Are you unsure about the legitimacy of an Income Tax Notice or Order you received lately? No need to worry some remedies can help you avoid this unnecessary dilemma. The Income Tax Department has introduced a method that uses a computer-generated Document Identification Number (DIN) to help you validate any information received from them.

From October 1 2019, onwards, every official communication related to inquiries, investigations, assessments, appeals, orders, penalties, information verification, rectifications, and prosecutions from the Income Tax Department will include a distinct DIN.

Latest Update

- Taxpayers can verify communication from the income tax department via the ‘Authenticate Insight DIN’ feature provided by the Income Tax portal. This feature can be accessed on the AIS Home Page, increasing communication security. The validity of notifications is enhanced by this layer of verification.

Here’s a guide on utilizing the DIN to verify the genuineness of notices and orders issued by the Income Tax Department.

Simple Definition of Document Identification Number (DIN)

The Document Identification Number (DIN) is an exclusive code set by the Income Tax Department in India. This system facilitates transparency, accountability, and efficiency in tax administration by furnishing official instructions.

According to these guidelines, every official communication sent by the Income Tax Department, dated on or after the mentioned circular’s issuance date, must include a DIN. It’s important to note that communications without this specific identifier are considered invalid and carry no legal weight.

The implementation of DIN has standardized and safeguarded the notice-issuing process of the department.

According to this framework, every communication issued from the department must now have a unique 15-digit alphanumeric code. This step not only enables tracking and monitoring but also lowers the risk of fraudulent or unauthorized communications. It makes a more protected and efficient way for both taxpayers and tax authorities so they can correspond with each other easily.

What Are the Advantages of DIN?

Improved Responsibility: DIN establishes a sense of responsibility in the tax administration system. It ensures that the source of every communication can be traced, thereby minimizing the occurrence of unauthorized or untrustworthy correspondence.

Lowered the chances of fraud: Earlier, the absence of standardized identification numbers created favourable conditions for fraudulent notices and communications to circulate. DIN significantly raises the difficulty level for unauthorized parties to send fake or misleading documents.

Proficiency: Streamlined document management is a key advantage of the DIN system, benefiting both tax authorities and taxpayers. It facilitates efficient tracking, and retrieval, and reduces administrative burdens.

Improved Transparency: DIN enhances transparency in the communication process between the Income Tax Department and taxpayers. Every document or communication is given a specific identifier, which makes it easier to track and confirm the legitimacy of official notices and orders.

Verify the Validity: The verification of legitimacy is made convenient for taxpayers through the DIN system. By checking the DIN on the official website, taxpayers can easily confirm the authenticity of notices and orders from the Income Tax Department. This feature provides reassurance that the communication is indeed genuine.

Efficient Handling of Appeals and Adherence to Tax Regulations: DIN makes the process of managing appeals easy and promotes compliance with tax regulations. This enables taxpayers to respond more effectively to official I-T notices and orders, resulting in smoother interactions with tax authorities.

Digital Transformation: The DIN system aligns with the wider shift towards digitization and e-governance in tax administration. It encourages the adoption of electronic communication and reduces reliance on physical paperwork.

Organized: DIN brings standardization to the system by introducing a uniform format for identification numbers. This simplifies comprehension and working with the system for both tax authorities and taxpayers.

Enhanced Documentation/Record Management: The DIN system offers superior documentation for both entities involved. Tax authorities can ensure precise record-keeping of all communications, while taxpayers can effectively monitor the notices and orders they receive.

Important: Easy Guide to e-Notices with Its 6 Types As Per Income Tax

Lucidity with the Law: Communications without a DIN are considered null and void. This enables taxpayers to confidently respond to legitimate communications while missing any fraud instances.

Minimum Discrepancies: Bringing DIN into use minimizes the occurrence of errors in document management since each document has a unique identification. Reduced probability of mishandling or misplacing vital tax documents.

How to Verify an Income Tax Notice with DIN?

To authenticate a notice/order/letter issued by the Income Tax Department, follow these steps:

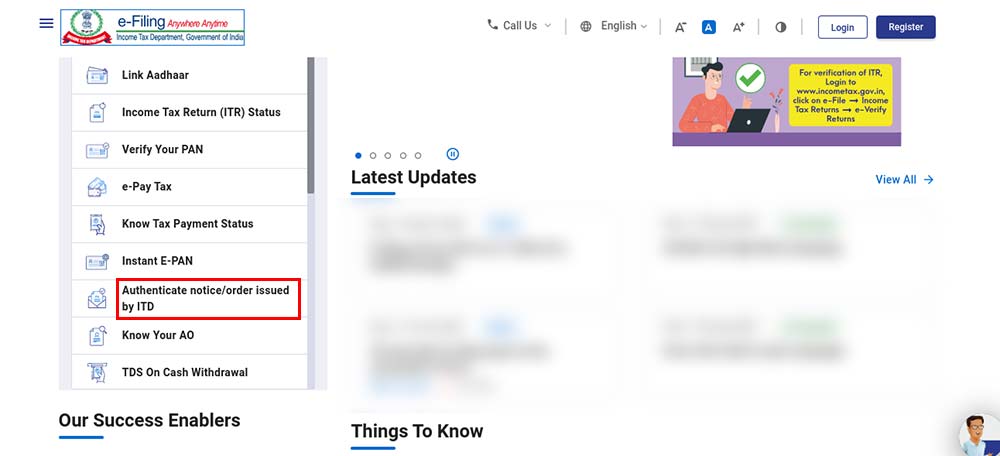

Step 1: Log in to the e-filing portal. On the income tax portal homepage, click on “Authenticate order/notice issued by the Income Tax Department” under the quick links section.

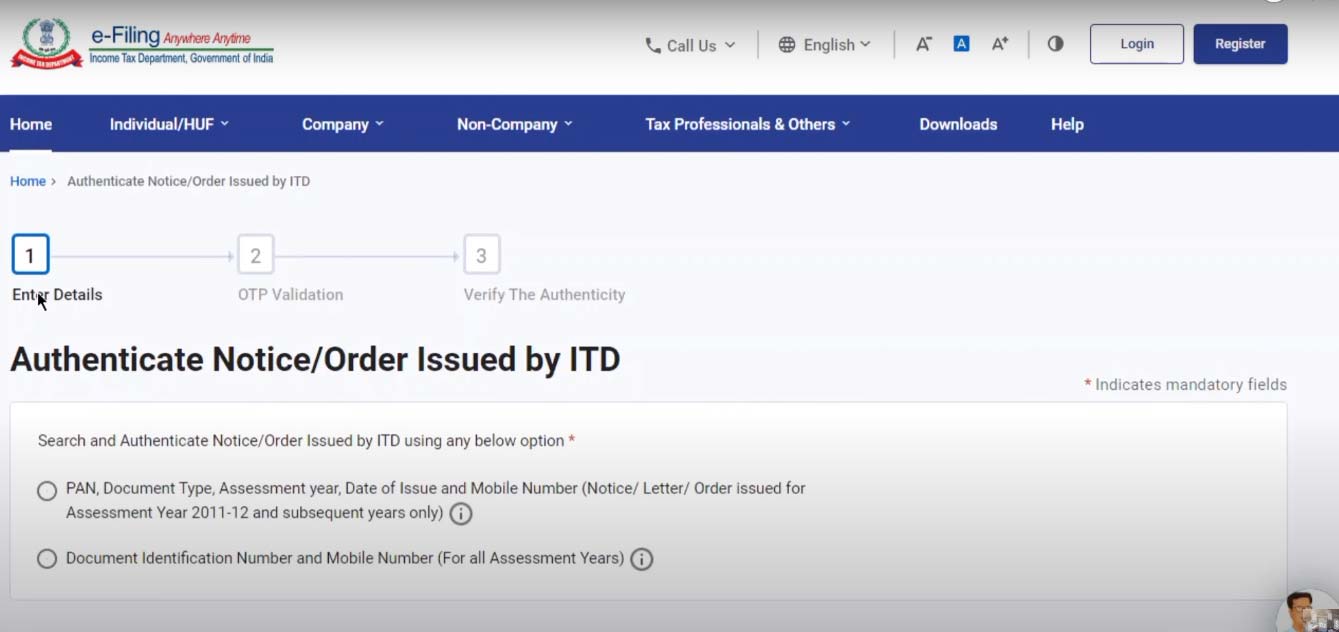

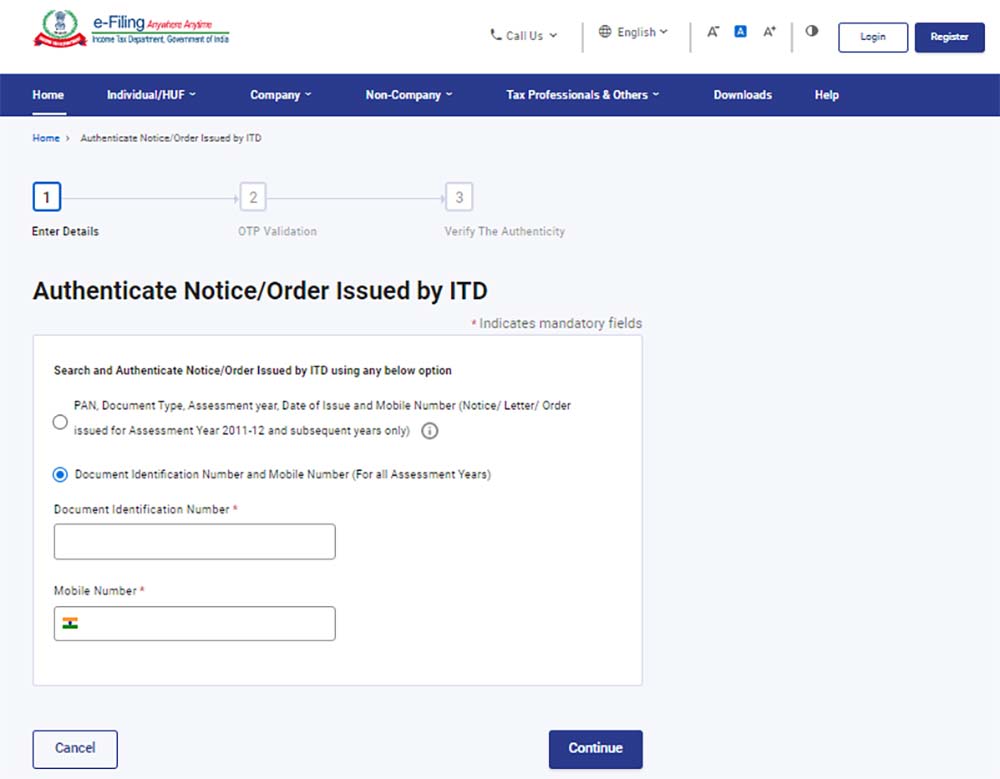

Step 2: You can verify using either of the following methods:

- Document type, Permanent Account Number(PAN), assessment year, issue date, and mobile number (for tax notices/orders/letters issued for AY 2011-12 and next years)

- DIN and mobile number (for all AY)

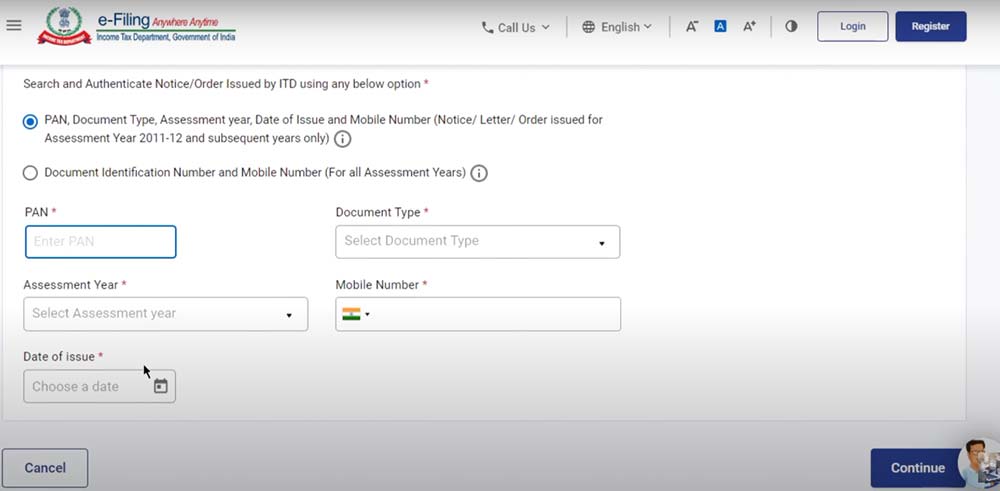

Process No 1: Fill in PAN, assessment year, document type, and issue date. This method is applicable for AY 2011-12 and subsequent years. Below is a screenshot provided that will appear on your screen. Click on continue filling in the details.

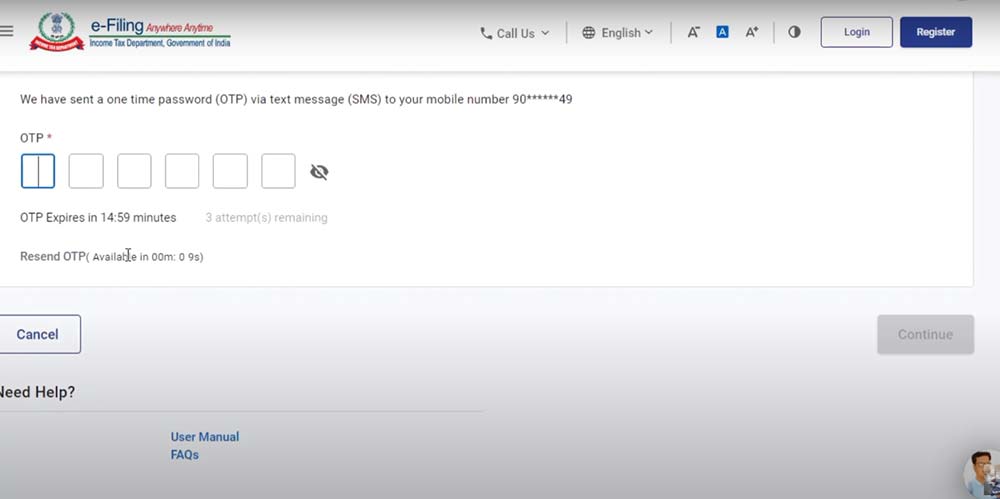

Step 3: After completing method 1, enter the mobile number and validate by entering the received OTP (one-time password).

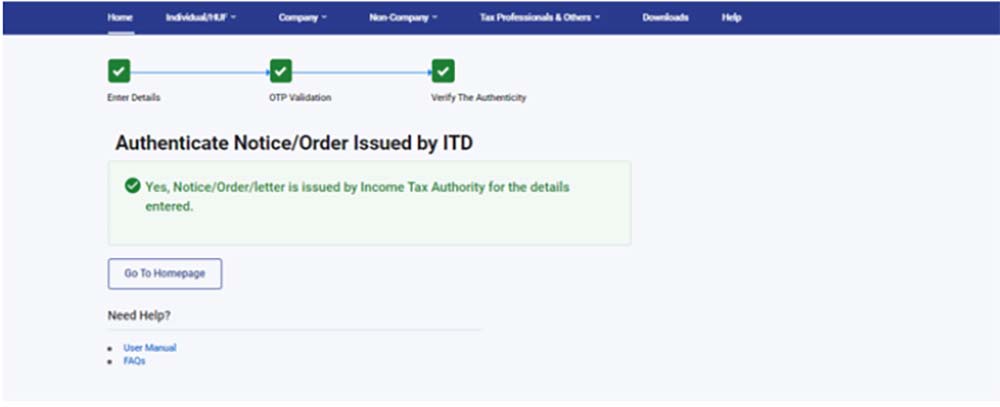

Step 4: If a notice has been issued, a screen will appeal as provided below.

Step 5: If no notice exists for the specified period, a different screen will be displayed which is referred to below.

Process No 2: You can follow another alternative method to authenticate through DIN and mobile number. Continue entering your DIN and mobile number. An OTP will be sent to the provided number. Enter the OTP to validate.

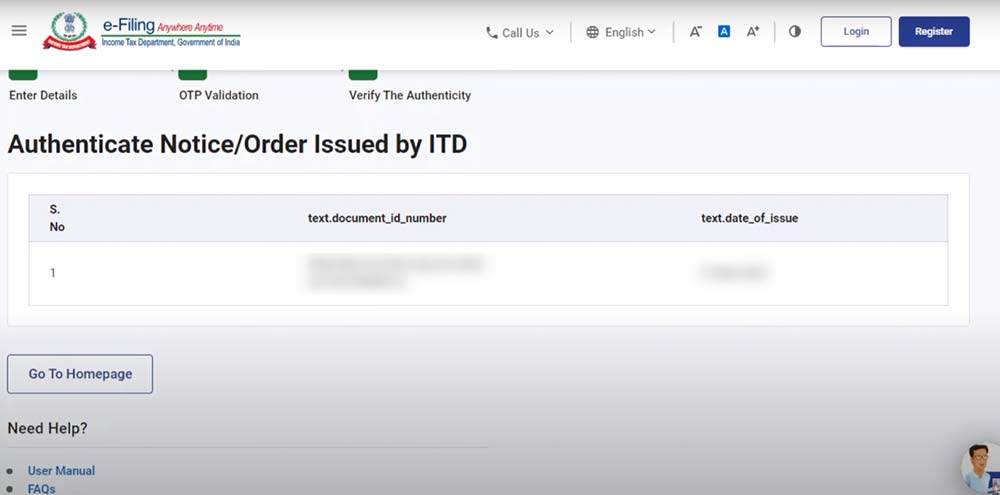

Step 6: A screen will be displayed if any notice has been issued. A screenshot is provided below for your reference.

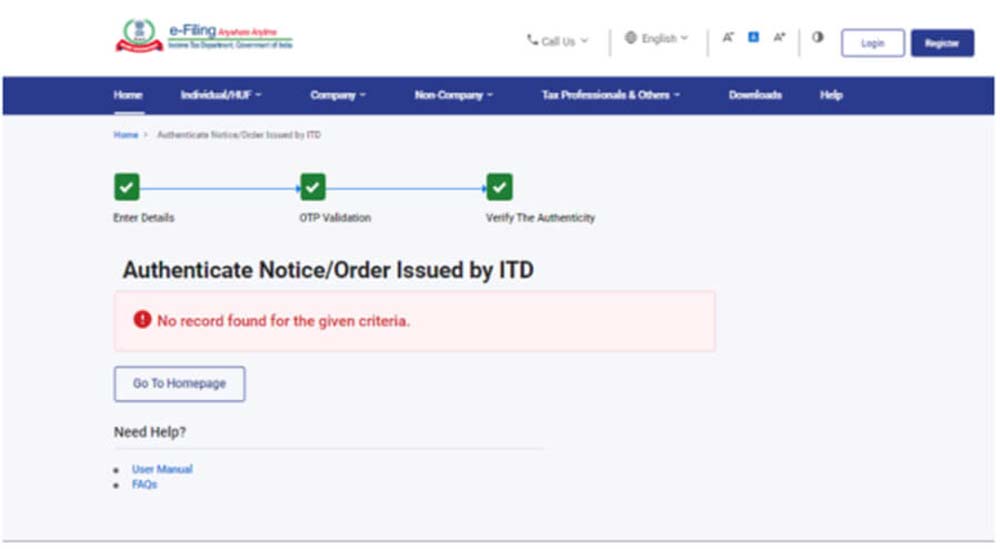

Step 7: If notice has not been issued then the below screen will be displayed.

Note: Failure by income tax departmental officers to quote the Document Identification Number would render any such communication invalid. It would be considered that the officer never issued such communication.

Top FAQs Related to Document Identification Number (DIN)

Q.1 –What Is a Document Identification Number (DIN)?

A Document Identification Number (DIN) is a unique ID generated for documents issued by the income tax authority in India. It helps track and authenticate various communications, including notices, orders, and letters.

Q.2 – Who Needs a DIN?

The income tax department officials who issue documents such as notices, orders, or letters to taxpayers are required to mention a DIN on these documents. Taxpayers themselves do not have DINs.

Q.3 – What is the importance of DIN?

DIN is crucial to make sure documents issued by the income tax authority are genuine and dependable. It assists taxpayers in verifying the legitimacy of communication or notices received from tax authorities.

Q.4 – What to do in case of not having a valid DIN?

If a document issued by the income tax authority does not have a valid DIN, it may be considered invalid, and its authenticity can be questioned. It is crucial to verify the document’s genuineness through the e-filing portal.

Q.5 – How to Verify a Document through a DIN?

Authenticating a document through a DIN is easy, you just have to log in to the e-filing portal of the Income Tax Department and enter the relevant details (PAN, Assessment Year, Document Number, Date of Issuance). You will receive a one-time password (OTP). After entering the OTP, you can confirm the authenticity of the document on the portal.

Q.6 – Can DIN be utilized to authenticate any kind of document?

DIN is primarily employed to authenticate documents related to income tax such as notifications, orders, and correspondences, provided by the income tax authority.

Q.7 – Is it mandatory to verify all documents through DIN?

Yes, income tax officials are obligated to mention a DIN on all documents issued to taxpayers. Verifying documents through DIN helps maintain transparency and accountability.

Q.8 – What to do in case I have doubts regarding the document’s authenticity?

In case of doubts concerning the authenticity of a document received from the income tax authority, you should go through a verification process on the e-filling portal. If the document is found to be without a valid DIN or raises suspicion, seeking legal assistance is advised.

Q.9 – Is it possible to view documents online if they have a valid DIN?

Yes, once a document is verified using the DIN on the e-filing portal, you can access and review it online. Generally, it is furnished in PDF format for viewing and downloading.

Q.10 –Is it allowed to seek clarification or raise disputes regarding the contents of a document if needed?

Yes, if you have questions or concerns regarding the document or its content, you can request a clarification by communicating with the income tax authority. You can also follow the appropriate legal procedures to resolve the problem.

What is the format of DIN from Income Tax department? I got a letter which has DIN & Notice No: ITBA/INV/S/131/2024-25/1069160364(1)/3932. Which part of it is DIN?

DIN number format is unique 8 digit numeric number

I want which part of above number is din

where can we find DIN number in 148 notice