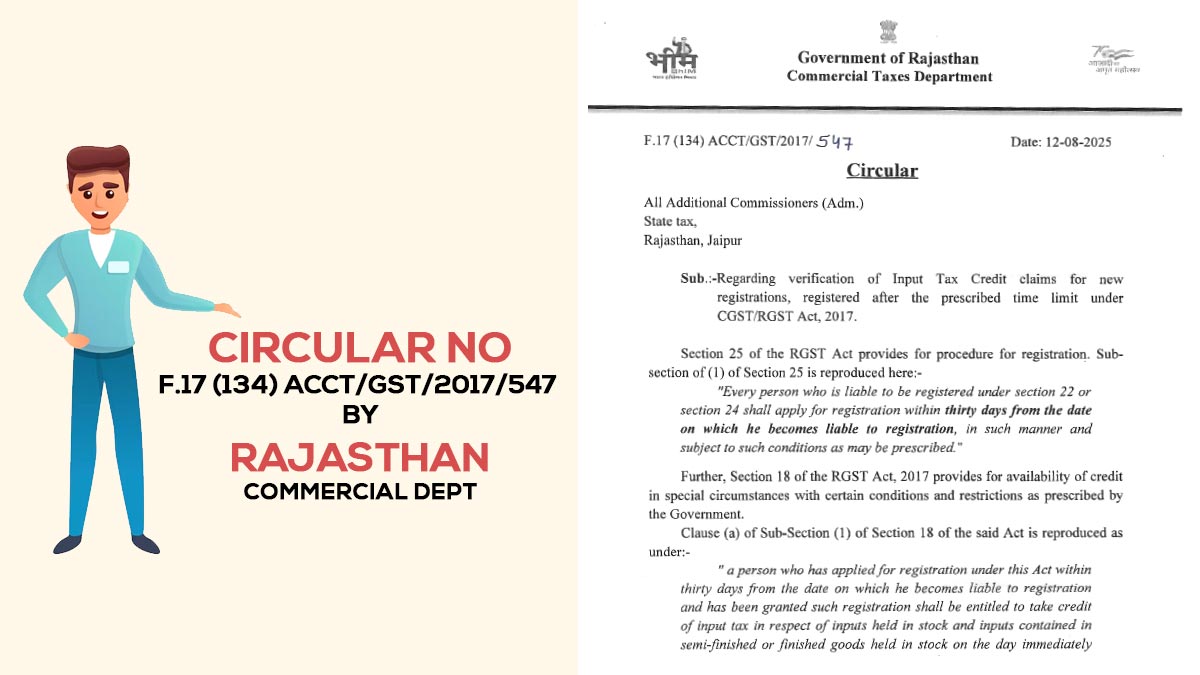

The Rajasthan Commercial Taxes Department has issued Circular No. F.17 (134) ACCT/GST/2017/547, dated August 12, 2025, directing strict verification of Input Tax Credit (ITC) claims for businesses obtaining GST registration after the prescribed 30-day period under the CGST/RGST Act, 2017.

Taxpayers u/s 25 of the RGST Act should apply within 30 days from the date they become liable. Also, section 18(1)(a) cites that the GST input tax credit (ITC) on the pre-registration stock is permitted merely when the application is made in the 30-day window. Rule 40 of the RGST Rules defines the manner and time limits to claim such credit by Form GST ITC-01.

As per the department, various instances were there in which the registration applications were submitted after the regulatory period, raising concerns for the incorrect ITC claims on the pre-registration stock. The Comptroller and Auditor General of India (CAG), in its 2018-19 Revenue Report, shows the absence of checks in these matters, asking how the genuineness of pre-registration ITC claims was being validated.

In reply, the department has now directed:

- Obligatory tracking of all new GST registrations by proper officers.

- Rejection of all ITC claims associated with the period before the date of application, in cases where registration was pursued after the 30-day limit.

- Stringent compliance by all Additional Commissioners (Administration) to ensure the directives are uniformly implemented.

Read Also: Delhi CGST Sets Up Helpdesk to Assist Taxpayers Facing GST Registration Issues

This measure is for stopping revenue leakages and ensuring that ITC benefits are extended merely for businesses in complying with the regulatory registration timelines.

Please Read the Circular