The Income Tax Appellate Tribunal (ITAT), Delhi Bench set aside reassessment proceedings, citing inconsistencies between the grounds for reopening and the subsequent additions.

Bhawani Castings P. Ltd., the appellant, submitted its income tax return for the Assessment Year (AY) 2018-19 on 28.09.2018, stating a loss of ₹12,52,594. The AO issued a notice following Section 148A(b) of the Income Tax Act, accompanied by grounds for reopening the assessment.

The appellant responded on 22.03.2022, asserting that it had not conducted purchases from the parties mentioned in the notice. However, the AO dismissed the objections and proceeded with the reassessment.

On 30.03.2023, the AO directed an order including ₹1,35,40,359, attributing the sum to alleged bogus purchases from M/s G.S. Industries. This addition was made based on a statement by Shri Deepak Sharma, given post the reopening reasons. The assessee questioned that the statement lacked validity as it was unsigned by the recording officer.

Read Also: Delhi ITAT Cancels Tax Notice U/S 148 Due to Mechanical Approval by the PCIT for Reassessment

The appellant further highlighted that the reopening reasons referenced different entities associated with Deepak Sharma and did not mention M/s G.S. Industries, leaving the addition improper.

The assessee furnished invoices for transactions of dealings with M/s G.S. Industries, presenting payments executed via banking channels. Despite accepting the sales and books of accounts, the AO issued an order without adequately checking the documents.

The Commissioner of Income Tax (Appeals) [CIT(A)] expressed doubts about the transactions, but the documents, including addresses, contact details, and vehicle numbers, were adequate to prove the legitimacy of the purchases.

The tribunal evaluated the submissions and analyzed the authorities’ orders. The assessee questioned the validity of the assessment reopening. The reopening grounds issued on 17.03.2022, alleged that a search on the Deepak Sharma group revealed bogus purchase entries linked to M/s Mahinderpal & Sons and M/s Jai Bhole Traders.

The AO claimed the assessee engaged in fictitious transactions with these entities. However the assessee refused to make any transactions of purchases from these entities.

A subsequent statement by Deepak Sharma, given on 14.07,2022, implicated M/s G.S. Industries as a paper entity. Based on this, the Assessing Officer (AO) made an addition of ₹1,35,40,359, alleging bogus purchases from M/s G.S. Industries. The tribunal noted that G.S. Industries.

The appellate tribunal observed that the reopening reasons were not mentioned by G.S. Industries, creating a mismatch between the reopening justification and the additions.

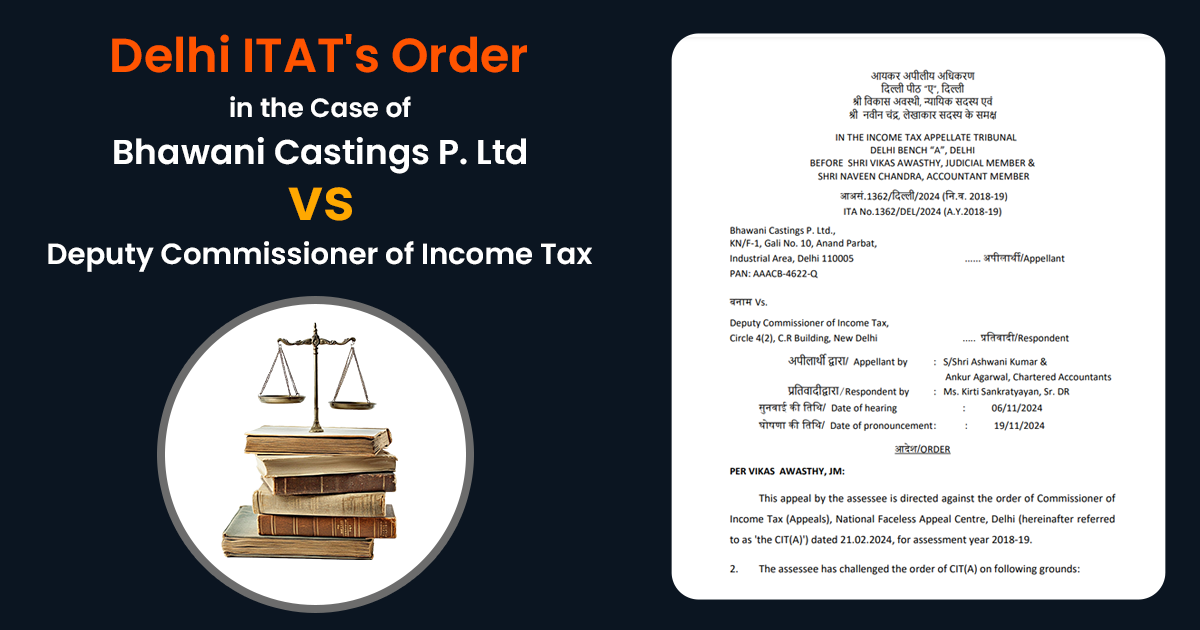

A bench comprising Judicial Member Vikas Awasthy and Accountant Member Naveen Chandra ruled that the reopening reasons did not align with the final additions and relied on a third-party statement recorded post-reopening notice. Therefore, the tribunal declared the reassessment invalid and dismissed the proceedings.

The appeal filed by Bhawani Castings P. Ltd. was finally approved.

| Case Title | Bhawani Castings P. Ltd. vs. Deputy Commissioner of Income Tax |

| Citation | ITA No.1362/DEL/2024 (A.Y.2018-19) |

| Date | 19.11.2024 |

| Appellant by | S/Shri Ashwani Kumar & Ankur Agarwal |

| Respondent by | Ms. Kirti Sankratyayan |

| Delhi ITAT | Read Order |