The deadline for submitting Form GSTR-3B for July 2025 has been pushed back by the Central Board of Indirect Taxes and Customs (CBIC). This announcement was made in a notification issued on August 20, 2025, right when the original deadline was approaching.

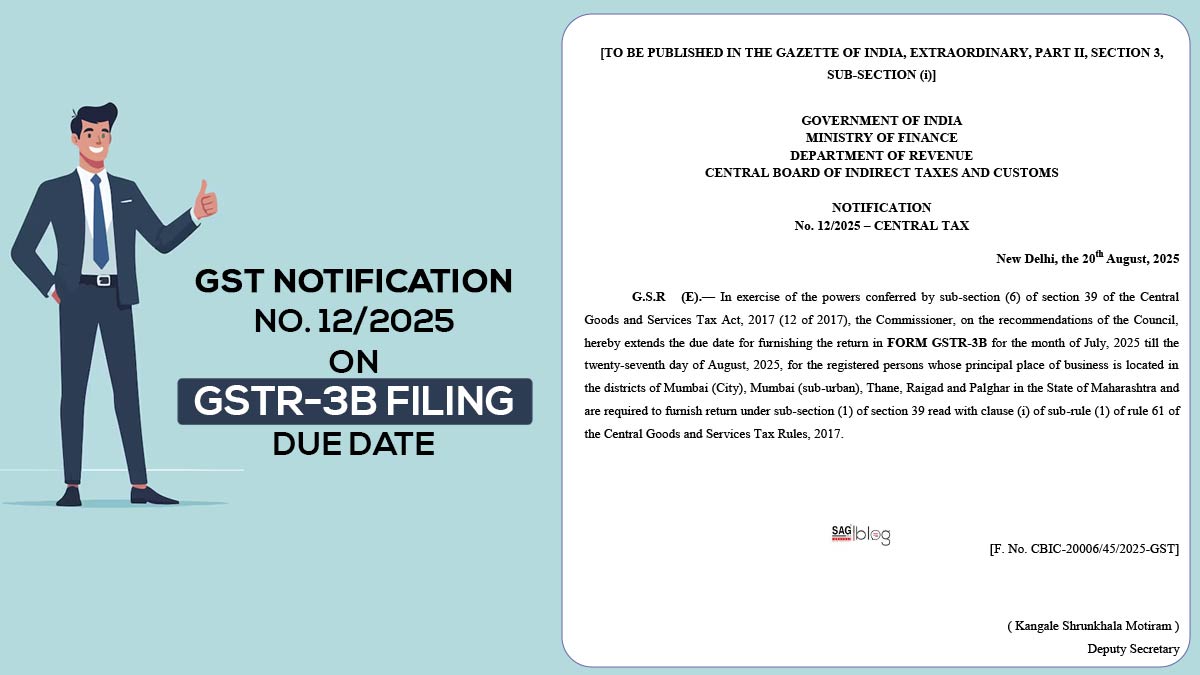

According to the central tax notification No. 12/2025, the amended due date to submit the GSTR-3B is 27th August 2025. The same extension is applicable for the registered persons whose principal place of business is in the districts of Mumbai (City), Mumbai (Suburban), Thane, Raigad, and Palghar in Maharashtra.

Under the powers conferred by Section 39(6) of the CGST Act, 2017, read with Rule 61(1)(i) of the CGST Rules, 2017, the extension has been granted, on the GST Council’s suggestions.

Under the same relief, no late fees or penalties will be charged on taxpayers in the affected districts if they submit their July 2025 GSTR-3B within the updated deadline.

This decision has been made in between the incessant rains and severe monsoon conditions, which have disrupted business operations, transport, and connectivity in the Mumbai Metropolitan Region and adjoining districts.

Amid natural calamities and adverse situations, CBIC has earlier adopted similar relaxations. Taxpayers will be in relief by this notification. The GSTR-3B must be filed every 20th of the following month.

Read Notification for GSTR-3B Due Date