The High Court of Delhi permitted taxpayers who are registered under GST to claim collected CENVAT credit from the pre-GST system till 30th June 2020 and that the high court also stated that the benefit of the transitional credit will be applicable for 3 years since the launch of GST on 1st July 2017. It is the same period which is stated in the limitation Act.

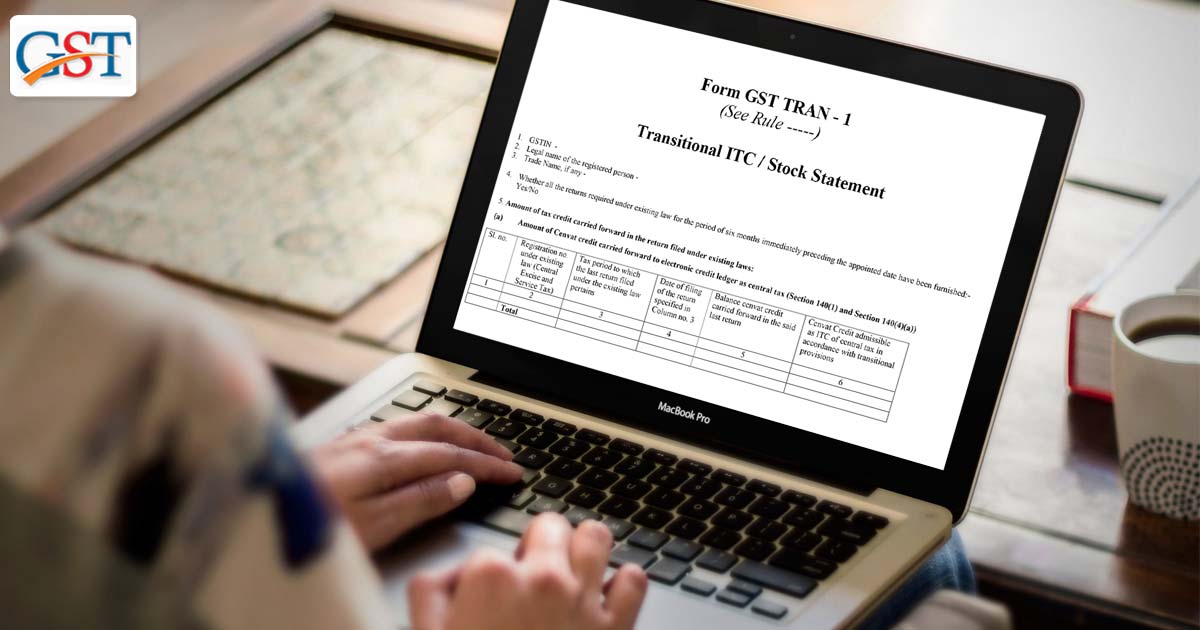

As per the GST Act, by filing the form TRAN-1

It is important to mention here that rule 117 of the GST Act made a deadline necessary for claiming the credit. However, taxpayers argued that the input tax credit is a right and not a concession, thus the deadline is not applicable.

Abhishek A Rastogi, who is a partner at Khaitan & Co, and who also argued for the petitioner Brand Equity Treaties and said that “The time limit prescribed under Rule 117 was challenged before the Delhi High Court. The Delhi High Court in the virtual hearing held today clearly held that the prescribed time limit will not be applicable as it is a directory and not mandatory. The court also ordered that the extended time limit of three years should be applicable not only to the petitioners but to all other petitioners who are facing the hardship of transitional credits”.

Even from the initial days after the introduction of GST, the government suspects that a huge amount of transitional credit was being claimed or availed in a way that is contrary to or forbidden by law. The Income-tax department also had conducted analyses and checked around Rs 2 lakh crore of transitional credit which were claimed by taxpayers till the original deadline.