How did you proceed further?

Check whether there is any mismatch in your details in PAN card and Aadhaar card or else contact the department in this regard.

In my Aadhaar example A Raja, but in PAN it is Raja A. Why all the character are their why it is saying mismatch govt should take steps to solve.

Hello sir, As I am linking PAN with Aadhar, In e-filing website In place of Name as per Aadhar, I have written my father name and it is linked successfully. now How to change my father name bcoz in pan card my father name is there, in Aadhaar database my father name is there. How to change my name?

Please clarify your query.

My both PAN and AADHAR were successfully linked but while the link UAN with pan, it states that my PAN is not verified (error says– name not matching IT records). Please help me!! what should be done here? How come name is not matching though both are linked successfully?

Check that is there any mismatch in the name mention on PAN and name as per UAN.

Hi,

My brother spelling in Aadhaar card and pan card is different. how can I change this. while applying provident fund it showing the mismatch. How can I resolve this? Please advice on this.

First, you have to correct the spelling in the document, which has incorrect details and then you have to link your Aadhaar with pan card.

Correct the spelling in which proof it is incorrect then Aadhaar and pan name should be same also in UAN portal update the same name as per aadhaar and pan then only it resolved in UAN portal for PF.

Hi,

My Aadhar card DOB was wrong, then I corrected with enrollment centre and it got updated(On Aug 2017). But still, I am unable to link my PAN with Aadhar, getting the same error message.

Can you please help me out here.

Thank you.

I am also having PF withdrawal problem due to name mismatch between Aadhar and PAN database. Government is mandated the Aadhar reality not done any measures to do it. I have updated PAN with Aadhar no and a name and it was asked me check name as per the Aadhar, I did it same. But it’s taken wrong format name. First up all PAN database should not allow if the name is wrong from Aadhar, Even Customer has given right names still it took the wrong name. Without having these basic measures govt shouldn’t mandate the Aadhar. Because of this helpless govt and tax officials, the public is suffering a lot. Unless you are not having any right system better don’t put rules. First, improve your basic system in such a way to take the rule and then put rule. Let us see when our tax guys will wake up and see these basic problems.

My father name is misprinted with ‘E’ Instead of ‘i’ in Aadhaar card but my PAN card details are correct. How can I change my father name?

You have to rectify your father’s name in Aadhaar card.