The Orissa High Court, in a ruling, set aside the rejection of a GST appeal filed with a short delay, holding that sufficient cause was shown and that the principles of natural justice require giving the taxpayer an opportunity to explain the delay.

The applicant, Debasish Nandi, submitted the writ petition contesting the rejection order on 23.12.2025, passed by the Additional Commissioner of State Tax (Appeal). This rejection was incurred due to the failure of the applicant to respond to a notice on 06.12.2025 during the pendency of his appeal against a demand order of ₹9,55,640 raised under section 73 of the OGST Act for FY 2023‑24.

The petitioner argued that the appeal, though filed on November 27, 2025, was delayed by only 8 days beyond the statutory three-month limit and was still within the one-month condonable period permitted under Section 107(4).

The petitioner also stated that the delay was due to medical treatment, which hindered timely compliance with the notice. The counsel claimed that the Appellate Authority should have exercised its discretion more liberally and accepted the explanation for the delay.

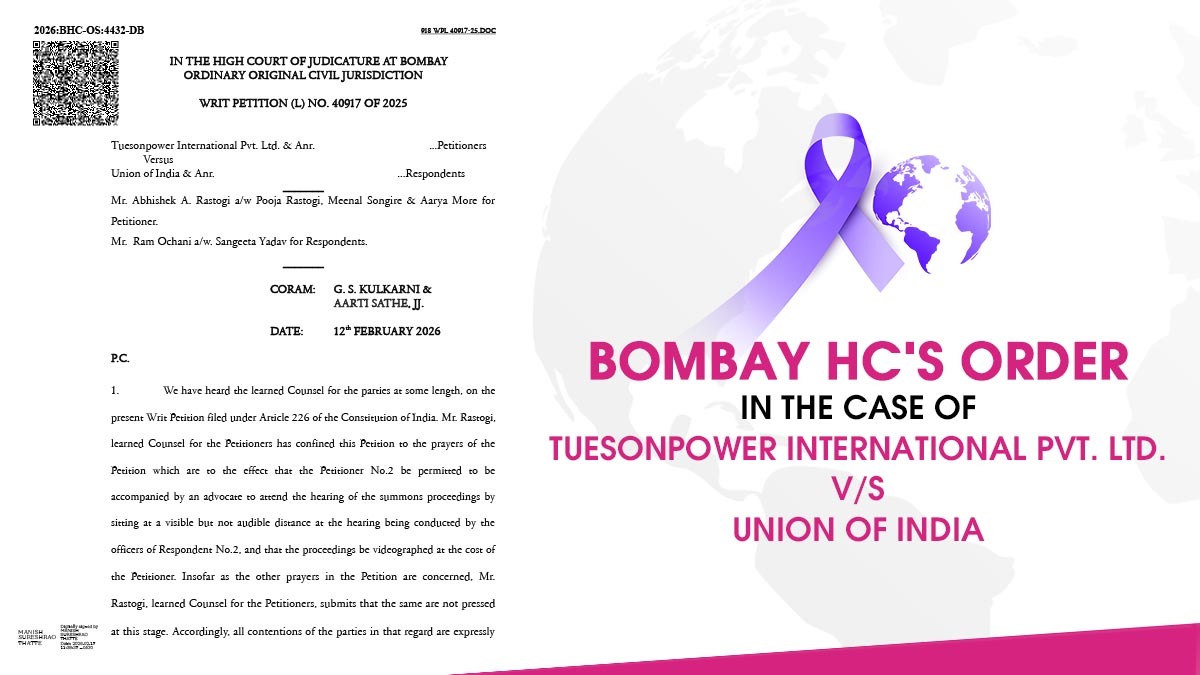

Also Read: Bombay HC Mandates a Minimum 3-Month Timeline Between SCN and Final GST Order

While the revenue contended the appeal, arguing that the rejection was justified since the applicant failed to reply to the notice and did not demonstrate sufficient cause for the delay.

The High Court post-hearing, both sides ruled that the applicant must be provided a chance to explain that the delay emerged because of the circumstances beyond his control. Also, the department does not provide any proof to disprove the applicant’s explanation of the applicant.

The rejection of the order has been set aside by the HC on 23.12.2025, and the applicant was asked to appear before the appellate authority on or before 02.03.2026 and his reply to the notice on 06.12.2025.

Recommended: Orissa HC Cancels GST Assessment Order Over Contractor Name Mismatch on WAMIS & IT Portal

The Appellate Authority was asked to consider the explanation after granting a hearing, the bench, Chief Justice Harish Tandon, and Justice Murahari Sri Raman stated.

After making the observations and issuing directions, the case was concluded, and the writ petition was disposed of.

| Case Title | Debasis Nandi vs Commissioner of Commercial Taxes and GST |

| Case No. | W.P.(C) No. 883 of 2026 |

| For Petitioner | Mr S.A. Mohanty |

| For Respondent | Mr Sheshadeba Das |

| Orissa High Court | Read Order |