What is the ITR 4 Sugam Form?

ITR stands for Income Tax Return and ITR 4 Sugam Form is for the taxpayers who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE of the Income Tax (IT) Act. If the turnover of the aforementioned business becomes more than Rs 2 crores, then the taxpayer can’t file ITR-4.

Provided Section 44AD and Section 44ADA limit increased to 3 crore and 75 lakh, respectively amounts received during the previous year, in cash, does not exceed 5% of the total gross receipts of such previous year.

Latest Update in ITR 4 Form

- The IT Department has released the latest version of the Excel-based utility (V1.3) and the JSON Schema of ITR-4. Download now

- CBDT has released a new schema for e-filing of ITR 4 form for residents, HUFs, and firms (other than LLPs) with a total income of up to Rs 50 lakh, as well as income from business and professions under sections 44ADA, 44AD, and 44AE, and agricultural income up to Rs. 5 thousand.

Who can File the ITR 4 Sugam Form?

ITR 4 Sugam form can be filed by the individuals / HUFs / partnership firm (other than LLP) being a residents if:-

- Total income does not exceed Rs. 50 lakh.

- Assessee having business and profession income under section 44AD,44AE or ADA or having interest income, family pension, etc.

- Having agricultural income up to Rs 5,000/-

- Have a single House property.

- Long Term Capital Gain u/s 112A provided the LTCG 112A does not exceed Rs.1.25 Lakhs and there is no loss to be carried forward or set off under the capital gains head.

It must be noted that the freelancers involved in the above-mentioned profession can also choose this scheme only if their gross receipts are not more than Rs 50 lakhs.

File ITR 4 Via Gen IT Software, Get Demo!

Who Can’t File the ITR 4 Form for AY 2025-26?

A person whose income from salary or house property or other sources is more than Rs 50 lakh cannot file ITR 4 Form for AY 2025-26. A person who is a director in a company or has invested in the unlisted equity shares or has any brought forward/ carry forward loss under house property income cannot file the ITR 4 for AY 2025-26.

Read Also: Section-Based Income Tax-Saving Tips For Salaried Person

Due Date for Filing ITR 4 Sugam Form for FY 2024-25 & AY 2025-26

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- FY 2021-22 (AY 2022-23) – 31st July 2022

Guide to File Income Tax Return (ITR) 4 Sugam Online:

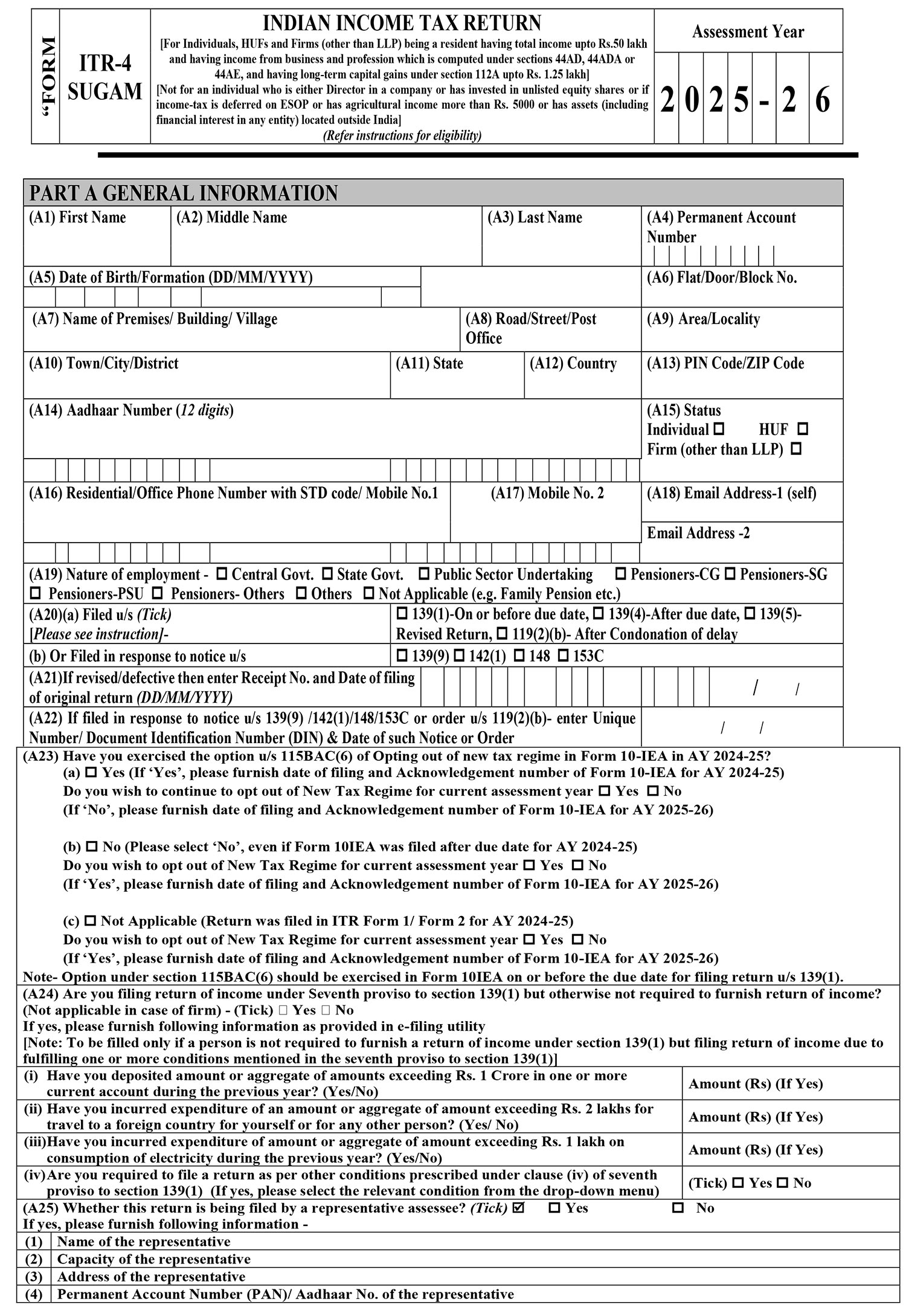

PART A: General Information

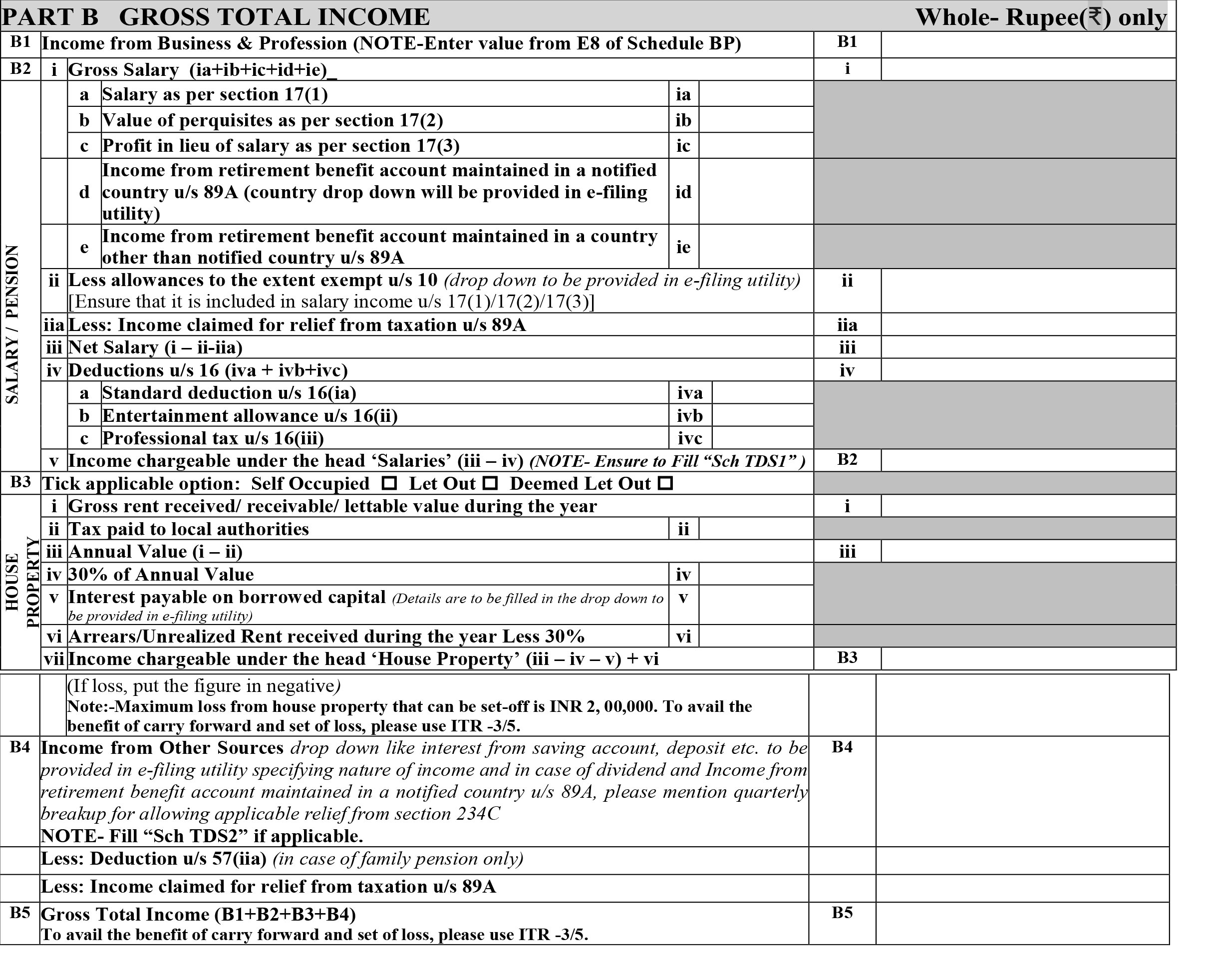

Part B: Gross Total Income

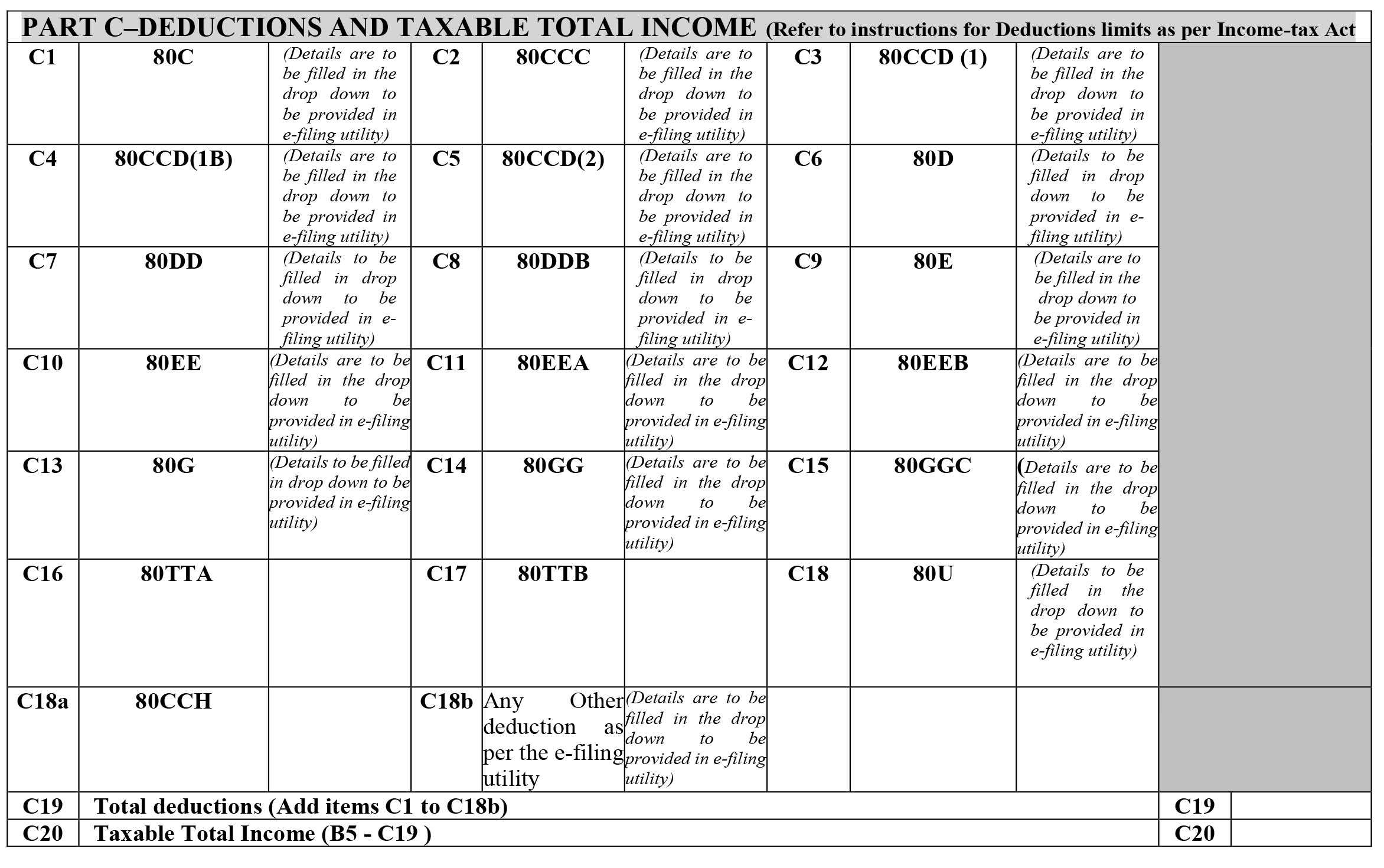

Part C: Deductions and Taxable Total Income

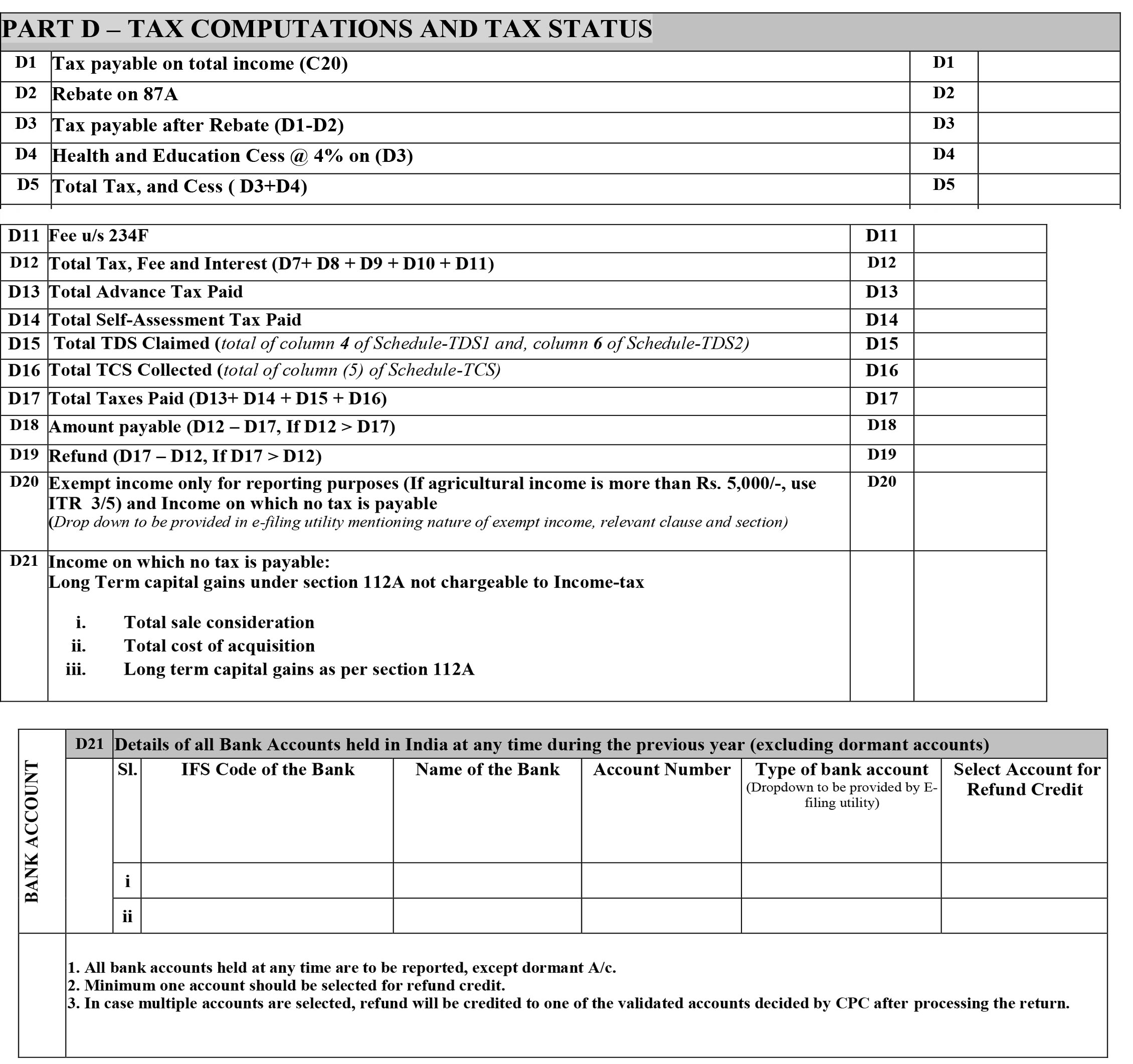

Part D: Tax Computations and Tax Status

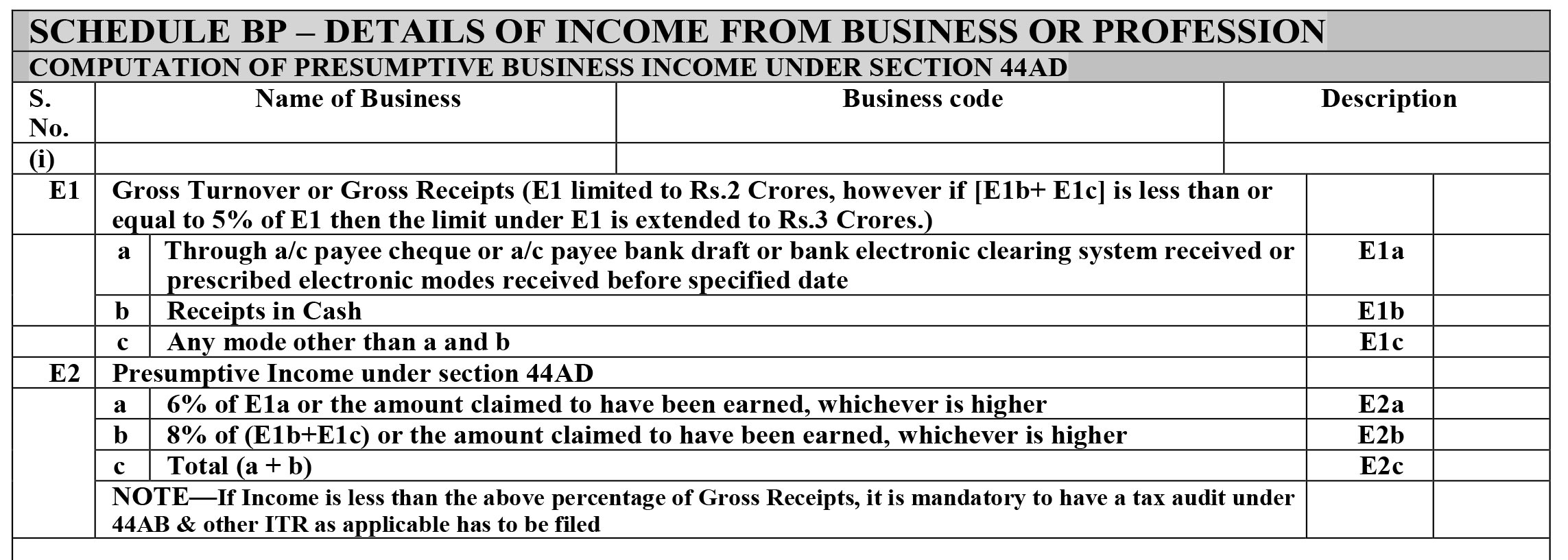

Schedule BP: Details of Income From Business or Profession Computation of Presumptive Business Income Under Section 44ad

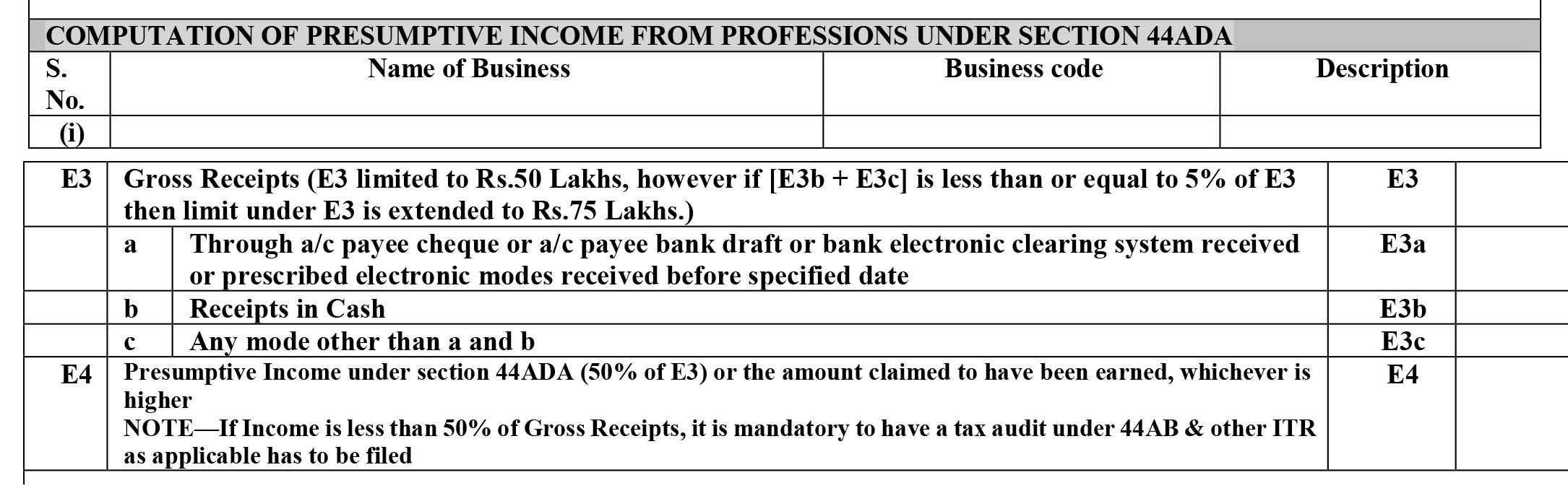

Computation of Presumptive Income From Professions Under Section 44ADA:

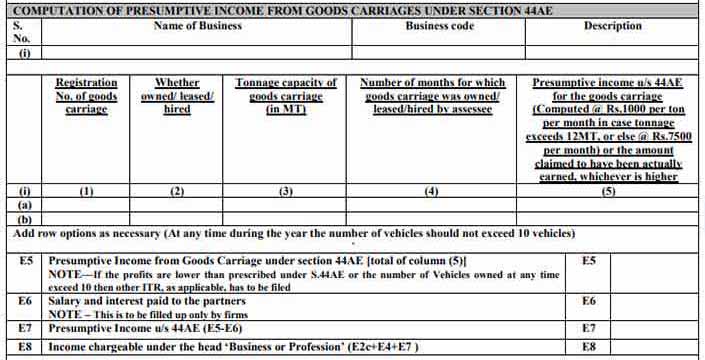

Computation of Presumptive Income From Goods Carriages Under Section 44AE:

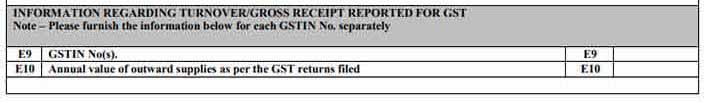

Information Regarding Turnover/gross Receipt Reported for GST

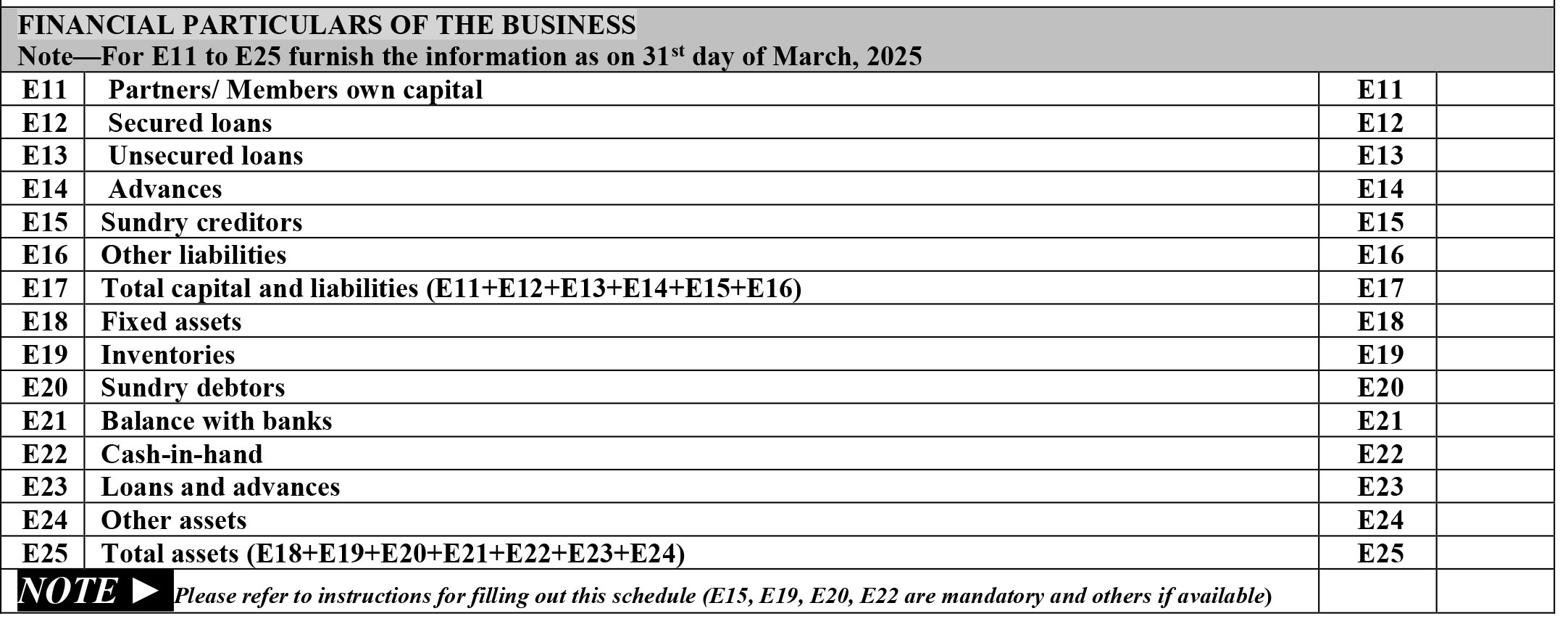

Financial Particulars of The Business

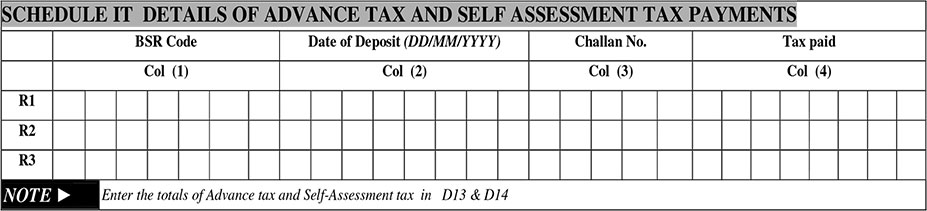

Schedule IT: Details of Advance Tax and Self Assessment Tax Payments

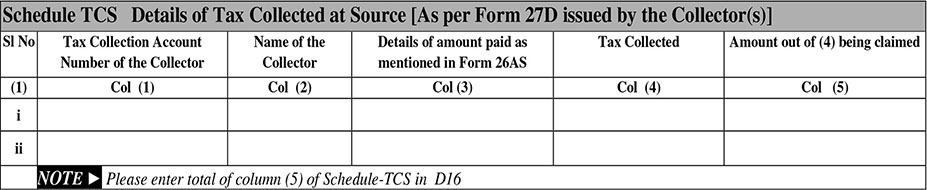

Schedule TCS: Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

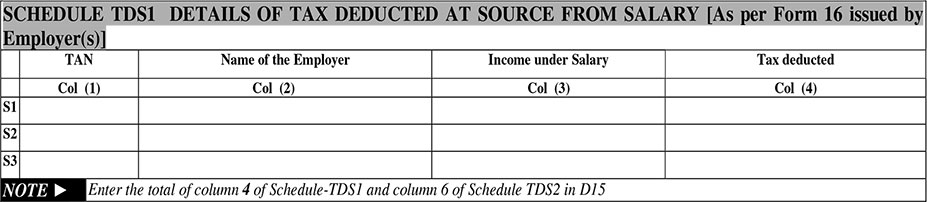

Schedule TDS1: Details of Tax Deducted at Source From Salary [as Per Form 16 Issued by Employer(S)]

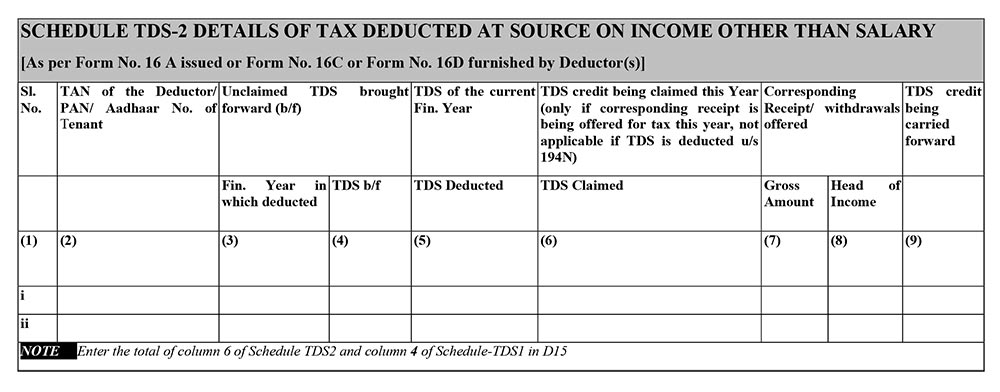

Schedule TDS2: Details of Tax Deducted at Source on Income Other Than Salary [as Per Form 16 an Issued or Form 16c Furnished by Deductor(S)]

Recommended: Penalty Provisions If Not File Income Tax Returns for Current FY

ITR 4 Online User Manual Guide

Sir, My company was paying Rs. 40,000 per month as consultancy fee and deducted TDS u/s 194JB for the Fy:2024-25. Total fee Rs. 480,000 for the said year. Do i have opt for Presumptive income u/s 44ADA for this professional fee? Please advise.

I am working on contractual basis and getting a meagre annual amount of Rs. 1.14 lakhs only. However, my TDS is being deducted @1% under section 194(c ). Which ITR is to be filled and where this annual amount is to be shown?

You can file ITR 4 OR ITR 3 .If select ITR 4 then amount show in turnover column. if select ITR 3 amount show in sales in P&L account.

How to file a partnership firm’s ITR using Genius Software, whose balance sheet has been filed through Genius software. Please do tell the entire procedure as I am real confused.

Please Call to us on this number 0141-4072000

‘Date of filing of Original ITR” or “Ack number” in part A Gen is not matching with the Original ITR Date / Acknowledgement number in efiling Database

Please enter proper “Date of filing of Original ITR” or “Ack number” in part A ) Showing this error while i am uploading

Updated return.

“Please contact Income Tax Portal related to Updated Return.”

did you get the solution?

@Vikas Rawat Sir,

I am also facing the same issue while submitting Updated ITR.

Had you resolved the issue?

If Yes, Kindly help me too by stating how it had been resolved.

Hi,

I am an individual and working as Technical consultant for a company which makes payment for my services under 194JB. I also receive pension from PSU Bank. Both income is well under Rs. 15 lakhs/ year. Which ITR Form I need to file my IT Retirn?

You need to file ITR 3 as TDS is deducted under section 194JB which relates to Business Income

salary income 180000

44ad income 300000

STCG 1500

other income 2540

can i file ITR 4 as presumtive income?

Sir,

My company is paying me Rs 1 lakh per month as a professional fee, not as salary, and not deducting PF etc. They have given me Form 16A and showing the income paid is under 194JB.

Which ITR do I file?

Thank you

File ITR-4, since source of income is under Profession

Please, we can’t furnished ITR 2, When we could furnish ITR 3, your customer care no is not satisfied us regarding the problem your bogus activities such as the previously furnished return of deceased person by his legal heir, the return had processed and refund raised but you send mail to assessee deceased Pan is not linked with bank .your activities is ridiculous, How deceased Pan would link with her legal heir a/c.?

My friend working as a photographer and doing editing jobs under one photoshop. For that work received salary on a monthly basis(Pls note there is no PF deductions and Salary slip for that). In addition to that, he personally going to wedding parties and other functions as a photographer and received an amount under his name. Kindly suggest under which ITR he needs to file ITR 1 or ITR 4…Please reply

ITR4

for it returns and gst returns ping me at angalasaikrishna@gmail.com

If contactor base employee to form 16a, ITR 4 to applicable but financial particular of busiess in complesory, please advice. only single line income. no other income.

In ITR-4 mentioning of the amount of financial particulars are mandatory, you have to fill that otherwise the utility will show an error message regarding this.

Which ITR form should I file if having presumptive income from business turnover less than 50 lakhs and losses on capital gains to be carried forward and brought forward from previous years.

ITR 3

I had a salary income up to 6th mar-2020. And income as a consultant for the rest of march-2020 due to job resignation. Can I file form ITR-1 and ITR-4 both? for AY 2020-21.

You can’t file both ITR-1 and ITR-4 for AY 2020-21. Only one ITR is filled for one assessee

I can’t understand properly please provide more simple method. How to fill form 4?

Sir, I have no sales for the year 2019-20, So, I filed Nil GST return, Hw can I filed an income tax return for the A.Y. 2020-21

Hi Vineeta:

I work as an information security consultant and don’t work as salaried. I have no other earning and this year earning is not more than 3 lakhs

Questions:

Which ITR I would fill and which section I have to fill as I don’t have any other income this year?

There was a TDS deduction when I got paid from the company where I work as a consultant which I have to claim?

thank you in anticipation!!

If you want to fill Income on presumptive basis then ITR-4 is applicable otherwise ITR-3 is applicable

hi,

I am a salaried person working in PVT ltd firm, also I have my proprietary company, so do I need to file ITR4? or I need to file ITR1?

pls suggest

If you have presumptive income, you are liable to file ITR 4

I am a small business like catering and canteen, want to file ITR by own, need to know how to compute all details like capital, unsecured loans, etc

I.t.assess limit of cash on hand maximum at the end of the financial year (March) for the trading firm and the individual person.