Receipts via a foreign entity from the provision of software services to oil companies in India being like business profits are not chargeable in India in the absence of its Permanent Establishment (PE) during the relevant AYs, Delhi ITAT ruled.

Section 44BB of the Income Tax Act includes a unique provision for the calculation of the taxable income of a non-resident taxpayer who is in the business of delivering services or facilities in association with or supplying plant and machinery on hire, used or to be used, in the prospecting for, or extraction or production of, mineral oils.

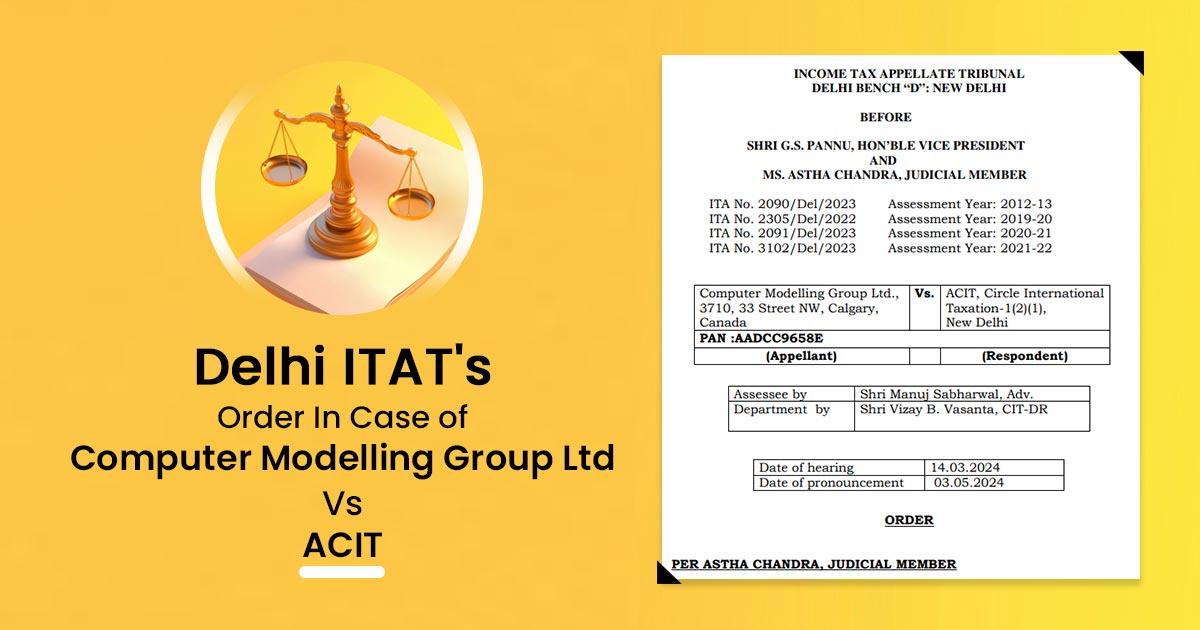

The Division Bench G.S. Pannu (Vice President) and Astha Chandra (Judicial Member) marked that the impugned receipts of the taxpayer are not levied to tax in India under the provisions of Section 44BB of the Act for the reason that the taxpayer does not have a PE in India in the pertinent AYs under regard and that being a resident of Canada, through the more beneficial provisions under the India-Canada DTAA, the taxpayer is regulated.

Concerning the case the taxpayer, a foreign company and a tax resident of Canada, is in the business of supplying reservoir simulation software to oil companies like ONGC, Oil India, Vedanta, etc. including corresponding software maintenance support services and training services for acquiring the operation of such software.

Under Section 148 the AO issued notice on the foundation that the taxpayer did not file the return for the impugned AYs despite receipts from Indian companies on which TDS had been deducted and concluded that the taxpayer was furnishing products and services which were being used to support exploratory activities in oil and gas exploration and production. Subsequently, the AO applied Section 44BB and calculated the taxpayer’s income at Rs. 36.44 Lac equivalent to 10% of the aggregate receipts of Rs. 3.64 Cr.

On the ruling of the jurisdictional High Court in OHM Ltd. and PGS Exploration, the bench relied on which it was ruled that the presence of a PE is a condition precedent for applicability of Section 44BB.

It is acknowledged particular that the taxpayer does not secure a PE in India and since it is the tax resident of Canada, India-Canada DTAA and nextly noted that Revenue has not carried on record any material to establish to the contrary, Bench remarked.

When the treaty provisions are advantageous, they ought to be applied, as the Bench ruled that section 44BB does not override the provisions of section 90.

The Bench remarked that the AO was unable to carry the record of anything to prove the existence of a taxpayer PE in India and that it is not the case of the Revenue that the taxpayer has the PE in India at the time of the impugned AYs.

Hence the Bench concluded that as the taxpayer does not include a PE in India in the impugned AYs, related receipts do not levy tax u/s 44BB.

The question of treating them as royalty or FTS is not effective as the impugned receipts experience the character of business income, the ITAT asked the AO to grant TDS credit for the tax deducted at source on the impugned receipts and also to grant interest u/s 244A.

| Case Title | Computer Modelling Group Ltd Vs. ACIT, Circle International |

| Citation | ITA No. 2090/Del/2023 Assessment Year: 2012-13 ITA No. 2305/Del/2022 Assessment Year: 2019-20 ITA No. 2091/Del/2023 Assessment Year: 2020-21 ITA No. 3102/Del/2023 Assessment Year: 2021-22 |

| Date | 03.05.2024 |

| Assessee by | Shri Manuj Sabharwal, Adv. |

| Department by | Shri Vizay B. Vasanta, CIT-DR |

| Delhi ITAT | Read Order |