Filing an income tax return is a scheduled process for every taxpayer and must be completed annually. The ITR filing is also a mandatory process to be followed for multiple reasons, including financial and record maintenance, while beneficial for the future loan perspective.

For FY 2025–26, it is to be noted that the due date for filing the Income Tax Return by an assessee is 31st October 2026 for all audit cases, while for non-audit cases, the due date is 31st July 2026. The revised ITR due date for non-audit cases is 31st December 2026. The due date for filing the Income Tax Return by an assessee who is required to furnish a report under Section 92E was 30th November 2026.

Note down, it is very important for all the assessee to file income tax returns online having an income of 2.5 lakhs per annum(excluding senior citizens) and to claim a refund. While it is a significant process, it is also easy to track refunds and ITR returns online.

Definition of E-filing

E-filing is the process of electronically furnishing the returns of the taxes paid by you. The government allows both Online and Offline Income Tax Return (ITR) filing, whichever is convenient for the taxpayer. However, E-filing or electronic ITR Filing has overtaken the traditional offline method as many taxpayers find it convenient to file the returns from their offices without much paperwork. Above all, e-filing is a free-of-charge procedure.

Why You Must File ITR Before the Due Date?

It will be more correct to make sure that all the details of the accounts are true, and the ITR returns on filing need much more attention. To avoid errors, one needs to check documents, tax statements, interest income certificates, etc. If one returns the ITR, then the chances of errors decrease.

The loss will be moved forward: The Income-tax plan is to carry ahead the losses from one fiscal year to another. Although taxpayers can avail of this if they file ITR before the expected last date.

Quick Refund: If the taxpayers file their return before November 30, then refunds can be processed for those who are waiting for the same. Earlier ITR filing may be confirmed before it gives quick tax rebates.

Let’s Come to the Step-by-Step Process of ITR Filing FY 2025-26

As mandated by the Constitution of India, Income tax return filing is a foremost requirement for all registered taxpayers in India. Thanks to the outbreak of technology in India, the ITR filing can now be done online mode.

E-filing or electronic filing is the process for filing online Income tax returns, and the write-up is aimed at giving you the complete information on the e-filing ITR process, its significance, eligibility, deadline and so on.

Income Tax Calculations

Firstly, the taxpayer needs to make the exact calculation of his taxable income in line with the current tax norms applicable to him. Here, calculate your free Income Tax

Document Organization

- The taxpayers will have to obtain all the documents of monetary value, i.e. income, investments, assets, and bank accounts, apart from government documents like Permanent Account Number (PAN) and Aadhaar number or Aadhaar enrolment ID. It is not necessary to attach these documents while filing ITR online, but still, one needs them to fill out the form due to the details engraved on them.

- Also, the documents related to income other than salary, like capital gains, rental income and dividend income, will be needed while filing the IT online, and it is also suggested that the taxpayers should maintain a separate file of documents for every previous ITR filed.

Document Checklist For Filing ITR Online

The most important thing that the assessee would require to start with the filing of ITR is the required documents. Documents the assessee would need to vary depending on the type of income he has:-

Personal Documents

- PAN Card

- Aadhaar card or Aadhaar enrollment number

- Details of domestic assets and liabilities

- Details of foreign assets

Income-related Documents

- Details of exempt income earned during the year

- Form 16/16A/16B to fill in the details of income

- Balance sheet, P&L account statement and other audit reports, wherever applicable

- Details of Sales/Turnover/Gross Receipts during the year

Bank-related Documents

- Bank statement

- Interest statement of the year

- Details of all bank accounts held during the year( IFSC code, account number, name and nature of account)

Tax-related Documents

- Copy of last year’s tax return

- TDS certificate

- Saving certificate or deduction

- Form 26AS to cross-check TDS details

Real Estate-Related Documents

- Buyer agreement, sale deed and investment documents to show capital gains on sale and details of exemption if availed or not

- Lease deed to show rental income

Investment and Expense Related Documents

- Home loan statement to claim a deduction on the Principal amount and interest on the home loan

- Proof of investment, such as a mutual fund account statement

- Premium receipt for life insurance plans

- Medical insurance premiums and preventive checkup receipts, etc.

Other documents, such as proof of donation

Income Tax Preparation

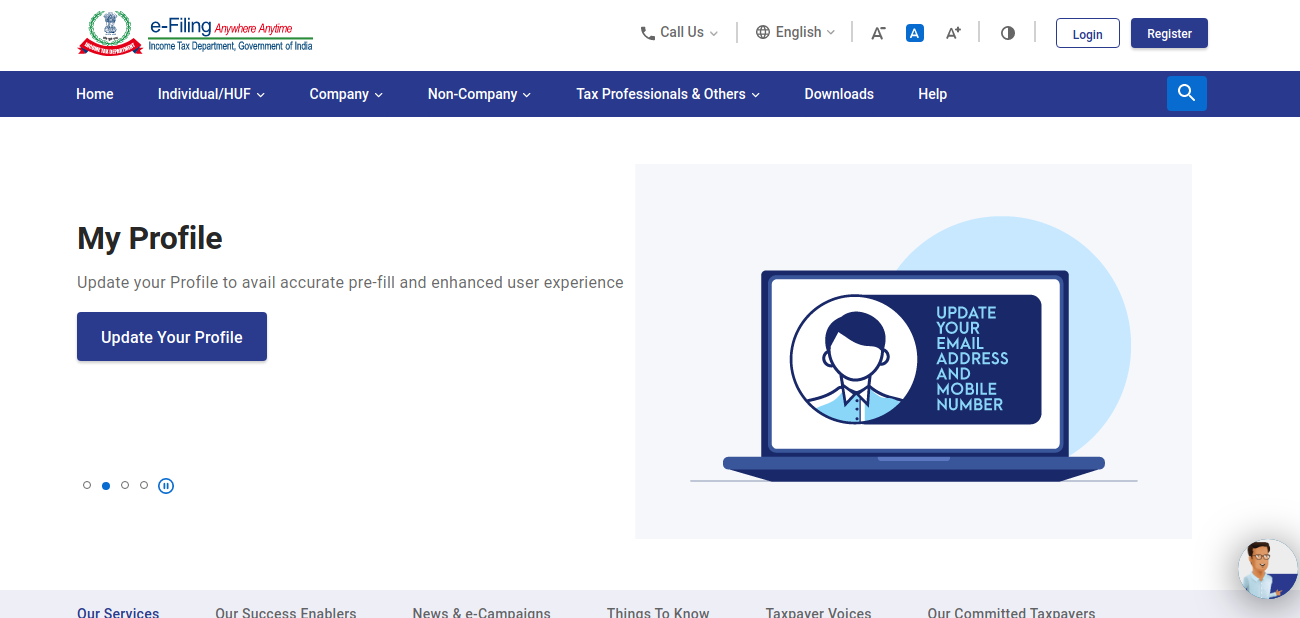

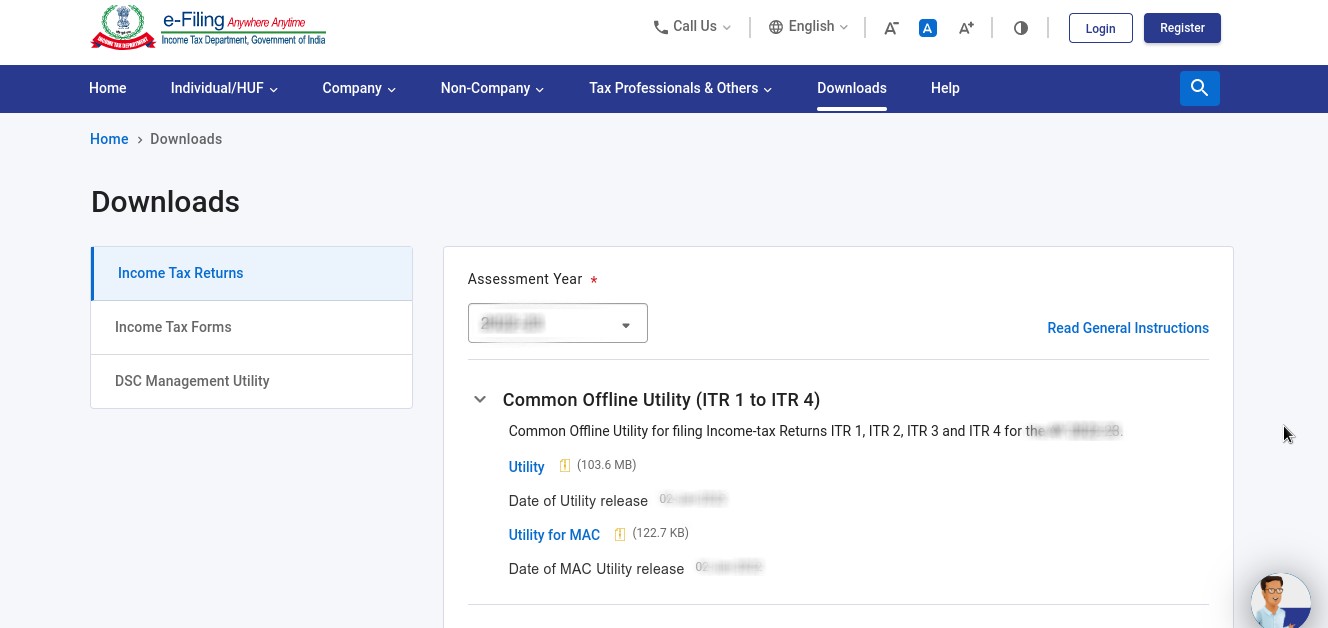

Go to the official site for income tax filing (link: www.incometaxindiaefiling.gov.in) > Go to Downloads, then select AY > Download Common Offline Utility> Install the setup

Create an ITR e-filing Account

After having all the desired documents handy, one must log in to an ITR e-filing account through the Income Tax Department’s website. The details like user ID (your PAN) and password will be needed for logging.

However, if a taxpayer is a first-time ITR filer, then they may create an ITR e-filing account on the same website with a few other details.

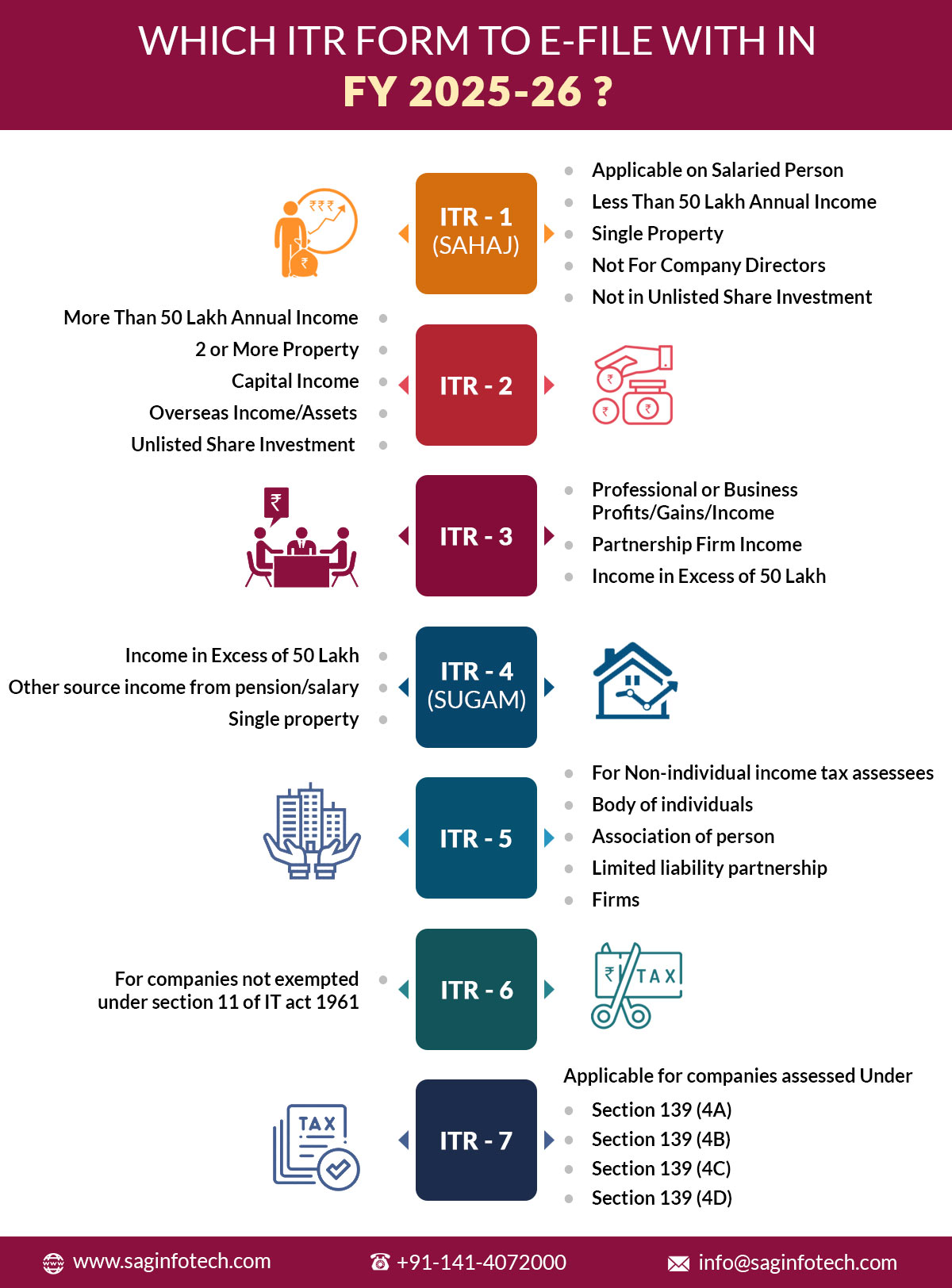

ITR Form Selection

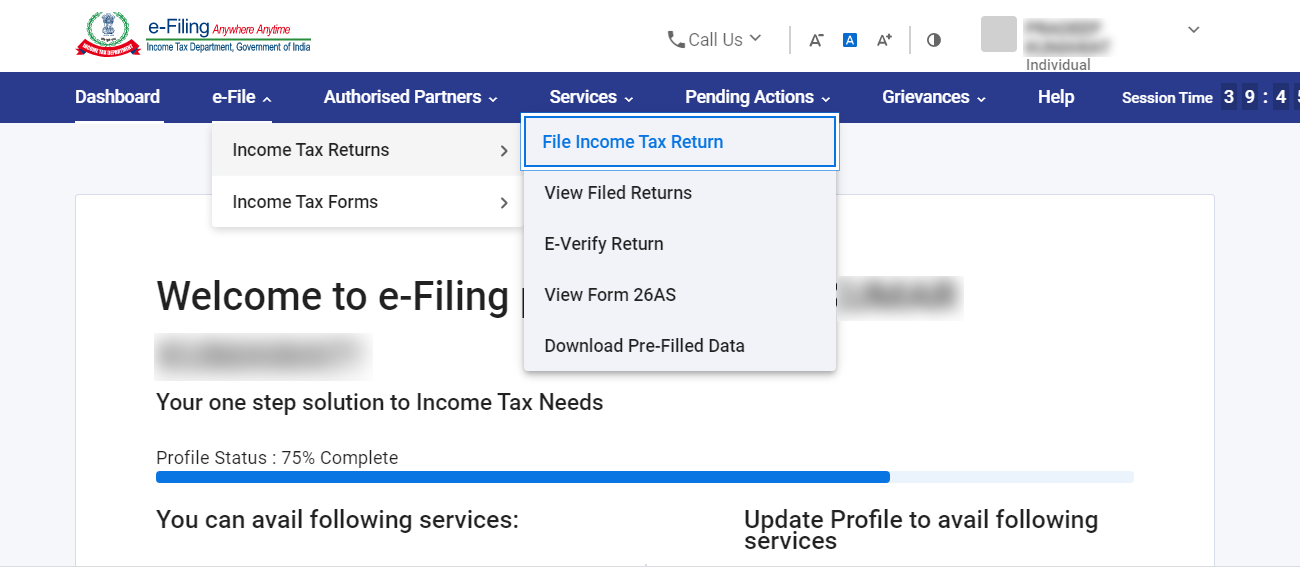

After logging into the ITR e-filing account, one must click “filing of the income tax return” on the dashboard. Then select the assessment year (AY) for which the taxpayer has to file an ITR. After which, choose the ITR form. For Individuals and HUFs having income from profits and gains of business and profession, ITR 3 is mandatory.

For Individuals, HUFs and Firms(other than LLP) being resident and having total income up to Rs 50 Lakhs (75 lakhs if 95% revenue receive in online mode) and income from business and profession which is computed under section 44AD or 44ADA or 44AE ITR-4 is to be filed( Not for individuals who are a director in a company or have invested in unlisted equity shares).

According to a tax expert, “ITR-1 does not apply to non-residents and not ordinarily residents, the ITR-2 form is no longer applicable for individuals or HUF (Hindu Undivided Family) who have profits and gains from any business or profession and are required to file form ITR-3.”

Read Also: Important Steps for Beginners to Filing Income Tax Return

In case one selects the wrong ITR form, the particular form is considered to be defective, so it is advisable to be cautious. Swapping of ITR forms is also not suggested, as, for example, ITR 1 and ITR 2 are 2 different forms. ITR 2 is for those having an income of more than 50 lakhs and having 1 or more houses, while ITR 1 is for those who have less than 50 lakhs of income and a single house.

So, in case a person filed ITR 1 instead of ITR 2, then it would be considered a return that will be treated as defective, and you will need to file a revised ITR using the correct form. File the return within the specified timelines.

Various ITR Forms and Their Applicability

- ITR 1 – For Individual residents (Not Ordinarily Resident) having total Income up to Rs 50 lakhs, Salaried income, single House Property, Other Sources Income (Interest, Dividend, etc.), and Agricultural Income up to Rs 5 thousand (Not applicable to Individuals being Directors in a company or have invested in Unlisted Equity Shares)

- ITR 2 – For Individuals and HUFs not having income from profits and gains of business or profession

- ITR 3 – For Individuals and HUFs having income from profits and gains of business or profession.

- ITR 4 – For Individuals, HUFs and Firms (other than LLP) being a Resident having a total of up to Rs 50 lakhs and having income from business and profession computed under sections 44AD, 44ADA or 44AE and agricultural income up to Rs 5 thousand (Not applicable to Individuals being Director in a company or has invested in Unlisted Equity Shares)

- ITR 5 – For persons other than:-

(i) Individual,

(ii) HUF,

(iii) Company and

(iv) Person filing Form ITR-7 - ITR 6 – For companies other than those claiming exemptions under Section 11

- ITR 7 – For persons, including companies, required to furnish returns under sections 139(4A) or 139(4B) or 139(4C), or 139(4D)

Note: Income earned in the previous year is called a financial year, while an Assessment year is a year succeeding the previous year in which the taxpayer assesses their income and files their return of income.

Convert the File Into JSON Format

Once the details are validated > select the ‘Download JSON’ button

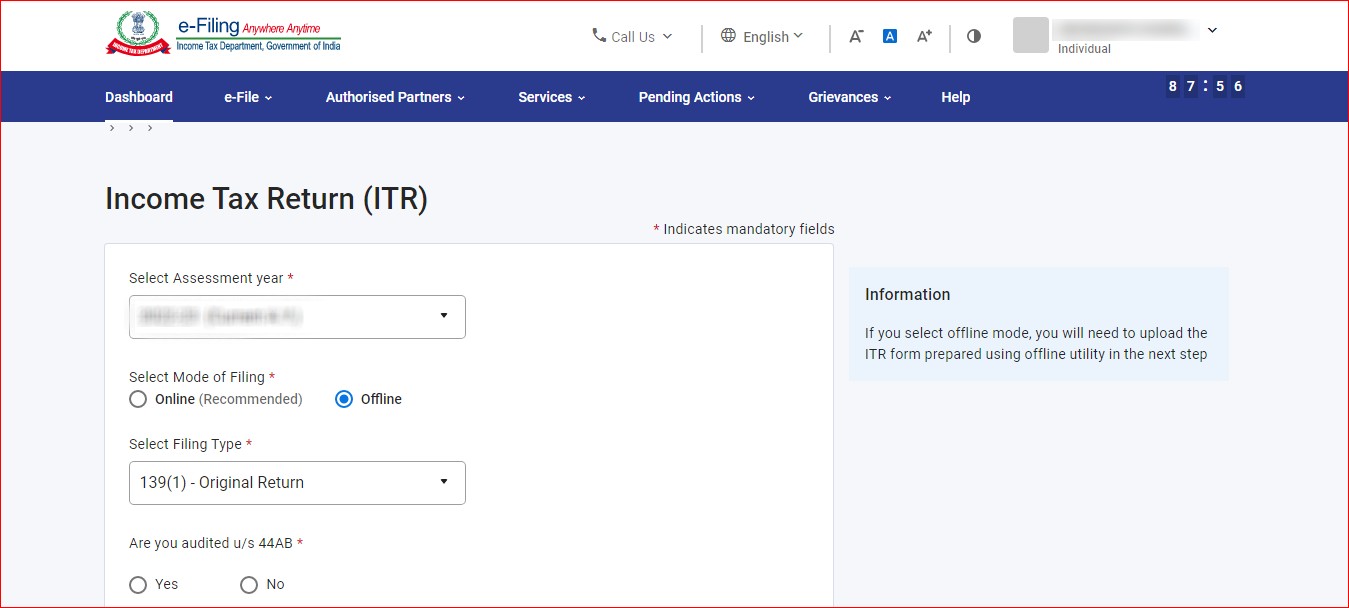

JSON to Income Tax Portal

The last step is to upload the JSON file to the official income tax portal. Log in to the portal > Select ‘e-file’ > Select ‘Income Tax Return’ option from the dropdown

Filling Out Details

The first and foremost details are the Aadhaar number or Aadhaar enrolment ID, which is mandatory to file an ITR return online, as the system won’t allow the filing of returns online without this information.

According to the expert, “ITR forms are seeking a lot of new information like the break-up of salary and house property income to be furnished in ITR-1 form instead of a single amount of income/loss, as required to be furnished earlier.”

E-verification of Returns & Uploading

The last step to file the IT return is to verify your details and upload them to the portal. The ITR window will remain open for 30 days to get your return verified from the date of return submission. One can also send a duly signed copy of ITR-V to the Central Processing Centre tax department by ordinary or speed post.

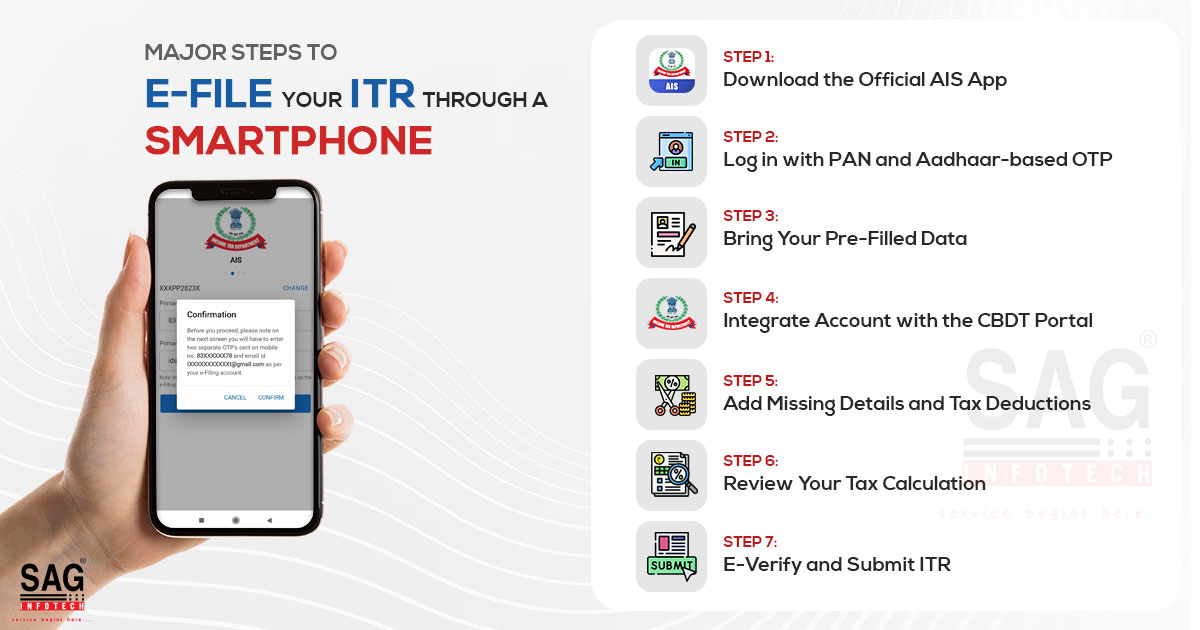

How to e-file Your ITR Using a Smartphone?

Eligibility for Income Tax Return Filing

The eligibility for filing the ITR is decided based on the annual income earned by an individual. Below is the threshold limit that decides whether to file the returns.

- Individuals below 60 years – Yearly Income Rs 2.5 lakhs or more

- Individuals between 60 years to 80 years – Yearly Income Rs 3 lakhs or more

- Individuals above 80 years – Yearly Income Rs 5 lakhs or more

There are other factors under which one needs to file the returns:

- Income Source – Salary, Rent from the property, Income from Business or Profession, etc

- Claiming the refund – It is mandatory by law for an individual to file their ITR if they are claiming a refund from the government.

- Loan or Visa Application – It is easier for an individual to get a loan or visa if they are a constant ITR filer.

- A Business – It is mandatory for every registered company operating in India to file returns.

Assessment Year v/s Financial Year

Assessment Year is the period just after the Financial Year. It is the time when the income earned in the preceding Financial Year is computed to judge the tax liability.

Financial Year is the period in which the income is earned by a business, individual or any financial entity. The period is said to start from 1st April to 31 March.

Calculating the Payable Income Tax

Make use of the tax calculator to find out the exact amount payable in tax. The utility is available free of cost online. Using the utility, one can find the accurate tax liability for the three consecutive financial years at once.

E-Filing Advised to Non-assessees

Filing a return is always beneficial for the taxpayer as well as the government. Individuals can file a zero return if they are not paying taxes. This is helpful in case of availing of a loan from the bank or applying for a visa.

Multiple Tax Returns Filing at One Time

Taxpayers can easily file multiple returns from a single account. An Effective e-filing Income Tax software helps you file the forms of the current year as well as the previous year under one user account. You can compute the taxable amount and file the returns anywhere and anytime within your comfort zone.

In Case I Lost My Income Tax E-filing Password

There are instances where taxpayers are in trouble because they have lost their passwords for their Income Tax returns. One must always store the credentials in a safe file, the access to which is with the taxpayer himself, the concerned CA or the accountant.

In such a case, there is an option for resetting a password. This can be done by using Forget your Password, put your PAN and select the appropriate option through which the Income Tax Department Validate your OTP and provides a way to change your password.

To be noted: It is suggested to mention the PAN with Aadhaar in the IT Returns. If Aadhaar has not yet been received, then one can mention the enrollment number in the return.

Frequently Asked Questions About ITR Filing

Q.1 – How can I mention the Aadhaar Enrollment Number in the ITR?

There is a separate column for mentioning the 28 digits Aadhaar enrollment number in the ITR. First, mention the 14 digits Aadhaar enrollment id then mention the date.

Q.2 – There are deductions that go unnoticed in Form 16. Is it possible to claim the refund on such deductions?

There are various deductions under Sec 80 (ELSS, PPF, Life and health insurance, NSC, Children tuition fees,5 years fixed deposit, donation for charity, repayment of a home loan) that are not mentioned in Form 16 given by the employer. It is possible to claim a refund on such a deduction in the ITR filed by you. You can even claim the HRA in the ITR

Q.3 – What are the consequences of not filing the ITR on or before the due dates?

There is a penalty u/s 234F of Rs. 5,000 if one fails to submit the returns on or before the due dates. However, the amount of penalty shall not go beyond Rs. 1000 if the annual income of the taxpayer is less than or up to Rs. 5 Lacs.

Q.4 – Which form do I need to file if my annual income is above Rs 50 lacs?

ITR 2 is the annual return form to be filed in case if the taxpayer’s annual income is Rs. 50 lacs or more. He is then not eligible to file ITR 1. The taxpayer also needs to disclose the details of the assets owned by him. Assets and corresponding liabilities are required to be mentioned in Schedule AL of the ITR Form.

Father name rong

PAN card mismatch ho Raha hain please help

i am a retired senior citizen Pensioner NON RESIDENT, staying Africa having income less then Rs5lac but not able to file a return 2019-2020 assessment

the extended due date gone. India

The consultant said that the new system not accepting any Data for 2019-2020

And can not file now India

Advise how to file the return? What is ITR form no/

If not able to file what is the problem?

kindly assist.A lot of thanks

ITR Form depends on nature and source of income. Please contact CA/Professional

Pan card processing huva ya nahi balance to cut gaya

Hi am just now working in India, do I need to pay tax??? Since 2011 I was in a UAE resident.

It depends on your income.