Simple to Understand PAN Card

For the purpose of uniquely identifying taxpayers, the Indian Income Tax Department issues PAN cards. Every taxpayer has access to this 10-digit alphanumeric code. The Permanent Account Number card makes it simple for taxpayers to conduct a variety of financial transactions while also assisting the Income Tax Department in tracking and verifying that taxes are paid properly.

The Indian Income Tax Department has launched the PAN card for taxpayers. The new taxpayer is automatically allocated a PAN when they file their first income tax return.

Due to an increase in PAN applications, this change was made. It is important to remember that someone who already has a PAN will not be eligible to receive one. Taxpayers are currently only issued an e-PAN if they are individuals. Only for a limited period of time is this service free of charge. A first-come, first-served basis will be followed for the issuance of a PAN.

Read Also: Why Should You Link Your PAN to Aadhaar Card

Who is Eligible to Apply for a PAN Card?

Applicants should meet the following criteria to qualify for a PAN card:

- A resident of India is required

- Individual taxpayers are eligible (not corporations or HUFs)

- A PAN cannot be held by someone who already has one

- Aadhaar Card is Necessary

- Your Aadhaar must be linked to an active mobile phone number

- Update and correct your Aadhaar information

Steps to Apply New PAN Card Via Genius Software

Step 1: First, you have to install Genius Tax Filing Software on your desktop or PC

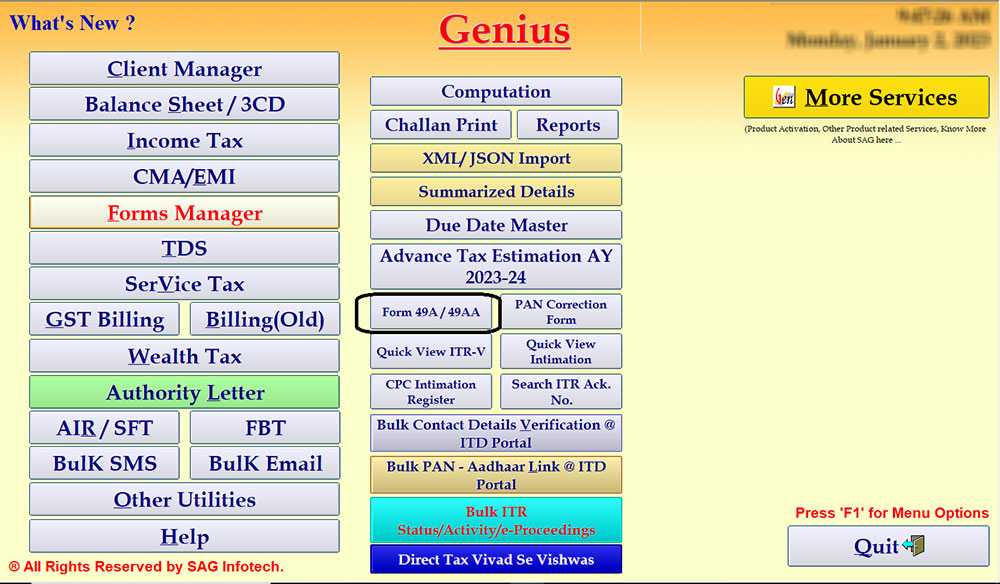

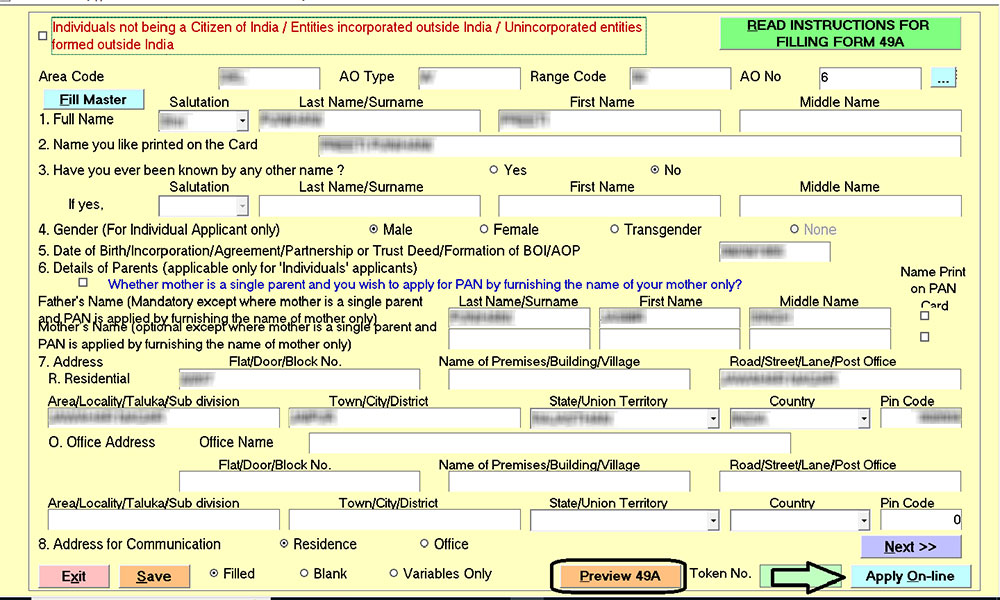

Step 2: Open the Software – Go to Income Tax- Click on ‘Form 49A/49AA’

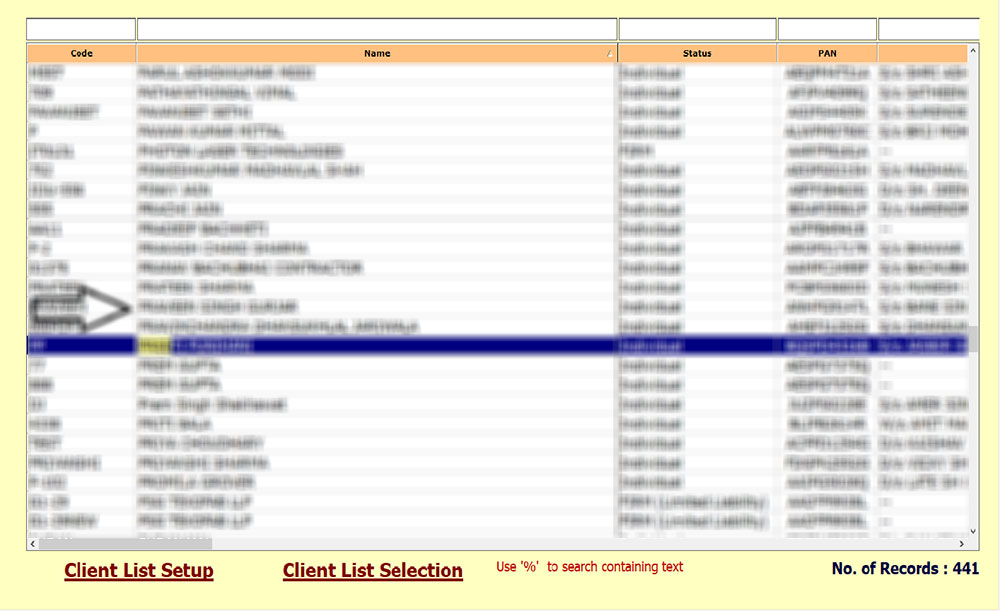

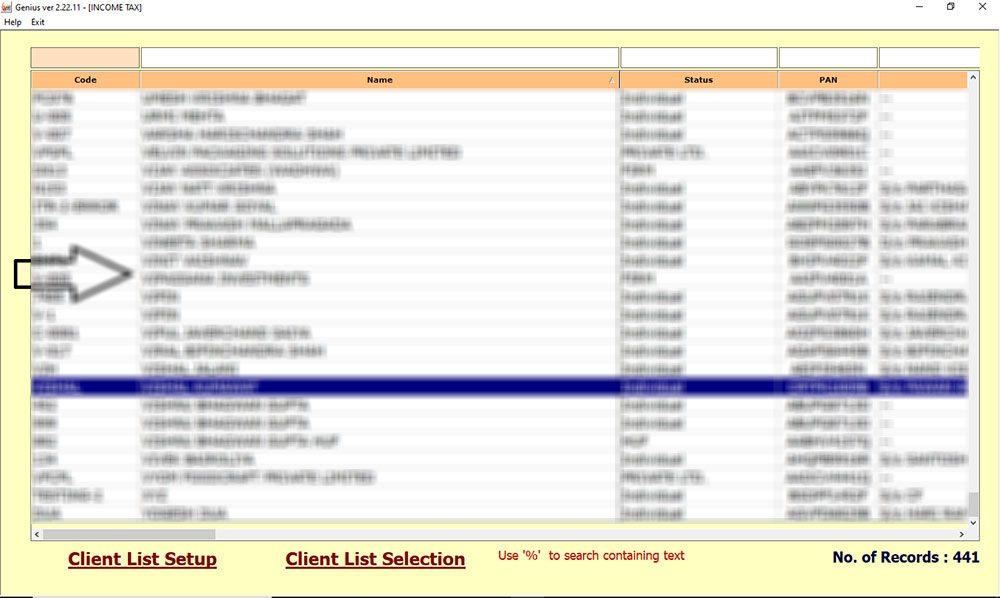

Step 3: Select the Client to whom you want to apply for a New PAN Card

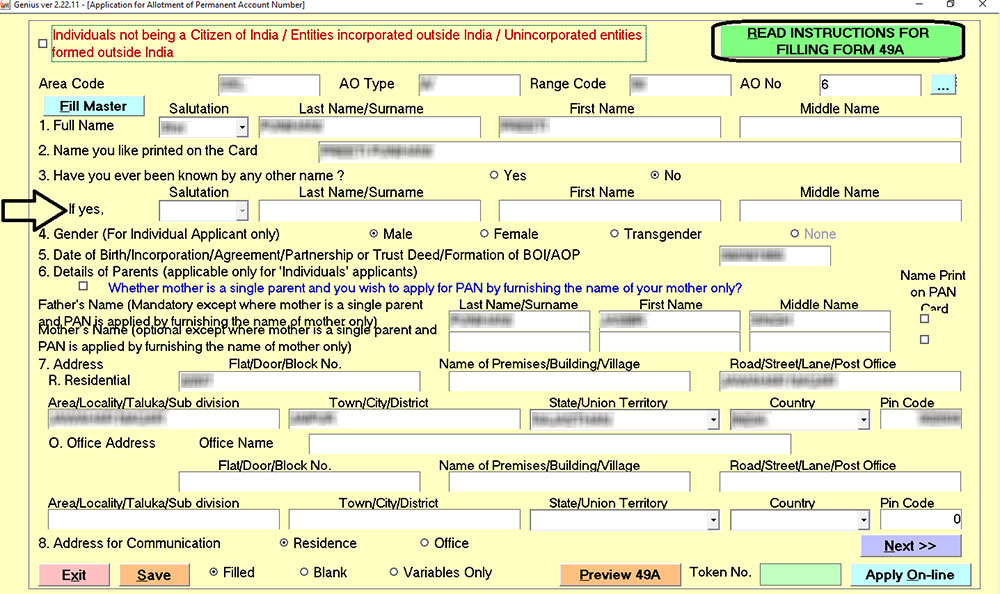

Step 4: Fill in the details like Address, Date of Birth, Gender, etc. and click on Next Tab to fill in the 2nd Page. You can also read the instructions for filling out Form 49A through the tab “Read Instructions for Filling Form 49A.”

Step 5: You can take the preview of the 49A Form through Tab Preview 49A and can also apply online through the tab Apply Online.

PAN Correction Process Via Genius Software

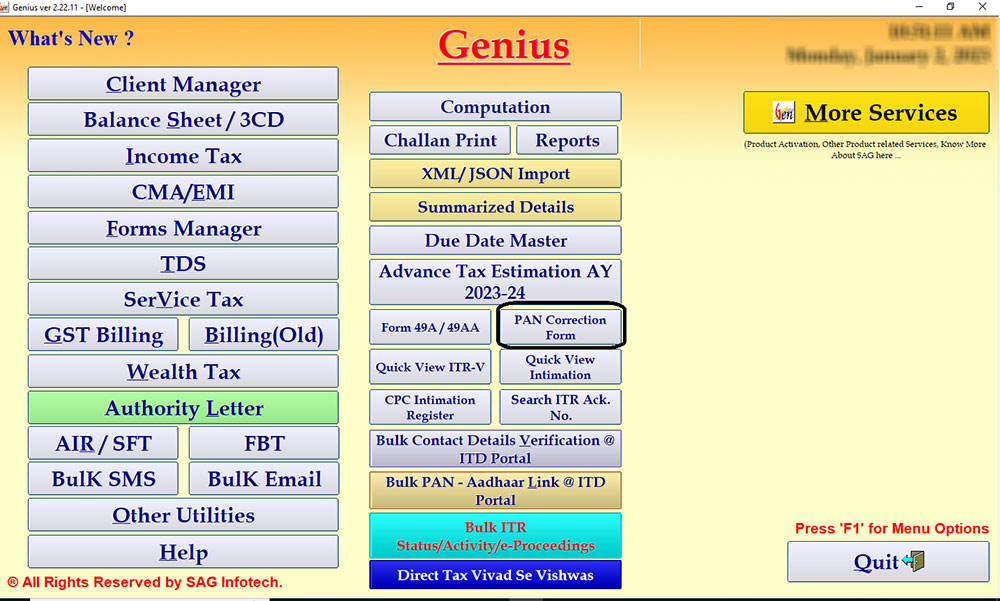

Step1: Open the Software-Go to Income Tax- Click on ‘PAN Correction Form’

Step 2: Select the Client of which you want PAN Correction

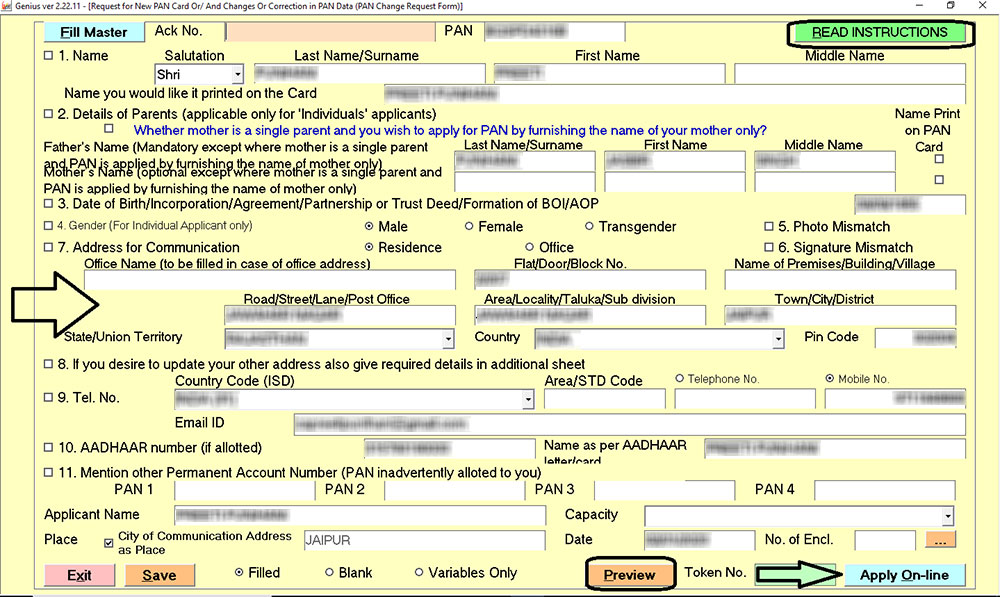

Step 3: Click on the Applicable fields for which you want to make the correction, and read the instructions through the tab Read Instructions for making the PAN Corrections. You can take the Preview of Form through the tab Preview, and can Apply Online through the tab Apply Online.

God morning madam, how to find PAN details of a school with its TAN details

If you have TAN login details @ITD then You can get the details of PAN from profile section.