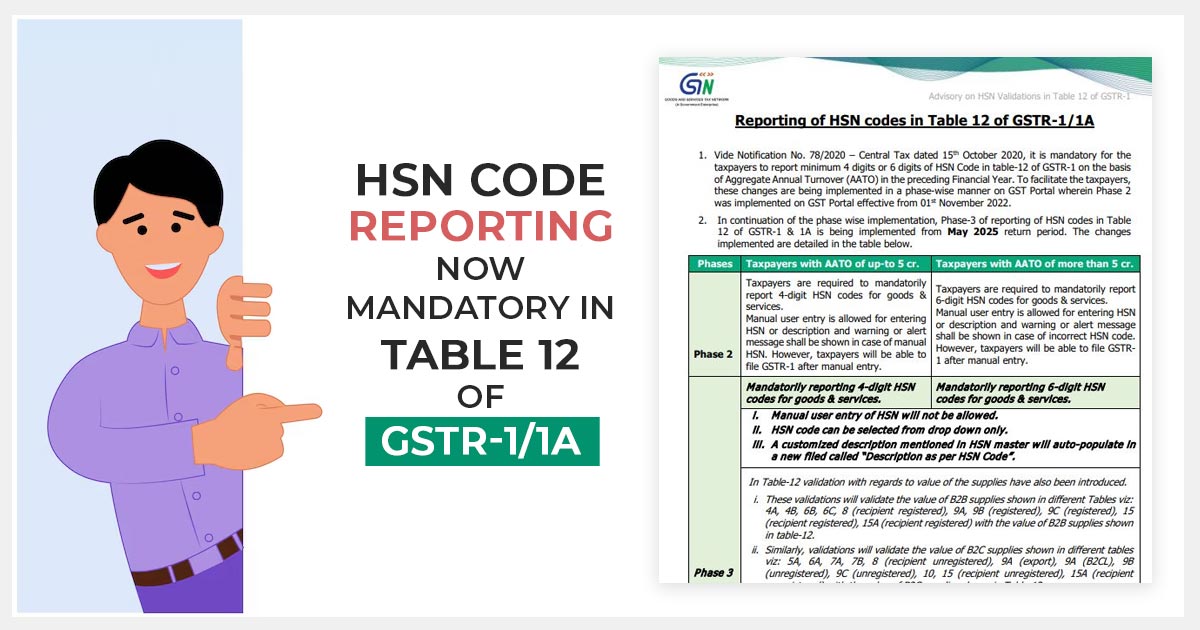

Updated in the reporting of Harmonized System of Nomenclature (HSN) codes in Table 12 of GSTR-1/1A is executed by the Goods and Services Tax (GST) Portal, as per the amended advisory. Such amendments are to ease the reporting process for taxpayers, which is rolled out in phases.

Key Updates of New Advisory

Below, we have discussed important key updates of reporting table 12 in GSTR-1 and 1A:-

Compulsory Selection of HSN Code: No more permission available for manual entry of HSN codes. From a dropdown menu, the taxpayers should choose HSN codes to ensure precision and compliance.

Table Division: Table 12 has been separated into “B2B Supplies” and “B2C Supplies” tabs, authorising separate and detailed HSN summaries for different types of transactions.

Downloadable HSN Code List: Addition of a “Download HSN Codes List” button enables the users to download an Excel file containing updated HSN & SAC codes along with their descriptions for easy reference.

Phase 3 Performance- The taxpayers should report 4-digit HSN codes w.e.f. May 2025 return period who have an Aggregate Annual Turnover (AATO) of up to ₹5 crore. 6-digit HSN codes are to be reported by the taxpayers having an AATO surpassing Rs 5 crore.

Automated Report: A customised description from the HSN master will automatically populate in a new field labelled “Description as per HSN Code” on selecting an HSN code, lessening manual effort and potential errors.

Required Table 13: Table 13, which demands details of documents issued, is now obligatory, w.e.f. May 2025 return period.

Enhanced Product Name Search: The “Product Name as in My Master” button is now searchable, permitting auto-population of HSN code, description, Unit Quantity Code (UQC), and Quantity upon selection, streamlining the reporting procedure.

Read Also: Phase III HSN Code Mandatory in Table 12 of GSTR-1/1A from Jan 2025

The amendment in the advisory would assist the taxpayers in precisely reporting HSN codes and ensure compliance with the GST norms. The amendment’s objective is manual input minimise errors, and enhance the overall efficiency of the GST reporting process.