The Central Board of Indirect Taxes and Customs ( CBIC ) has now Notification No. 02/2024 – Central Tax (Rate) dated July 12, 2024, in line with the Goods and Services Tax Council ( GST Council ) proposals to waive agricultural produce exceeding 25 Kilograms or 25 Litres from GST.

Earlier, GST applied to food items that were “pre-packaged and labelled” as described by the Legal Metrology Act, 2009.

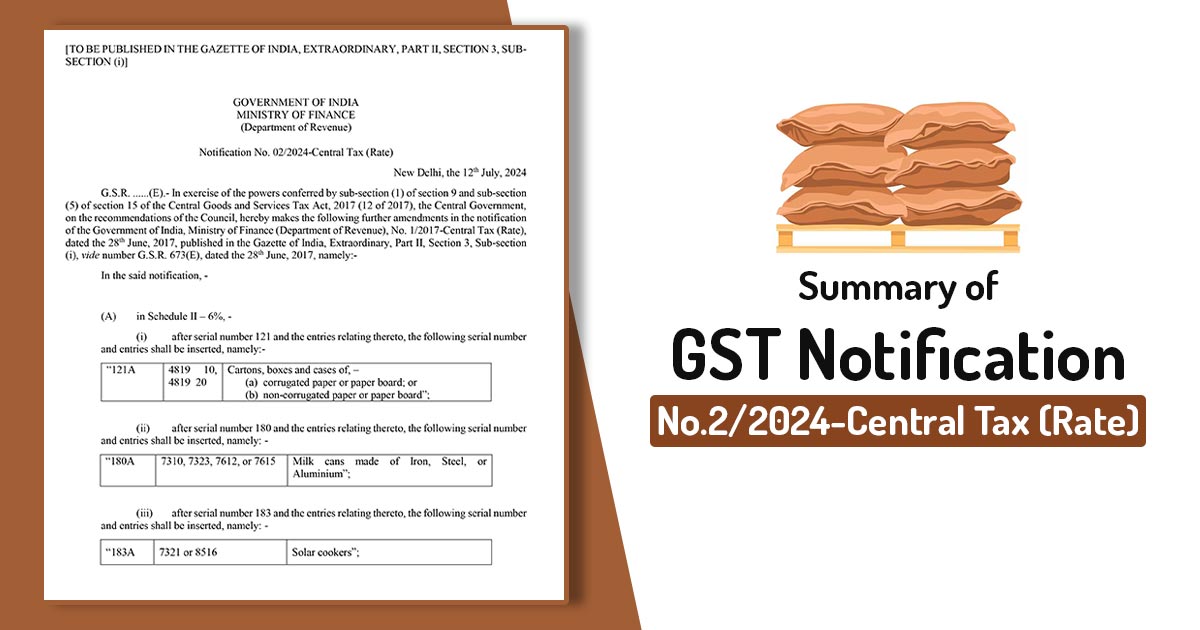

Under its powers granted via sub-section (1) of Section 9 and sub-section (5) of Section 15 of the CGST Act, it revises the CGST Rate Notification. In the Explanation after Schedule VII, the below proviso is added:

The word ‘pre-packaged and labelled’ directs to a ‘pre-packaged commodity’ as expressed in section 2(l) of the Legal Metrology Act, 2009 (1 of 2010). This description demands the package or its securely affixed label to bear declarations as per the Legal Metrology Act, 2009, and its rules.

Given that, even after the Legal Metrology Act, 2009 and its rules, agricultural farm produce in packages exceeding 25 kilograms or 25 litres is not considered ‘pre-packaged and labelled’, the notification described.

Likewise, GST Notification No. 03/2024 – Central Tax (Rate), on July 12, 2024, issued under sub-section (1) of Section 11 of the CGST Act, amends Notification No. 2/2017-Central Tax (Rate), dated June 28, 2017, adding the same proviso.

A recommendation was made to replace the state of being “branded” with “pre-packaged and labelled”, in the 47th GST Council meeting dated 29th June 2022 in Chandigarh chaired by Union Finance Minister Nirmala Sitharaman.

Thereafter the CBIC issued Notification No. 6/2022-Central Tax (Rate) dated July 13, 2022, amending the “brand name” definition to “pre-packaged and labeled” in Notification No.1/2017-Central Tax (Rate), on June 28, 2017 (“the CGST Rate Notification”), applying GST to such food items when they are “pre-packaged and labeled.”

An amendment has been legislated by CBIC influencing the agricultural sector. Earlier GST was applied on the food items that were pre-packaged and labelled as described under the Legal Metrology Act 2009.

Now agricultural farm produce in packages over 25 kilograms or 25 litres is waived from GST, irrespective of the Legal Metrology Act, 2009 provisions. Under the Integrated Goods and Services Tax Act, 2017 (“the IGST Act”) and the Union Territory Goods and Services Tax Act, 2017 (“the UTGST Act”) same notifications have been issued.