The Delhi High Court has confirmed that payments by Indian companies to foreign entities for the resale or use of computer software are not classified as royalty.

In a significant ruling, Justices V. Kameswar Rao and Vinod Kumar concluded that the Indian entity bears no obligation to tax deducted at source (TDS) in these circumstances.

The bench concerning the same relied on Engineering Analysis Centre of Excellence Pvt. Ltd. v. The Commissioner of Income Tax & Another (2021), where the Supreme Court expressed that amounts paid by Indian companies for the use of software developed by foreign companies do not amount to ‘royalty’ and that such payments are not taxable in India.

The income tax department begins proceedings against respondent-Xiocom (NZ) Ltd, a US-based company engaged in designing and furnishing off-the-shelf software solutions.

The respondent in the Assessment Year (AY) 2010-11 has sold its software to Zylog Systems (India) Ltd. to use the technology in specific areas in India.

The Department claimed that the income of ₹19,24,80,000 generated via the respondent through the articulated transaction was imposed to tax in India u/s 9 (1) (vi) of the Income Tax Act, 1961, and under Article 12 of the Indo-NZ Double Taxation Avoidance Agreement.

The demand has been set aside by the Commissioner of Income Tax (Appeals), quoting Director of Income Tax v. Infrasoft Limited (2013), where the High Court has ruled that where the right transferred is not to use the copyright but just to use the copyrighted material, it does not direct to any royalty income.

The department, after ITAT kept the order of CIT(A), approached the High Court.

The Delhi High Court relied on the Engineering Analysis Centre of Excellence (supra) and cited that,

“it is clear that the consideration for the resale/use of computer software through EULAs/distribution agreement is not Royalty for the use of copyright of the software and the same does not give rise to any taxable income in India and as a result, the persons referred to under Section 195 of the Act were not liable to be deduct any TDS under Section 195 of the Act.”

Therefore, it dismissed the appeal.

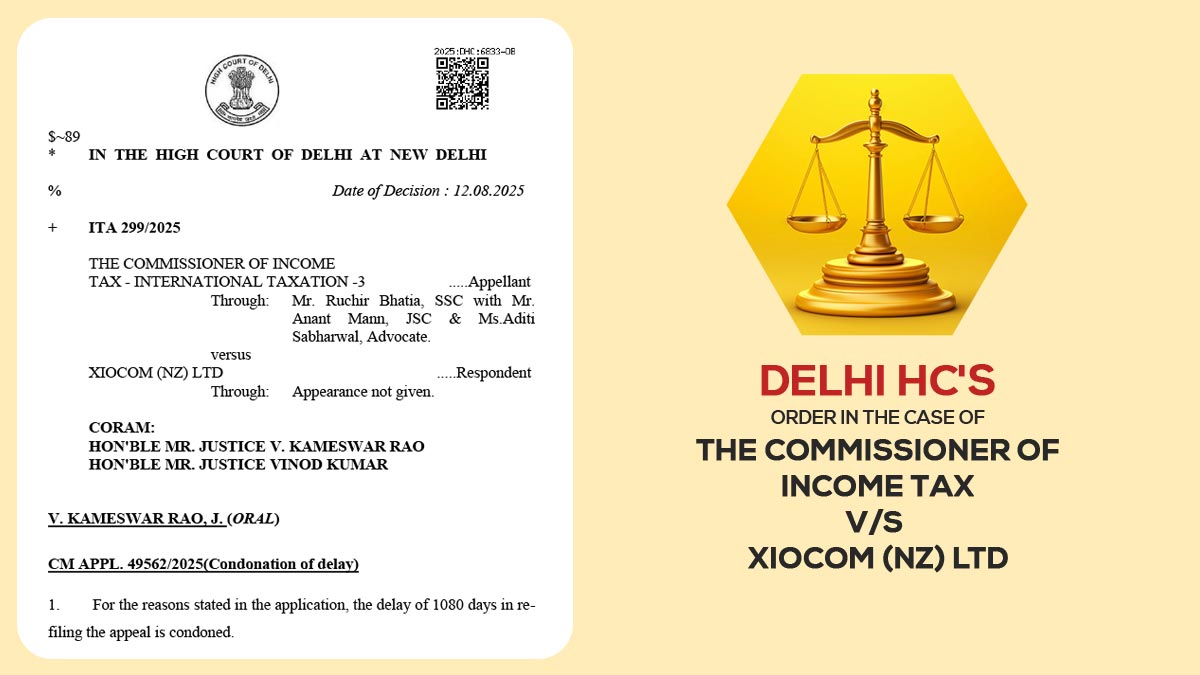

| Case Title | The Commissioner of Income Tax vs. XIOCOM (NZ) LTD |

| Case No. | ITA 299/2025 |

| For the Appellant by | Mr. Ruchir Bhatia, Mr. Anant Mann, and Ms.Aditi Sabharwal |

| Delhi High Court | Read Order |