Definition of New GST Forms SPL-01 and SPL-02

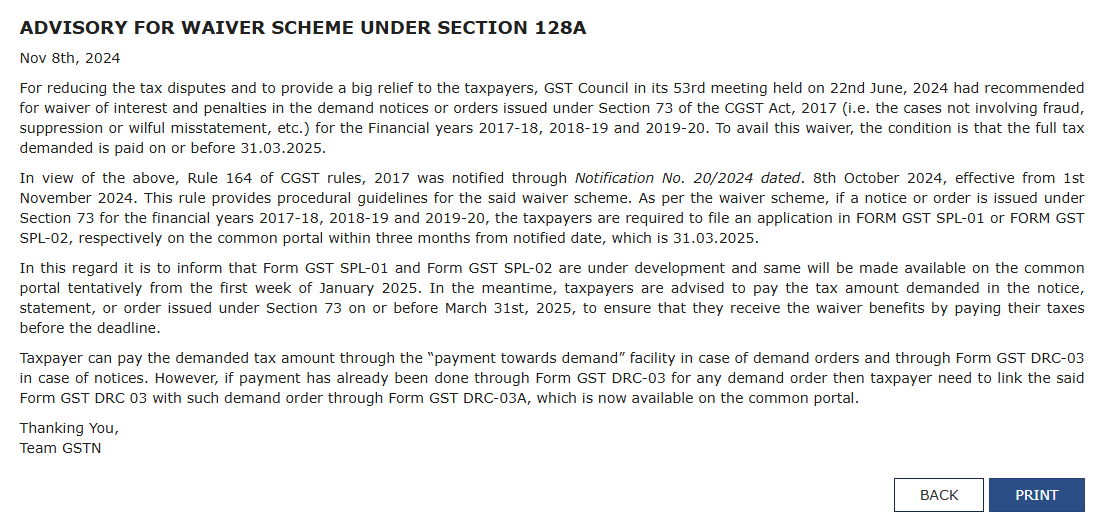

In November 2024, the Goods and Services Tax Network (GSTN) announced that GST Forms SPL-01 and SPL-02, to claim the exemption of interest and penalties under section 128A of the GST Act will be introduced in January 2025.

Latest Update

- The GSTN team is working to resolve issues with filing applications (SPL 01/SPL 02) under the waiver scheme. View more

- GST Form SPL 02 is now available at the GST official portal, along with the filing process. Read PDF

53rd GST Council Meeting

From the suggestions of the GST council in its 53rd meeting dated June 22, 2024, the same development has emerged that has the objective of lessening the tax disputes and furnishing relief before the assessees.

The waivers have been approved for the interest and penalties on demand notices or issued orders u/s 73 of the CGST Act, 2017 particularly for the fiscal years 2017-18, 2018-19, and 2019-20 by the council.

The same exemption applies merely to matters that do not comprise fraud, suppression, or willful misstatement, furnished the whole tax demanded is filed by March 31, 2025.

Read Also: Key Provisions and Their Impact on GST Section 128A

The government to streamline the execution of the same exemption scheme has rolled out Rule 164 to the CGST Rules, 2017, through Notification No. 20/2024, on October 8, 2024, effective November 1, 2024. Rule 164 drafts procedural guidelines for claiming this scheme.

When Will the SPL-01 and SPL-02 Forms Be Available on the GST Portal?

Under section 73 for the aforementioned financial years, Taxpayers who receive a notice or order are required to file the applications via Form GST SPL-01 or Form GST SPL-02 on the common portal within three months from the notified date, culminating on March 31, 2025.

The GSTN has specified that the development of Forms GST SPL-01 and SPL-02 is arriving shortly with an anticipated release date in the first week of January 2025. The assessees are suggested to ensure the payment of the demanded tax amount cited in the notice, statement or order u/s 73 by March 31, 2025, to be entitled to the exemption benefits.

GST Network said in its advisory, that the payments could be incurred via the payment towards the demand option for the demand orders or through Form GST DRC-03 for the notices.

If the payment has been finished earlier through Form GST DRC-03, the assessees should link it before the related demand order via Form GST DRC-03A, which has been available to the portal.

19-20 we have paid the tax amount .Please waive the respective interest and penalty for the concerned order