The Kolkata Bench of the Income Tax Appellate Tribunal (ITAT) has ruled that a widow is entitled to claim Tax Deducted at Source (TDS) credit based on her deceased husband’s income. This decision clarifies the rights of widows regarding tax credits related to their late spouses.

As per sub-rule (2) of Rule 37BA and sub-rule 3(i) of the Income Tax Rules, 1962, if the income is assessable in the hands of any other person, the credit of TDS would be given to him for the year in which the income is shown, Sonjoy Sarma (Judicial Member) and Rakesh Mishra (Accountant Member) expressed.

Following the death of her husband, Jagbandhu Das, the assessee, who is his wife, assumed ownership of the proprietorship concern as the legal heir. As a result, she became the new proprietor of the business.

Concerning the said proprietorship along with the interest income in the name of Late Jagbandhu Das, which was duly offered for taxation by the taxpayer, the related TDS was claimed by her in the ITR.

The TDS credit was not being provided by the assessing officer in the name of the Late Jagbandhu Das by referring to the unmatched TDS. The short credit of TDS on this count is Rs. 22,06,321. Also, there was an imposition of the consequential excess interest u/s 234B and 234C of the Act.

The taxpayer, dissatisfied with the assessment order, has furnished a plea to the Addl./Joint CIT(A), who dismissed the appeal.

Taxpayer, in addition to her income of Rs 59,33,102, as the taxpayer has proposed the income of Rs 73,13,808 (which is the income of the proprietorship firm of her deceased husband and his interest income, on whose behalf the return of income for the said year was not filed nor the tax credit for the TDS of Rs.22,06,321/- on his behalf was made) towards the taxation in her income return, she is qualified for claiming the related TDS of Rs.22,06,321 as tax credit in terms of Rule 37BA(3)(i) of the Income Tax Rules, 1962.

Read Also: Wife’s Income Taxed, Husband Can’t Be Taxed Again by AO: Rajkot ITAT

Under the law, the TDS credit made in the name of her deceased husband will be permited to her since the income has been shown by her in her income return and the taxpayer may approach the deductor to get the records corrected as mandated under rule 37BA, if needed, so that the TDS is reflected in her PAN and file the proof before the Ld. AO that the credit for the TDS has not been taken by any other person, the bench expressed.

The Tribunal in the above-said view has permitted the plea.

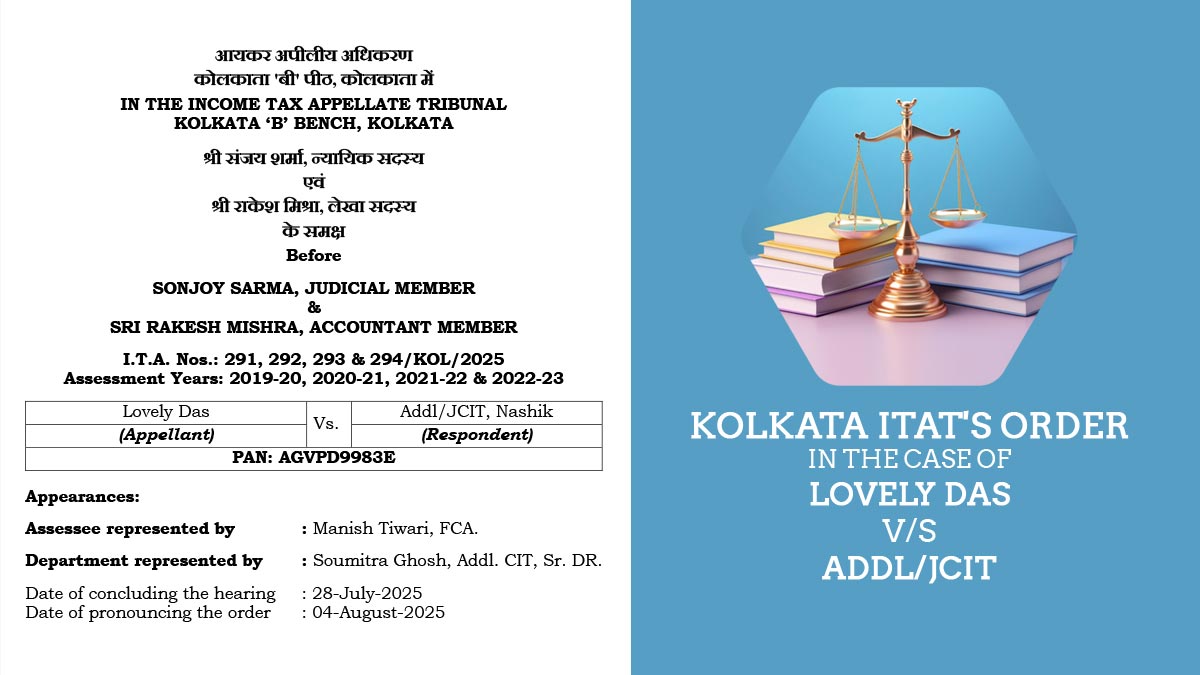

| Case Title | Lovely Das vs. Addl/JCIT |

| Case No. | I.T.A. Nos.: 291, 292, 293 & 294/KOL/2025 |

| Assessee represented by | Manish Tiwari |

| Represented by | Soumitra Ghosh |

| Kolkata ITAT | Read Order |