The Delhi High Court stated that the norm of proof beyond a reasonable doubt could not be applied to Section 148 of the Income Tax Act, 1961, which allows an assessing officer to reopen an assessment if there is reason to believe that the taxpayer’s income has not been assessed.

A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela noted that, “It is trite that the concept of “proving beyond reasonable doubt” applies “strictu senso” to penal provisions/statutes. It is also trite that in taxing statutes, in particular, section 148 of the Act, the “reason to believe”, must be based on objective materials, and on a reasonable view.”

Preferred by the Revenue observation was made in an appeal after the ITAT set aside a reassessment order by applying the principles articulated by the Supreme Court in Raja Naykar vs State of Chattisgarh (2024), a criminal case.

Revenue asserted that in criminal cases the release of the burden of proof is above reasonable doubt and cannot be applied to the principle of “reason to believe” as given in section 148 of the Act.

Considering, the HC mentioned ITAT misdirected itself in predicting its whole reasoning on a principle of law which validated

“The reliance placed by the learned ITAT on the aforesaid judgment of the Hon’ble Supreme Court cannot be ignored. It is apparent that the principles enunciated in the criminal jurisprudence in respect of a proof beyond reasonable doubt was erroneously applied to an issue which was subject of provisions of Income Tax Act.”

As per the court, this principle was complied with via the Supreme Court in Deputy Commissioner of Income Tax v. M.R. Shah Logistics (2022) specifying that the grounds for a valid reopening of assessment should be the availability of tangible material, which can direct the Assessing Officer (AO) to scrutinize the returns for the previous assessment year in question, to define, whether a notice u/s 147 is called for.

It ruled, “Predicated on the aforesaid judgments it can be safely inferred that the concept of burden of proof beyond reasonable doubt is not to be applied in cases such as the present one…In our opinion, the construction of the words “reason to believe” as construed by the Learned ITAT on the anvil of Raja Naykar (supra), is absolutely erroneous and cannot be made applicable to the present case,” and authorized the appeal.

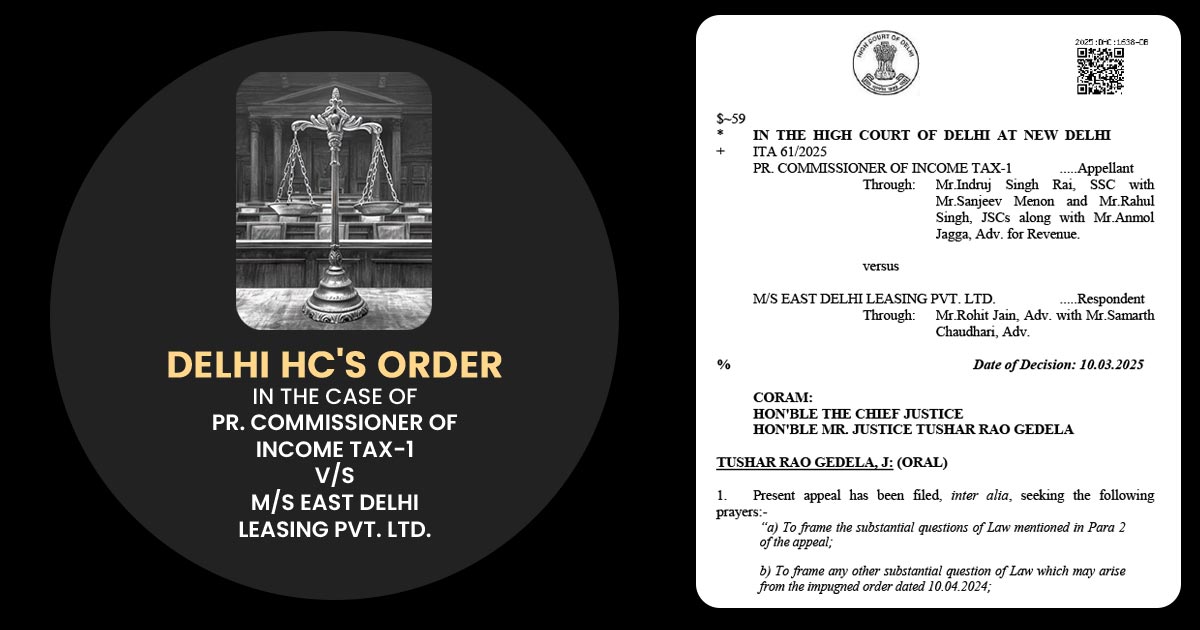

| Case Title | Pr. Commissioner Of Income Tax-1 vs M/s East Delhi Leasing Pvt. Ltd |

| Citation | WRIT TAX No. – 975 of 2025 |

| Date | 10.03.2025 |

| Counsel for Petitioner | Mr Indruj Singh Rai, Mr Sanjeev Menon Mr Rahul Singh, Mr Anmol Jagga |

| Counsel for Respondent | Mr.Rohit Jain, Mr.Samarth Chaudhari |

| Delhi High Court | Read Order |