The order has been quashed by the Delhi bench of the Income Tax Appellate Tribunal (ITAT) via the Deputy Commissioner of Income Tax (DCIT) for the assessment year (AY) 2021-22, where the assessing officer (AO) had applied Section 143(3) of the Income Tax Act, 1961, rather than the appropriate Section 153C of the Income Tax Act.

For the matter the taxpayer, Seema Jain an individual who is making income via rental properties, capital gains, and bank interest, had filed her income tax return (ITR) for the relevant year, reporting a total income of Rs. 89,56,500.

On 6-01-2021, an investigation was conducted at the premises of Parven Kumar Jain and M/s Jainco Ltd. In the investigation the AO discovered proof via Parveen Kumar Jain’s WhatsApp chat, specifying the cash payments for the sale of a property that the taxpayer owns.

The location of the property which is in question is at C-117, First Floor, Nirman Vihar, Delhi, and was officially sold for Rs. 80 lakhs through banking channels. AO alleged that another cash receipt of Rs 1,55,00,000 was not revealed in the income tax return.

Post recording the proof the AO must have started the proceedings u/s 153C of the Income Tax Act, 1961, applicable when the documents or assets of the third party are discovered in the investigation. Under Section 143(3) the assessment was performed.

As of this, the taxpayer has contested the process on a legal basis to the Commissioner of Income Tax (Appeals) [ CIT(A) ], asserting that the assessment was invalid without compliance with Section 153C. The AO addition is been kept by the CIT(A).

Therefore the taxpayer has approached the ITAT for relief.

The taxpayer claimed that as the investigation of a third party is used against her, the pertinent action on the taxpayer shall be within Section 153C of the Income Tax Act, as the date of search in the hands of the taxpayer varies from that of Shri Parveen Kumar Jain.

The bench, by marking the ruling of the Apex court in CIT vs. Jasjit Singh, ruled that the assessments engaged in the third party, the investigation materials should comply with the stated procedure in Section 153C of the Income Tax Statute. As per the judgment, the 6-year block period pertinent to the assessment should be computed from the date the AO obtains the documents.

The assessment order has been quashed by the ITAT, comprising of Sktijit Dey (Vice President) and M. Balaganesh (Accountant Member), and ruled that the proceedings had no legal standing as of the procedural lapses.

The appeal was permitted by the bench which ruled that any investigation of the additional grounds raised was not required as the assessment itself was void.

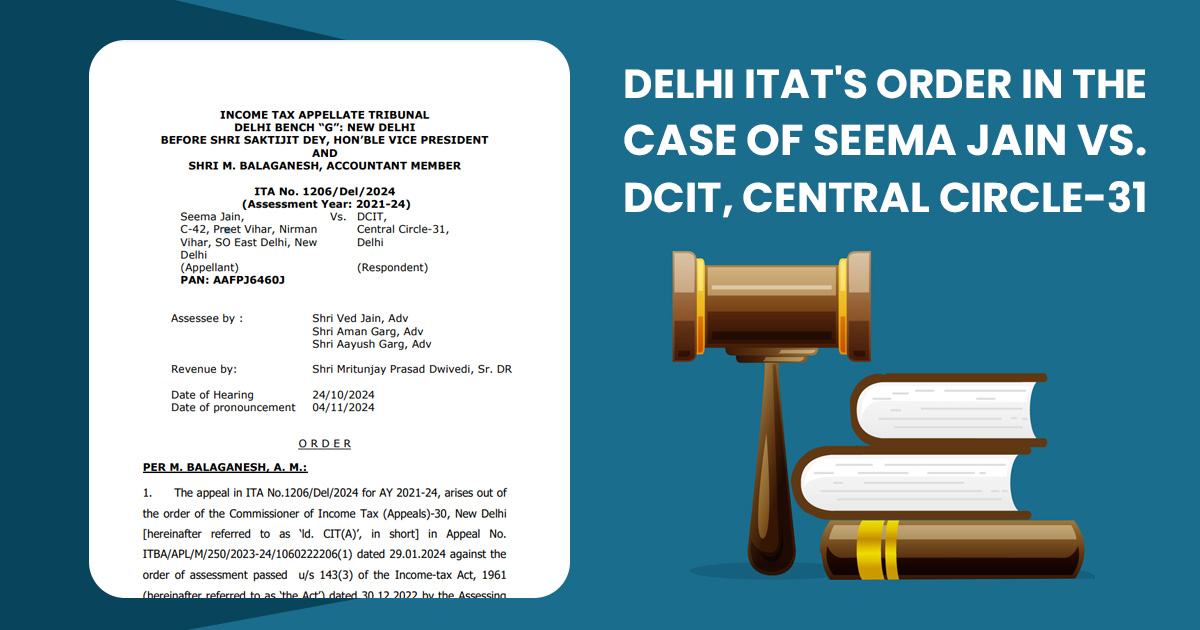

| Case Title | Seema Jain vs. DCIT, Central Circle-31 |

| Citation | ITA No. 1206/Del/2024 |

| Date | 04.11.2024 |

| Assessee by | Shri Ved Jain, Shri Aman Garg, Shri Aayush Garg |

| Revenue by | Shri Mritunjay Prasad Dwivedi |

| ITAT Delhi | Read Order |