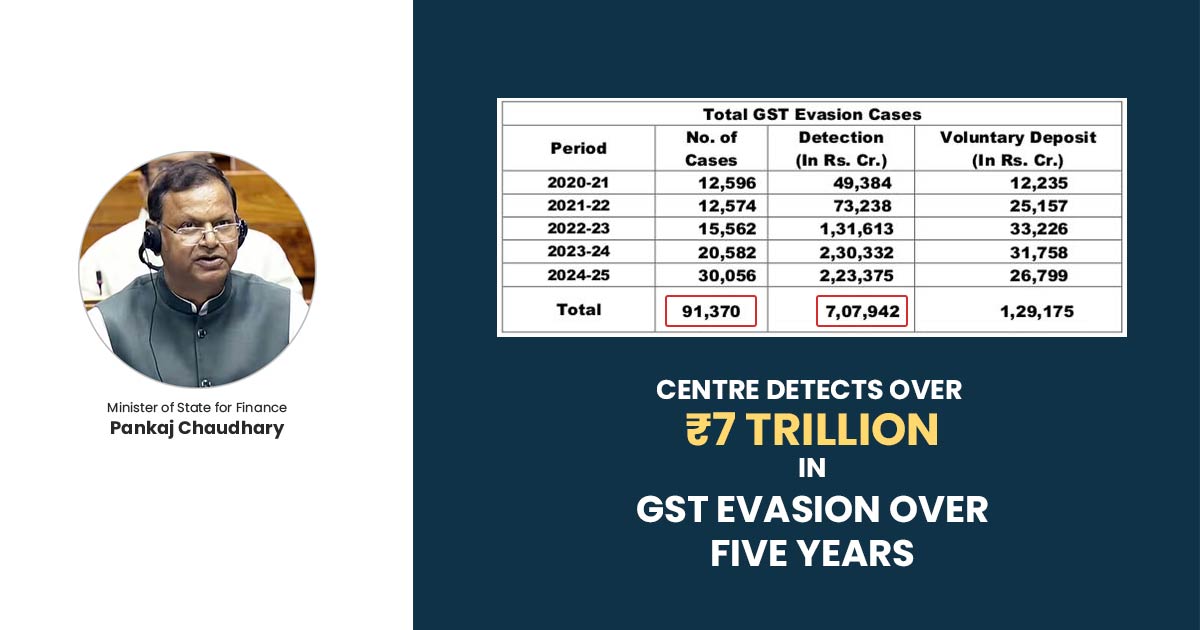

India’s indirect tax administration has identified significant goods and services tax (GST) evasion amounting to ₹7 trillion across 91,000 cases over the past five years, concluding in March 2025. This detection highlights ongoing challenges in tax compliance within the country.

MOF Pankaj Chaudhary in Lok Sabha cited that the taxpayers have already deposited Rs 1.29 trillion. The scope of tax evasion has surged from over Rs 49,300 crore in FY21 to ₹2.23 trillion in FY25, as per the minister.

Rs 1.78 trillion is from fake input tax credits out of the total tax evasion detected. Nearly 7% of this has been deposited by the taxpayers.

To ensure that some part of the disputed tax amounts gets settled in the appellate proceedings, and some of the demands are contested in the courts.

The detected rise in tax evasion matches with an expansion of data collection and reporting needs executed via the tax administration. For rectifying the compliance and preventing tax evasion Centre and Goods and Services Tax Network, the company that processes tax returns, has opted for various measures, as per the minister.

Read Also: GST Officers Detect ₹1.95 Trillion Tax Evasion in 25,397 Cases During April-January

These comprise e-invoicing transactions, automated risk assessment of entities based on their compliance attributes, emphasising outliers founded on system-flagged mismatches, determining peculiarities in the behaviour of the taxpayer, and selecting returns for scrutiny and taxpayers for audit based on distinct risk parameters.

In securing the revenue and seizing the evaders, such measures are supportive, Chaudhary cited.

Chaudhary explained that new techniques, such as facial recognition and electronic tracking of bill data, were being used to spot businesses that might be involved in fake or dishonest activities related to GST identification numbers. This helps identify potential issues early on.

“While the above measures contribute to revenue collection, impact of such measures in identifying systemic gaps, improving compliance and preventing recurring tax evasion is not ascertainable. The outcomes such as revenue growth and reduction in instances of tax evasion cannot be attributed solely to all or any individual such measure, as various other factors such as global economic conditions, economic growth in the country, level of domestic consumption of goods and services, tax rate, etc. are also relevant for this,” Chaudhary cited.

The minister, in answer to another question on lowering the 18% GST on health and life insurance polices, has cited the House that the issue was placed before the GST Council on 9 September 2024 in New Delhi.

The GST council, after detailed deliberations, has suggested setting up a ministerial panel to review the case. Samrat Choudhary, deputy chief minister of Bihar, is the panel’s convenor.

The convener in the 55th meeting of the GST Council held on 21 December last year in Jaisalmer, asked an additional time to finalise the recommendations of the panel. More time has been allowed by the council to the panel, Chaudhary added.

Read Order