The Income Tax Department has launched its new E-filing portal on June 7th, 2021. Consequently, these days, it is creating an awareness and learning campaign on how to proceed for registration and re-registration of Digital Signature Certificate (DSC) on the new Income Tax e-filing portal.

Latest Update

- The taxpayers now download the Digital Signature Certificate (DSC) Management utility at the official portal. Download Now

- The CBDT department has published the issues and solutions of the Digital Signature Certificate (DSC). Read PDF

- The Income tax department has published guidance related to facing an issue in DSC. Read PDF View more

Download Income Tax Software

What Exactly is DSC & Who Can Create it?

- As per Section 140 of the IT Act 1961, the person responsible for signing the I-T return could be

- Managing Director or

- any other Director (in case the MD is unavailable) in case of a Company;

- Any authorized person possessing a legal power of attorney in case of the presence of a Non-resident Company;

- Managing Partner of a Firm or any other Partner (in the specific case of Managing Partner being unavailable);

- Chief Executive Officer/ Principal Officer or Competent person in case of other entities such as Body of Individuals, Association of Persons,, Artificial Juridical person, Trust, Local Authority and so on

- Karta in case of a HUF;

- Self in case of an Individual or;

- Any authorized person possessing legal power of attorney in case the individual is not capable of signing the I-T Return or is outside India.

Any person who is willing to sign the Income Tax Return ‘digitally’ has to complete the registration process for the DSC on the e-filing website (www.incometax.gov.in ) before signing. Further, It is important to mention that any person can change or update his DSC registration any number of times.

Essentials Required in DSC Registration?

- To register the Digital Signature Certificate, the taxpayer must have

- the Registered user of the Electronic–Filing portal having a valid user ID and password;

- Downloaded and installed the emsigner utility;

- The USB token that is procured from a Certifying Authority Provider should be plugged into the computer;

- DSC USB token should be a Class 2 or Class 3 Certificate;

- DSC to be registered should be active and not expired; and

- DSC should not be revoked.

Steps to Download Emsigner Utility

Step 1: Open the Income Tax e-filing portal

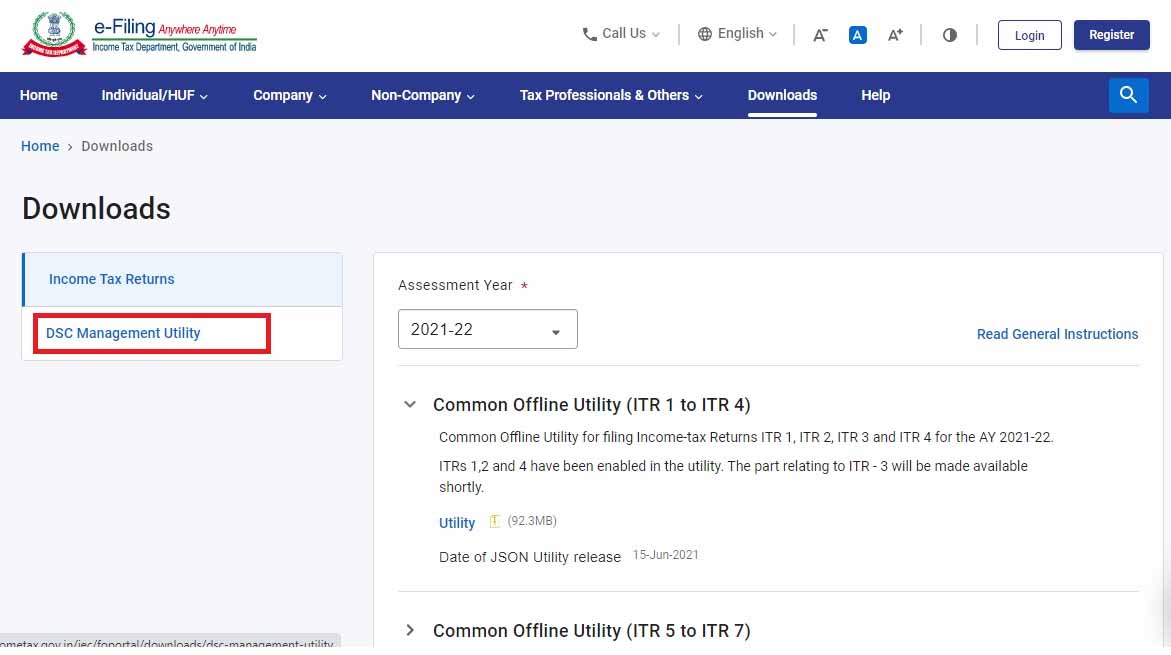

Step 2: Select the ‘Downloads’ tab from the header menu.

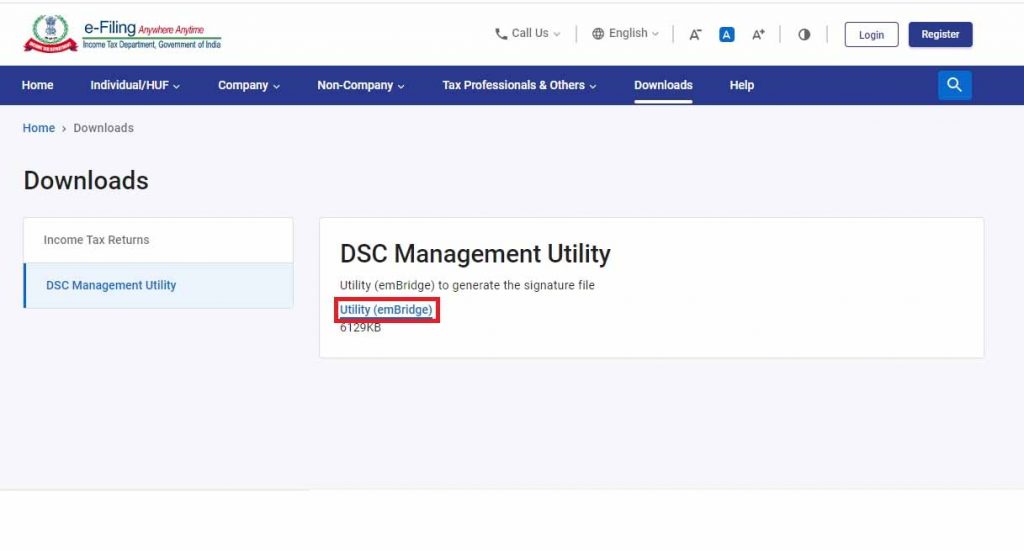

Step 3: Now Click on DSC Management Utility.

Step 4: Download the Utility (emBridge) to generate the signature.

Complete the Process of DSC Registration on the New Tax Portal

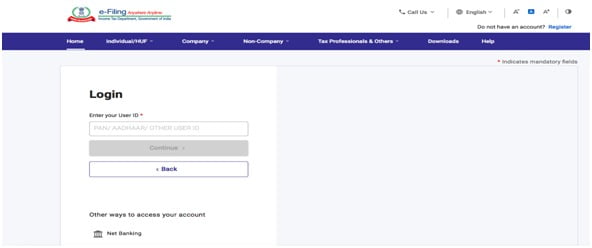

Step 1: The authorized signatory or Individual shall have to log into the E-filing website(www.incometax.gov.in ) using the Login particulars such as the user which may be your PAN, Aadhar Number, or any other ID and password of the company/firm / HUF / Individual and so on.

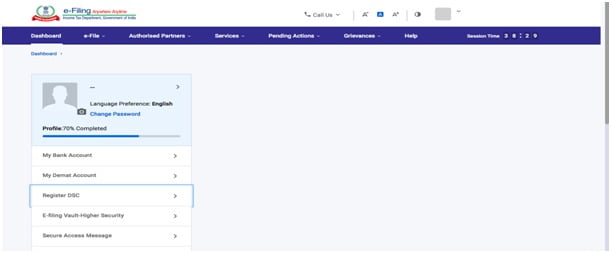

Step 2: He has to click on ‘My Profile’ from the Dashboard.

Step 3: Then, at the left side of the screen, he has to click the option ‘Register DSC’.

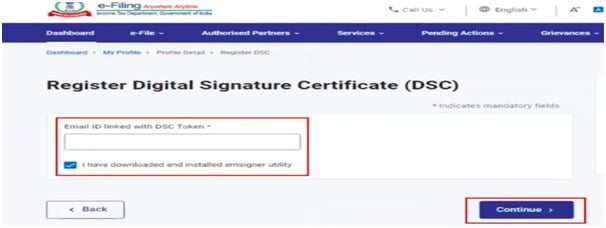

Step 4: Thereafter, Enter the linked mail ID and then select

“I have downloaded and installed emsigner utility” and click on ‘Continue’.

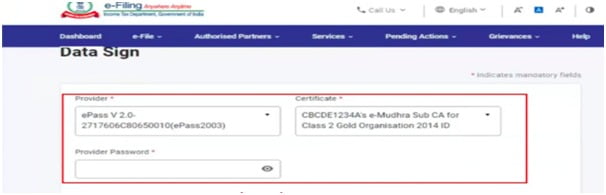

Step 5: In the last step, select the provider and certificate. Now Enter the provider password. Click on sign

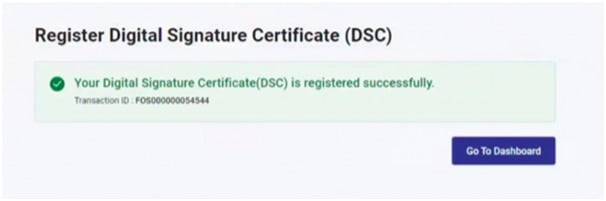

If the attempt for DSC is successful then a message will be displayed with the choice to go to the Dashboard.

My DSC is already registered from which i have approved my tax audit report.

But when i am filing ITR3, it says that DSC is not registered and when i am registering the DSC it it says that PAN is not matching.

How to resolve it?

same issue with me

Hello,

Have you got your DSC issue fixed or not?

I am also facing same situation and totally confused with that.

Please reply if you have resolved the issue.

Waiting for your reply

Need to change Dsc on Income tax portal,(DSC Already Register on Portal )

In my case the dropdown button of provider, it shows only one microsoft windows stores while i am trying from e pass token , but dropdown not shown e pass provider name. What is the reason ???

I am having the same issue. Did your query get solved? If yes, Please reply on this post with the solution

While registering DSC in New Income tax portal, Token Provider name showing but certificate not showing (I mean assessee name) Certificate box showing “eMudhra” only

If the person is having 2 DSC for e-filing purposes. After registering one DSC in an Individual’s efiling login profile, by using the same DSC as a Director of the company, whether we can upload the e-submissions / filing return etc on the new portal in the company’s case.

Also, one more query, whether two different person can upload e-submissions on different company’s e-submission by using this Directors’ DSC (assuming the above individual is the Director of a different company). This Director has 2 DSC and we have so many company’s where he the Director. Kindly advise.

Sir, when we click on the ‘Register DSC’ link nothing is displayed in the screen to proceed further. Can you help to identify the error?

Sir, in my case, the token is pickup by the site, but DSC is not showing whereas there is a valid DSC inn the token. what to do.

“Please contact to the department”

It is not asking me for email address before the emsigner tick box. And I believe because of that only I am unable to re-register my DSC

Did anyone else face this problem? What is the solution?

“Please contact to the department”

hi sir how to change authorized pan (Director Pan ) in the income tax new portal

Seems the DSC registration functionality as on 1st July 21 is activated only for individuals and not the company, llp etc.

Though many people have put help videos and blog only based on individual menu

Same issue we have faced, when we login individual option shows “Register DSC” but when we login Company there is no option shows. Can anybody guide us how to register DSC in company.

Now Register DSC option not available for companies

DSC can be registered only for the Individual in Income Tax Site. Login Directors at Individual Capacity at IT site and register. After that login with Company ID and e verify with Director DSC, ITR would be e verified.

How to capture the DSC on TDS login as deductor because I could not able file the return and I have already registered the DSC on traces also.

register the DSC on the income tax site as per pan login and it will get registered for TDS filing on the income tax site and you can file the TDS return using the tan login. there is no need for different registration DSC for tan

Hello Sir,

When I registered DSC there is a problem in emsigner that the smart does not perform the requested operation or the operation requires a different smart card.

What should I do to resolve this query?

There is no option of Register DSC coming when i visit Profile. It is case of LLP. Neither on Traces nor on Income tax site

Same problem is being faced by me.

Sir, i all process completed but error Something went wrong Please try again after some time

How to register DSC in case of LLP? The ‘Register DSC’ does not appear.

“Please contact to the department”

by mistake at TAN LOGIN ACCOUNT login with DSC activated how to disable this option I don’t want to login with DSC.Thanks

Sir, when we click on the ‘Register DSC’ link nothing is displayed in the screen to proceed further. Can you help to identify the error?

Click the emblem below left hand side

“Please contact to the department”

How to register DSC on TDS login as deductor

Login to Traces Site then go to profile. In the Profile section, there is a button for DSC Register there. Then you can register your DSC.

Sir, when we click on the ‘Register DSC’ link nothing is displayed in the screen to proceed further. Can you help to identify the error?

“Please contact to the department”