Service tax is not charged on repairs to a school building run by the Military Engineering Services, as cited by the Hyderabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT).

Angad Prasad, serving as the Judicial Member, along with A.K. Jyotishi, the Technical Member, expressed their views regarding the services provided to the Military Engineering Services (MES).

They indicated that these services pertained to the Sainik School operated by MES. In their opinion, since the building associated with the Sainik School is not intended for commercial use, the repairs undertaken on such a facility fall outside the range of service tax obligations.

The taxpayer in the same case was undertaking specific works undertaken for municipal authorities; works of a government department of water distribution systems as sub-contractors; Construction of Elevated Level Storage Reservoir (ELSR) for APIIC (SEZ); Construction of water supply facilities at an industrial growth centre for APIIC; Works undertaken for the Military Engineering Services (MES) – Certain civil and electrical works for Korukonda Sainik School; Certain repairs to Municipal Authority.

In the classification of services, the work titled ‘certain repairs to Municipal Authority’ was categorised under Works Contract Service (WCS). In contrast, other related works fell under the category of Management, Maintenance, or Repair Service (MMRS).

The demand holding that services were classifiable under WCS, except for MMRS, has been confirmed by the Adjudicating Authority.

The bench noted that, concerning the classification of the composite contract, it has been adopted perfectly by the adjudicating authority as WCS, except for MMRS.

Read Also: CESTAT: Police Do Not Engage in Security Business; Therefore, No Service Tax Will Be Levied

According to the tribunal, the construction of a water distribution system activity, whether furnished as a contractor or subcontractor, is like construction services and is not subject to tax because these constructions are for government departments or municipalities and are related to the drinking water supply.

Since APIIC is a public authority and its objective is the promotion of industries and not to be involved in commerce, the demand for construction of water supply facilities at the industrial growth centre for APIIC is also not tenable, the Tribunal mentioned.

The bench, according to the definition of WCS, construction services concerning properties, not primarily for commerce, are outside the scope of charging of service tax, and even repair services concerning a non-commercial government building are kept outside the extent of levy.

The tribunal in the above case has permitted the appeal.

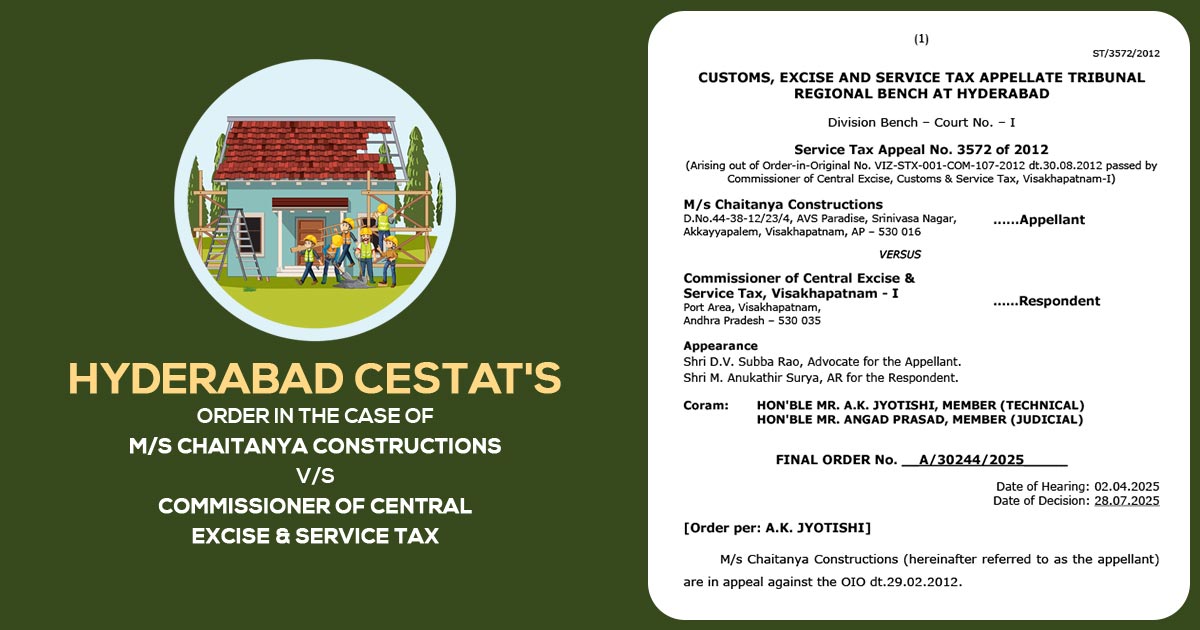

| Case Title | M/s Chaitanya Constructions vs. Commissioner of Central Excise & Service Tax |

| Case No. | Service Tax Appeal No. 3572 of 2012 |

| For the Appellant | Shri D.V. Subba Rao |

| For the Respondent | Shri M. Anukathir Surya |

| Hyderabad CESTAT | Read Order |