In this article, we have listed the best TDS software in India according to the reviews and ratings by professionals. This software can reduce the tax burden of Indian CAs (Chartered Accountants) and professionals along with error-less preparation of TDS compliance.

List of Top TDS Return Filing Software for CA and Professionals

As mentioned in the catalogue, we provide the best 15 TDS return filing software to assist you in hiding the complexities of TDS management. The TDS software is free to download and could work as per the present rules of tax legislation.

Submit Query Regarding TDS Software

#1. TRACES Offline Govt Utility

It is an institution affiliated with the Income Tax Department assisting the taxpayers and TDS deductors to look at the tax paid and to restore them for filing returns looking for refunds. It is considered the tax government’s finest step towards facilitating the people with online filing of TDS and TCS returns.

This tool is considered for 26QB Correction, Online Correction, Requesting for Resolution (Deductor or Tax Payer), Refund Functionality, Form 16 / 16A / 16B / 27D, Downloading Conso File / Justification Report / Form 26AS. This government TDS software encompassed an e-tutorial section basically to escort you towards managing your TDS returns. Here are some features of TRACES Govt Utility:

- The Form 26AS, which is a consolidated statement displaying all tax credits connected to the taxpayer’s PAN (Permanent Account Number), is available for viewing and downloading by taxpayers and deductors.

- Through TRACES, Deductors can apply and get a Tax Deduction and Collection Account Number (TAN).

- For their deductees, deductors might create and download TDS certificates.

- For deductors to understand the causes of defaults in their TDS accounts, the platform offered rationalization reports.

- Through several online services, TRACES permitted communication between taxpayers, deductors, and the Income Tax Department.

- Deductors were able to examine any TDS defaults and submit corrections for inconsistencies in TDS statements via the portal.

- The validity of PAN furnished via their deductees to affirm the preciseness can be performed by the deductors.

- Taxpayers and deductors could verify the status of their Challan-based tax payments.

Price & Ratings:

| Price | Free |

| Ratings | 5/5 |

| Product Page | https://contents.tdscpc.gov.in/ |

| Phone No | 1800 103 0344 |

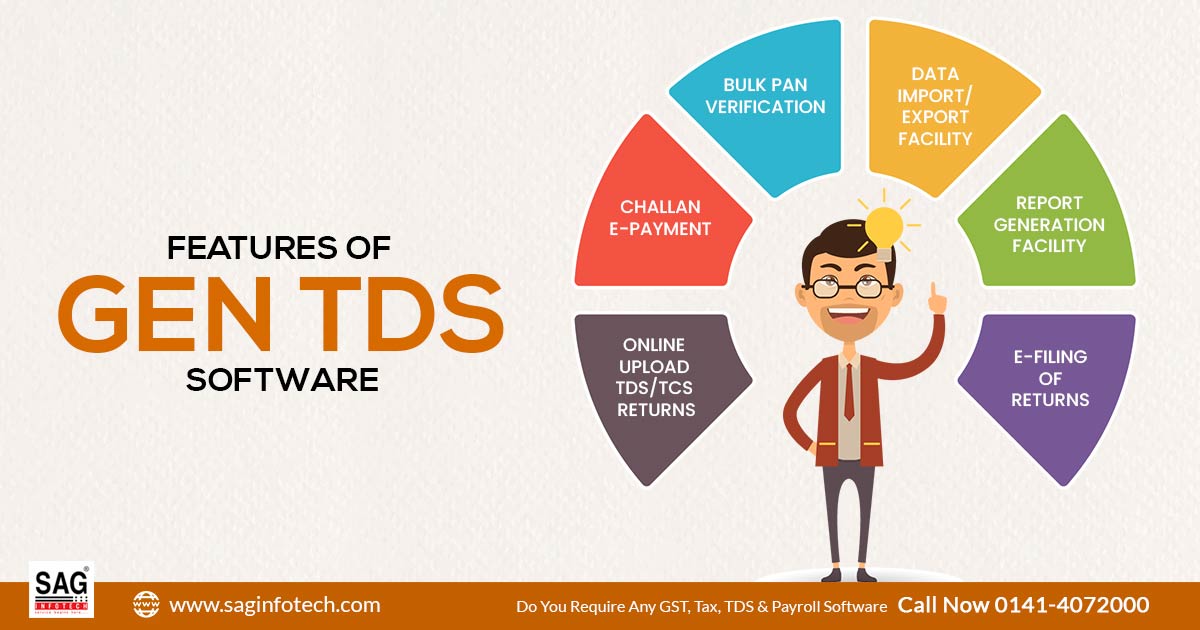

#2. Gen TDS Filing Software

This Gen TDS return software is depicted in a way to marks your TDS and TCS filing easier. Because of the simpler platforms, you will easily file online TDS and TCS returns which rigorously stick to the rules and regulations of TRACES and CPC. It is pre-deciding on the TDS amount, assembling TDS returns, evaluating interest and fines along with late filing fees, anything happens in a snap via the free version of TDS return filing software. It is a government-permitted TDS tool that is inscribed on India’s official tax information network website.

Although, the software can hold the top rank in the Indian government’s authorized TDS filing software list. Eventually, the software is intended to fulfil the taxpayer’s quick needs belonging to TDS filing. The software easily generates TDS forms 16, 16A, 15CA, 15CB and prepares 24Q, 26Q, 26QB, 26QC, 27Q, and 27EQ. This software is structured to ease the reason for TDS return filing.

Important features of Gen TDS Software:

- Ease of generation for the case of lower deduction and no deduction forms.

- With Both XML Generation Facility and Direct Online Uploading Utility for online filing of 15CA/15CB.

- Via ITD Portal TDS/TCS Statement (Regular or Correction) filing Directly Online.

- Form 16, 16A, 27D generation in PDF Format and Signed with a Digital Signature (Optional) including the Email utility.

- The option of request download during trace login is provided by the Gen e-TDS return filing software, aiding in the downloading of all requests you place on the trace website.

- Ease of Preparation and E-filing of the Returns 24Q, 26Q, 27Q, and 27EQ with Appropriate Validations including the Declaration of Non-filing for the Case of No TDS Deduction

- It creates challan including the utility of e-payment and online challan verification would be available.

- Helps in Filing and Uploading of Correction Statements including a Download Facility for All Requests such as Consolidated Files, Justification Reports, and others.

Price & Ratings:

| Price | INR 6000* |

| Ratings | 4.8/5 |

| Product Page | https://saginfotech.com/GeneTds.aspx |

| Phone No | 0141-4072000 |

#3. Clear TDS Return Software

To furnish the online TDS returns clear TDS is the perfect feature. The TDS return software is an expert in building e-TDS returns and e-TDS filing. The website possesses experience in preparing and improving the e-TDS statement, generating FVU files for Form 24Q, 26Q, 27Q (NRI) & 27EQ (TCS) towards TDS filing, import-export of files in related formats, and others.

The distinct task performer needs no downloading or desktop installation but permits various executions of CAs to work on that platform at that time. It then immediately makes, merges and emails Form 16 Part A, Part B and Form 16A. Some of the best features of Clear TDS software:

- You can make the e-TDS statements online and can perform amendments if required.

- An FUV file could be generated through you that is needed for different forms like 27Q, 27EQ, 24Q, and 26Q.

- You may do bulk PAN verification and discover all the deductors’ data.

- Through one tap it provides you to build, integrate and email forms 16 and 16A.

- The same TDS software will send the FUV in addition to generating it online.

- It will notify you when the TDS payment due date is approaching and if any TDS returns have insufficient deductions.

- Utilizing all challans that haven’t been eaten can help you save money, and its early warning system will let you know if TRACES sends you a TDS notice.

Price & Ratings:

| Price | No Information |

| Ratings | 4.5/5 |

| Product Page | https://cleartax.in/tds |

| Phone No | 8067458777 |

#4. TDSMAN Return Software

TDSMAN is a multiple-package TDS filing software that can be available in categories like standard, professional, enterprise, etc and the price tag starts at INR 4200. The hike-up prices are as per the version and the clients can opt for the version as per their demands with the compatibility of the NSDL. The TDSMAN offers services for the filing and processing of the e-TDS & e-TCS returns as well as the generation of the forms in the format and format for the 24Q, 26Q, 27EQ, and 27Q. The TDS and TCS certificates are also generated on demand by the software.

Check out the multiple features offered by the TDSMAN:

- Anyone can have the software with professional requirements.

- The convenience and user interface are the best features of the TDSMAN in the overall package of the TDSMAN. The limit of the records and financial year data package are all available as per the demand.

- The default analysis of complete data with payment interest and the calculations attached with the late fees data and the deductions also as the challan validation to take care.

- The complete, as well as overall quick updation of the compliance and auto-updates, are taken well under regard by the TDSMAN.

- The complete data can be imported and exported in the multi-user format and the multi-user version.

Price & Ratings:

| Price | INR 4500* |

| Ratings | 4.4/5 |

| Product Page | https://www.tdsman.com/ |

| Phone No | 033-4084-5500 |

#5. Webtel e-TDS software

Webtel offers TDS return filing solutions for clients and assessees. The Webtel e-TDS software is a simplification of the processing of TDS form as well as TDS certificate printing in form 16/16A for a complete time period. The Webtel e-TDS is a certified and authorised NSDL service provider.

Some important features of the Webtel e-TDS:

- TRACES Integration of Webtel e-TDS with TRACES request automation and View of Challan Status, Defaults etc. Certificate validation, and downloading of justification reports.

- Generation of processing of Form 24Q, 26Q, 27Q, 27EQ: e-Return & Paper Return.

- Statement of genuine & Revised TDS / TCS Statements

- e-TDS / e-TCS Return Through Excel Utility in case of a load of Data generation

- Form 16, 12BA, 12BB, Quarterly 16A & 27D generation and downloading

Price & Ratings:

| Price | INR 4650* |

| Ratings | 4.6/5 |

| Product Page | https://webtel.in/WEB-e-TDS.aspx |

| Phone No | 011-45054000 |

#6. WinMan TDS Software

WinTDS is the Winman-authorised software for the filing of TDS forms and TDS return preparation along with the e-filing and generation. Also one can easily generate multiple TDS forms such as form 16/16A and the much more common 24Q, 27Q, 27EQ, 26Q, etc. The software copy can be available at a minimum price tag of INR 13500 with other income tax software features to complement the product.

Features of Winman TDS Return Software:

- The e-return filing and multiple TDS form generation.

- The multiple online tools including the TAN/PAN application with the amendment of challan facility and common forms such as form 16/16A and the access of TAN registration etc are available as a facility.

- Multiple tools like WinTDS include their IFSC code list with TDS rates and the file locking feature to generate the e-return, auto-saving data auto diagnostic and multiple other important features to take care of.

- The software update will be downloaded automatically and the status of the update will be displayed on the common bar.

- Import and export of TDS reports are also maintained and handled with the option to revise TDS returns.

- The e-services of payment, message, payment details submission renewal registration etc are also available.

Price & Ratings:

| Price | No Information |

| Ratings | 4.4/5 |

| Product Page | https://www.winmansoftware.com/products/tds/ |

| Phone No | 9448327637 |

#7. Zen TDS Software

It is another software with an easing tool to assist your needs related to TDS return filing. This TDS software has a friendly approach which causes it to make TDS-related operations quick and attainable from offices, residences, or other remote locations. Tools validate with characteristics like

Development and Validation of e-TDS return file, generating Forms 26Q, 26QA, 26QAA, 27A, 27B, 27Q, 27EQ, 16, 16A, 27D, 49B, enduring challan, spattering errors, measuring TDS diminished, confirming the authenticity of challans, facilitate import and export of data, viewing return status, challan status, and so on. Here are some of the salient features of Zen TDS software:

- Zen TDS Software does not just create the e-return file but it also performs the validation.

- It can generate many forms including Form 16, 16A, 15G/H, 26Q, 24Q, 24G, 49B, etc.

- It creates several rectifying statements that keep records and track errors in returns.

- Its PAN verification features let you detect the wrong PAN.

- It prepares many MIS reports including salary reports, challan reports, return status reports, statement analysis reports, etc.

- The software incorporates many important online features such as uploading TDS statements, new deductor registration, PAN verification, challan verification, TAN registration, etc.

- The software has a bank code list and it can easily import data as well as export.

- It conducts calculations of TDS monthly basis which is fast.

Price & Ratings:

| Price | No Information |

| Ratings | 3/5 |

| Product Page | https://www.kdksoftware.com/zenetds.html |

| Phone No | 9314517671 |

#8. Saral TDS Software

Saral TDS is the perfect partner for you that supports you in every step of online TDS furnishing. The software has started new improvements in TDS compliance. An individual can depend on the TDS return filing software by downloading Forms 24Q, 26Q, 27Q, 27EQ, 16 and 16A, calculating TDS deducted, performing corrections in returns, and online verification of PAN, TAN and Challan.

Executing through the subject to make the public simpler, more precise and quicker filing of TDS return software is all recognised in the tax market. Similar to the other setups the software is meant for the satisfaction of the clients for their easy use. Some of the best features of Saral TDS software:

- Saral TDS Software was designed with a business-centric approach to provide services for different types of businesses.

- The software gives you access to the GST portal straight from the software and makes your TDS filing process hassle-free.

- Saral TDS provides an online PAN card verification service to enhance GST practices.

- The software can generate various tax-related documents, including form-16, for both employees and organizations.

- It can accurately calculate the employee’s applicable tax and automatically deduct the TDS from their salary every month.

- The software verifies the PAN of the deductees and the TAN of the deductor using the ITD information and cross-checks the details of paid Challans.

- The software allows easy transfer of information to TRACES, enabling users to access various Requests and Download options offered by TRACES.

- Business owners can access comprehensive management information reports for all their expenses and workflows concerning tax.

Price & Ratings:

| Price | INR 4950* |

| Ratings | 4.2/5 |

| Product Page | https://www.saraltds.com/ |

| Phone No | +91-80-23002100 |

#9. CompuTDS Software

CompuTDS, a component within the CompuOffice Software Suite designed for professionals, serves as an advanced solution for preparing and filing TDS and TCS (Tax Deducted/Collected at Source) returns. Tailored to cater to the needs of Tax Practitioners, Chartered Accountants, Accountants, as well as businesses and corporations, this software is developed using cutting-edge technology and is the product of a team with over 30 years of experience in taxation software. Its widespread installation base of over 60,000 users across India shows its credibility.

CompuTDS is for better processing in multiple tasks and that too at the price tag of a nominal INR 4500 and one can find the product even online. One should check the latest features like:

- Prepare e-TDS and e-TCS returns quickly and easily with correction under multiple forms like 24Q, 26Q, 27Q, 27EQ, 26QA etc.

- All-round preparation of multiple forms like 15G, 15H, 15I, and 15J.

- TDS/TCS certified forms 27D, 12BA, 16 and 27A generation.

- Preparation of TAN application and amendment with TAN registration.

- Import and export of complete data.

- Record management with challan e-payment and digitally signed form 16/16A generation.

- CompuTDS is also better at making a complete filing process in a hassle-free way with multiple features to sort out the issues in the overall compliance. Also, the software takes care of data and process timelines.

Price & Ratings:

| Price | INR 4500* |

| Ratings | 4.4/5 |

| Product Page | https://www.computaxonline.com/default.htm |

| Phone No | 0141-2609277 |

#10. SureTDS Filing Software

SureTDS also rates TDS filing solutions as per the compliance reports and has multiple companies under its clientele. It has 10+ years of expertise and assures the best support with multiple tech support on time. The sure TDS has been in the corporate entity for a long time and has been doing compliance records for government deductors as well.

There are some better posing features of SureTDS:

- Traces integration with online service utility

- Additional licence service for the multiple-user mode

- Salary computation with multiple financial years

- Automatic download of the backup and reserve for the update of the software

- Multiple MIS report development and generation for better research

Price & Ratings:

| Price | INR 3800* |

| Ratings | 4.2/5 |

| Product Page | https://www.suretds.com/ |

| Phone No | 9811181044 |

#11. Taxraahi TDS Software

Taxraahi TDS is an Income Tax Software developed to give taxation solutions to startups, SMBs, SMEs, and agencies. This web-based Income Tax Software is equipped with an easy-to-use user interface. Taxraahi TDS offers complete solutions for Windows operating systems and is suitable for desktop use. This Income Tax Software assists with Form 16 preparation, automatic calculation, and adding deductor and deductees. It is also efficient in challans, automatically verifying challans with OLTAS, generating and printing TDS certificates in Form 16/16A, and requesting and downloading Conso files.

Here are the most common features of Taxraahi TDS you need to know:

- Adding deductors/deductees challans

- Automatically Verify Challans with OLTAS

- Request and download the Conso file reports

- Automatic Calculation Process

- Form 16/16A TDS Certificates generated and printed

- TDS Computation

Price & Ratings:

| Price | INR 3000* |

| Ratings | 4.8/5 |

| Product Page | https://www.softwaresuggest.com/taxraahi-tds |

| Phone No | 8750008585 |

#12. TaxPro e-TDS Software

TaxPro e-TDS is a reliable platform for professionals to prepare and file their TDS online. This audit management platform works with provisions and has required functionalities that need to be carefully carried out while managing TDS returns. The TDS calculator software focuses on making everything effortless for users by easily generating quarterly e-TDS returns. Apart from the TDS returns filing process, with TaxPro software, users can file different forms like Form 61A, generate various types of certificates, make payments on challans like 280 or 281, apply for new PAN/TAN, and raise correction forms.

You can submit a challan cum return for TDS on an immovable property with Form 26QB using TaxPro e-TDS Professional. Additionally, You are allowed to submit quarterly TDS Return Forms 24Q, 26Q, 27EQ, and 27Q with inbuilt validation of data. Also, with TaxPro, you can import Excel sheets in TDS Return with revised Excel templates with built-in validation. It facilitates the direct generation of the original return FVU File from the Excel template.

Features of TaxPro e-TDS Software:

- You can easily access comprehensive reports regarding the “returns filed” and the “returns pending” owing to the elegant features of the software.

- To support users, the software allows PAN verification. They are capable of conducting single or bulk PAN verification at the same time.

- TaxPro TDS users can also easily file their e-TDS and check the generated file using the e-TDS file viewer which is one more useful feature of the software.

- Users can submit TDS returns with its updated returns support. They can also use it to automatically generate TDS.

- Users can manage a comprehensive report on the import and export operations performed by them.

- Important consolidated files and forms like Form 16s, and Form 16A can also be generated and downloaded with TaxPro from TRACES.

Price & Ratings:

| Price | INR 4800* |

| Ratings | 4.5/5 |

| Product Page | https://taxpro.co.in/taxpro-etds |

| Phone No | 020-49091000 |

#13. Hostbooks e-TDS Software

For Indian businesses, HostBooks TDS would be the software that has been made to handle the work concerned with the tax. The software provides compliance with the existing guidelines of GST for precise tax management. Direct access to the GST portal is provided through this tax management software, allowing users to register, file taxes, and do much more. It provides a cost-effective method for submitting TDS filing returns by drastically cutting down on compliance time.

National Securities Depository Limited (NSDL) approved HostBooks TDS which is an e-TDS service provider. The same would be a comprehensive dependable solution.

HostBooks e-TDS Software features:

- Easily file TDS/TCS returns online, eradicating manual paperwork and saving time.

- For simpler access to TDS data and simplified reconciliation, merge with TRACES.

- Easy to Generate precise TDS challans, providing appropriate tax payments.

- Create certificates of 24Q, 26Q, 27Q, and 27EQ, while complying with prerequisites for certificate issuance.

- Precisely compute taxable salary, acknowledging different exemptions and deductions.

- Effortlessly export or import TDS data in bulk from/to Excel formats, facilitating data management.

- Validate the TDS returns online status, giving real-time updates on the mechanism of filing.

Price & Ratings:

| Price | INR 4199* |

| Ratings | 4.6/5 |

| Product Page | https://www.hostbooks.com/in/etds-software/ |

| Phone No | 0124-4201354 |

#14. TDS-Plus Return Filing Software

Under the norms stated by the IT department within the compliance of the Income tax department, the Government of India, TDS-PLUS is been made which is an e-TDS & e-TCS return filing software.

The software generates eTDS and eTCS returns for all Forms – 24Q, 26Q, 27Q, and 27EQ. It also prints all TDS and TCS certifications (Forms 16, 16A, and 27D).

TDS-PLUS can manage massive amounts of data scattered over several taxpayers. Its usefulness is perfect for all sorts of taxpayers, including corporations, government agencies, banks and insurance firms, and most importantly, SMEs and individuals. CAs, Tax Consultants, TIN-FCs, and other professionals rely on the software’s stability, ease, and speed to handle TDS and eTCS data for their clients.

Some of the best features of TDS-Plus Software:

- For all four Quarters of forms 24, 26, 27, and 27E, Generate Regular and Revised returns.

- One tap for bulk PAN corrections

- Gives an alert for the notices through the Income Tax Department on the home page.

- Easy Verification of bulk PANs from TRACES

- Able to generate nil return.

- Validating text files software has an inbuilt NSDL facility.

- Through the link Generate digitally signed Form 16, Form 27D to e-filing of individual returns.

- Compatible with Financial Year from 2007-08 onwards

- For automatic regular and correction returns Generate Form 27A.

- It renders the condition for both manual and importing for deductee, payment & challan entry.

- Calculate the correct TDS or TCS amount.

Price & Ratings:

| Price | No Information |

| Ratings | 4/5 |

| Product Page | https://www.logictech.in/products/tdsplus-tds-tcs-filing-software.html |

| Phone No | 9871916565 |

#15. Monarch’s M-TDS Software

Monarch’s M-TDS is the ultimate solution for creating e-TDS / e-TCS returns, return submission CDs, and paper return filing software that is specifically created by the NSDL’s system requirements. All TDS and TCS certifications, including Forms 16, 16A, and 27D, are printed on the statement of TDS forms like 24Q, 26Q, 27Q, and 27EQ comprise more than 30 reports and annexures, as well. Here are some of the best features of Monarch M-TDS software:

- For audit Reports specify unlimited companies and multiple Auditors

- Easy data entry module

- Deductor and deductee master entry

- Exceeding 36 reports and registering for eTDS/eTCS format according to NSDL

- Payment credited information and TDS Challan entry.

Price & Ratings:

| Price | INR 3000* |

| Ratings | 3.2/5 |

| Product Page | https://www.techjockey.com/detail/monarch-m-tds-tds-management |

| Phone No | 9510056789 |

Top TDS Return Filing Services in India

In the preceding section, we’ve provided information on some of the best TDS tax return filing software available. However, some taxpayers may prefer using online website services to file their TDS returns, especially if they are not familiar with software usage. In such cases, individuals often seek the guidance of tax experts to assist them with their online TDS filings.

Below, we’ve outlined a selection of the top TDS return filing services tailored for individuals. These services enjoy significant popularity in the taxation market, and it’s essential to carefully review all instructions before availing any TDS-related services.

TDS2WIN

One standout option is TDS2WIN, a highly acclaimed tax and financial data management software solution with exceptional capabilities. TDS2WIN is specifically designed to simplify and streamline the often complex process of complying with Tax Deducted at Source (TDS) regulations.

This software has become an indispensable tool for businesses, accountants, and financial professionals alike. With its user-friendly interface and robust features, it empowers users to effortlessly generate TDS returns, calculate tax liabilities, and maintain compliance with the continuously evolving tax laws.

Whether you’re a small business owner or part of a large corporation, TDS2WIN offers a comprehensive solution to address your TDS needs. It not only reduces errors but also saves valuable time in the process.

Furthermore, the company stands out for its versatility and its ability to handle a wide range of financial data and tax scenarios. It ensures accuracy and reliability in all TDS-related transactions, making it an invaluable asset in the realm of finance.

Some of the features of TDS2WIN –

- Authorizes to work on numerous clients simultaneously

- Transfer filing status with you and your clients

- Compute the monthly TDS amount to be deducted

- Give warnings for Duplicate PAN, Name, or Blank Name

- Enrollment of Tax Deductor at TRACES and ITD Portal

- Easily prepare online TDS/TCS returns & modifications in Form no. 26Q, 27Q, 24Q, 27EQ, etc

- Importing Excel and Conso files for adding tax challans, deductors, deductees and more

Website: https://tax2win.in/services/tds-solution

EzTax TDS Solution

TDS Filing Service demands a detailed knowledge of the tax provisions, in which EZTax.in Experts assists you in filing your TDS Returns with ease. EZTax supports you in filing the TDS on Rent (Form 26QC), TDS on Salary (From-24Q), Sale on Property (From-26QB), NRI Payments (Form 27Q), Other Payments (Form-26Q), TCS Payments (Form 27EQ), with most reasonable & lowest price.

Self-Service TDS Return Preparation & Filing has made the process incredibly convenient. You have the option to utilize user-friendly online questionnaires or upload Excel sheets and Challans to generate an FVU File. The self-service TDS preparation online platform covers three specific forms. Additionally, there is an expert-assisted TDS filing service available for all these forms.

Features of EzTax TDS Solution:

- Computerized tax calculation and error detection

- Quicker and easier eFiling

- Updated FVU Version 7.8 Generation

- No limits to the tax challan number or tax deductors

- Import Excel Utility to work offline

- Print and Generate TDS Form 16 and 16A

- To fill a large TDS Return multiple people can work on a single return simultaneously

Website: https://eztax.in/tds/

TaxSpanner TDS Return Compliance

TaxSpanner stands as one of India’s most prominent and trusted online platforms, specializing in the preparation of accounting books and the filing of TDS, GST, and Individual Income Tax Returns (ITR). Founded in 2007 and headquartered in New Delhi, TaxSpanner has steadily grown to amass a vast and loyal customer base within this market segment.

The company’s overarching mission is to offer comprehensive solutions that enhance the efficiency of service delivery in the realm of personal taxation and finance by minimizing human interaction. TaxSpanner actively pursues this objective by delivering precise information regarding current tax regulations and offering top-tier customer support.

This user-friendly solution are designed to enhance the overall user experience, making it more enjoyable and straightforward. Furthermore, the company extends its expertise to assist both small businesses and large corporations in meeting their TDS E-filing requirements and reconciliation obligations.

Here are some of the best features of TaxSpanner:

- Online TDS automatically prefilled

- Download automatically Part A of Form 16

- Online for an error-free TDS return (24Q, 26Q, 27Q)

- Generate Part B, and combine it into a single PDF

- Tax vaults maintain your records safely and confidentially so you do not take any hassle of keeping separate tax files

Website: https://taxspanner.com/business/tds-returns-compliance

IndiaFilings TDS Return

IndiaFilings is a prominent platform renowned for offering comprehensive solutions for both companies and individuals in the realm of online TDS/TCS returns in India. Their TDS return services have earned a strong reputation for their efficiency and user-friendliness. IndiaFilings simplifies the typically intricate process of TDS return filing by providing an easily navigable online platform that enables users to file their returns accurately and punctually.

Whether you are a business owner or an individual taxpayer, IndiaFilings offers a diverse array of services designed to ensure that your TDS returns comply with the updated tax statutory.

What sets IndiaFilings apart is their commitment to delivering more than just submission services. They also offer expert guidance on TDS compliance, equipping users with a comprehensive understanding of TDS regulations and helping them mitigate errors and potential penalties.

With their unwavering dedication to keeping abreast of evolving tax laws and their steadfast commitment to customer satisfaction, IndiaFilings emerges as a trusted partner for anyone seeking a hassle-free and dependable means of managing their TDS returns in India.

Important features of IndiaFilings TDS return:

- Uploading Online TDS return filing

- Easier import and export data

- preparation of automatic forms 15H, 15G, 15I, and 15J

- Generation of online TDS and TCS certified forms 27A, 12BA, 16, and 27D

- Registration, preparation and modification of TAN application

- Keep your documents, e-payment tax challan, and generation of digitally signed forms 16 and 16A

Website: https://www.indiafilings.com/tds-return-filing

Most Important FAQs About Best TDS Software

Q.1 – Which is the best TDS filing software for professionals in India?

These TDS compliance software solutions are commonly used by chartered accountants to prepare TDS return filings, such as Government software, Gen TDS Filing Software, Clear Tax, TDSMAN, Webtel e-TDS software, WinMan TDS.

Q.2 – What is the working principle of TDS software?

It is remarkably easy to use many software applications that prepare TDS returns. It can be done on your own with the instructions provided, or you can also take advantage of free trial sessions if you want to make it easier.

Q.3 – What is the Need for a TDS Filing Software?

TDS filing software is a very important tool as the TDS filing is a major part in finalzaing the taxes to the government and this require a professional tool.

Q.4 – How can I try the TDS filing software before use?

The TDS software demo can be downloaded from the website. By downloading the demo version, you can test the useful features and utilities provided by company.

Q.5 – What is the System of Getting Updates on the TDS Return Software?

The software has an in-built feature to check for updates and notify users when there is a new update available. The new update is automatically downloaded upon clicking the update link in this notification. In the absence of an internet connection, you can download the update from website.

Q.6 – How Do I Uninstall the TDS return software?

Windows – Control Panel – Add / Remove Programs can be used to uninstall the software.