The interruption has been refused by the Rajasthan High Court with the beginning of the proceedings u/s 153C of the Income Tax Act, 1961 (“the Act”) that were alleged to have started only based on specific WhatsApp Chats, marking that the data in the chats were corroborated by certain transactions and therefore the said chat can be acknowledged to be coming under the definition of “other documents” under Section 153C.

The division bench of Justice Pushpendra Singh Bhati and Justice Chandra Prakash Shrimali held that the scope of Section 153C was not to confine the proceedings concerning ‘other person’ arising out of Section 153A but to enable these invocations such that in case there was any related proof which was explicit and corroborated by facts, no escape was feasible for such ‘other person’.

Section 153A of the Act provides for the assessment of income for 6 years of a person when a probe is performed.

Section 153C of the Act permits the assessment of the income of any other person based on the documents probed during a search.

A petition was heard by the court contesting the proceedings u/s 153C of the Act. It was the case of the applicant that while a probe was performed on one Om Kothari Group (“the Group”), specific WhatsApp chats were discovered that were between the directors and associates of the Group that showed that certain plots were purchased by the applicant from the Group using unaccounted cash.

Read Also: Genius Tax Software New Useful Feature of E-mail/WhatsApp

The applicant on these chats was provided with the notice u/s 153C of the Act, without any other incriminating document. It was claimed that Section 153C obligated that the default must have been shown in the books of account, or the documents or assets seized, and can not be based on WhatsApp chats.

While it was furnished by the State that the Chats were kept by the influential material to incriminate the applicant. It was claimed that the cited transactions in the chats had actually taken place, as shown in the probe, and it was clear that the plots cited in the chats were actually purchased by the applicant from the Group.

“…it is not a case where it can be said that the satisfaction so arrived at was based only on the WhatsApp chats, as the figures appearing in the chats are also appearing in the images of pages of unaccounted cash books maintained by key persons and employees of the Group…properties can be physically verified on the ground and the exchange of such properties is also confirmed and thus, the WhatsApp chats in question stand totally corroborated and defined as far as impugned notice is concerned.”

The court, after hearing the contentions, pursued section 153C of the Act and showed that the regulatory needs to be interpreted such that if the information was vague, it cannot form part of the sustaining material for the proceedings. But that was not the case in the existing case.

Recommended: ITAT Surat: WhatsApp Pics Alone Don’t Prove Income Without Verification

It was shown that the investigation performed on the group shows that the applicant has purchased the plots for which an influential amount was paid in cash outside the books of account.

Also, apart from recovering images in the digital devices, a statement of one of the employees was recorded, which contained deciphering of unrecorded accounts of transactions. Such an unaccounted cash component was shown in the chats.

The Court Mentioned That,

“The persons having the WhatsApp chats were connected with both the companies herein and the transactions were regarding specific plots and the details of cash payment were clearly contained in the WhatsApp chat, thus with such specific inputs, the same cannot be said to be vague or hit by the strict parameters of Section 153C of the Act of 1961.”

The Rajasthan High Court, in this case, ruled that there was enough information to begin the proceedings against the applicant, and as such, the petition was dismissed.

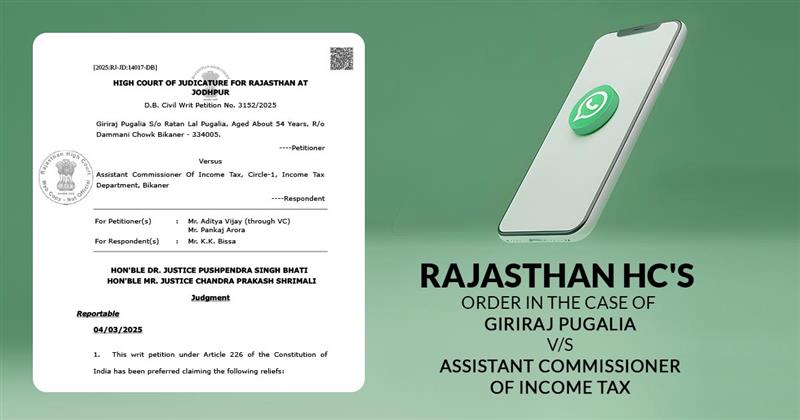

| Case Title | Giriraj Pugalia vs. Assistant Commissioner Of Income Tax |

| Citation | No. 3152/2025 |

| Date | 04.03.2025 |

| For Petitioner | Mr. Aditya Vijay, Mr. Pankaj Arora |

| For Respondent | Mr. K.K. Bissa |

| Rajasthan High Court | Read Order |