What is TDS (Tax Deducted at Source)?

The objective of levying Tax Deducted at Source is to collect the tax from the point or source where the income is generated. The tax is deducted by the payer in advance from the amount payable to the income receiver, and the same is deposited in the account of the Government.

However, the person on whose behalf the payment is deducted (receiver of income) shall be eligible to get the credit of the aforesaid amount. He shall be provided with a TDS (Form 16) certificate by the deductor.

However, you don’t have to manually count whether you are a deductor or receiver. Gen TDS E-Filing Software is there for you since there are hundreds of transactions in a few hours and you have other important commitments to fulfil.

Read Also: All About Form 16B and Download TDS Certificate on TRACES

What is TDS Certificate Form 16

Form 16 is the income tax form practised through the companies to provide the information for the tax deducted. Form 16 is acknowledged as the proof furnishing of the ITR through your employer to the government. For instance, if the income exceeds the tax exemption limit then the employer is needed to deduct the TDS from your salary and submit the same to the government.

If the salary income is lower than the tax exemption limit then towards that concern the employer shall not deduct any TDS. when the employer furnishes Form 16 this reveals that your employer has furnished your ITR. The form could indeed be recognized as your salary TDS certificate.

Form 16 described how much an employee earned in the fiscal year and how much has been deducted as a TDS. The form has two parts Part A and Part B. Part A comprises PAN, TAN details, name, address, TDS deducted, and other details of the employee and employer.

Part B points to information like additional income, deductions, tax payable, salary paid, and others. The Form is basically furnished through the employers every year on or before 15th June.

Why Only Gen TDS Software?

It is both effective as well as efficient in addition to being accurate, user-friendly, and widely accepted by the client across the length and breadth of the country. Moreover, our software is in line with the statutory requirements of the TRACES in India. Our Gen TDS return filing software has been approved by the government and meets all the quality benchmarks set up.

Due to the promising nature of Gen TDS software and its acceptability across the country, we are planning to launch it abroad also — both in Eastern and Western Countries of the World as per prevailing laws.

The other promising attribute of Gen TDS software is that it can determine the TDS amount, Calculate Interest along with penalty or late fees, and file TDS returns. The software is giving its full hardship to come out as the most acknowledged software throughout the leading brands.

Lastly and importantly, it was accoladed to a leading rank by the government of India. Here, we are providing complete information on how to download and generate Form 16 by Gen TDS Software step by step including all the original screenshots.

Simple Process of Generate/Download Form 16 by Gen TDS

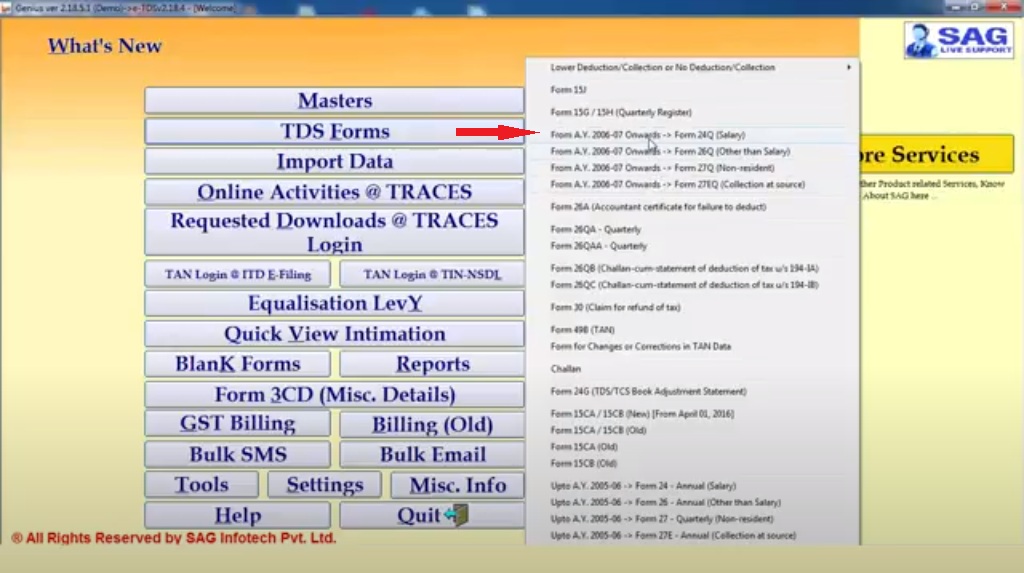

Step 1: First open the software by clicking the software icon, then click on the ‘TDS Forms’ option, and now press the ‘Form 24Q (Salary)’ option.

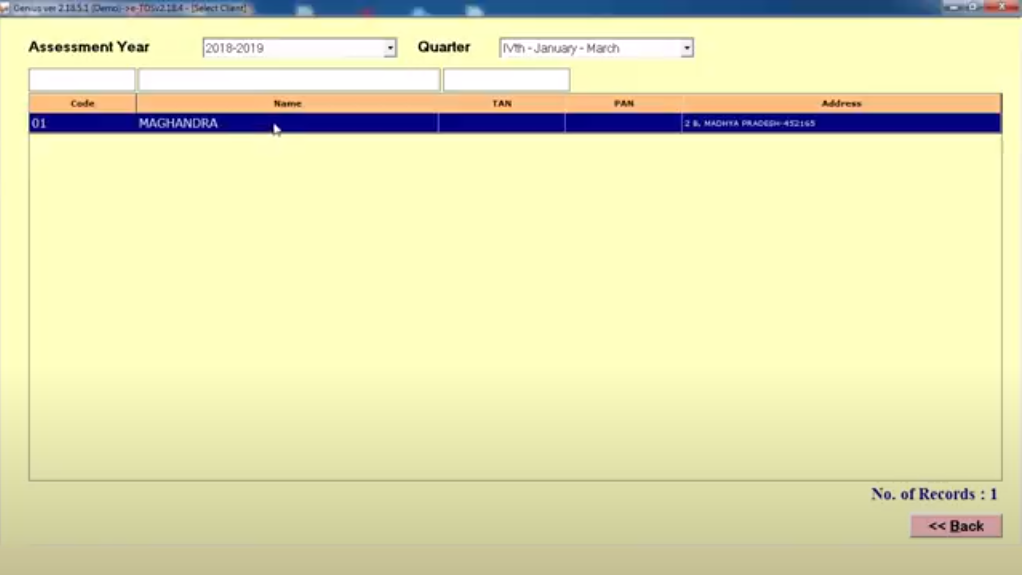

Step- 2: Then select the Assessment year and name

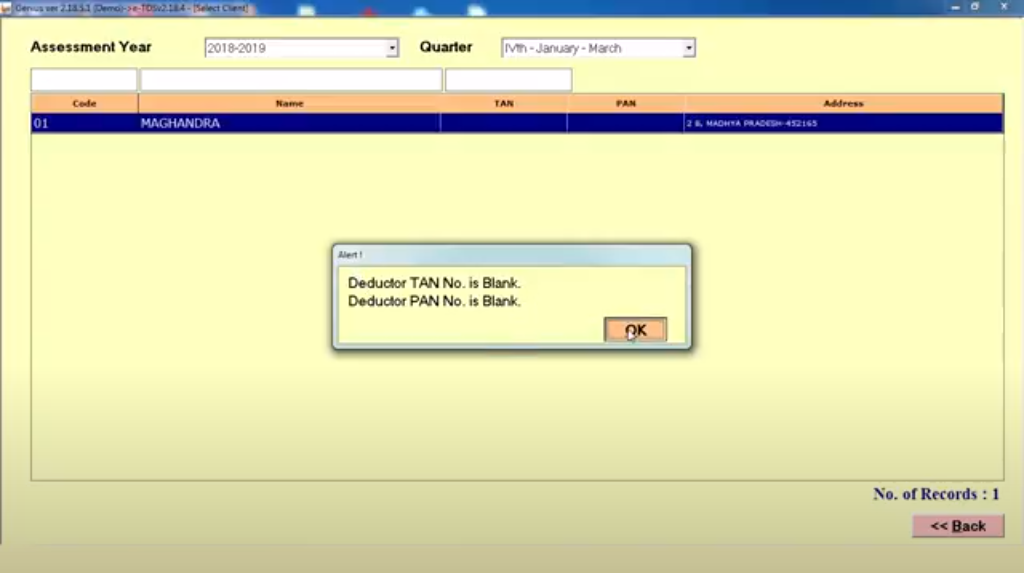

Step 3: In this process then show a pop-up, after that users click ok.

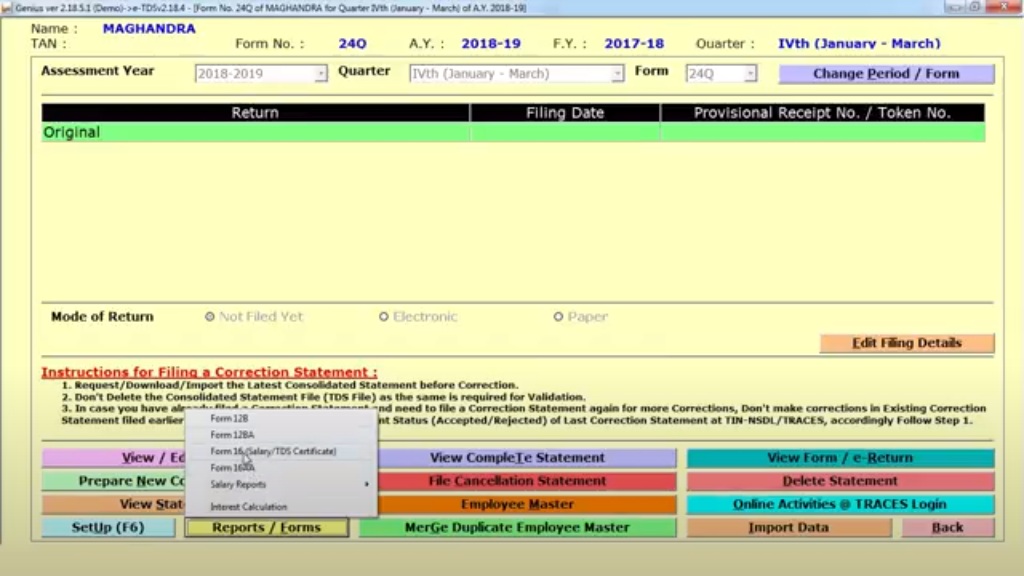

Step 4: Then click the reports form and show a pop-up now select Form 16 (Salary TDS Certificate)

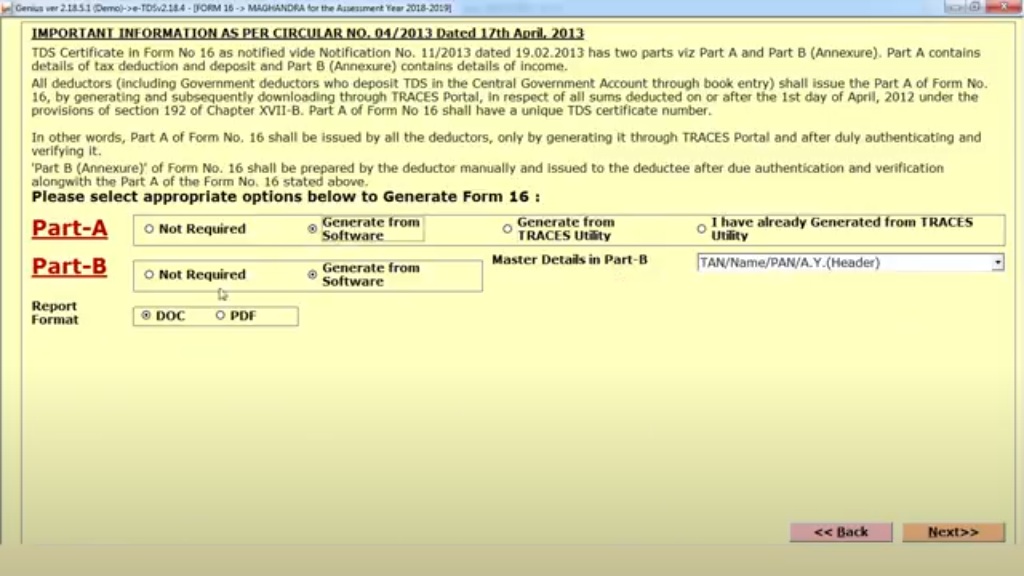

Step- 5: Now choose options for generating Form 16 from the software and TRACES utility.

General Queries on Form 16 (Certificate)

Q.1 – What is Form 16?

This Form certifies the deduction of tax at source and is issued

- After deduction of tax by the employer on behalf of employee and

- After submission of the tax by the employer (on behalf of employee) in the government treasure.

Q.2 – How could I obtain Form 16?

You have to contact your employer for receiving the aforesaid Form 16.

Q.3 – What is the Utility of Form 16?

Form 16 is a significant/valuable document due to the following reasons:

- It is documentary evidence that your employer has deducted the tax from the salary you earned and deposited it in the government treasure.

- It helps in filing the Income Tax Return by supplying the details of income of employees.

- Since it is a documentary proof, It is usually requested and referred to by the banks and the financial institutions when you apply to them for sanction of loans.

Q.4 – Explain the Mechanism of Due dates for the Issue of the Form 16 & Form 16A Certificates?

The Form 16 is issued on an annual basis and is required to be issued by 31st of May every year.Other than that Form 16A is issued on quarterly basis and has to be issued within a period of 15 days from due date of the submitting the statement of the tax deducted at the source as per the rule 31A.

Q.5 – Is Form 16 Applicable to Employees Who Have Zero Tax?

Form 16 is basically a certificate of Tax Deducted at Source and it is available on the website https://www.incometaxindia.gov.in/ . In case, If an employee has a zero tax liability, there is no necessity access and fill Form 16 for aforesaid employee. However, an individual can still get Part A of the Form 16 in case he has a liability of zero tax or in other words he does not have any tax

Q.6 – How Can I Generate Form 16?

On the website https://www.incometaxindia.gov.in/ Go to Form 16 Options page following by navigating from ‘Payroll’ to ‘Admin’ to ‘Form 16’. Thereafter, On the right-hand corner, you would find the option of ‘Settings’. Thereafter Click on the ‘Settings’ option to further proceed.

Q.7 – How to Enable or Disable the Form 16’s Front Page?

Kindly follow the below-mentioned steps to enable or disable the front page of the Form 16:

- Thereafter Go to the option of the ‘Payroll’, then ‘Admin’ and finally ‘Form 16’.

- Thereafter,You shall be redirected to the web page of ‘Form 16’.

- Then Select the option of the ‘Settings’ in the panel of the ‘Current Settings’ on the page.

- Thereafter You will be again be redirected to the ‘Form 16 Options’ page

Form 16 Generation Option: Click on the check box that is next to the ‘Show Form 16 Cover Page’ Next, click on the Save option. A message will pop up on the screen informing that Form 16 Option has been saved successfully

Q.8 – How to Enable the Default View of the Digital Signature?

Follow given steps to make possible the default view of the digital signature:

- First up Go to the ‘Payroll’ option, then to ‘Admin’ and thereafter to ‘Form 16’. FinallyYou will get the page of ‘Form 16’.

- Thereafter Click Settings button in the Current Settings panel of the page. You will be redirected to the Form 16 Options page.

- Then the Form 16 Generation section will enable you to select the checkbox that is next to Use the default appearance for the digital signature.

- Then Finally, click on the ‘Save’ option. A message shall appear on the screen which shall confirm that Form 16 Option has been successfully saved.

Q.9 – How to Generate Form 16 for Those Employees Who Have Already Resigned?

The process for the resigning employees shall be the same as that of the regular employees.

Q.10 – How to Authenticate the Form 16 Signature if it’s Showing Invalid?

You could validate the digital signature easily if you have already installed CA on the Microsoft Certificate Store. Alternatively you might also add the Root Certificate of the signing certificate by yourself.

Q.11 – How Can the Prerequisite Components be Mapped to Form 12BA?

You have to follow the below mentioned steps to modify or view the mapping:

- Simply Go to the ‘System Settings’, then go to the ‘Income Tax’, then to the option of ‘Advance’ and then finally to ‘Form 12BA Mapping’.

- You shall be redirected to ‘Form 12BA Mapping’ page.

- Lastly, click on the ‘Save’ option. A message will pop up on the screen stating that your data has been successfully saved.

Q.12 – How to Generate the Form 12BA & Form 16 Together?

Follow the below-mentioned easy steps to create Form 12 BA along with Form 16:

- First up, Go to ‘Payroll’ and then to the ‘Admin’ option and thereafter to ‘Form 16’. Form 16 page shall appear on your system screen.

- Select the option of ‘Settings’ in Current Settings panel. You shall be directed to the ‘Form 16 Options’ page.

- The Form 16 Generation section shall let you select the check box next tothe ‘Form 12A’

- Lastly click on ‘Save’. A message will pop up on the screen stating that the Form 16 Option is successfully saved.

Q.13 – How to Verify if a Digital Signature is Already Installed or Not?

You may check for the certificates in your system’s browser to confirm it.

Q.14 – How Can the Default Appearance of the Digital Signature of Form 16 be Enabled?

To enable this option, Follow the given steps:

- Go to option of ‘Payroll’ and then to ‘Admin’ and then to ‘Form 16’ finally. Form 16 page will pop up on your system screen.

- Select the option of the ‘Settings’ in the Current Settings panel. Thereafter You shall be directed to the ‘Form 16 Options’ page.

- Form 16 Generation section shall let you select the check box next to ‘Use the default appearance for the digital signature’.

- Then Finally, click on ‘Save’. A message will appear on the screen which shall prompt you that Form 16 Option has been successfully saved.

Q.15 – How to Proceed for the Updation of the Company Details on the Form 16?

Follow the below mentioned steps for updating the company details on form 1:

- Go to the ‘System Settings’ and then move to ‘General’ and then finally to the ‘Company Settings’. You shall be redirected to the ‘Company Settings’ page.

- Then in the second stage, Update the name of your company in the field of ‘Company address’.

- Finally, click on ‘Save’ option . A message shall pop up on the screen stating that information of your company has been successfully saved.

Q.16 – How Can Form 16 be Verified?

You can verify Form16 of yours by referring to IT Statement or IT Declaration . Or, you can also refer to the Form 26AS online.

Q.17 – How to Change the Location Along with Date of the Digital Signature?

The TDS circle of your organisation shall define and disclose the location for your digital signature and the e-Token installed during the generation of Form 16 that shall spontaneously confirm the date of digital signature.

In case, Indian taxpayers want to try the most suitable solution for their TDS (Tax Deducted at Source) Return filing compliance. Download a free trial of the Gen TDS Software for easy E-filing, generating Form 16 (Salary/TDS Certificate), and much more.