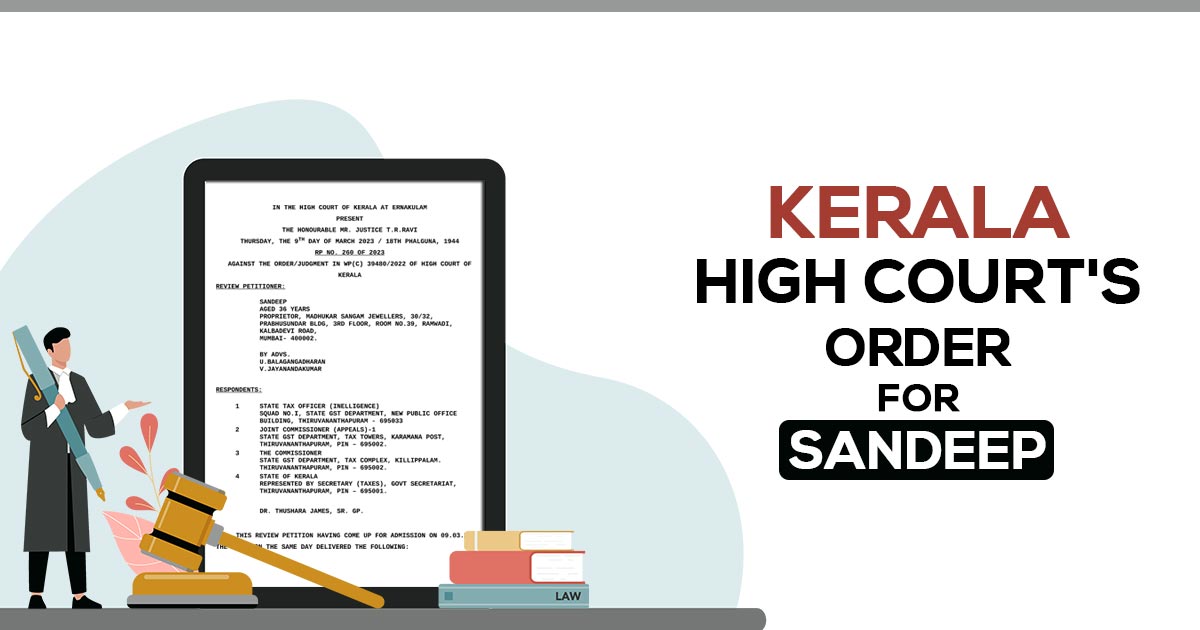

The Kerala High Court (HC) rendered to fix the interim stay order issued with the mistake of the order to remit 20 per cent of the tax on the disputed amount.

For reviewing the interim order issued through the court, the applicant Sandeep has filed a petition in which the court has authorized an interim stay for 2 months while the condition is that the applicant remits 20% of the disputed demand in 1 month.

The order to remit 20% does not what has thought under Section 112(8)(b) of the CGST Act, 2017, and the thought is merely the sum equal to 20% of the left amount of the tax in dispute, in addition to the amount filed under sub-section 6 of Section 107.

No petition will get furnished under sub-section (1) a sum equal to twenty per cent. of the remaining amount of tax in dispute, in addition to the amount filed beneath sub-section (6) of section 107, that comes through stated order 1 “subject to a maximum of fifty crore rupees”, for which the petition has been furnished as stated under Section 112(8)(b) of the CGST.

Until the petitioner has filed completely, no petition will get furnished under sub-section (1), as stated under sub-section 6 of section 107, the same portion of the tax amount, interest, fine, fee, and penalty that comes through the impugned order, considered through him and the sum equal to 10 per cent. of the left tax amount in a conflict emerging via the said order, for which the petitioner has furnished.

Important: Latest News and Highlights of Kerala High Court

The order was issued by mistake and is required to get amended, Single member comprising Justice T R RaviI followed. The review petition gets authorized by the court and recalled the order.

| Case Title | Sandeep Vs State Tax Officer |

| Citation | WP(C) No.39480/2022 |

| Date | 09.03.2023 |

| Appellant | U.Balagangadharan V.Jayanandakumar |

| Respondent | Dr. Thushara James |

| Kerala High Court | Read Order |