What is the New TDS Section 194T?

The Finance Bill, 2024, presents a significant change for partnership firms with the proposal to insert a new TDS section 194T of the Income Tax Act, 1961. The same move has the motive to bring payments made to partners, including salary, remuneration, commission, bonus, and interest, under the TDS purview. At present no provision for TDS on such payments is there.

The suggested section 194T of the Income Tax Act obligates the partnership firms to deduct TDS at a 10% rate on aggregate payments of more than Rs 20,000 in a fiscal year. The same comprises the credits to the capital account of the partner or any other account. The provision would come into force from 1st April 2025, applying to the AY 2025-26 and onwards.

Latest Update

- The CBDT has released the TDS payment guidelines for the salary of a firm’s partner under Section 194T through the Seventh Amendment Rules, 2025. Read Notification

What is the Purpose of TDS Firm-to-Partner Payment?

For the objectives of Tax Deducted at Source (TDS) all the payments made to the partner along with the salary, remuneration, commission, bonus, or interest, would get integrated and deemed as a single aggregate amount. It shows that even when the individual payments are lower than Rs 20,000, they will still be levied to TDS when the total aggregate amount surpasses the limit.

The proposed Section 194T is as follows:

“194T. (1) Any person, being a firm, responsible for paying any sum in the nature of salary, remuneration, commission, bonus or interest to a partner of the firm, shall, at the time of credit of such sum to the account of the partner(including the capital account) or at the time of payment thereof, whichever is earlier shall, deduct income-tax thereon at the rate of ten per cent.

(2) No deduction shall be made under sub-section (1) where such sum or the aggregate of such sums credited or paid or likely to be credited or paid to the partner of the firm does not exceed twenty thousand rupees during the financial year.”

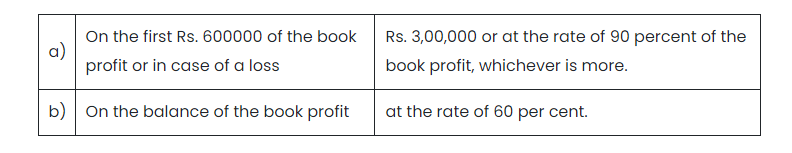

The government would have also announced the revisions to the remuneration limit for working partners that come into force from the AY 2025-26 onwards. The suggested revised limits are as follows –

The budget proposals do not propose relief to the partnership firms, the surged limit on the permitted deductions for remuneration paid to working partners partially satisfied the anticipation of the taxpayers.

The new TDS regime would need the partnership firms to adopt and ensure compliance from the subsequent fiscal year. The firms must learn the implications of section 194T and factor in the TDS deductions at the time of making payments to their partners.

Major Key Provisions of Section 194T

Here we have discussed the major key provisions of section 194T:

TDS Rate

10% is the applicable TDS rate.

TDS Threshold Limit

If the aggregate amount paid to the partner in a financial year surpasses Rs 20,000 then only the TDS shall be applicable.

Timing of TDS Deduction

As per section 194T, TDS must get deducted at the earlier of the below-mentioned two events-

- During the credit to the account of the partner.

- During the payment whether in cash, cheque, draft, or any other mode

- Assuring that the tax is deducted promptly and accurately, preventing any evasion or delay in tax payment

TDS Applicability

The same TDS section applies to the payments made before the partners of a firm, along with the salary, bonus, commission, interest, or remuneration.

What is the Method to Compute the Limit of INR 20,000?

There are two methods to compute the threshold limit of Rs 20,000-

- Single Payment: If a single payment surpasses Rs. 20,000, TDS is to be deducted, as discussed in the above example relating to Dhairya

- Aggregate Payments: If the case is of making multiple payments, each less than Rs. 20,000, TDS is to be deducted if the total of such payments surpasses Rs. 20,000 in the fiscal year.

For instance, Seema is drawing remuneration of Rs 15,000 per month from her partnership firm, in April 2025 she received 15,000, and as it is below the thresh-hold limit no TDS is accountable to be deducted, next month she again receives a salary of Rs. 15000 now as per my view TDS will be deducted on Rs. 10,000 as it surpasses the threshold limit.

By using a cumulative method, all payments, regardless of size, are taken into consideration, resulting in a wider range of taxable income.

Section 194T Applicable Date

You have learned the same based on my previous two examples, that Section 194T will come into force from 1st April 2025. To prepare for the same revision the firms have the window along with setting up the required systems and processes to adhere to the new TDS provisions.

In What Way Does It Vary from Section 192?

Section 192 of the Income Tax Act deals with TDS on salaries, which applies solely to income levied under the head “Salaries.” It does not include payments made to partners of a firm, since these are not regarded under the “Salaries” head.

Explanation 2 to Section 15 mentions that salary, bonus, commission, or remuneration to partners of a firm are not included in the income head “Salaries.” Thus, these payments were not obligated for TDS under section 192.

Through drawing these payments under the TDS, section 194T bridges this gap ensuring that the income of the partners from the firms is within the tax deduction at source.

What Will be the Effect of Section 194T On Firms?

Below is the impact of TDS’s new section 194T for companies:

Increased Tax Compliance Burden

Section 194T major impact is the rise of the compliance load on firms, particularly smaller ones. These firms are needed to receive a Tax Deduction and Collection Account Number and ensure timely TDS deductions and deposits. It adds an administrative layer to their functionality, requiring strict maintenance of records and timely compliance.

Capital Blocking

TDS deduction at a 10% rate on payments surpassing Rs 20,000 could directed to a temporary blocking of capital for partners. The same can impact their liquidity, particularly when the returns are delayed. Firms shall be required to handle their cash flows efficiently to mitigate the impact.

Tips to Know During Compliance and Record-Keeping

To comply with Section 194T, firms should:

- Filing of TDS Returns: File quarterly TDS returns describing the deductions and payments made, which increased the load on small firms.

- Issuing TDS Certificates: Issue TDS certificates (Form 16A) to the partners, furnishing them with proof of the tax deducted.

- Deduct TDS: Confirm that TDS is deducted at 10% on payments surpassing Rs. 20,000 thresholds, from April 2025 i.e. date of applicability of this section

- Deposit TDS: Deposit the deducted TDS to the government within the specified duration, and in the proper manner to prevent any fees or penalties

- Get Your TAN – If it has not been received yet: Firms should obtain a Tax Deduction and Collection Account Number (TAN) if they do not have one.

Section 194T Advantages

To be honest, this part is more of a hindrance than anything else, but I’m making an effort to find the good in it.

Financial Discipline

Imposing TDS deductions infuses financial accountability in corporations, prompting them to keep accurate financial records and comply with tax policies.

Enhanced Tax Compliance

Section 194T bringing partner payments under the TDS net, assures effective tax compliance and lessens the scope of tax evasion. The same contributes to the clarity and integrity of the tax system.

Read Also: A Brief Study of Newly Added TDS Section 194M

Broadened Tax Base

The inclusion of partner payments in TDS widened the tax base assuring that more income is within the tax at source. It assists in surging the collection of revenue for the government.

Challenges and References

Here the below points we have mentioned some challenges and references in detail:

Effect on Liquidity

The TDS deduction could impact the partner’s liquidity specifically in the matters where the refunds get delayed. The firms and partners are required to plan their finances to handle the impact.

Awareness and Education

To ensure the streamlined implementation it is important to develop awareness and educate the firms about the new TDS provisions.

Administrative Load

The administrative load of adhering to section 194T could be influential for small firms. They are required to invest in systems and manpower to manage the additional compliance needs.

Closure: Section 194T is a significant amendment in the Income Tax Act that has the motive to revise tax compliance and widen the tax base. It draws the additional compliance needs and possible liquidity challenges for firms and their partners, and it assures that the income is taxed at source properly.

It is required for the firms to prepare for the identical revision by setting the effective systems and processes, getting TAN, and ensuring timely TDS deductions and deposits. Section 194T with proper execution and adequate awareness could contribute to the transparency and efficiency of the Indian tax system.

Government want to close all partnership firms and LLP. First they put 30 % tax which is higher than Pvt.Ltd Company (25 % tax.)TDS deduction could impact the liquidity of the small partnership firm.They have to take TIN number.Every small firm will filed return for refund. No need to pay advance tax,because govt.already collect in the form of TDC.Govenment is after small business people .More and more new laws disturb people.Mera Bharat Mahan

Please be clear .

FY 2024-25 or FY 2025-26 .

If FY 2024-25, then answer question of Mr Girishji, reproduced below :

the question is that any payment made from 01.04.2024 to 23.07.2024 to the partner by the firm without deduction of TDS U/S 194T, which is more than Rs. 20,000/-, since the said section is came into the force after 23.07.2024 then what is the implication of interest on delays payment as well as filing the TDS return for the earlier period i.e. Q1 (April-June-2024)

Section 194T applicable from F.Y. 2025-26.

You could have made it clear that this provision is applicable from 23.07.2024, meaning thereby the payment made in this financial year is covered by the section. By saying that this is effective from the ay 2025-26 (meaning thereby FY 2024-25) and giving the example of salary drawn in 2025, you seem to convey that the payments made in this fiscal will not be hit by the section.

TDS under section 194T is deducted at 10% on payments surpassing INR 20,000. this section is applicable from 1st April 2025.

26Q

means for the financial year 2024-25

as per finance Act 2024, if new inserted Section 194T ofthe Act, is application w.e.f. from 01.04.2025 AY 2025-26, budget speech dated 23.07.2024.

the question is that any payment made from 01.04.2024 to 23.07.2024 to the partner by the firm without deduction of TDS U/S 194T, which is more than Rs. 20,000/-, since the said section is came into the force after 23.07.2024 then what is the implication of interest on delays payment as well as filing the TDS return for the earlier period i.e. Q1 (April-June-2024)

Section 194T will come effect from 01.04.2025.

194T KI DETAIL KON SE FORM MAIN JAEGI. 26Q OR 24Q