The Government of India has made several changes to the ITR forms that individuals must use when filing their income tax returns. The new forms (ITR-1, 2, 3, 4, 5, 6, and 7) have been currently used for the Assessment Year 2025-26.

The IT department has enabled the common offline utility for Windows platforms for ITR 1, ITR 2, ITR 3 and ITR 4 for AY 2025-26. Let’s have a deeper look at the Income Tax Return ITR Form.

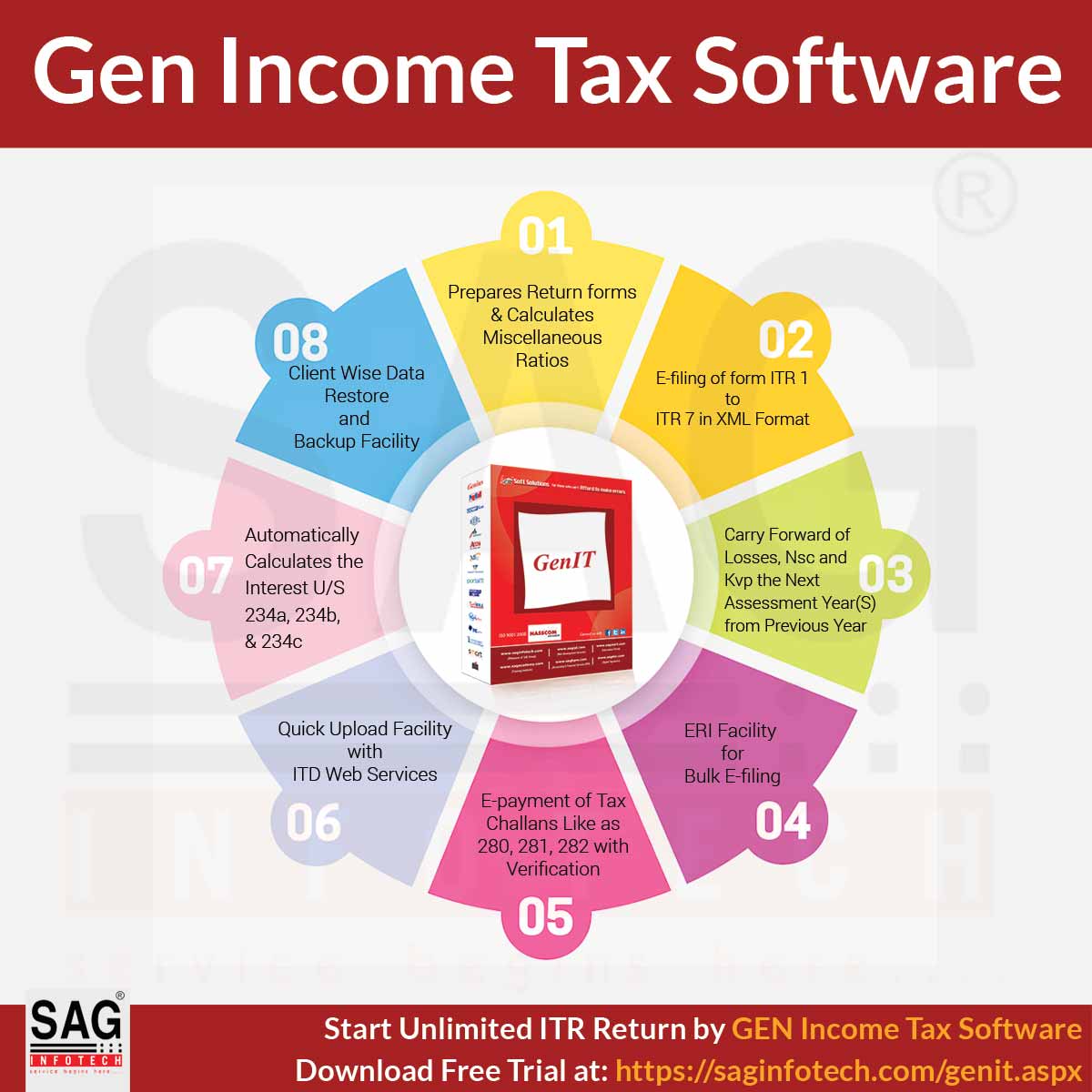

File ITR Forms Via Gen IT Software, Get Demo!

ITR 1 Form is filed by taxpayers and individuals who are residents with a total Income of up to INR 50 lakhs when the Income is from Salaries, One House Property, Other Sources (Interest, dividends, etc.), and Agricultural Income up to INR 5 thousand.

ITR 1 SAHAJ Form is not for Non-ordinary residents, or for an individual who is either a Director in a company or has made an investment in Unlisted Equity Shares.

The ITR-2 is filed by individuals or HUFs who are earning income other than income from “Profits and Gains from Business or Profession and Individuals who are not eligible to file the ITR-1 Form”.

The ITR-3 Form can be filed by those Individuals and Hindu Undivided Families having income from Proprietary business or from carrying out his/her profession and who are not eligible to file ITR 1, ITR 2 or ITR 4.

ITR 4 Sugam Form is for taxpayers who have opted for the presumptive income scheme under Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act.

Note: If the turnover of the business is more than Rs 2 crores, then the taxpayer will have to file ITR-3.

ITR 5 Form is meant for firms, LLP, AOP (Association of persons) and BOI (Body of Individuals), Artificial Juridical Person (AJP), co-operative society, Estate of deceased, Estate of insolvent, Business trust and investment fund, subject to some conditions.

ITR 6 is a tax return form for all companies that are not claiming the exemption u/s 11 (Income from property held for charitable or religious purposes). The 31st of October is the due date for filing the ITR 6 for AY 2025-26.

ITR 7 Form is meant for all Charitable /Religious trusts u/s 139 (4A), Political party u/s 139 (4B), Scientific research institutions u/s 139 (4C), University or Colleges or Institutions or Khadi and Village industries u/s 139 (4D) that require the exemptions. There are different sections divided into categories, namely:

- Under Section 139 (4A)- if they earn from a charitable /religious trust

- Under Section 139 (4B)- if they earn from a political party

- Under Section 139 (4C)- if they earn from scientific research institutions

- Under Section 139 (4D)- if they earn from universities or colleges or institutions or khadi and village industries

Sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW mandates the electronic filing on or before the date of filing the return of income.

Gen Income Tax Software is an advanced software solution for faster return filing of ITR 1 to ITR 7 forms that fulfil all your computation needs in compliance with the prevailing Income Tax norms. Calculation of Income Tax, Self Assessment Tax, Advance Tax and Interest calculation u/s 234A, 234B, 234C could have never become so accurate and hassle-free without the invention of this “Gen Income Tax Software”.

The software is meticulously designed, well considering all the government rules and regulations, in such a way that there is no room left for errors, and the returns can be uploaded directly to the government income tax online portal.

I am a retired teacher and receiving a pension. I withdraw cash exceed i ng2000000 tds deducted. i am filling itr continuously sincelast20years.which it form applicable in which head withdraw amount shown

Section 194 jb kis itr mai file karna hogy mai technical consultancy per tha tds 6720 rs claim karna h plz reply me

yes it is compulsary to take itr

ITR 4 jayega 44ADA mai…

I had worked as a Coding teacher with Whitehat Jr. They had paid me the salary and issued Form 16-A for the TDS deducted by them under Section 194-JB. Please advise which ITR to be filed and under which head this income will be shown in ITR.

ITR 4 jayega 44ADA mai…

I expect online filing of ITR-2 for AY 21-22 will be available in new IT Portal shortly

Ho rhe h ab file itr2

I retired in Jan,2021 My gross income Including commutation of PF, gratuity, leave incashment, interest income is more than Rs 50lacs, but taxable is less than 27 lac, which form reqired to be fill

ITR 1 or ITR2.

I have income from salary, divided,, interest income only

I am working in a private firm. My salary is ₹20000/- per month only.

Can I file itr.

Yes You can file ITR

Yes you can file ITR

Hi, In AY 20-21 I was in the job for 4 months and then I started a business for the rest of the AY. Which ITR, I shall file?

ITR-3 is applicable if you having income from business and profession and salary also.

How can I fill itr for enterprises business

It depends on your income