Simple Description of the Income Tax Challan

The Challan is a form used by the government for collecting taxes. The Income Tax department receives the tax through a challan first deposited with the authorized banks and then with the challan. The challan can be paid online via net banking or offline at designated bank branches by submitting the challan.

Who is Allowed to Create an Income Tax Challan?

On the e-Filing portal, registered or non-registered users (Corporate and Non-Corporate users, Representative Assessees and ERIs) can create the income tax challan.

An Explanation About the Form 29C

The person other than a company must prepare a report in accordance with section 115JC of the Income Tax Act, 1961, for the purpose of computing the adjusted total income and alternate minimum tax.

What is the Filing Eligibility for Form 29C?

Taxpayers who are subject to AMT provisions must obtain Form No. 29C from a Chartered Accountant certifying the AMT and adjusted total income have been computed by the Income Tax Act. The report must be submitted on or before the due date for filing the income tax return.

Genius Software Helps to Fill Form 29C & Challan Details

In India, Genius is the most suitable software for filing tax returns since Assessment Year 2001-02. Using this software, you can easily file unlimited client returns, including income tax, TDS/TCS, AIR/SFT, and many more, by the most current taxation regulations.

The Genius package includes six different modules, including Gen IT (Income Tax), BAL (Balance Sheet), FORM MANAGER, CMA, and TDS (Tax Deducted at Source).In addition to providing multiple features, Genius is among the best tax filing software in India.

Some of the Best Features of Genius Software:

- Unlimited Tax Return Filing with TDS/TCS Returns

- Statement of Multiple Capital, Affairs, Profit & Loss, and Trading accounts preparations. Automatic transfer of profit to computation.

- Forms 49A and 49A-Correction must be prepared and submitted online.

- Automatic transfer of client master data, carryover of losses, NSC, and KVP details to the following assessment year (s).

- Ability to calculate advance tax using data entered in the current year or information from the previous year.

- Relief Calculation for Arrears, Pensions, Gratuities, and Family Pensions from the Academic Year 1979–1980.

- Form 10E is generated automatically.

- Creating tax challans (282,280,281) and making online payments.

- Separate Statement of Capital Gain in Tabular Format.

- Interest under Sections 234B, 234A, and 234C is calculated.

- Calculator for reverse taxes.

Procedure to Fill Form 29C & Add Challan Details Via Genius Software

Below is a brief summary of how to fill form 29C and challan details using the Genius Return Filing Software:

Steps to Fill Out Form 29C

Step 1:- First Install Genius Tax Return Filing Software on your laptop and PC.

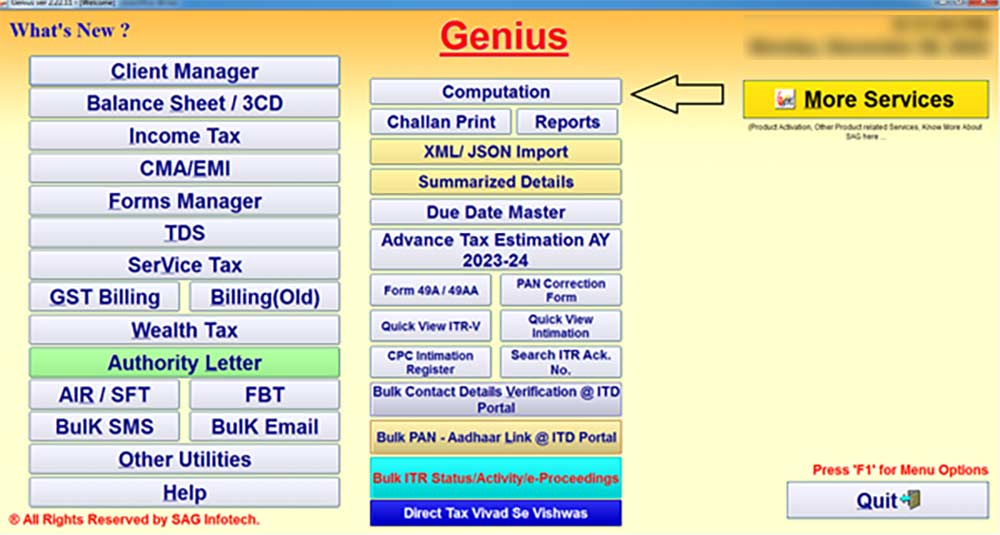

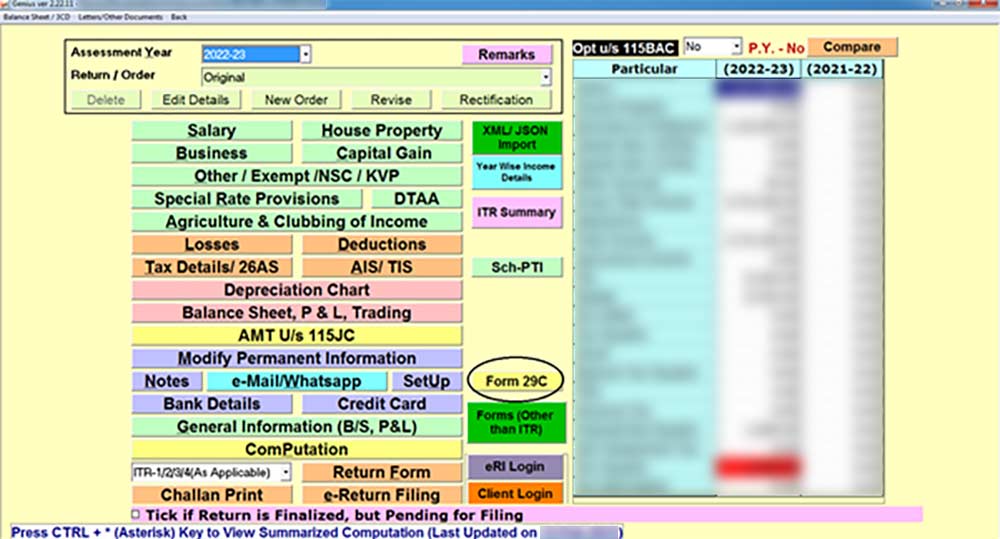

Step 2:- After that Open the Software and then click on Computation.

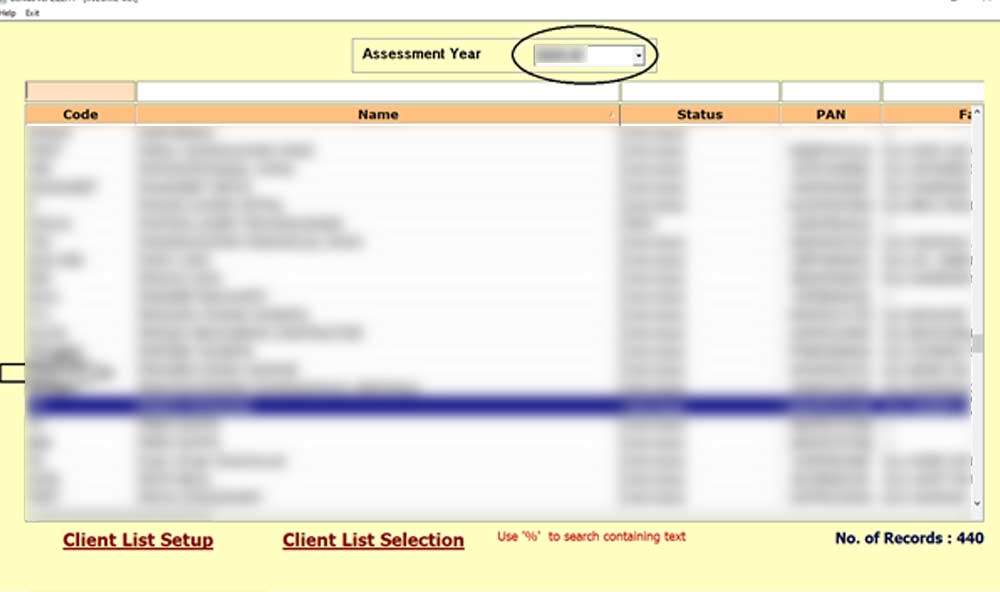

Step 3:- Now Select the client for which you want to file Form 29C.

Step 4:- Click on Form 29C.

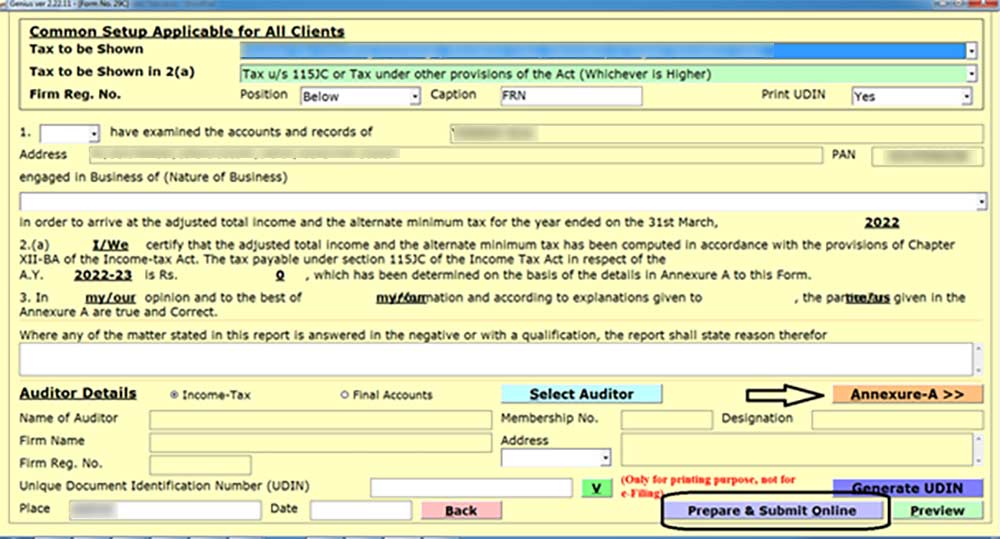

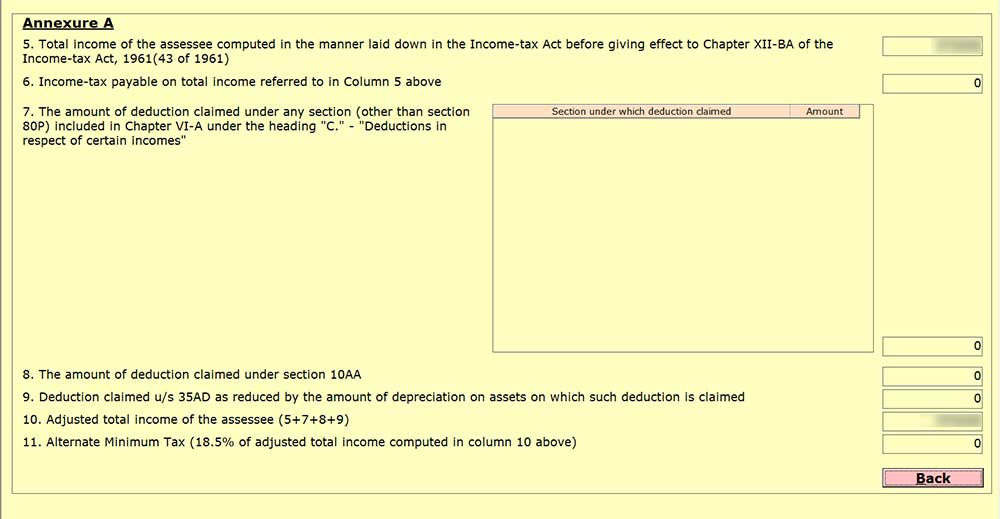

Step 5:- Fill in the details as well as Annexure-A as applicable to you.

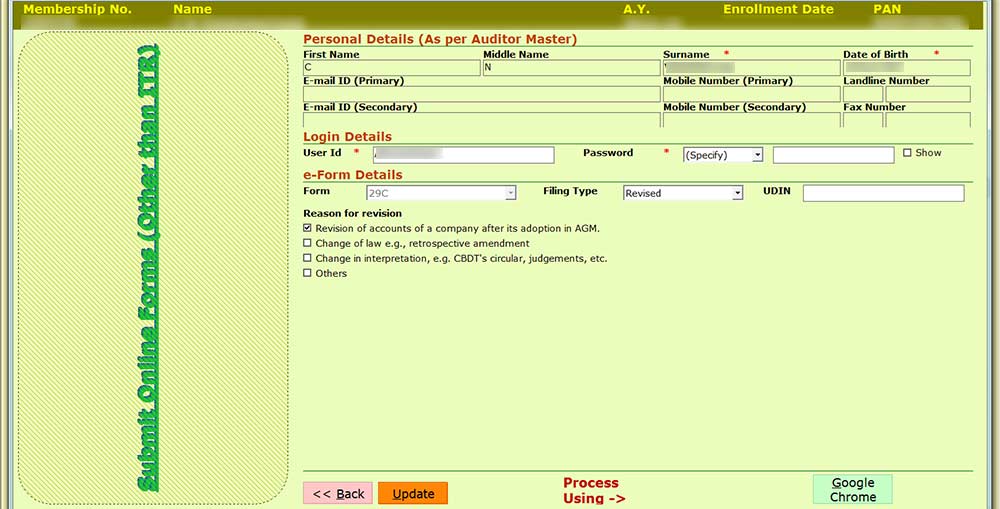

Step 6:- After that click on Prepare & Submit online button and upload it using the Google Chrome button.

Add Challan Details in Genius Software

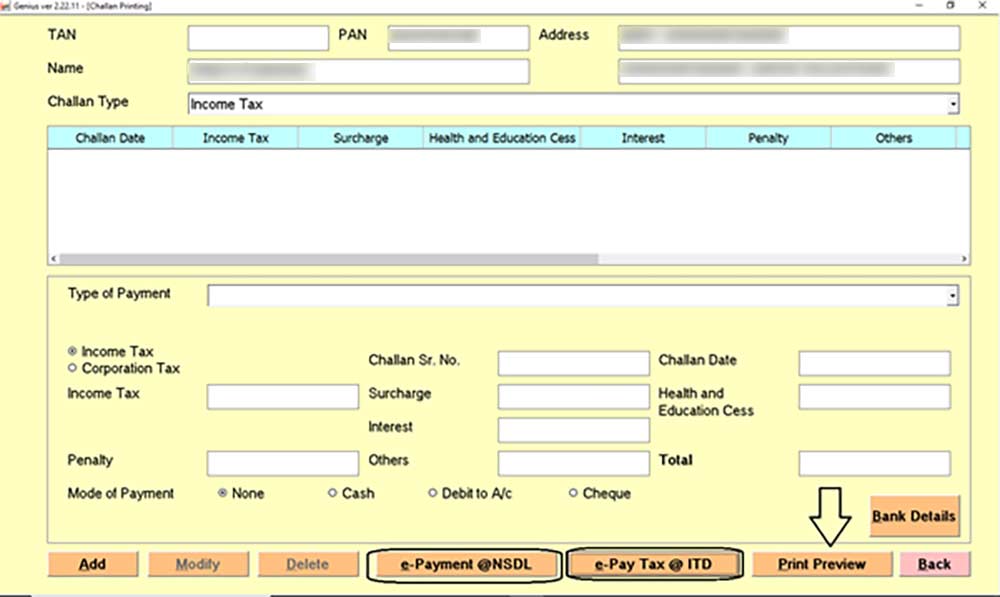

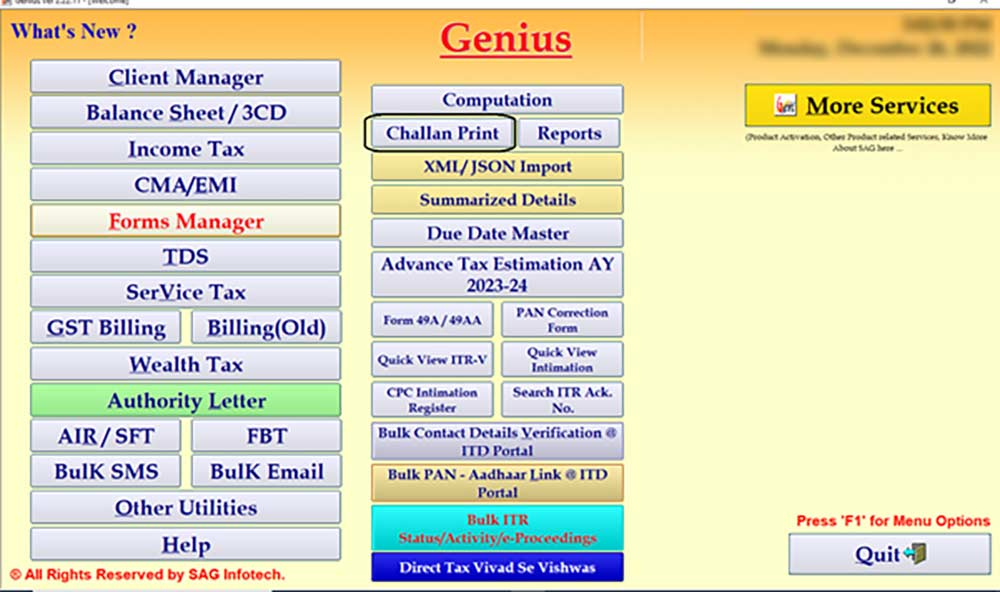

Step 1:- First Install the Genius Software and after that Go to Income Tax and then Go to Challan Print Option.

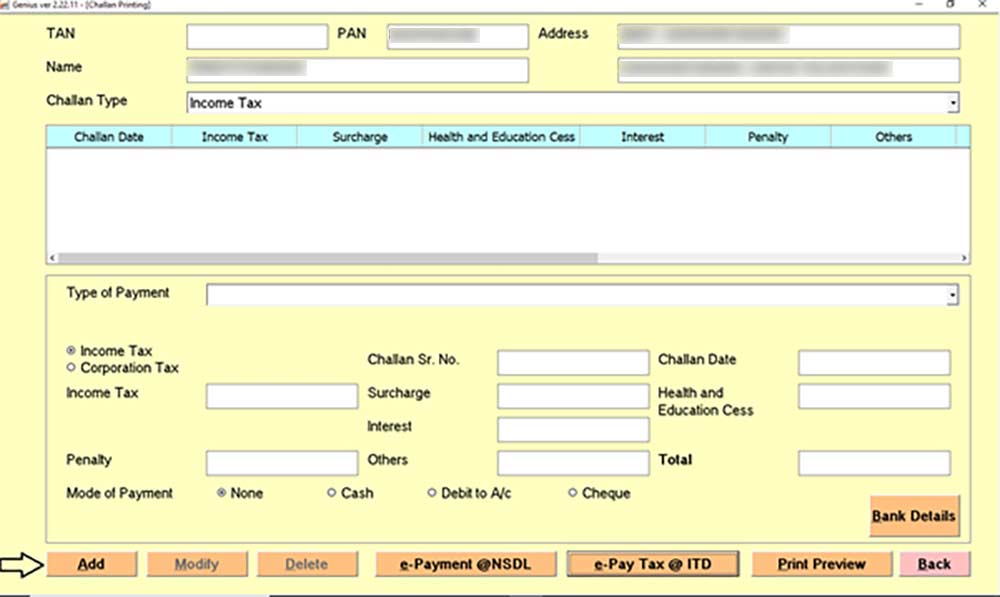

Step 2:- Now Select the Client and Assessment Year and after that click on Add button Select the Type of Payment and Fill in the details like Income Tax, Surcharge, Interest etc.

Step 3:- After Filling in the details make the payment of Challan online either through e-payment @ NSDL or e-pay Tax @ ITD. You can also take the Print Preview of the Challan and pay the amount of challan physically at Bank.