The declaration of HSN (Harmonised System of Nomenclature) codes in invoices under the Goods and Services Tax (GST) regime in India is a significant compliance need that differs as per the type of sale, B2B (Business to Business) or B2C (Business to Consumer) and the taxpayer’s annual turnover. The HSN codes support in categorising the goods and services for precise taxation and reporting.

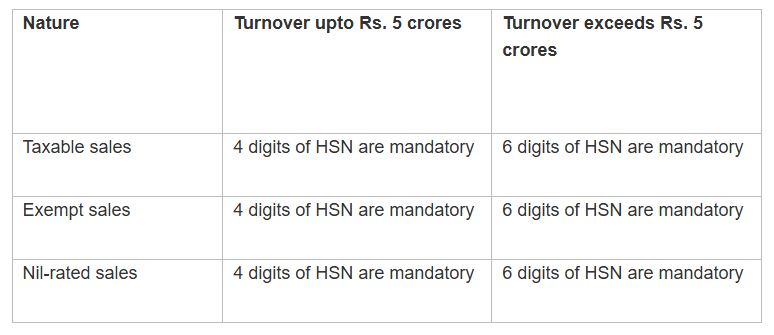

The use of HSN codes for B2B sales is obligatory across all sorts of goods, whether they are levied to tax, exempted, or nil-rated. The business with a turnover up to Rs 5 crores is mandated to cite at least a 4-digit HSN code on invoices issued to other businesses.

The requirement becomes strict if the turnover surpasses Rs 5 crores. The same rule ensures effective specificity and standardisation in the transactions of the businesses and supports cross verification by the tax authorities.

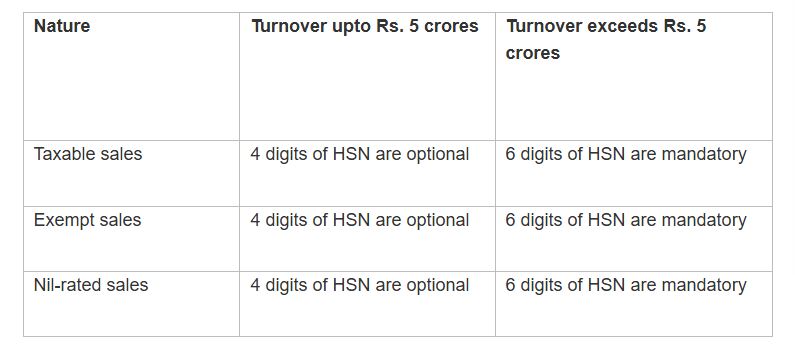

In B2C sales, the pre-requisite of compliance is relaxed for businesses with a lower turnover. If the turnover is up to Rs 5 crores, citing a 4-digit HSN code is optional, irrespective of whether the goods are taxable, waived or nil-rated. Smaller businesses engaged in direct selling to the consumers are been furnished with some operational ease through this.

The regulations coordinate with those of B2B transactions, and the obligation to cite a 6-digit HSN code in all B2C invoices is essential once the business turnover exceeds Rs 5 crores.

B2B Sales Data Reporting

B2C Sales Data Reporting

Note:

- We will check the Aggregate Turnover PAN-wise rather than GSTIN-wise.

- For export sales, the HSN code of 8 digits is obligatory.

I Think it’s mandatory now for both irrespective of turnover. I talked to GST helpline