The Indian government has provided a search tool for finding out the business details by the means of GST number to bring transparency between shopkeepers and customers. People must use this tool while GST number search to find out the registration type of business.

Although many of business units are faking the registration and trying to evade the taxes by illegitimate displaying of GSTIN number and collecting the taxes from the consumers on the other hand. Now the public can find out the complete details of a business just by entering the GST number of the particular business on our GST helpline app and get to know the important links for ascertaining the legitimacy of the business unit. We guide you through the complete steps for finding out the business details under GST:

Before making payment for any invoice, it is important to verify the mentioned GST Number On the invoice. There are various cases reported where suppliers provided fake GSTIN to collect taxes from the customer and to create fake invoices for fake inward supplies to claim the Input tax credit. To Mitigate the risk, protect the honest taxpayers, and catch such malicious taxpayers GST Portal provides the facility to verify the GST Number.

Need Free Demo of GST Compliance Software

The Process to Verify GST Number?

GSTIN or Goods and Service Tax Identification Number is a unique 15-digit number, it is the business identity number registered with the Government of India. GSTN portal has a GSTIN Verification tool that will check whether the GST number you searched is a genuine GSTIN or not. The step-by-step procedure is given below.

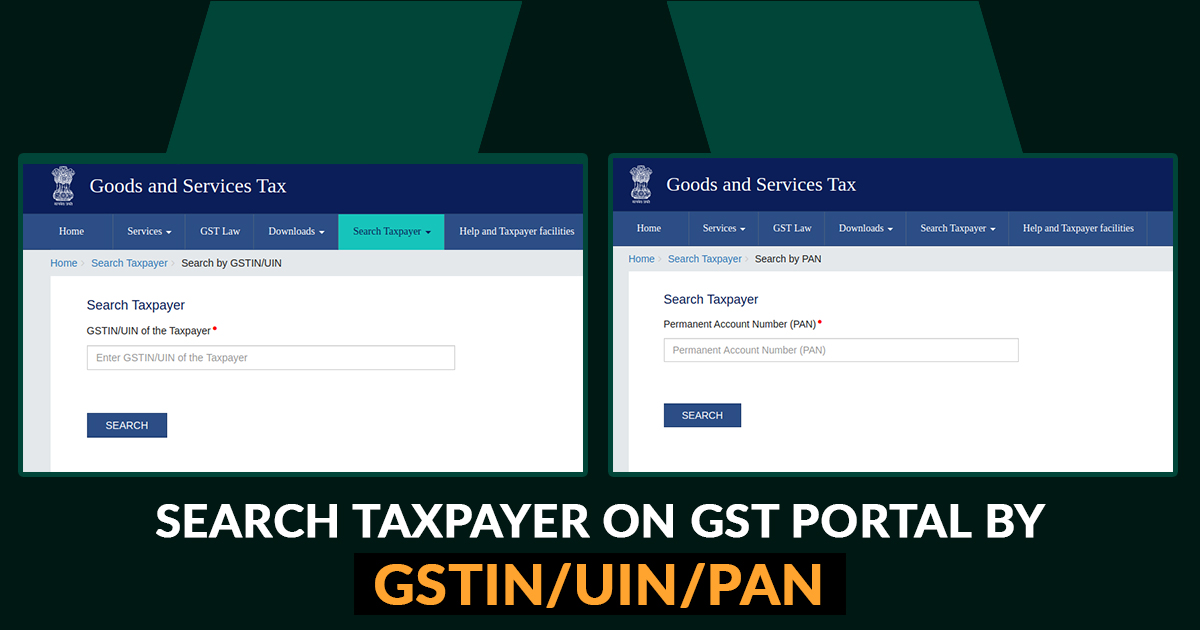

Process of GST Verification & Search Taxpayer by GSTIN/UIN

- Go to the official GST portal i.e https://www.gst.gov.in/

- Click on the dropdown of the Search Taxpayers

- Now here click or tap on search by GSTIN/UIN

- Now on the next page, enter the GST Number and solve the captcha

- Click on Search

It will show you whether the GSTIN is ethical or not. If the GST Number is incorrect it will show you an error notification and if it is correct then it will show you the following details.

- Legal Name of Business

- Taxpayer Type

- GSTIN / UIN Status

- Nature of Business Activities

- State Jurisdiction

- Center Jurisdiction

- Date of registration

- Constitution of Business

Verify GST Number & Search Taxpayer by PAN

- Open any browser and head up to https://www.gst.gov.in/

- Click on Search Taxpayers Dropdown icon

- Then click on Search taxpayer by PAN

- Enter the PAN Solve the captcha.

- Now click on Search.

Same as above, It will tell you whether the PAN is linked to any GSTIN, and is it correct or not. In case of incorrect details, it will show you an error message. If found correct it will show you some extra details of GSTIN linked to the PAN.

Verify GST by Name

Till now this facility is not available on the portal, you can verify details either by PAN or GSTIN itself.

GST Number Format & Structure

- For Example, GST No. 22AAAAA0000A1Z4

- The Fist 2 digit: Unique State code, For ex.- for Delhi it is 07

- Next 10 digits/characters: PAN Number of Taxpayer

- 13th Digit: Registration number of the taxpayer with the same PAN

- 14th Digit: Z by default

- 15th digit: Check Digit, Number or alphabet

Procedure to Find Business Details by GST Number

- In the first, the consumer will have to enter the GST number in the GSTIN bar correctly.

- After which enter the captcha code for validation of the search query.

- Press search and get all the details of the business.

The search query will provide the details of the business along with the registration type i.e. normal or composition scheme. Also, the search will provide the details GST return filing done by the business in the past with dates.

Benefits of GST Number Search:

Find out the tax liability – If the business is registered as a composition scheme dealer than he is not eligible to charge GST from the customer. In this way, the customer can avoid paying GST and can save money

Claim against any past fraud – In case, the consumer had already paid the GST in the past, he can verify the GST registration type of the business and can claim the taxes paid. Find out the invoice credibility – Most of the business units provide fake GST invoices in case they are not registered, one must perform the GST number search of the customer has a doubt over the transactions activity of the business unit and ascertain the validity of the such GST invoice.

Recommended: How to Check Genuine GST Bill Online Given by Shopkeepers

How to Complain About Fake GSTIN?

If you encountered a fake GST Number then you must inform the respective authorities. You can make a call or send the complaint at helpdesk@gst.gov.in

There are other methods to search for the details of the taxpayer. You can search for the details using the PAN number of the business or you could specifically search for the details of the composition taxpayer.

How can I file NIL GST?

Not fill any data in the return or through the SMS facility. You can file Nil GST Return