The Income Tax Appellate Tribunal (ITAT), Mumbai, has ruled in favour of an appellant who was imposed with a Rs 1.16 lakh penalty for late filing of TDS returns.

The company, M/s. J Duncan Healthcare Pvt. Ltd. made payments to two Russian companies, called JSC OLS Ltd. and JSC Viterani, for services they provided. When making these payments, the company withheld a portion of the money, about 10%, for taxes, which is known as Tax Deducted at Source (TDS).

The Russian companies did not secure a PAN (Permanent Account Number) in India, because of which the taxpayer can not submit the TDS returns. Thereafter, the company reversed the entries and does not claim any payments from either of the foreign companies. As the company does not file payments and does not deduct TDS, it was not needed to submit the TDS return.

Read Also: Solved! Important Questions Related to TDS Return Filing

For not filing TDS returns within the said time, the Income tax department incorrectly imposed a late fee of Rs 1,16,000 u/s 23E. The same has been contested by the taxpayer with the ITAT Mumbai, claiming that the JCIT did not acknowledge the fact that the services were not rendered by the foreign companies, and therefore the company reversed the accounts. The company cited that it is not needed to submit a TDS return as it did not deduct TDS.

ITAT acknowledged with the taxpayer and ruled that no question was there to submit any TDS return if the payment was not incurred and TDS was not deducted on the same. As per that, the ITAT asked the AO to withdraw the imposition of the fee and remove the addition of Rs 1,16,000.

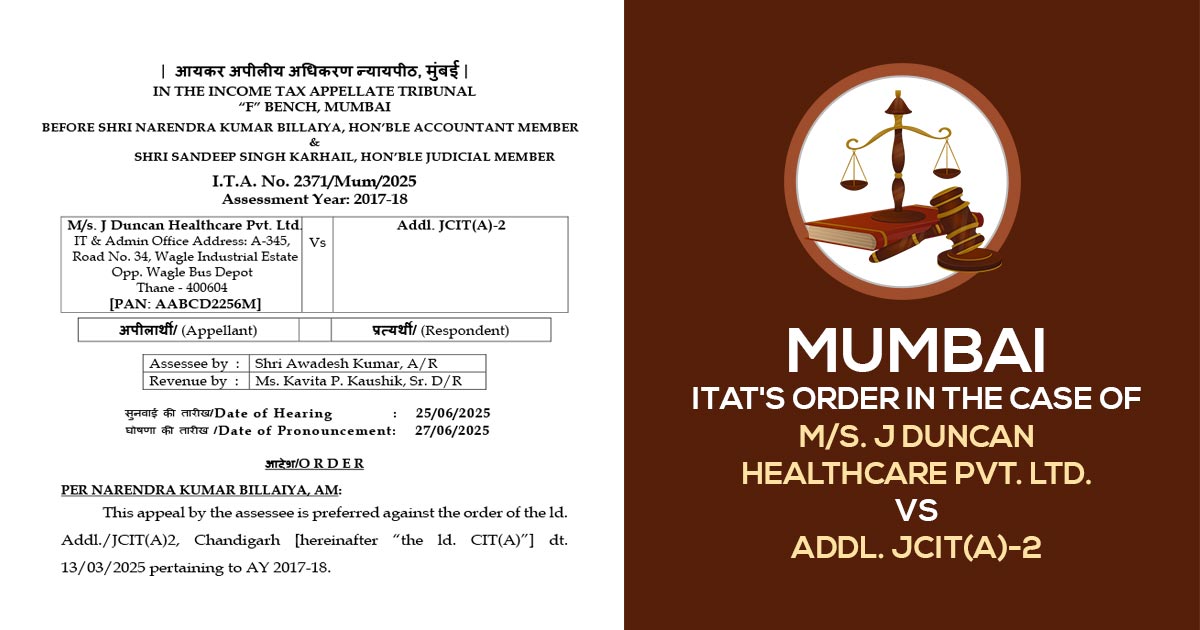

| Case Title | M/s. J Duncan Healthcare Pvt. Ltd. vs. Addl. JCIT(A)-2 |

| Case No. | I.T.A. No. 2371/Mum/2025 |

| For Petitioner | Shri Awadesh Kumar, A/R |

| For Respondent | Ms. Kavita P. Kaushik, Sr. D/R |

| Mumbai ITAT | Read Order |