The Income Tax Department launched the new website of Income Tax on June 7th, 2021. The website has had various technical problems since its launch. One of these is the problem related to ITR. Let’s know it in detail here.

Various Errors Related to ITR

People were excited about the new Income Tax website, but after the launch, they are facing various problems with it. The long list of problems also includes problems related to ITR filing, due to which people are getting frustrated. It is obvious that ITR filing is one of the main functions of the Income Tax website, along with other functions. But right now, the website is not able to perform its main function properly.

Submit Query for Error Free Return Filing Software

Common ITR Issues Faced by Taxpayers in FY 2024-25

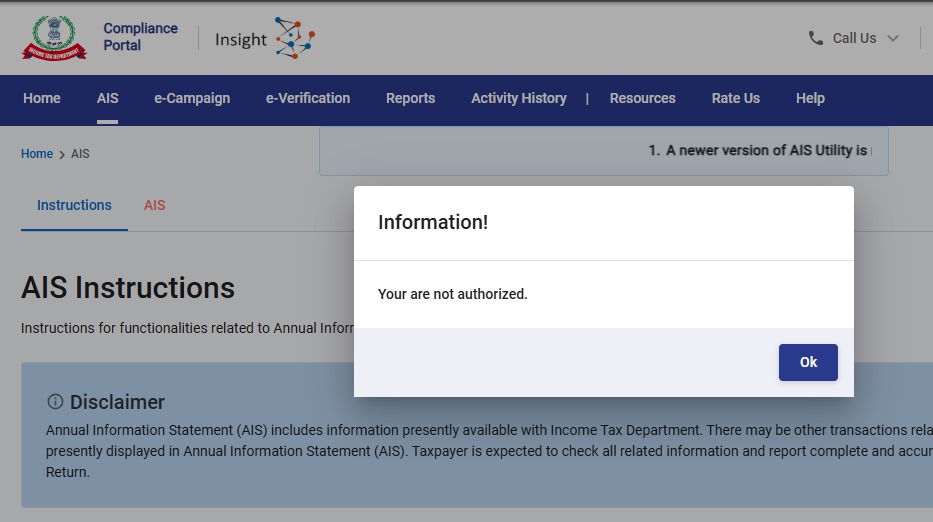

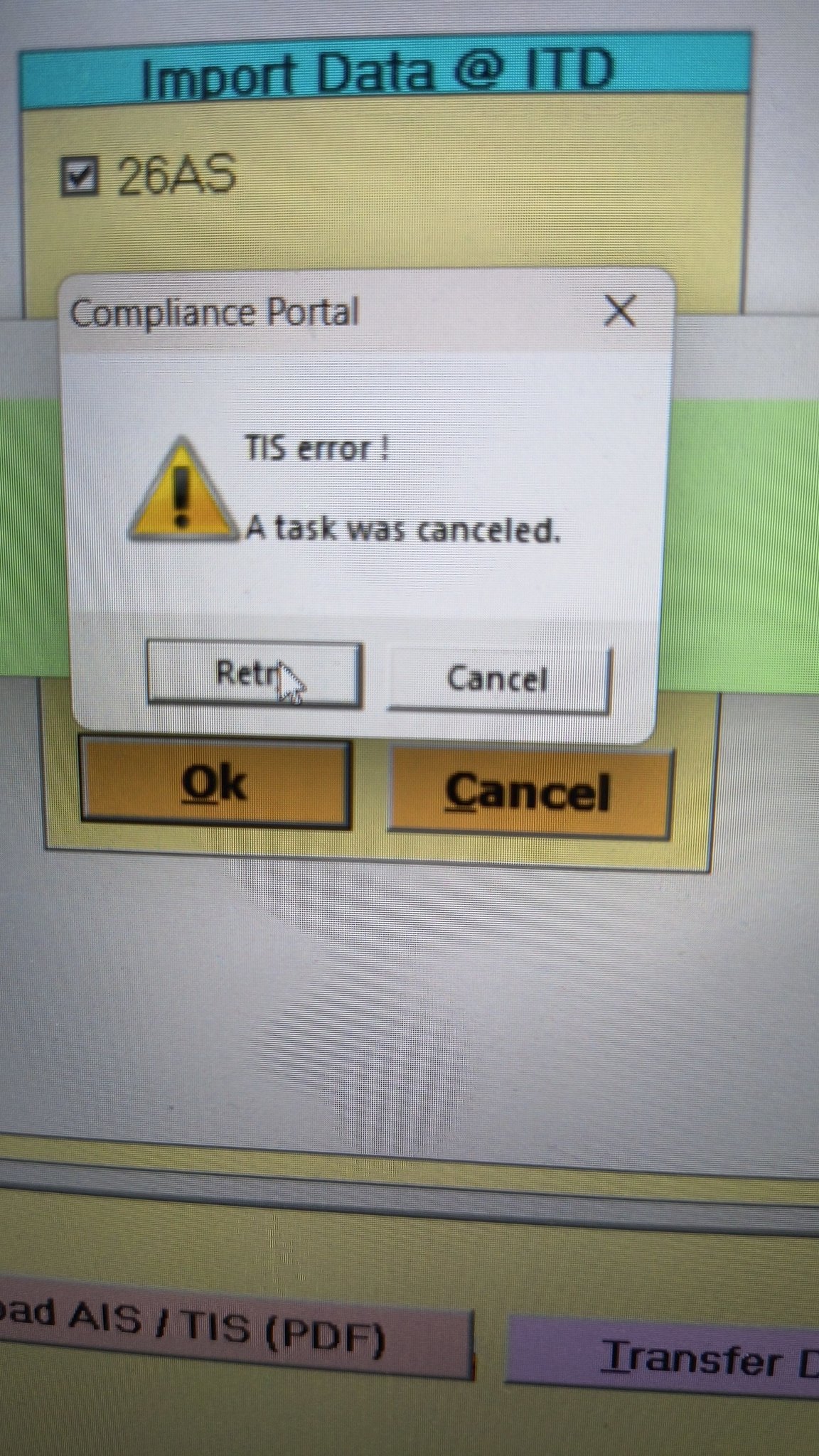

- Error 1: The income tax portal has been issuing an error for the past few days, making it impossible to download the AIS and TIS Data. According to the given challenges in the ITR filing, it would be mindful to think about extending the additional deadline by 2 to 3 weeks. The lack of these important records significantly complicates the tax filing process. Here is the error below –

- Error 2: While submitting the return in ITR-2, the Assessee is facing the following validation error. This error is not coming while filing ITR-3:

- In Schedule CG, the value of b1eii should be: (a) the difference of B1eiA and B1eiB, if eiA > eiB, else 0, if the date of acquisition is before 23 July 2024 and the transfer is on or after 23rd July 2024; (b) 0 in any other case.

- Error 3: While submitting the return in ITR-2, the Assessee is facing the following validation error. This error is not coming while filing ITR-3: In schedule CG, the dropdown at sl. no. B10a, &; Whether the date of limitation /withdrawal was before 23rd July 2024 & is not selected.

- Error 4: While submitting the return in ITR-2, the Assessee is facing the following validation error:

- In Schedule Part-BTI, Sl. No. 15 Aggregate Income of Schedule B-TI is not equal to Sl. No. 12 – 13 + 14

Genius Software Makes Income Tax Filing Easy and Secure

Since Assessment Year 2001-02, Genius tax software has been the number one tax return filing software among Indian tax professionals. Clients can file unlimited returns with this software, including income tax, TDS, AIR/SFT, and other tax forms. Gen BAL (Balance Sheet), Gen IT (Income Tax), Gen CMA, Gen FM, TDS (Tax Deducted at Source) and AIR/SFT make up the six modules of the Genius program. Among the best taxation software in India, Genius provides multiple features such as Backup, Restore, and Password Settings.

total income as per partb-t is 0 is not matching with total income as per schedule amt how solve problem

I am unable to rectify the errors in S-CG, F table. In the table there are auto filling & new entries (BFSA data) are accepting. How to rectify the errors?

STCG saved & confirmed value not appearing in Srl no.2 of Table F. When the same value is entered manually & then confirmed, it is not get saved.

While filling ITR -2, when I fill a schedule and then click on SAVE button or CONFIRM button “Loading” message comes on. and nothing happens. It hangs. How do I fill my data in Schedules like Schedule 112A and Schedule Capital Gains?

I am getting error as below. Unable to resolve, please guide/help.

Field Name – Type of account

error Description – please select type of account

I am also getting this error. have you found the solution?

a error massage reflect in validation type of account in itr-1

I am getting this error. have you found the solution?

Same Error – Tried re-Validating Bank Account Details but still this error shows up.

THIS IS THE SIDE EFFECT OF 70/90 HOURS OF WORK BY THE EMPLOYEE OF THE GREAT NARAYAN MURTHY.

For this error

Field Name – Type of account

error Description – please select type of account

You need to delete/remove those bank accounts that have prevalidation failed. After that restart filing with new itr form, this will delete the draft.

After this you will not have this error

Thanks Jigyarth Joshi, it worked for me as well.

I Solved the issue by removing Bank Accounts which were unvalidated

Have you found the solution ? I am facing the same trouble.

TYPE OF ACCOUNT SHOW KAR RAHA HAI

if you have more than one bank account must check the account type and validate all the bank accounts which has been added in the portal and then proceed

Need to check the details of bank accounts are entered correctly or not.

you have to remove the failed bank account numbers from failed bak accounts list

I’m facing this error, and even after trying again after 24 hours, the same error still shows up.

You have exceeded the limit to invoke the service on this network. Please try after 24 hours.

DID YOU SOLVE THE PROBLEM

ITR3_INFY24_PartA_GEN1_personalinfor_status_ny7ki this error showing while filling ITR 3

I got an defect notice and i try to revise and submit and always getting ” Invalid Receipt number. Please retry and enter correct acknowledgement number. Did any one got this error and how to fix this ?

Check the acknowledgement number from the return against which receive the notice. Still getting the same error then contact to income tax portal.

I’m trying to file rectification request, and have opted for data correction. So I have refilled ITR 2 for AY20-21 and generated X M L using the latest utility. However, when I’m trying to upload the X M L while doing online rectification I am getting error cannot fetch details.

Double-check that the XML file you generated using the latest utility corresponds to the correct ITR form (ITR-2) and AY (Assessment Year 2020-21). Sometimes, uploading an incorrect XML file can lead to errors.

[#/ITR/ITR1/Refund: required key [BankAccountDtls] not found];#;Please contact the developer of your utility with the error key

Please update your bank account details for a refund on the Income Tax portal.

Same problem happened with me today i.e., on 30/06/2025. Is there any solution for it? or it need to be resolved by the department?

errors found – type of account – please select type of account

[#/ITR/ITR1/Refund: required key [BankAccountDtls] not found];#;Please contact the developer of your utility with the error key

[#/ITR/ITR4/TDSonOthThanSals/TDSonOthThanSalDtls/0/DeductedYr: Select is not a valid enum value];#;Please contact the developer of your utility with the error key

Getting this error, Can anyone help !!?

My network problem please solve

Need help