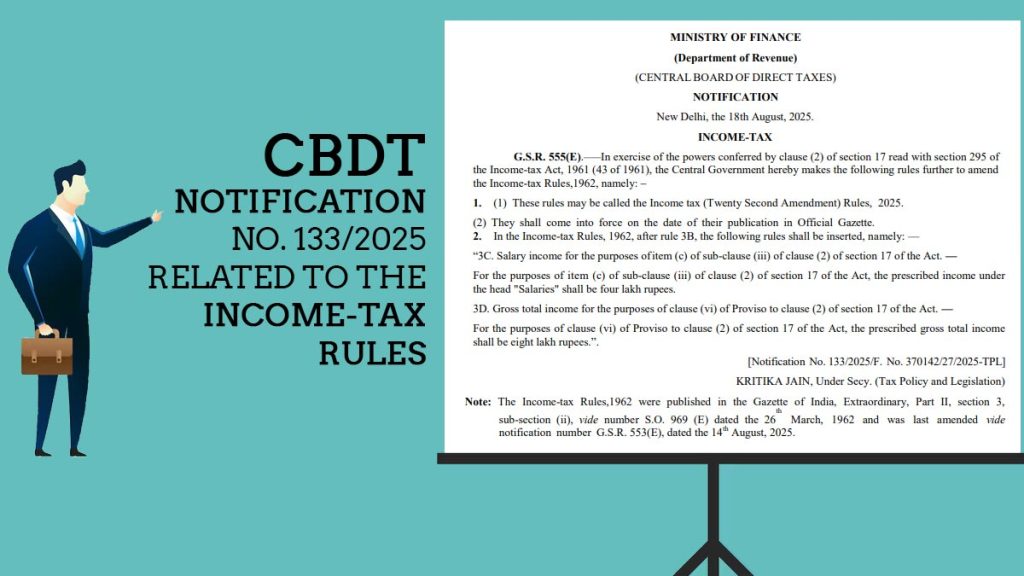

The CBDT has released a notification No. 133/2025/F. No. 370142/27/2025-TPL that brings important updates to the Income Tax Rules set in 1962. This update is part of the Income Tax (Twenty Second Amendment) Rules, 2025, and it aims to improve how income tax regulations work.

A recent update has introduced two new rules, Rule 3C and Rule 3D, which set specific income limits. These rules are created to clarify certain terms related to taxation under the Income-tax Act, 1961.

- As per Rule 3C, and in accordance with (c) of sub-clause (iii) of clause (2) of Section 17, the minimum salary for a certain purpose is set at Rs 4 lakh

- As per Rule 3D, the prescribed gross total income for clause (vi) of the proviso to clause (2) of Section 17 is Rs 8 lakh.

The motive of such an amendment is to deliver clarity in the calculation under the head “Salaries” and facilitate income categorisation u/s 17 of the Act.

The revision came into force on its publication in the Official Gazette on August 18, 2025.

The same is the government’s measure to ease the tax administration and deliver precision in the provisions of the income tax, particularly for the salaried taxpayers.

What is Section 17 of the IT Act, 1961?

Section 17 of the Income-tax Act, 1961, provides a detailed definition of what constitutes “salary” for tax purposes. It is not limited to just basic pay; it also includes various allowances, perquisites, and other forms of compensation received in addition to the regular salary. This means that many types of income earned from employment are treated as part of the salary for taxation.

Read Official Notification