The tax additions of ₹42.94 lakh each against the Gurgaon-based couple, Rachita Sahgal and Vivek Sahgal, have been rejected by the Income Tax Appellate Tribunal (ITAT), Delhi Bench, citing that the department wrongly invoked Section 153C of the Income Tax Act.

According to the bench, the seized documents merely “pertained to” the taxpayers, rather than “belonging to” them, making the assessment legally untenable.

From a January 2018 search against the M/S Navneet Dawar group, the case originated when documents allegedly citing unaccounted property transactions were recovered.

It was claimed by the tax department that such documents belonged to the Sahgals and made similar additions of Rs. 42.94 lakh in their hands for AY 2018-19. The absent couple in the hearings challenged the additions via written submissions.

“The assessment’s legal validity has been scrutinized by the Bench Comprising Satbeer Singh Godara (Judicial Member) and S. Rifaur Rahman (Accountant Member). They said that after the 2015 modifications to Section 153C(1)(b) differentiate between documents that “belong to” the taxpayer (applicable to money/bullion under clause a) versus those that “pertain to/relate to” them (under clause b). The seized papers dropped under the latter category, making the department’s fulfillment note legally imperfect.”

The department’s dependence on Section 292C’s presumption is been refused by the tribunal, citing this only applicable against the persons from whom the materials are seized, not third parties like the Sahgals. The additions cannot be kept without the proof corroborating the alleged on-money payments.

The bench pronouncing the order permitted the appeals to remove the additions. The same ruling outlines rigid compliance with Section 153C’s revised legal requirements, specifically the distinction between “belonging to” and “pertaining to” documents in search assessments.

Important: ITAT Delhi Quashes Reassessment Over Discrepancy Between Reopening Reasons and Additions

As no precedents were mentioned, the decisions align with the legislative objective for the amendment of section 153C 2015, which reduces the extent to assess third parties in investigation matters.

The claim of the department that Exhibit-13 (seized documents) explained the additions failed, since the tribunal did not discover any connection between the materials and the income of the couple.

The same specifies another instance where ITAT does not validate the assessments grounded on inappropriate section 153C invocation, safeguarding taxpayers from additions that do not have the legal grounding.

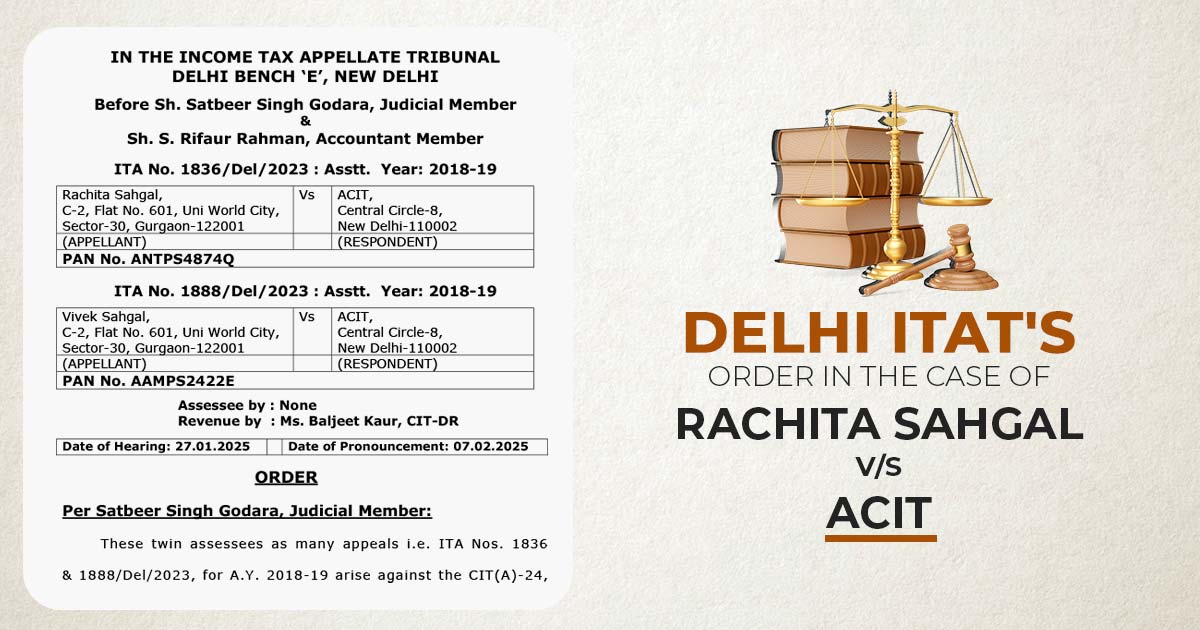

| Case Title | Rachita Sahgal vs. ACIT |

| Case No. | ITA No. 1836/Del/2023 : Asstt. Year: 2018-19 |

| Assessee by | None |

| Revenue by | Ms. Baljeet Kaur |

| Delhi ITAT | Read Order |