The Income Tax Appellate Tribunal (ITAT) in Delhi ruled that the assessment conducted by the Assessing Officer under Section 143(3) on December 27, 2019, following a notice issued under Section 143(2) on September 22, 2018, is invalid.

The tribunal found that the notice was not in the format required by the Central Board of Direct Taxes (CBDT). As a result, the assessment was deemed null and void from the outset and has been quashed by the ITAT.

Case Facts

During the demonetization period taxpayer deposited Rs 2,68,78,500. The taxpayer cannot appear before the AO and the Commissioner of Income Tax (Appeals), i.e ex-parte order before both authorities.

Additional Ground raised during the proceeding

The taxpayer has raised additional ground that “On the facts and circumstances of the case, the Assessing Officer erred in issuing notice u/s 143(2) of the Income Tax Act, 1961, dated 09.08.2018 in violation of CBDT Instruction F.No.225/157/2017/ITA-II dated 23.06.2017. Therefore, the said notice is invalid, and the assessment framed pursuant thereto is vitiated in law.”

Taxpayer Furnishes That

CBDT on 23.06.2017, has issued an instruction vide instruction no F.No.225/157/2017/ITA-II for the revised format of notice under section 143(2) of the Income-tax Act, 1961 (hereinafter “the Act”).

In para 2 of this instruction, CBDT established three formats of notices: Limited Scrutiny (CASS), Completed Scrutiny (CASS), and Compulsory Manual Scrutiny, and formats were attached on pg. no. 2,3, and 4, respectively. In para 3 of the instruction, CBDT directs that all the notices u/s 143(2) of the Act shall subsequently be issued in revised format only.

According to the Hon’ble Supreme Court decision in the case of UCO Bank vs. CIT (237 ITR 889) and Back Office IT Solution Pvt. Ltd. vs. Union of India (2021) SCC OnLine (Del) 2742, instructions of CBDT are binding on the Income tax authorities.

Hence, under section 143(2), the issuance of notice in an effective format is a jurisdictional need, and any defect therein will proceed to the root of the assessment proceedings. An issued notice in breach of the law could not grant jurisdiction on the Assessing Officer (AO) to proceed with scrutiny assessment. Thus, he files that the notice on 22.09.2018 issued under section 143(2) is not valid and unenforceable in law.

Tribunal Decision

The Assessing Officer cited the assessment u/s 143(3) dated 27.12.2019 is as per the notice issued under section 143(2) dated 22.09.2018, which was not in the specified format as notified by the CBDT, is bad in law and void ab initio, and it is hereby quashed, Hon’ble Delhi ITAT ruled.

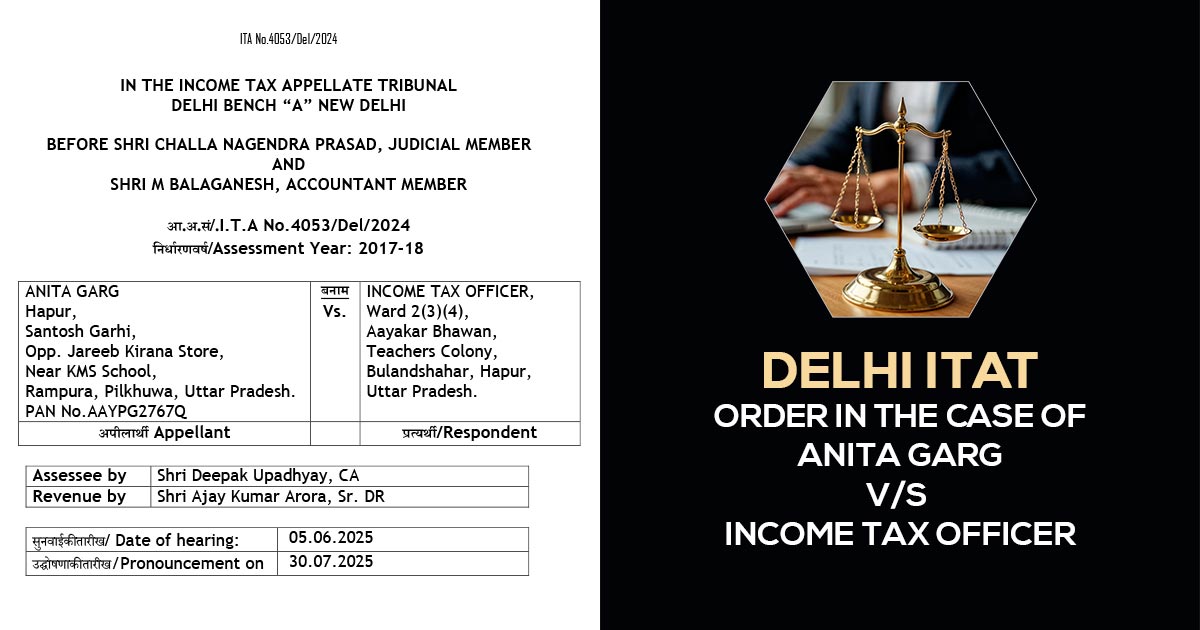

| Case Title | Anita Garg vs. Income Tax Officer |

| Case No. | I.T.A No.4053/Del/2024 |

| Assessee by | Shri Deepak Upadhyay |

| Revenue by | Shri Ajay Kumar Arora |

| Delhi ITAT | Read Order |