The Ahmedabad Bench of Income Tax Appellate Tribunal ( ITAT ) has said that the provision of Section 254(2) of the Income Tax Act, 1961 could not be utilized for a recall and analysis order by the tribunal. It is believed that the aforesaid provision has the objective to rectify the mistake seen from the records.

The taxpayer Neetaben Snehalkumar Patel, applied to amend the order passed through the tribunal. As per the taxpayer, there was a mistake in the order. The taxpayer urged that the tribunal-passed order be recalled and another chance to be allowed to the taxpayer to present its matter before the Tribunal after re-fixing the appeal.

It was argued by the department that there was no mistake seen from the record in the ITAT order and that the other application was misdirected. Assessing Officers (AO) in the assessment order discussed that the share faced via the taxpayer was a penny stock and the CBDT Circular No. 5/2024 was squarely applicable to the facts.

Hence ITAT rejected the objection of the taxpayer to the low tax effect. The department furnished that there was no mistake in the order of the tribunal.

Read Also: Orissa HC Dismisses Appeal Against ITAT’s Order Over Denial of Revenue’s Recall Application

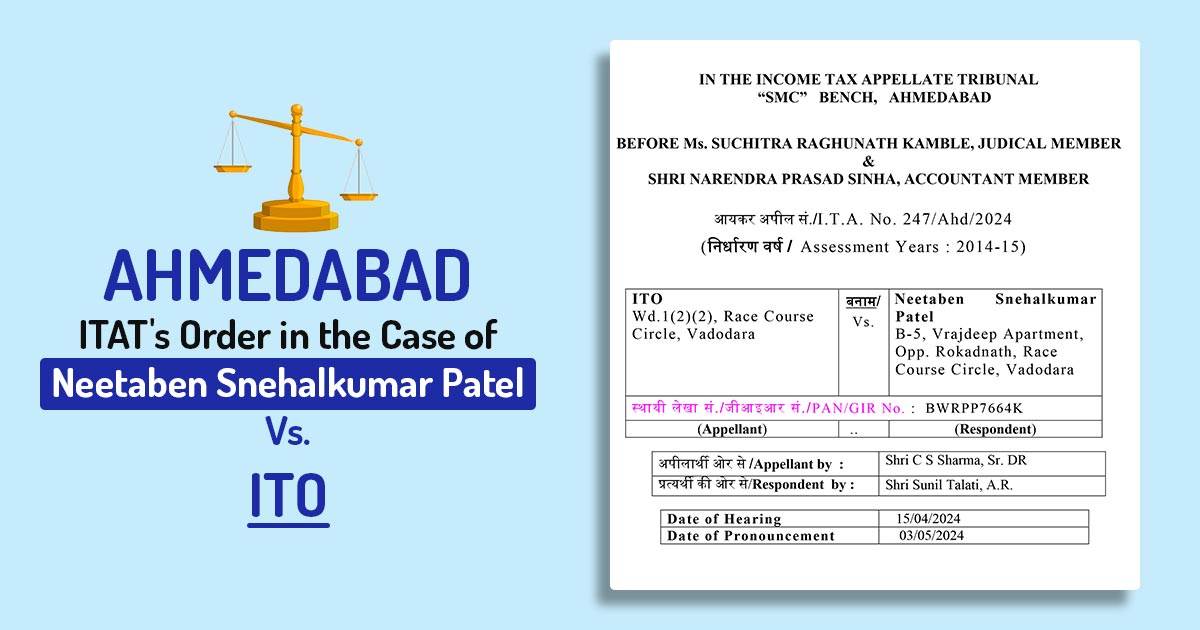

The two-member bench of Raghunath Kamble ( Judicial Member ) and Narendra Prasad Sinha ( Accountant Member ) has marked that the order passed by the ITAT recalling its earlier order, which was passed in the practice of powers u/s 254(2) of the Act, is outside the scope and ambit of the powers of the Appellate Tribunal granted u/s 254(2) of the Income Tax Act, 1961.

The Tribunal while dismissing the application remarked that the finding as provided via the tribunal was not merely on the grounds of the portion of the order to which the taxpayer has objected. The tribunal’s recorded finding is not disputed as wrong and no error in the findings has been marked.

It was ruled by the Income Tax Appellate Tribunal (ITAT) does not need to revisit its order and dwell on its merits because the power u/s 254(2A) is restricted to correcting mistakes seen on record.

| Case Title | Neetaben Snehalkumar Patel Vs. ITO |

| Case No. | I.T.A. No. 247/Ahd/2024 |

| Date | 03.05.2024 |

| Appellant by | Shri C S Sharma |

| Respondent by | Shri Sunil Talati |

| Ahmedabad ITAT | Read Order |