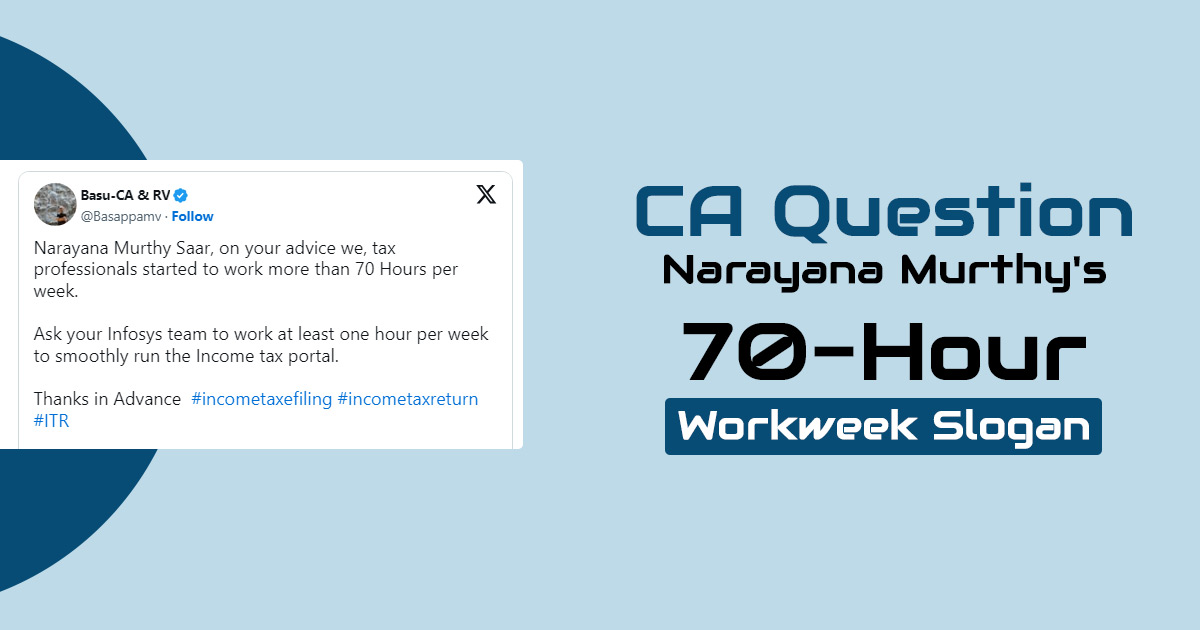

A Bengaluru-based chartered accountant (CA) in between the rush to file the ITR before July 31 has a funny take on Infosys founder Narayana Murthy’s famous suggestion, encouraging young professionals to work 70 hours a week to build the country. While angering on X Basu (@Basappamv) mentioned that even after working for more than 70 hours a week he and other CAs are encountering issues with the income tax portal that the Infosys has developed.

On your recommendation “Narayana Murthy Saar,” Basu wrote that we tax professionals have begun to work for more than 70 hours per week. Tell your Infosys team to work for at least 1 hour per week to streamline the income tax portal. Thanks in advance.

Infosys founder Narayana Murthy mentioned that the youngsters must work 70 hours a week when India wishes to finish with the economics that has made immense progress in the last 20 to 30 years.

This post has been struck with various X users.

Ishwar Singh (@IshwarBagga) remarked that 70 years comprised of struggling with his IT support for 30 hours. He was good enough to know this and notified the nation. A true nationalist who knows the development team’s strength.

Read Also: Quick Guide to Use Pay Income Tax Later on 2.0 ITR Portal

Some people pointed out that Murthy is no longer accountable for the company’s daily operations.

Dhruv Rai Puri (@dhruvraipuri) mentioned that Dude, Narayana Murthy has passed the mantle and moved on. It’s like addressing Bill Gates today when your Windows machine crashes.

Technical obstacles

A technical slowdown has indeed been notified by the other CAs while downloading the AIS and TIS leading to delays in filing income tax returns.

There is a normal delay while filing income tax returns this year,” a tax expert cited.

Three factors are the major cause for the delay technical glitches on the portal, the dynamic nature of AIS, and the delay in sharing Form 16 by some companies (despite the statutory June 15 deadline).

They affirmed that the procedure this year has been affected because of the delays in accessing the pertinent tax details related to the individual taxpayers.

A tax expert mentioned that issues are being faced by us in accessing the Annual Information Statement (AIS) and Tax Information Statement (TIS) for various clients as of the delay that has been caused via the operationally of the tax filing portal server.