On December 21, 2024, the 55th Goods and Services Tax (GST) Council meeting, held in Jaisalmer, Rajasthan offered an amendment to Sections 107 and 112 of the Central Goods and Services Tax (CGST) Act, 2017 as a measure of facilitating the process of filing of appeals concerning only disputes related to the penalty amount.

Finance Minister Nirmala Sitharaman, in the press meeting that starts at 6:38 P.M. IST, was concerned about the proposal to lessen the pre-deposit amounts on penalties. The council meeting was attended by notable dignitaries, including the Union Minister of State for Finance Shri Pankaj Chaudhary and other state-level leaders.

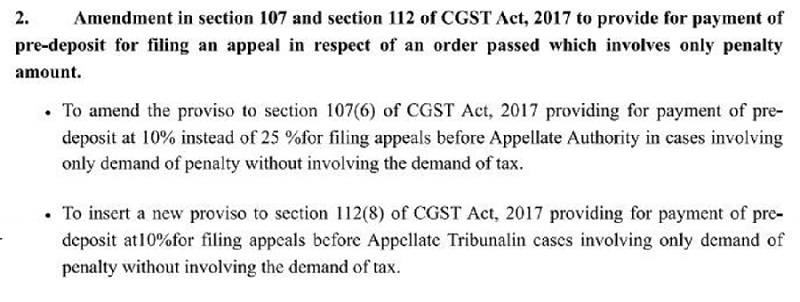

On the suggestions of the 55th Meeting of the GST Council’ a press release has been issued that furnishes for the amendment to the proviso to Section 107(6) of the CGST Act, 2017 which imposes a 25% pre-deposit fee for filing a plea to the appellate authority.

The amendment proposed asked to lessen the pre-deposit fee to 10% from 25% of the penalty amount, particularly in matters engaging merely the demand of penalty and no tax demand.

Additional suggestions have been made likewise calling for the introduction of an updated proviso to Section 112(8) of the CGST Act, 2018 allowing the payment at 10% pre-deposit for instituting appeals before the Appellate Tribunal in matters concerning demand of penalty only, and no dispute based on tax.

In a way, the amendment has been made to not prejudice taxpayers and the government as the penalties do not cause the loss of revenue to the government opposite to the loss generated from the unpaid taxes. Reducing the legal penalty shall promote simpler access to means of justice for the dissatisfied people.