The Kolkata ITAT Referring to the decision in the case of Anudip Foundation for Social Welfare vs. CIT(Exemption), Kolkata – ITA No. 1341/Kol/2023, ruled that the taxpayer will not be denied the advantage of the Sec 80G because of the technical errors emerged in making application as of the confusion and misunderstanding on in properly interpreting the pertinent provision.

Section 80G of the Income Tax Act deduction is a utility that permits taxpayers to claim deductions for various contributions made as donations. The deduction under the Act is unrestricted for contributions to the defined relief funds and charitable institutions.

The Bench of Sanjay Garg (Judicial Member) and Rakesh Mishra (Accountant Member) mentioned that “if the assessee is granted final approval by the CIT(E) then, the benefit of approval u/s 80G of the Act, available to the assessee prior to the Amendment brought vide Amending Act of 2020, will be deemed to be continued without any break”.

Case Fact

The taxpayer applied for provisional approval under Clause (iv) to First Proviso to section 80G(5) and it was granted by the CIT(Exemption) in Form 10AC, which was valid from June 28, 2022, to A.Y 2025-26. After that, the taxpayer applied for final approval under Clause (iii) to First Proviso to section 80G(5), which was rejected by the CIT(Exemption) observing that the taxpayer had already started its activities even before granting of provisional approval, and since the period for making application cited in Clause (iii) to First Proviso to section 80G(5) had already expired.

Tribunal Observations

The institutions which stood already approved under section 80G(5)(vi) on the date of Amendment brought to section 80G by Taxation and Other Laws need to re-apply for fresh registration under Clause (i) to the First Proviso to section 80G(5) and those institutions have to be granted approval for five years by the CIT(Exemption) without any enquiry, the Bench noted.

Related News:- Section-Based Income Tax Saving Tips For Salaried Person

Bench mentioned that the said date for the final application for the approval under clause (i) to the First Proviso to section 80G(5) was stipulated as 3 months from 1st Day of April 2022, but, the CBDT from time to time extended the date for filing of the said application under Clause (i) to the First Proviso to section 80G(5).

Bench mentioned that the institutions that are required to apply for the first time or the institutions that did not stand approved on the Amendment date brought by the Taxation and Other Laws Act, 2020 could apply under Clause (iv) of the First Proviso to section 80G(5).

The Bench for the case revealed that the provisional approval had indeed been granted to the taxpayer institution till the A.Y 2025-26, and hence, the taxpayer trust was not restricted from making such an application for final approval. The petition of the taxpayer has been partly permitted by the Income Tax Appellate Tribunal and asked the CIT(Exemption) to grant final approval to the taxpayer under Clause (iii) to First Proviso to section 80G(5) if the taxpayer is discovered qualified.

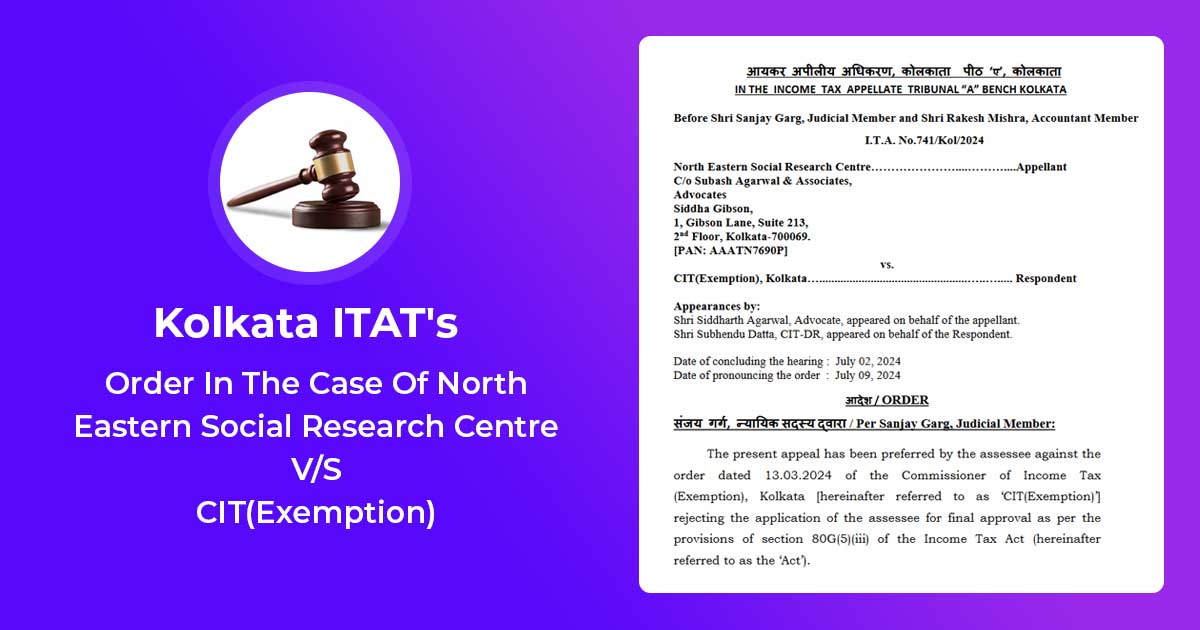

| Case Title | North Eastern Social Research Centre V/S CIT (Exemption) |

| Case No. | I.T.A. No.741/Kol/2024 |

| Date | 09.07.2024 |

| Counsel For Appellant | Siddharth Agarwal |

| Counsel For Respondent | Subhendu Datta |

| Kolkata ITAT | Read Order |