To facilitate the process of the income tax payment and address any errors in the income tax challans, an online challan correction feature has been introduced by the income tax department on the ITR portal. To increase the efficiency and precision in the procedure of the income tax payment, the same feature has been implemented.

Taxpayers have a seven-day window from the date of their income tax payment to utilize this new feature. After this period, they must return to the traditional offline method for making corrections.

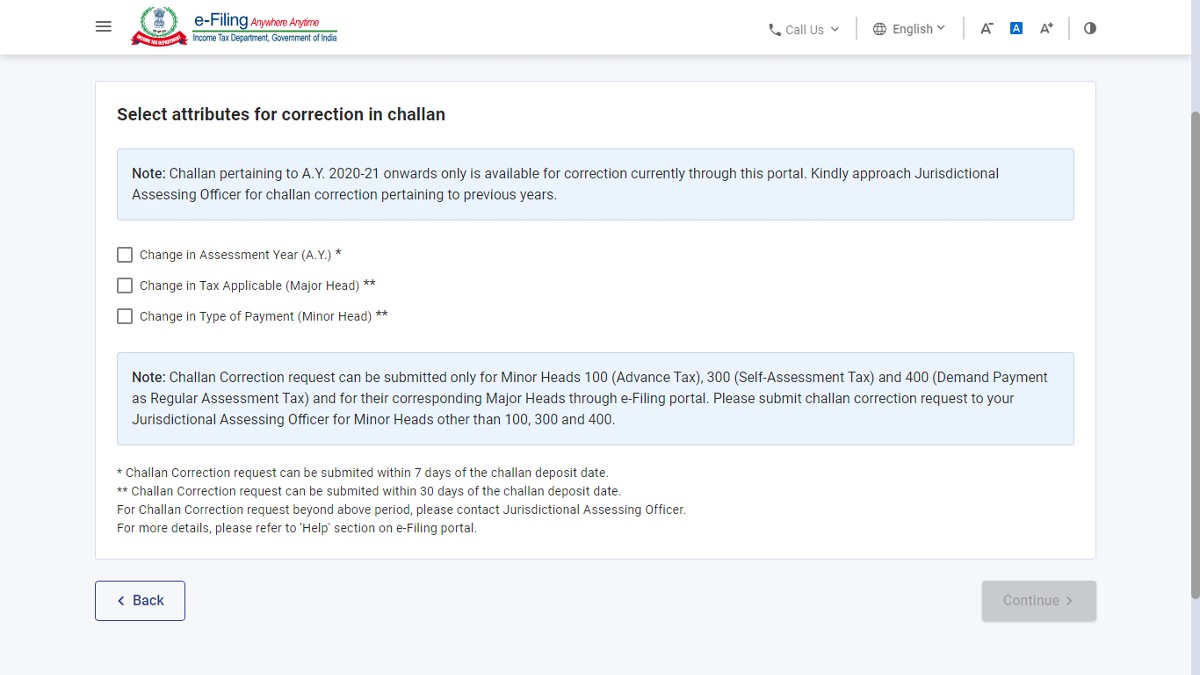

The online Challan Correction feature applies to challans associated with the Assessment Year (AY) 2020-21 (Financial Year 2019-20) and all future years. This means that individuals paying taxes for AY 2020-21 and later can use the online platform to fix certain errors, eliminating the need to visit income tax offices in person.

The assessee can use the Challan correction option to revise the three important pieces of information in their income tax challans-

- Minor heads (e.g., advance tax)

- Major heads (e.g., code 0021 for individual income tax)

- Assessment Year (AY)

According to the e-filing website for income tax, “Challan correction requests can be submitted for minor heads: 100 (Advance tax), 300 (self-assessment tax), and 400 (demand payment as regular assessment tax) and for their related major heads via the e-filing portal.”

Instructions for Correcting Challans Feature in the ITR Filing Portal

Taxpayers should make sure they fulfil the following requirements before utilizing the online “Challan Correction” feature:

- It is important to register on the e-filing ITR portal.

- In the ITR filing process, the challan requiring correction must not be utilised.

- No due challan correction requests should be there.

Procedure to Rectify Errors in the Online Challan Feature

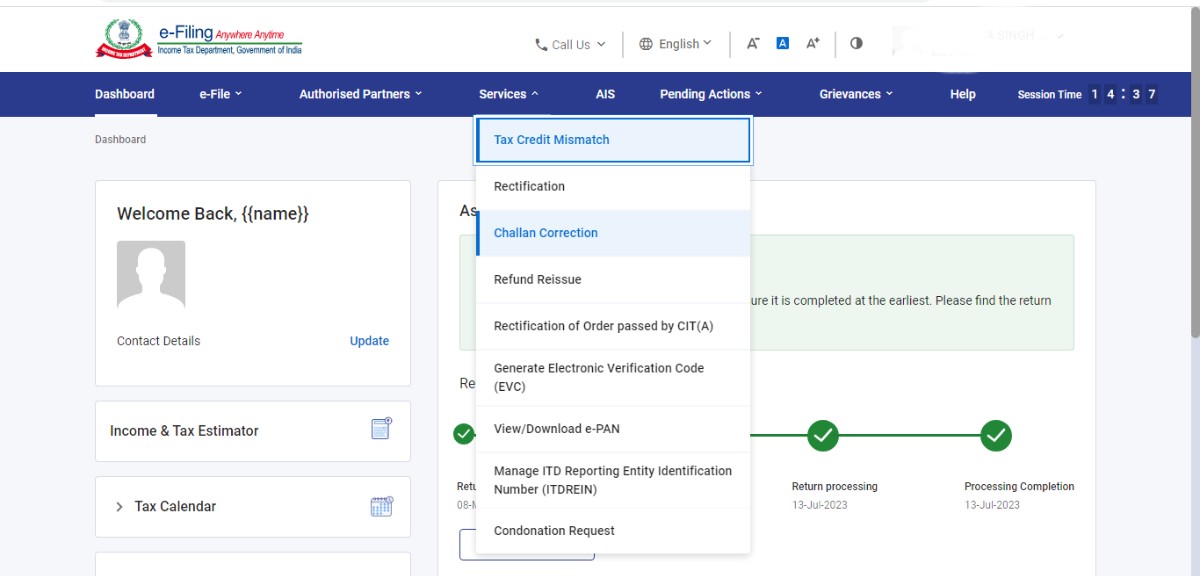

Step 1: Log in to the e-filing ITR portal.

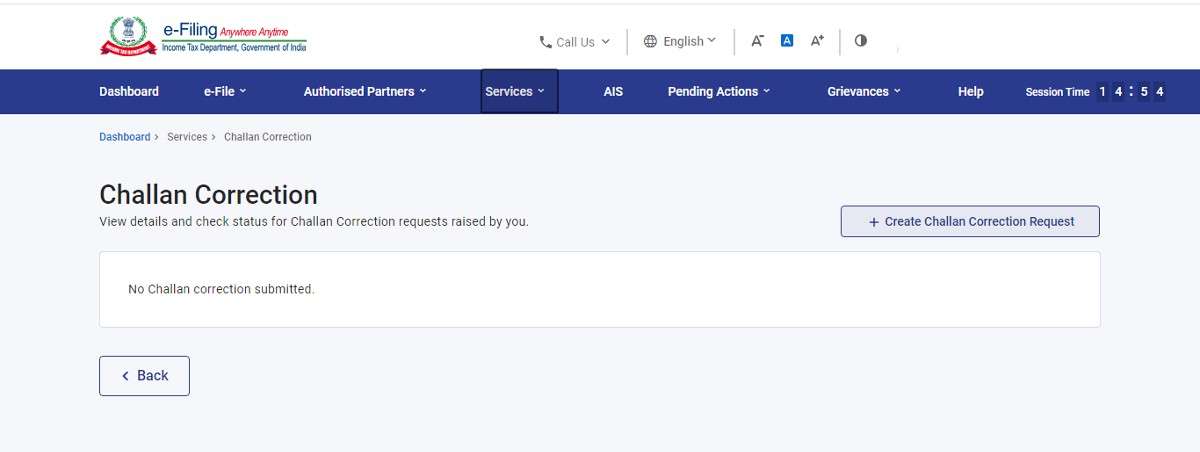

Step 2: Choose “Create Challan Correction Request” on the newly opened webpage.

Step 3: Choose the pertinent option that requires correction:

- Amendment of the assessment year

- Revision of the applicable tax (Major head)

- Adjustment of the payment type (Minor head)

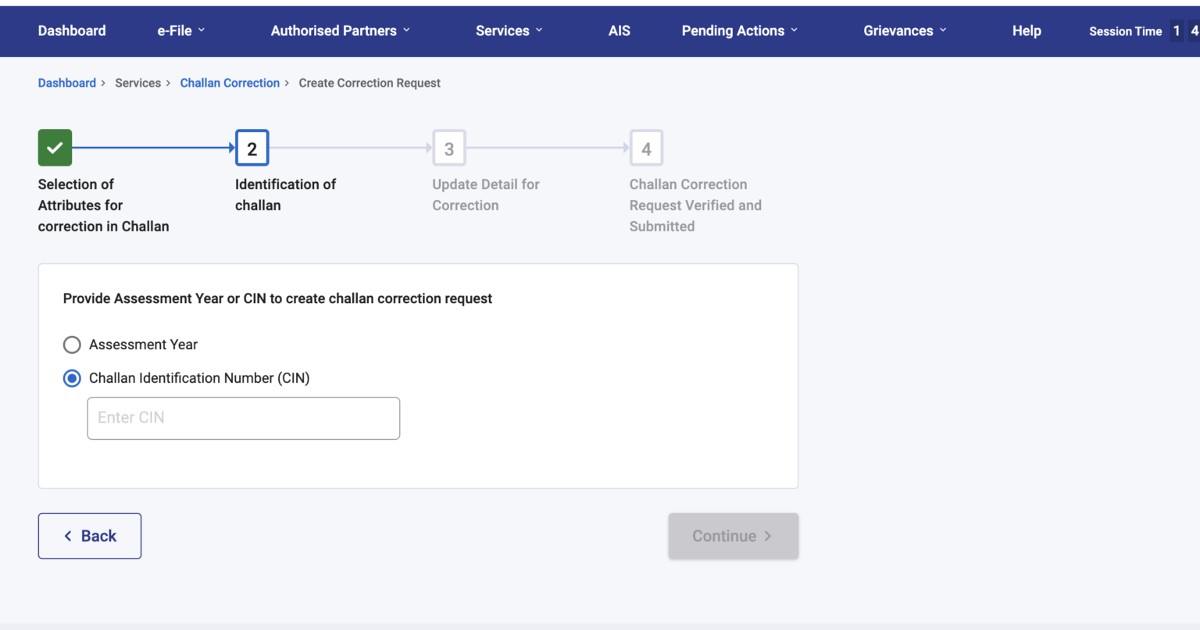

Step 4: File the required income tax challan data that needs correction, like the assessment year or the Challan identification number (CIN).

Step 5: Depending on your choice, a new webpage will be generated. If you’ve provided a CIN number, it will display the corresponding challan details. Alternatively, if you’ve chosen an assessment year (AY), it will show a list of all challans linked to that AY, and you can select the specific challan that needs correction.

Step 6: Enter the accurate details for the selected option.

Step 7: Validate the correction in the tax challan using one of these methods: Aadhaar OTP, digital signature certificate (DSC), or electronic verification code (EVC) through net banking, Demat, or bank account. After successfully e-verifying the correction, the income tax e-filing website will provide a confirmation message along with a transaction ID. Make sure to keep the transaction ID for tracking the progress of your correction request.

Tracking the Improvement of the Challan Correction Feature

To check the status of the tax challan correction, log in to the ITR portal and click on the ‘Challan Correction’ option under the services tab. This page will provide you with the most up-to-date information regarding the status of your correction request.