The Income Tax Department, in its updated release, states that more than 9.11 crore registered users have submitted their income tax returns for FY 2024-25 as of February 28, 2025. This figure is significant, considering that the total number of registered users stands at 13.96 crore, meaning that over 65% of registered users have filed their ITRs for the current year.

As per the data out of this number, the total number of e-verified tax returns up to Feb 28, 2025, stands at 8.56 crore.

An income tax refund of up to Feb 28, 2025, has been issued by the income tax department in FY 2024-25 which stands at ₹3.92 lakh crore. More than 40% of the users have submitted the returns using the utility given via the tax department.

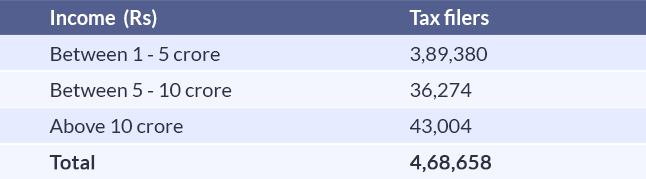

Over Rs 1 crore

From these taxpayers, those whose income lies in the range of Rs 1 crore to Rs 5 crore is a whopping 3.80 lakh, and those having an income between ₹1-5 crore are over 36,274, reveals the income tax department’s (ITD) data till Feb 28, 2025.

Read Also: Best 15 Income Tax Software for CA Professionals

A total of 43,004 taxpayers filed income tax returns (ITR) exceeding ₹10 crore. In total, 4,68,658 taxpayers filed tax returns exceeding ₹1 crore for FY 2024-25 (including 3.89 lakh, 36,000, and 43,000).

Maharashtra State Takes the Lead

In a state-wise manner, the number of tax filers from Maharashtra stood at 1.38 crore till Feb 28. The related number for Gujarat was 87.90 lakh and for UP it was 90.68 lakh.

In Delhi the same number stands at 44.45 lakh and in Andhra Pradesh, it was 30.76 lakh while Punjab had 43.79 lakh tax filers. From states outside India, the figure stood at 87,501.

Growth In ITR Filing

There has been significant growth in tax filings compared to last year across income tax forms. For ITR-1, there was a 0.11 per cent increase; for ITR-2, the growth reported was 33.89 per cent; and for ITR-3, there was a 15.50 per cent increase.

The growth is 5.59 per cent for ITR-6, and for ITR-5 there has been a 6.46% rise in 2024-25 over the previous year.