A general issue regarding the mismatch in names occurring in the PAN card and Aadhaar card has been surging day by day, as in the common process to link the Aadhaar card to the tax return file, the issue of name mismatch recurs in every taxpayer application.

As the government has mandated the linking of Aadhaar cards while filing income tax returns, the issue has been stagnant if you are unable to link PAN with Aadhaar for a while and to revoke the issue, the government has summed up solutions regarding the name mismatch problem and has ordered that if any name mismatch occurrence persists, the taxpayer can have the option to attach a scanned copy of his her PAN card with the file.

Free Demo for Best ITR Filing Software

These are the following Important Steps to Link Aadhaar with PAN Card

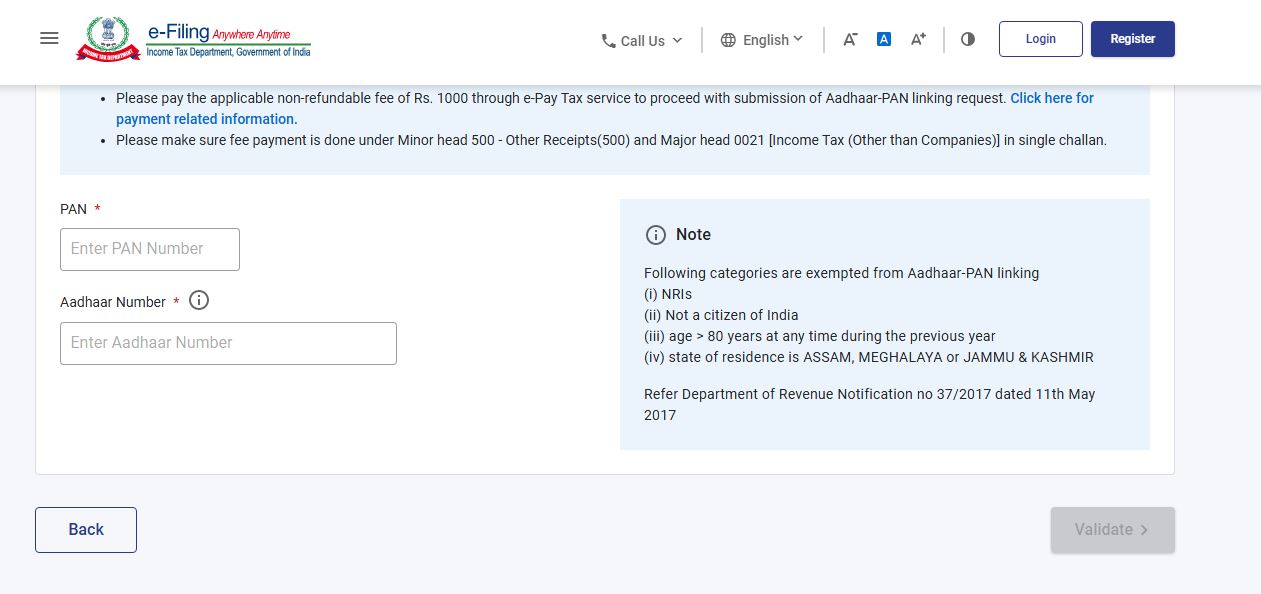

The Income Tax Department has disclosed how to link PAN with Aadhaar in just a few simple steps. In fact, it doesn’t require a login or registration at the e-filing website. Anyone can avail of this facility and link their Aadhaar with their PAN. Just follow the simple steps given below and link your Aadhaar with your PAN:-

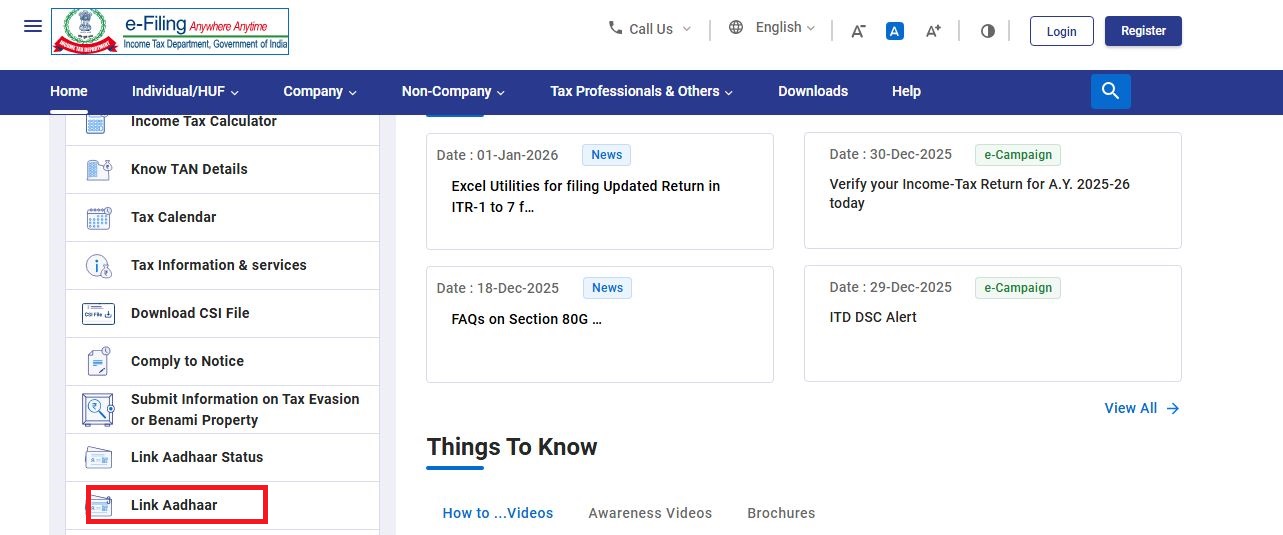

Step 1: Visit https://www.incometax.gov.in/iec/foportal/ and click on the left-hand side of the website under the Services menu> Link Aadhaar.

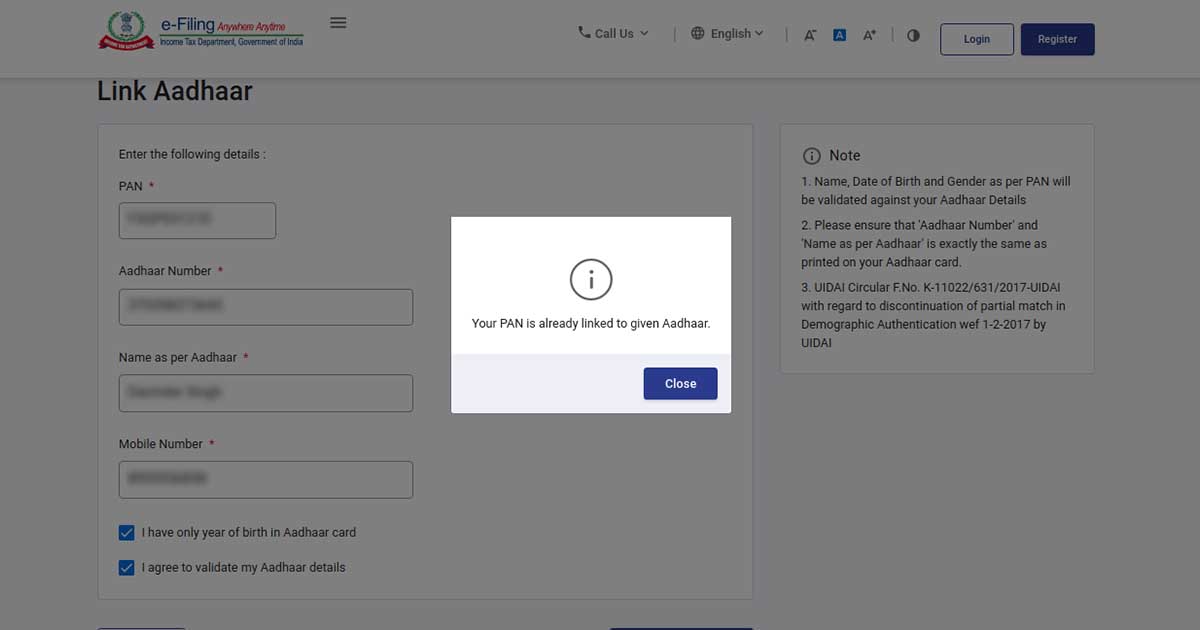

Step 2: Mention the required details, PAN number, Aadhaar number, and name. Ensure that you have to ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

UIDAI is the government website for Aadhaar. After the verification from UIDAI, the linking will automatically be confirmed.

Step 3: If, in any case, there is any slight difference between the Aadhaar name provided by the taxpayer and the actual name in Aadhaar. A One-Time Password (Aadhaar OTP) will be sent to the registered mobile number with Aadhaar. Taxpayers or candidates must be sure that the date of birth and gender in PAN and Aadhaar are exactly the same.

In case, the Aadhaar name must ensure that you have ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

Apart from this, the government authority has also proposed to include a column on the official website of the tax department in which a link will be provided to link the Aadhaar card, by which an OTP will be generated in any name mismatch scenario occurs.

The OTP will come through the text message on the registered mobile number of the taxpayer, and after entering the received OTP on the portal, the linking will be established between the Aadhaar card and the PAN card. The only condition that will fulfil this service is that the birth date must be the same on both cards to finalise the linking process.

Step 4: After filling out all the details and the Aadhaar number, the system will show a message if your Aadhaar is linked with the PAN.

Read Also: Simple Steps for Filling New PAN Card Application Online

The name-mismatch issue was persistent after the Union Minister Arun Jaitley proposed in the financial bills of GST to mandate the linking of Aadhaar cards in every filing of tax returns. Some of the common issues regarding the linking of the PAN card to the Aadhar card are special character recognition, in which the Aadhaar card is unable to recognise any special characters, while on the same side PAN card can recognise special characters.

The second issue in the row comes as the initial recognition, in which the Aadhaar card is unable to recognise the initials, whereas the PAN card takes the initials. Finally, the point of the middle name is also prevalent in the mismatch issue, as the Indian community changes the surname after marriage, especially females, which in turn gives rise to the name mismatch.

One must remember that the linking of both an Aadhaar card and a PAN card is only eligible in the case of name mismatch, which is when the birth date of the individual is mentioned the same on both government IDs. This has been mandated by the government as it will help in identifying the taxpayer’s identity on a firm basis.

Who all are exempted from linking the Aadhaar Card and PAN

According to the central government and the Supreme Court orders, there is a necessity for the linking of Aadhaar and PAN, as also notified in the income tax department rules and regulations. Section 139AA was held by the court, while the Central Board of Excise and Customs also released a notification mentioning all the exempted entities for the linking.

The following list specifies the exempted individuals for whom section 139AA is not applicable:

- Those categorised as Non-resident Indians as per the Income Tax Laws

- Not a citizen of India

- Is of the age of 80 years or more at any time during the tax year

- Residents of the states of Assam, Meghalaya and Jammu and Kashmir

Most Important Reasons to Link Your PAN Card with Aadhaar

The Government of India has made it mandatory to link your Aadhaar with your other identities. Taxpayers who do not link their PAN card with their Aadhaar will be liable for all penalties under the Act for failing to link their PAN, and their PAN will no longer be valid after that.

But the thought may have struck your mind that you have been using your PAN card and suddenly need to link it with your Aadhaar. Well, here are the top 10 reasons why you should link your PAN with your Aadhaar.

Abide by the Law

The Government of India has made it mandatory to link your PAN card with an Aadhaar card under Section 139AA of the Income Tax Act, 1961.

Avoid Tax Penalties

If you do not link your Permanent Account Number (PAN) card with an Aadhaar card, you may be imposed with several charges and penalties, such as deactivation of your PAN card and a penalty of up to Rs. 1,000.

Makes the Verification Process Easy

Aadhaar is every Indian citizen’s unique identity, and it is accepted at all government portals. Tax authorities can easily verify the authenticity of the taxpayer if his or her PAN is linked with Aadhaar.

Helps Authorities Stop Tax Evasion

Having taxpayers’ PAN cards linked with their Aadhaar cards helps authorities prevent tax evasion by evaders. It makes certain that all taxpayers have their unique identification number, and it will be easy for them to track those who are not paying the tax.

Speed up Your KYC Process

KYC is mandatory to avail of various financial services, like online transactions, UPI transactions, or personal loans. Linking your PAN with your Aadhaar makes the process of KYC updation easy and fast.

Make Tax Filing Easy

Linking your PAN card with an Aadhar card can ease the process of tax filing for you. Because it will pre-file your details in the Income Tax Return form or fetch details automatically.

Avail Various Governmental Services Easily

Government schemes and services require an Aadhaar card to avail. It may make it necessary for all other services to have your PAN card linked with your Aadhaar card down the line. If you meet this prerequisite by linking your PAN card with your Aadhaar card, you can easily access various government services.

Easy to Make All Financial Transactions

After linking your PAN card with your Aadhaar, you can easily carry out various financial transactions. You are always asked to provide your PAN card when opening a bank account, making investments, and applying for loans.

Helps in Authenticating Identity

You can authenticate your identity easily, and you can also prevent identity theft by linking your PAN card with your Aadhaar card.

Avoiding Duplication

It has happened so many times that a PAN with the same details has been mistakenly provided to two individuals. It’s a common problem brought on by many people possessing duplicate PAN cards. The misuse can be prevented by linking your PAN card to your Aadhaar card.

Sir, my both PAN and AADHAR were successfully linked but while applying for my PF, it states that my PAN is not verified (error says– name not matching in IT records) while I’m claiming for PF. Please help me!! what should be done here? How come name is not matching though both are linked successfully?

The same problem, kindly suggest…

Contact to the department for assistance.

I am also facing the same issue. What is the resolution?

Hello sir, My aadhaar and pan card does not match when my aadhaar and pan card documents are filled same. Please give the solution.

Please contact department for assistance.

The same problem here…. could you please tell me,…which department do I need to contact?

You have to contact to income tax department for checking your data in their database.

Hi,

My Name in PAN CARD is Sandhya Siddabathula but in Aadhar Card it is Siddabathula Sandhya. I am unable to verify Aadhaar card in pf account. in the month of May 2017, I have changed my date of birth in Aadhaar which was wrongly entered. It is reflected in E-card didn’t get a hard copy.

Can you please let me know so I need to send a request for the name change again?

thank you,

sandhya

If there is any mismatch between DOB in PAN and Aadhaar card whether linking will be done or not DOB mismatch means years are same in pan and Aadhaar but month and days are different whether it will link or not.

My name is same in aadhaar card and bank account, but can not link as there are 3 spaces in bank name & only 1 space in aadhaar card.so I doubt while matching even space between initials and name are counted as an alphabet and it compares.so we can not do much as our software designers need to look at this and find a solution. Now I have to close the bank account and open a new one (in the same bank or other) with the same name as in aadhaar card that is the only solution!

I called bank customer care they don’t give much help so does the bank people. Every time they take me to ATM TO UPDATE ADHAR, after 7 days I know same failed result. when I ask again they say it will be ok, I feel that everyone will be in trouble after dec31st when bank account freezes, for all those not linked to aadhaar card, even though the same genuine person cannot operate his bank account for spelling mistakes/space in his name.who can help us? I have no words for this government, who makes every citizen run here and there for simple matters.ordinary common man suffers and die.!!!!!who cares.

Now the same problem exists for EPF & Aadhar linking…

“contact department for assistance.”

By sending GST form

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 393307931902: Name

when in send GST practitioner form I get this answer my pan card and aadhaar are linked before

contact department for assistance.

How I can? Contact number, please.

GSTN helpdesk no. : 011-49111200

CBEC helpdesk no. : 1800 1200 232

Details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 391173726520: Name

Please elaborate your query.

Hello, Both Pan card and Adhar card Name and date of birth is correct but the same is not linked. how it can be linked. How we can know the details of PAN?

These kind of problems are common when the government opt for a builder. I’m trying to get my PAN card from two months, every time it says some or the other problem. I hate this govt from bottom of my heart.

You can raise your query to the department regarding this.

HI ALL,

DO CAPITAL LETTERS MATTERS IN BOTH AADHAR,WHERE PAN WILL NOT ACCEPT SMALL LETTERS, IN MY CASE 100% NAME,DOB AND GENDER IS MATCHING WITH EACH OTHER BUT PAN DETAILS ARE PRINTED IN CAPITAL LETTERS AND AADHAR IS PRINTED IN SMALL LETTERS, PLEASE LET ME KNOW ANYONE FACING THE SAME PROBLEM AND IF ANYONE GOT SOLVED WITH the SAME CASE.

There should not be any kind of problem of mismatch due to the capital letter while linking aadhaar with the PAN but if in your case it is showing any error then you should contact the department.

DO CAPITAL LETTERS MATTERS IN BOTH AADHAR, WHERE PAN WILL NOT ACCEPT SMALL LETTERS, IN MY CASE 100% NAME,DOB AND GENDER IS MATCHING WITH EACH OTHER BUT PAN DETAILS ARE PRINTED IN CAPITAL LETTERS AND AADHAR IS PRINTED IN SMALL LETTERS, PLEASE LET ME KNOW ANYONE FACING THE SAME PROBLEM AND IF ANYONE GOT SOLVED WITH the SAME CASE.

No, linking is not case sensitive. In case the issue persists then contact the department for assistance.

Yes , i a m also facing same issue

How I solved the problem regarding my name on PAN card is correctly printed but name as per PAN details in the income tax department data is incorrect. I have no middle name but arbitrarily written as ‘Rani’ in the internal data but printed on pan card without ‘Rani’ which is the correct. kindly tell me the remedy for which i am innocent but getting unnecessary punishment.

Worked for me. Thank you

I corrected updated my Aadhar on 11-07-2017.Now my name and dt of birth are fully matched in both Aadhar and Pan.But still not linked both after a lot of try.Strange?

What to do?

You have to contact to income tax department.

Are you still facing the issue or is it resolved now ?

Name mismatch due to a small error.

My name is S.V.Rajkumar but in Adhaar card typed as S.V. Rajkumar There is a space typed (due to pressing of Spacebar in Keyboard) so the space taken as Alphabet.

You need to rectify the same.

Hi

My name in Aadhaar and PAn card is mismatch , how i can solve it, any other simple step is available for Aadhaar number updation wit PAN card suppose i change my name in aadhaar, other document also need to change?

Hi All,

My details in Aadhaar and PAN is exactly the same and 100% correct but still it is saying that mismatch of details, can you please help me out.

You need to contact department for assistance.

i have apply for change in name and dob accordingly aadhaar but from two month application is in process in income text department my dob is incorrect in pan card what i should do to link pan and aadhaar card. My aadhaar is right.

Contact department for assistance

my address in PAN card and aadhaar card is different and spelling mistake in father`s name in pan card….can i link aadhar card and pan card? in pan card they ask for communication address, so is it necessary to update my permanent address which is different from the communication address which i filled in pan card. plz reply someone. thanks

yes, you can link aadhar. No need to update for aadhar linking purpose.

yes you can link aadhaar. No need to update for aadhaar linking purpose.

Despite the details on aadhaar and pan same,unable to link aadhaar with pan. I have updated DOB on Aadhaar card on 15th july . Updation done successfully. Checked on e-aadhaar. Plz. help me otherwise my ITR wil not be processed and pan will become invalid. Contacted to income tax department but they say we don’t know anything. Please help me to resolve the issue……Awaiting your reply

WHAT PROCESS HAS BEEN DONE BY YOU FURTHER, I AM FACING THE SAME PROBLEM.

Dear,

Did your problem get solved? I also have same problem.

Please let me know if problem resolved. my mail id is swapnilbadhan1@gmail.com

Hi Sir, I have update my Aadhaar after i got Bio Metrics error in Aadhaar. Now i have got updated Card. Still i am not able to link Aadhaar with Pan on IT portal. Name, age and DOB is same on both Cards. Can you please suggests what next i should do.

You should contact department for assistance.

Dear Team,

Name Mismatch in Aadhar and Pan card , i couldn’t able to link in aadhar ,can you please help me to resolve my issues.

Name in Aadhar : Rahmankhana

Name in Pan : A Rahman Khan Abul hasan

DOB is same in Both, can you please suggest to resolve my issues.

Dear Team,

Name Mismatch in Aadhar and Pan card , i couldn’t able to link in aadhar ,can you please help me to resolve my issues.

Name in Aadhar : Rahmankhan

Name in Pan : A Rahman Khan Abul hasan

DOB is same in Both ,can you please suggest to resolve my issues

You need to make changes in aadhaar or Pan card for linking.

Thanks for your suggestion. My mother is also facing similar problem: name mismatch. Actually her PAN card is printed with correct name (matching with Aadhar) but her name in the PAN database is showing different name (alias name). She raised a change request, but the acknowledgement status is same (“Under processing”) for the past 10 days, not sure whether the process we followed is correct or not. Could you please provide the correct process and supporting document details that need to be submitted to PAN authorities. Thanks in Advance.

can you please provide link for name mismatch

While linking Aadhar with PAN Card, after all the details are filled and submitted, there is no message of any error and the screen is being changed to login screen. On verification, the Aadhar remains not linked with PAN card.

Please advice.

please contact department for assistance.

My PAN is recently updated, I corrected spelling in my last name. I received hard copy but these changes are not reflected in e-filing portal. This causing me failure in ITR submission. The last name field in ITR is non editable.

Call center, helpdesk mail are tossing issue in each others court.

Please suggest any way around.

My Aadhar and Pan card shows mismatch of Surname. How can i rectify the mismatch. kindly suggest the detail process for correcting the mismatches.

You have to apply for correction in your aadhaar card at UIDAI.

Hello,

While linking the pan and aadhar card, it says that there could be mismatch in name, gender or birthdate?

The only difference betwwen the two cards is that last name appears first on pan card, while aadhar card starts with First name, middle name and then last name?

Could this be the issue? If so what do I need to update and how. Thanks for your help.

Yes you have to make correction first for linking Aadhar and PAN.

Hi

I had biometric issue for my aadar card. So recently i updated them in one of enrolment center. UIDAI customer care dept saying that need to wait 90days to get update them. But i am unable to link the aadar with PAN ,still showing biometric integration issue. Its something aadar database issue, nothing i can do. But due date of tax filing is jul31st.

I enrolled at aadar center on 27th jun 2017. Will take 90days to update. How slow we are.

Kindly suggest me.

It will get updated within 5-10 days No need to worry.

I have mismatch of DOB in PAN and Aadhar. So unable to link. What are the options available for me?

Firstly you have to make correction in PAN or Aadhar in which DOB is wrong. Thereafter you can link PAN and Aadhar.

I have updated my aadhar details to match with PAN. The updated details are also reflecting online in e-aadhar.

But when i am linking PAN with Aadhar, i am still receiving details not matched error.

How to resolve this. Any contact number/email address for resolving this ?

Contact income tax department for assistance.

Hi Pardha,

Same is the case with me also. I logged a grievance on UIDAI portal. The email id is : help@uidai.gov.in

I attached old and updated aadhar. Told them still I am not able to link aadhar with PAN. The issue is still with them and I am waiting for solution.

Thanks and Regards

Vikalp

Hi All,

I am able to link now with the same details as earlier. Not sure what has changed.

Hi Pardha,

I am also facing the same issue. I have recently updated my aadhar, but couldn’t link, same mismatch error persists. Can u tell me with in how many days your problem got solved automatically? Thanks in advance.

Did you get ur problem solved?

Sir, while l am linking pan with Aadhar it says name is mismatched but my name’s in both are same.date of birth is also same,sir please give me a solution for this , expecting for the reply

If there is any difference in spelling of name then u have to update your aadhaar.

Sir, while l am linking pan with Aadhar it says name is mismatched but my name’s in both are same.date of birth is also same,sir please give me a solution for this , expecting for the reply

I have a name mismatch in PAN & Aadhar.

Tried to use the OTP method to link both, but i am not able to receive the OTP number on my registered Phone.

Please help!

hello sir,

good article but when i enter all information of pan and adhar then mismatch name error occurs but no OTP option what i am doing wrong it shows a dialog of update adhar or pan card

Exactly. There is no link existing in the incometax website which will take aadhar otp and link in case of name mismatch.

This author has not put any practical working things. all he has done is a copy paste from IT Website/Newspapers.

Please suggest solution to this…..

Click under services menu, author has written the post to see the procedure of linking Aadhaar and PAN. incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

WHAT DOES IT MEAN BY “TECHNICAL PROBLEM AT UIDAI. TRY AGAIN” ??

This is site issue. You have to retry.

Hi,

Is this issue resolved for you? If so, how did you resolve this?

If father’s name mismatch in both aadhaar and pan card we can link pan card and aadhaar?

Yes you can link the aadhaar.

since the govt. states that AADHAAR details ( name , DOB , address etc. ) are only genuine and correct ,

which cannot be duplicated , it would be advisable / desirable , once AADHAAR DETAILS on the

I T Filing Website , all these details should automatically be changed in P A N Details without any

fuss , for which software may be set . ( Or The P A N Card May Be Treated As Cancelled ) ;

OR a new appropriate form may be prepared to fill in all the correct details / desired details ,

including Aadhaar Number and P A N Card Number , and accordingly Aadhaar Card And PAN

Card Details may be noted by both the Depts. , and FRESH / NEW Cards could be issued to

the concerned person ; BETTER SUGGESTION Will Be That A Draft Of Aadhaar Card And P A N

Card May Be Sent To The Person Concerned And Ask For Their Confirmation , and then

the details as confirmed by the person may be corrected / updated in Aadhaar Card And PAN

Card Details , And THEN ISSUE A FINAL / NEW / FRESH CARDS To Them. Unfortunately efficiency of

the people gone gone from bad to worst – even when All The Details Are Sent DULY CLEARLY

TYPED IN TYPEWRITER IN CAPITAL LETTERS , THEY ARE UNABLE TO PRINT THE CARDS CORRECTLY .

TYPEWRITER ,

Sir,

I can’t link my Aadhar with my pan card Because, the name in pan card mismatches with aadhar. What can I do now sir??

You have to update your aadhaar card for it.

Name inthe aadhaar card is correct.But the name in PAN card is incorrect There is a spelling mistake in the pan card name. Then what is the solution to correct it?

despite matching details in PAN and adhaar linking is not happening. Why plese?

Sir, you have to contact to department for the same.

Hi Jayadev,

This problem is coming to me also. Do you got any solution?

Sir , the details of the PAN card and the Aadhaar card matches but still while linking the details its showing unsuccessful message .How to overcome this problem

Do consult with Income Tax Department.

SIR THE DETAILS OF PAN CARD AND AADHAAR CARD MISMATCH . HOW LINKING AADHAAR CARD PAN CARD FOR ITR FILLING PLZ HELP ME

If there is mismatch in aadhaar and pan card then you have to update your aadhaar, only then you will be able to link aadhaar with PAN.

Hi

I have linked the Aadhar to PAN,even though if I try to update the PAN in EPFO portal,it is showing “Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department)”

Suggest what to do next?

You need to apply for Aadhar card correction by mentioning the exact name as appearing in PAN card.

can u please tell me what is the procedure if Date Of Birth mismatches????

If Date of Birth is incorrect, you have to apply for PAN correction.

I have the same problem and went to vendor for change in PAN card (date of birth ) more than 2.5 months gone but no response-just reply – your application isunder process. shakuntla

I need help what shall I do for filing itr otherwise I shall loose my refund of Rs.13000 deducted by bank on various fdr intt paid in my account. Please guide if any one has idea or procedure to file without linking or shall I approach to I.Tax deptt office manual filing?

shakuntla

While i am linking aadhaar card with pan i got the problem that the name appeared in aadhaar card mismatched with pan card then i clicked on aadhaar card updation link and i entered the OTP and i got received the URN number. i don’t know the procedure after getting that URN number can u please tell me that procedure

i am also at this stage. any update?

Please tell me any solution you find to resolve your issue.Thanks

shakutnla

now this linking is made easy ; please visit http://www.incometaxindia.efiling.gov.in and click link aadhaar ;

put in PAN and AADHAAR Number alongwith name as per UIDAI Data ; if the DOB and Gender

okay , then it will be linked (after verification from UIDAI , and linking will be co nfir med ;

in case of mismatch in Aadhaar name procided , Aadhaar OTP will be sent to the mobile number

registered with UIDAI ; I could link my PAN And Aadhaar and also got confirmation on line ;

sir after entering that OTP i think u got URN code/number then afterwards what’s the procedure to be followed for aadhaar link with PAN?????

Additional otp not provide to me

Since govt. says that aadhaar card details / printed thereon are all only genuine and correct the details are printed thereon as we have given / desired ( name , date of birth , address , mobile number etc. ), these details ONLY be linked / corrected / updated in P A N Card / P A N Data ; the P A N details , particularly the name noted in P A N Data is lengthy and in full ( which is unnecessary ) with surname , given name, middle name etc. ( AND IN NO CASE P A N DATA Details SHOULD BE UPDATED. Corrected As IO P A N DATA ( P A N Card Was Issued man y number of years back at the instance of I T DEPT . ( perhaps as was felt necessary at that time ).

Hope common sense will prevail with all concerned ; people have some bank accounts, FDs, with banks and with some private companies, which will have lot or problems / difficulties in operating them. ;

As The Above is going to take much time , and I T R filing has already started , for this year I T Dept. should accept the I T R As filed ( by mentioning the Existing P A N Card Number And Aadhaar Card Number , as otherwise I T Dept. will have hardly a ny I T R with them if the I T R as filed are accepted as it is ( without insisting for linking both ) The Govt/IT Dept. UIDAI should apply their mind properly and try to understand the problems / difficulties of The Citizens who are honest in filing their I T R .

I can’t understand why there is so much confusion over linking PAN and Aadhaar even if there is a match in database????? All are comfortably forgetting the database structure of Aadhaar. It recognizes you and updates your identity not only just through date of birth or name. IT CAN RECOGNIZE EACH AND EVERYONE THROUGH THEIR BIOMETRICS. So provide these finger print identification devise at income tax offices so that tax payers who can walk in and put their fingers to get themselves identified. Not to forget that Aadhaar was devised not for matching your name or date of birth. It is just and only for matching the BIOMETRIC ATTIRIBUTES to identity your uniqueness. You can be identified matching your name on driving license, ration card, school certificate, electoral ID or anything though a manual process. The uniqueness about the Aadhaar is the Biometric attributes. WHERE ARE THE TECHNOCRATS HIDING, FEARING THEIR BLACK MONEY EXPOSURE if they are identified through their Biometric attributes. Come out give tangible solutions to the citizens of their country. By the way, every day I mark my attendance through an Aadhaar enabled biometric attendance system in office and gets my identity verified using my finger prints. But when I tried link my Aadhaar with Bank and PAN, it is not matching, because the PAN database comprise only initials in their full form. So there is a mismatch. But no technocrat talking about my biometrics to get myself identified for linking with the PAN or Bank account. Why???????

My aadar biometrics is not updated yet instead they are askimg me to wait till 90days to get update them. So unable to link my aadar with PAN. Unable to file my income tax.

Kindly suggest me.

I agree but common sense is rare. I faced same difficulty and call centre is useless. If govt thinks adhar is reliable why they should not have adhar and abolish pan. Morever mobile no correction in adhar changes incorporation should be made user friendly.

My PAN and Aadhaar detail matched but not link why

It takes some time to update your data in IT department database, so either you have to wait or you can contact the department.