The Delhi High Court in a decision has set aside an order for an alleged excess claim of Goods and Services Tax ( GST ) Input Tax Credit( ITC ) for the FY 2018-2019.

The applicant has contested the order on 15th March 2024 which was issued without regarding the answer furnished via the applicant dated 10th March 2024.

The counsel of the applicant, Parveen Kumar Gambhir, along with Rakesh Kumar and Akul Mangla, claimed that the applicant had furnished proof via Form GSTR-2A, GSTR-8A, and GSTR-9, demonstrating no excess ITC claim. However, this proof was not reviewed by the Proper Officer.

The counsel of the respondent Avishkar Singhvi, ASC, with Shubham Kumar, Naven Ahmed, and Vivek Kumar Singh accepted the notice for the respondents.

Read Also: Delhi HC Orders Re-adjudication to Address the Taxpayer’s Incapability for Responding GST SCN

The Division Bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja remarked that we have been taken through Form GSTR-2A, as available on the portal and from it prima facie seems that it has not been inspected by the Proper Officer. Concerning that, we believe that the impugned order calls for a remit.

The Bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja set aside the impugned order. The SCN was restored on the file of the proper officer to re-adjudicate as per the statute post investigating the response furnished via the applicant and post-furnishing a chance of the personal hearing before the applicant within the duration stated under section 75(3) of the Goods and Services Tax Act, 2017.

The proper Officer had not reviewed the submitted forms. Consequently, the impugned order was set aside, the Delhi HC Division Bench revealed.

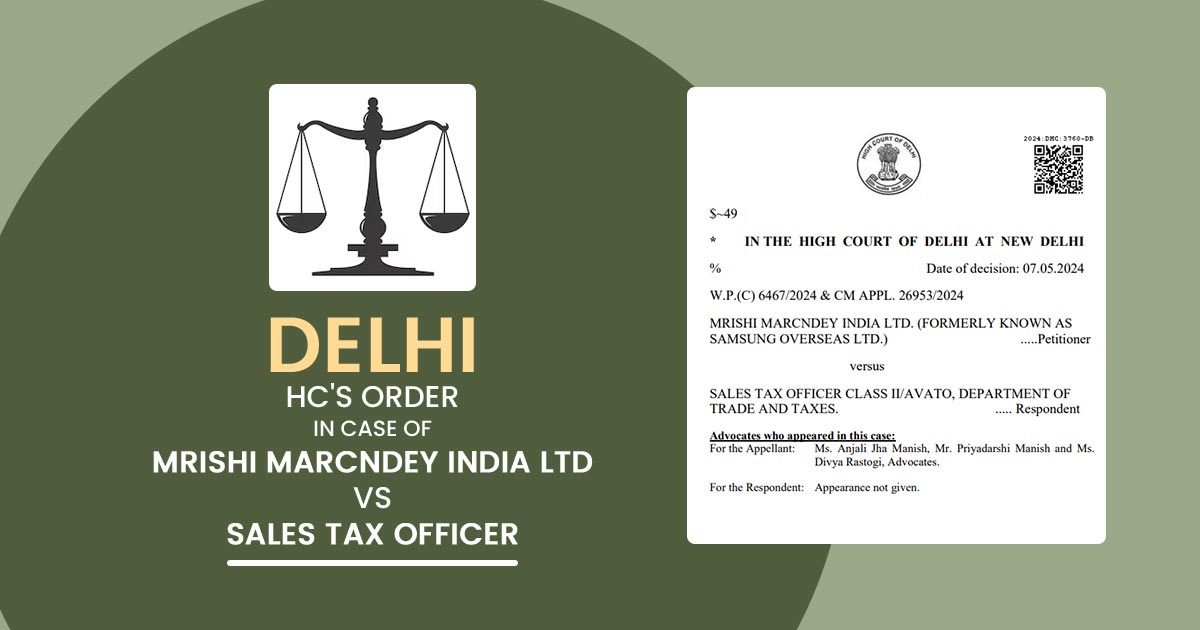

| Case Title | Mrishi Marcndey India Ltd Vs Sales Tax Officer |

| Citation | W.P.(C) 6467/2024 & CM APPL. 26953/2024 |

| Date | 07.05.2024 |

| For Petitioner | Ms Anjali Jha Manish, Mr Priyadarshi Manish and Ms Divya Rastogi, Advocates |

| For Respondent | Appearance not given |

| Delhi High Court | Read Order |