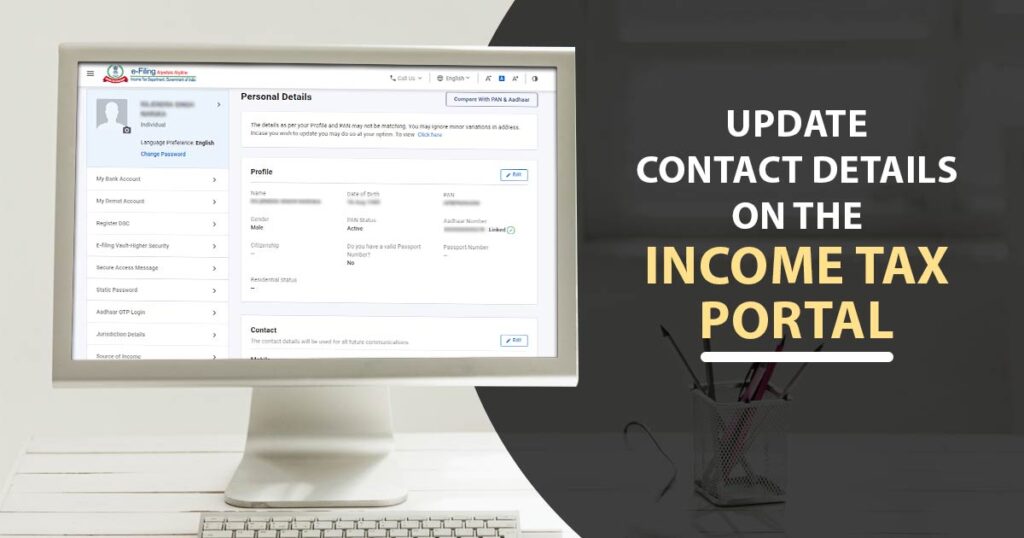

Whenever we log in to our income tax account, the first thing that flashes on the screen is the pop-up to update our contact and residential details. We often tend to hit the skip button and move on with other crucial tasks.

If the details are already updated then it’s good but if not then it is highly recommended to update the details before going ahead with your tasks in the Income Tax Account. These details are crucial when it comes to income tax queries, filing or refunds.

Moreover, the Income Tax department uses your contact details mentioned on the e-filing portal whenever it needs to communicate any piece of information or update related to your tax compliance (SMS, email, physical notice, etc.).

There have been instances when the taxpayer himself is not updating the details or is providing the details of the third person for convenience. That is hindering the IT department in terms of privacy and direct contact with the taxpayer on their personal email IDs or mobile numbers. For if a taxpayer has requested to reset the password of an account but has not received the email/SMS communication from the IT department either due to his old/wrong email or mobile number.

To get rid of the chaos, the IT department in 2014 initiated a provision which says that ‘one mobile number or email ID can be used for a maximum 10 accounts as primary contact’. The provision ensures that the family members (not more than 10 separate users) can have the same mobile number registered in their accounts.

Read Also: Easy Way to Switch New to Old Income Tax Scheme for Taxpayers

So that the entire communication received from the department (for any member of the family) is visible at a common email or number shared. Still, it is advised for the taxpayers to enter their personal contact details rather than details on a shared basis (this keeps the privacy between you and the IT department).

To be noted: Taxpayers can enter any person’s mobile number as a Secondary Contact (no matter how many accounts are linked with secondary contact).

For getting notifications from the department on the Secondary number, the user can Select Profile > Settings > My Profile and mention the alternate contact details (secondary contact) for receiving SMS, email, etc.

Guidance to Update/ Authenticate the Contact Details on the Tax Portal

| For the First Time User | During Registration, enter the accurate mobile no. and email ID > You will get an activation link on your email ID and the OTP on the mobile number > Click on the Activation link and enter the given OTP for successful registration and activation of contact details on the e-filing portal. |

|---|---|

| For Already Registered User | After logging in to your Income Tax Account, a pop-up flashes on the screen requesting you to update your contact details (email ID and mobile number). If there is any updation, the user must then and there update the details or confirm that the details provided are still valid. In the case of updation, once the valid details are entered by the user then the department will thereon send the OTPs (PIN 1 and PIN 2) to the new number and email ID given. > The respective PINs shall be entered in the grids where it is asked to complete the process of detail updation (authentication on email ID and mobile number). As soon as the process ends, the new contact details will be visible on the taxpayer’s profile. While updating the details if PINs are not received by the user on time then he/she must opt for ‘RESEND PINs’. The PINs received on the given contact will be active for 24 hrs only. To be noted: Taxpayers must validate their details by entering the PINs within 24 hours of receiving them. If ignored then the same registration process shall be followed all over again. |

Taxpayers must follow the above-mentioned process and update/fill in the valid details for the sake of their own privacy and data security with the tax department. So that the communication from the IT department shall directly be received to your personal contact number/email ID.

Please Note:

- Secure the emails and SMS received from the tax department by preserving them in the ‘safe list’ or ‘white list’. So that the data is saved with you for future reference. Never block, reject or spam the notification received from the tax department.

- Please check for an email from the Department for PIN in your Inbox as well as the Spam or Junk folder (mail id – DONOTREPLY@incometaxindiaefiling.gov.in)

Updating Address

After updating the contact details, the department notifies you to update your residential location/postal address. So that your postal address shall be in the records of the Income Tax Department in case there is any physical notice to be sent from the department’s side.

how to update mobile number and email in my tax efiling account