The main purpose of this blog post is to explain how to easily use the Pay Income Tax Later option on the new ITR filing 2.0 portal. On the income tax e-filing website the income tax department would have incorporated a new feature that permits a person to file the income tax subsequently. It directed that a person can carry on filing ITR excluding filing the due income taxes.

The income tax amount can be paid once the ITR is furnished with certain conditions. The ITR can merely be filed once the unpaid taxes are paid.

What is a Pay Income Tax Later Option?

A pay-later option was provided by the income tax department when we furnished the ITR. Hence a person can file an income tax return (ITR) excluding paying income tax dues through the usage of the same option.

Learn the method to use the pay later option on the income tax department’s e-filing portal.

Where Can I Use Pay Income Tax Later Facility?

For the payment of self-assessment taxes, the Pay Later option could be utilised merely at the time of ITR filing. Now for tax payments such as advance tax, TDS, and others, the pay later option could not be utilised.

Main Features of the ‘Pay Later’ Option for Filing ITR

Choosing the Right Time: The income tax department has not established a strict timeframe for settling tax payments. However, financial experts strongly recommend settling the dues in the same month as filing your Income Tax Returns (ITR). This proactive technique permits in preventing the accumulation of penal interest.

Highlights of the Pay Later Feature: While this feature is designed to provide relief to taxpayers by allowing them to file ITRs without upfront tax payments, it comes with certain conditions to be aware of: Conditions- This feature specifically addresses self-assessment tax payments made during the process of filing ITRs. However, it’s important to note that you cannot defer advance tax and TDS using this option.

Resulting Consequences: Choosing to use the ‘Pay Later’ option is not without consequences. Taxpayers may be categorized as an “assessee in default,” which could potentially lead to penalties and the accrual of interest on the unpaid tax amount.

ITR Assessment and Penalty: Once your ITR is processed, you will receive a notice indicating any outstanding tax amounts. To avoid incurring penal interest, it is advisable to make the payment within 30 days of receiving the notice. However, there is some confusion among many taxpayers regarding whether penal interest starts accumulating immediately upon selecting the ‘Pay Later’ option.

Introducing ‘Pay Later’ Functionality: To improve the experience for taxpayers, the Indian Income Tax Department has introduced an innovative feature on its e-filing portal called the ‘Pay Later’ option. This feature enables taxpayers to submit their Income Tax Returns (ITRs) without the immediate obligation of paying taxes.

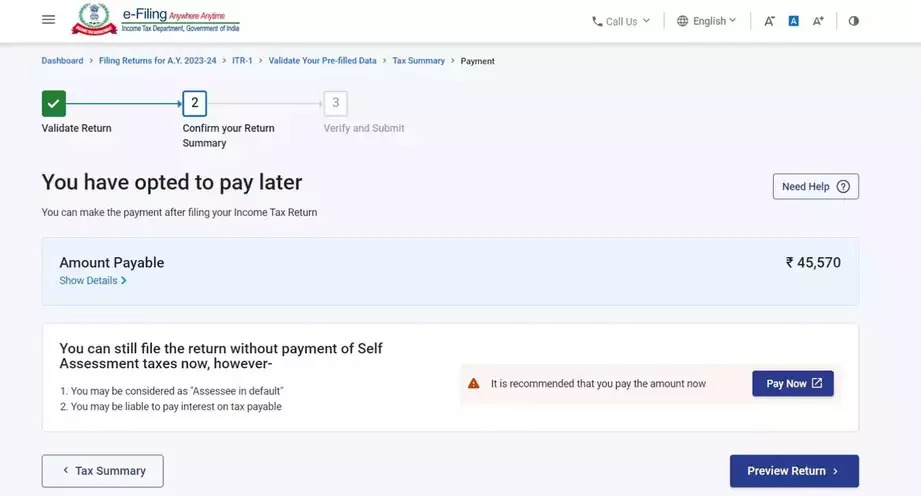

Make use of the Pay Later Option: When you reach the final stage of your ITR filing process, you will encounter two options on the grounds of the amount of tax you owe: ‘Pay Later’ or ‘Pay Now.’ By selecting ‘Pay Later,’ you can proceed with filing your Income tax return without an immediate tax payment and then verify your submission using the prescribed methods.

Tax Dues can be Repaid Later: For those individuals who have chosen to Pay later there are two major routes to settle their tax dues:

- E-Pay Tax Method: on the portal navigate to the e-pay tax section and finish the due tax payments.

- Tax for the Regular Assessment: Comply with the provided norms on obtaining the notice of intimation to make the payment.

You should note that if you losses to follow the same then it can levy additional penalties as well as interest.

What Did You Lose After Using Pay Income Tax Later Option?

When choosing the ‘pay later’ option, there are a few things to bear in mind. The first thing that appears when you choose this option during ITR filing is the phrase “You may be considered as assessee in default.” It will also state that “You may be required to pay interest on tax payable.”

If penal interest is charged on tax debts, the person in question will be regarded as an assessee in default. Once a person is considered to be an assessee in default, the income tax agency may begin taking any necessary action to recover those taxes.

A notification notice will be provided to the person following the processing of the ITR, according to the helpdesk representative for the income tax department. You will be informed in this notification that you owe taxes and should do so as soon as feasible. After that, a person has 30 days to pay any unpaid income tax obligations without facing penalty interest. Penal interest will be applied if the unpaid taxes are paid more than 30 days late.

The one-month term, however, has generated conflicting viewpoints among tax specialists. Both Bangar and Tanna contend that the person is in default as soon as he or she selects the pay later option. As a result, 1% punitive interest will be charged on unpaid taxes. If tax obligations are fulfilled beyond 30 days, there will be an extra 1% criminal interest charge.

What Happens When Selecting the Pay Income Tax Later Option?

If a taxpayer chooses the “pay later” option, they are required to pay their taxes as well as any applicable interest and fees as soon as possible and, in any event, within 15 days after receiving notification that their ITR is deemed to be inaccurate. If the ITR is still unsatisfactory after 15 days, it will be deemed invalid, and in addition to the negative effects of not paying self-assessment tax, additional rules will also apply as if the taxpayer had not submitted the return.

Read Also: All About E-pay Tax Feature with Online Payment Procedure

The income tax division does not have a set deadline for paying tax obligations under the pay later option. Income tax obligations must be paid by a person in the same month that their ITR is submitted. An individual has until July 31, 2024, for instance, to settle tax obligations if an ITR is submitted on July 11, 2024, utilizing the pay later option. Penal interest will be assessed if the payment is made after this deadline.

Step-by-Step Procedure for Using Pay Income Tax Later

When a person files their ITR, the option to pay later will show up. The following steps make it simple to employ this option, and the process is not difficult.

Step 1: Proceed to the new income tax filing portal- https://www.incometax.gov.in/iec/foportal/ and log into your account through the use of your user ID (PAN or Aadhaar) and password.

Step 2: After logging in, tap on the ‘e-file’ option, choose the ‘income tax return’, and then select ‘file income tax return’.

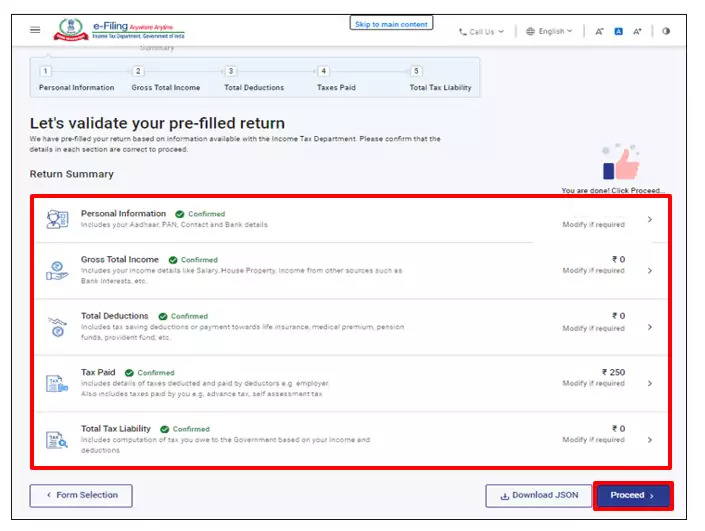

Step 3: You could initiate the procedure of ITR filing. The same shall comprise validating your personal details, income details, deductions claimed, etc.

Step 4: The income tax site will automatically compute if you owe any additional taxes after you have entered all the necessary information regarding your income and deductions, where appropriate. You will need to verify your complete tax payment here using the ITR that was submitted.

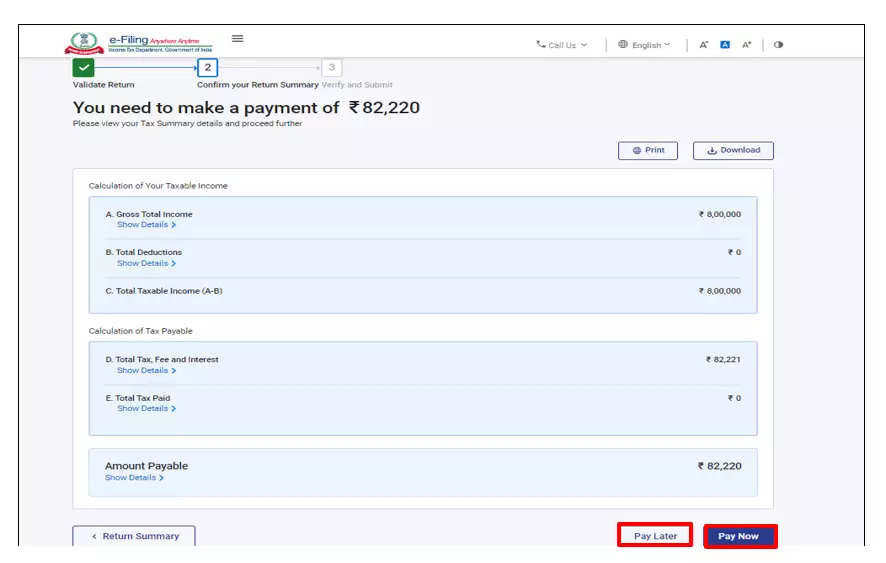

Step 5: You may see a summary of the specifics of your required income tax payment on this page.

Step 6: Let’s say you would have agreed with the additional tax liability then you are able to choose either the Pay Later or Pay Now option.

Step 7: When you choose the Pay Later option you are able to file your Income tax return without any income tax payment.

Step 8: You shall enabled to file your Income tax return once you have chosen the pay later option. You must verify your ITR after filing through the use of any of the 6 options available.

What is the Method to Pay the Taxes Later?

There are two methods to file the income tax dues once your ITR gets filed After choosing the pay later option, there are two ways to settle outstanding income tax obligations.

- Through the use of the e-pay tax method

- Making income tax payments post obtaining the notice of the tax demand.

Using the e-pay tax method: After successfully submitting the ITR, you can use the e-pay tax option to settle any outstanding tax debt. If income tax obligations are paid before the tax demand notice is sent, no penal interest will likely be issued.

Filing the tax dues post obtaining the notice from income tax: Post-processing of ITR the notice of tax demand shall be issued.

In two ways the assessee could settle his income tax dues.

Self-Assessment Tax: When the income tax is filed before obtaining any notice through the income tax department or under 15 days of obtaining the defective ITR notice then the same could get remitted in the form of self-assessment tax on the income tax portal. The tax council in the defective notice/intimation, shall furnish a chance to the person to fix the defect (i.e., payment of taxes due according to the ITR in this case) before processing the same.

Regular Assessment Tax: In this instance, the ITR is processed, the tax authorities issue a demand notice, and the taxes must be paid as tax on standard assessment on the Income Tax Portal. If appropriate, interest under Sections 234B and 220(2) (when demand is not paid within the prescribed timescale), as well as a penalty under Section 221 (assessee in default), may be assessed for late payment of self-assessment tax.

The assessing officer may levy a penalty under section 221 if the individual is regarded to be an ‘assessee in default’ for failing to pay tax accepted as payable in ITR but not paid by the due date of filing ITR. However, the imposition of a penalty is not automatic.

Before imposing the penalty, the assessing officer must give the person a fair chance to be heard. No fine may be assessed if the person proves to the assessing officer’s satisfaction that the default was due to valid grounds.

If the assessing officer is dissatisfied with the justifications given by the person, he or she may impose a penalty up to the amount of back taxes owed. It’s vital to remember that the assessing officer has the right to impose a penalty even if the subject has already paid the tax at issue.

Please be aware that the demand notice may be sent for any further tax adjustments that the tax department may make when processing the ITR, in addition to utilizing the “pay later” option.

Closure

The ‘Pay Later’ feature is undeniably a forward-thinking step, offering a flexible approach to ITR filing without the requirement of an immediate tax payment. However, it is the responsibility of taxpayers to use this feature wisely and ensure the timely settlement of their taxes. With prudent utilization, taxpayers can truly enjoy a hassle-free and seamless tax-filing experience.