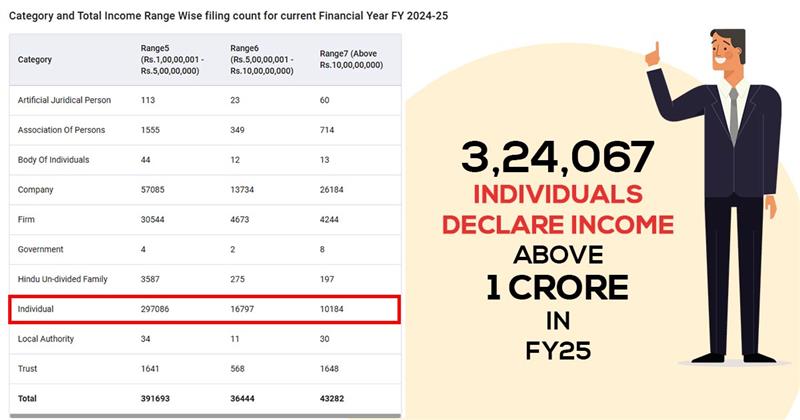

The latest data from the income tax department regarding the indication of rising high-income taxpayers and improved compliance shows that 3.24 lakh individuals in India have furnished their income tax returns (ITRs) for the incomes surpassing Rs 1 crore in the FY 2024-25 ending March 31, 2025.

On the Income Tax India e-filing portal, the available information specifies that a majority of 2.97 lakh individuals reported annual income between Rs 1 crore and Rs 5 crore. Additionally, 16,797 individuals filed returns in the Rs 5 to Rs 10 crore income bracket, while 10,184 individuals reported incomes surpassing Rs 10 crore

Total Individual Income Tax Filers in FY 2024-25

| Income Bracket | No. of Individuals |

|---|---|

| Rs 1-5 crore | 2,97,086 |

| Rs 5-10 crore | 16,797 |

| Above Rs 10 crore | 10,184 |

| Total | 3,24,067 |

When integrated with the information from the companies, firms, HUFs, trusts, associations of persons, government bodies, and local authorities, the number of tax filers reporting income over Rs 1 crore rises to 4.68 lakh. It contains:

- 3.89 lakh entities with income between Rs 1-5 crore

- 36,000 entities in the Rs 5-10 crore bracket

- 43,000 entities reporting income surpassing Rs 10 crore

India Witnesses a Rise in ITR Filing

The information also shows the motivating trends in overall tax compliance. A total of 9.19 crore income tax returns were filed for FY 2024-25, from which 8.64 crore returns were successfully e-verified as of March 31, 2025.

- Total registered users on the Income Tax portal: 14.01 crore

- Registered individual users: 12.91 crore

- Aadhaar-linked individual users: 11.86 crore

In filing the specific ITR forms, there was a significant rise, particularly among non-salaried and high-income earners-

- ITR-1, the most commonly used form for salaried individuals, registered a modest rise of 0.54%.

- ITR-2 filings increased by 34.69%, often used by individuals with capital gains and multiple income sources.

- ITR-3, used by professionals and business owners, witnessed a 16.66% growth.

- Overall, ITR filings in all categories increased by 7.81% compared to FY 2023-24.

Robust Compliance Indications From High-Income Groups

Tax experts attributed the rise in high-value return filings to the surge in digitization, improved data monitoring by the Income Tax Department, and the strengthening of compliance norms across sectors.

The increase in the number of core-plus income tax filers shows the expanding wealthy class of India and the success of sustained enforcement measures like TDS tracking, AIS (Annual Information Statement), and improved analytics.