The income tax IT department secures the latest Annual Information Statement (AIS) on the compliance portal that furnishes a complete object of the details to the assessee with the facility to take online feedback. AIS is much more described in detail with respect to the previous Form 26AS that consists of effective details towards the financial transactions of the assessees beyond the TDS as well as TCS transactions.

Gen IT – AIS Compliance Software

Latest Update in New AIS

- The CBDT has introduced a new e-campaign related to resolving mismatches between the AIS and ITRs. Read Press Release

- Now taxpayers can easily review transactions within AIS’s new functionality and submit feedback. View more

- The AIS new functionality that allows taxpayers to provide real-time feedback on every transaction. Read Press Release

- The AIS utility is now available for Mac OS users at the official e-filing portal.

- The Income Tax Division has launched the mobile app “AIS for Taxpayers” to help taxpayers to view their information as it appears in Annual Information Statements (AIS)/Tax Information Summary(TIS). Read Press Release

- For AY 2023-24 and onwards, Form 26 AS displays only TDS/TCS information. An Annual Information Statement (AIS) will include other taxes, such as advance tax and self-assessment tax.

- The CBDT has published the 15 very important FAQs for the new Annual Information Statement (ASI). Read More

- New AIS (Annual Information Statement) version 2.0 under the directorate of income tax systems. Taxpayers can easily view and download full information in PDF format. read more

- The new form e new Annual Information Statement (AIS) is now available on the Income-tax e-filing portal web 2.0. The taxpayers can easily download it in different formats such as PDF, CSV & JSON. You can click on the link ‘AIS’ under ‘Service Tax’ on the portal

“The derived information in TIS will be used for pre-filing of Return (pre-filling will be enabled in a phased manner), the department stated.”

What is the Latest Annual Info Statement (AIS)?

The income tax IT council specified that the assessee can now access the latest Annual Information Statement (AIS), which consists of some more segments of details such as interest, dividends, securities and MF transactions, and remittances from abroad, on the e-filing portal.

The IT council in the previous month has prolonged the list of higher value translation concerns to finance that enables the assessee in their Form 26AS through engaging the information of the mutual fund MF purchases, foreign remittances, and the information inside the Income-tax returns of some other assessees.

Form 26AS is the annual consolidated tax statement which can be approached on the website of the income tax through the assessee via their Permanent Account Number (PAN). The latest annual information statement can be accessed by tapping on the link “AIS” by the services tab upon the latest income tax e-filing portal. “AIS provides ease of access! It can be accessed now on the e-filing portal & downloaded easily in downloadable formats of PDF, CSV & JSON (machine-readable format). Click on link ‘AIS’ under ‘Services’ tab on http://incometax.gov.in,” said the IT council.

AIS has opted the assessee to see and validate the assessee info available within the taxmen furnished that the feedback towards the case of any difference, view or update the Taxpayer Information Summary (TIS) utilized towards pre-filing of Income-tax return. For the year 2020-21, the budget has been published in which the new Form 26AS has mentioned where the profile mentioned of the assessee is more extensive just than the information of the tax collected and deducted at source.

More details mentioned consist of the foreign remittance generated from an individual via an authorized dealer the breakup of the salary within the deductions availed through the employee details of the income tax return of the additional assessee the interest on the income tax refund details made in the statement of the fiscal transactions. The value displayed inside the TIS might be acknowledged during the furnishing of the income tax return. Towards the scenario, the income tax return furnishes formally along with some details that are not mentioned in the Income-tax return the return might be amended to show the true details it specified.

The latest AIS can be available via tapping the link Annual Information Statement (AIS) under the “Services” tab on the new Income tax e-filing portal (https://www.incometax.gov.in. The Form 26AS upon the traces portal shall indeed carry on the latest AIS is verified and is fully operational by the income tax council inside the statement specified. The latest AIS consists of extra data describing the interest, dividend, securities transactions, mutual fund transactions, foreign remittance information, and much more.

Easy Manage of AIS Mistakes on the Official Portal

During the filing of the taxes, one essential document for verification is the Summary statement of AIS. last year the Annual Information Statement (AIS) had launched which is a complete statement and consists of the information of the 46 the financial transaction such as Income, Investment, Expenditure happened in a particular Financial Year.

AIS Errors

The government would say to the assessee in revamping the issues of misreporting or the technical problems where the system would not fully or fetch the information wrongly.

The same utility has been launched by the Government that supports the assessee to validate the details available with the department. The function of AIS would be to file the returns without any hardship and acknowledge the missed income during the calculation part of the total income which the taxpayers perform.

What Would be the Errors Seen by Assessees?

- Instance in the property sale with numerous owners: There is an overall value of the property listed in every owner’s AIS, but not their individual share of the value.

- Instance with Joint Accounts: AIS displays the total interest of the joint holders.

- An instance of duplication of entries: Inflated income can be found in the AIS after duplicate entries are discovered by taxpayers.

- The instance of Reporting the former year’s details: Transactions reported in AIS may relate to the Previous Year, not the current Financial Year for which a return is due.

- For instance HRA: Assessee has leased the property in the prior year, but it is being reflected in the current year.

- In which the income does not relate to the assessee: Transactions that may not belong to the taxpayer may be reflected in AIS.

What Would be the Method to Report these Errors in AIS?

A drop-down option would be mentioned in the IT portal for each transaction in the column of feedback. The assessee could precisely opt for the option by either accepting or refusing the information.

The options in the group would be:

- Information is accurate

- Information is not taxable

- Information is not fully valid

- Information is duplicated/ contained in other details.

- Information is declined.

Through the other means, the taxpayer could download the utility through the AIS portal and upload the same post its revamp.

Procedure Engaged in the Utility Download & Uploading the Feedback

- Go to https://www.incometax.gov.in/iec/foportal and log in to your account through your PAN or Aadhaar Number.

- Now tap on the link ‘AIS’ beneath the ‘Services’ tab.

- Download the AIS utility from the resource section of the compliance portal (AIS Homepage).

- Now download AIS as JSON through the AIS section and import JSON in the AIS utility.

- Furnish feedback on the AIS utility and export the feedback file.

- Lastly, you get finished by uploading the output file.

You would take reference from the resource sections concerned documents and assist the section with any issues on the AIS homepage or else you could call on 800-103-4215 for further assistance.

What Way AIS is Distinct from Form 26AS?

Form 26AS is similar to the tax passbook that poses the TDS and TCS information furnished with respect to the assessee’s PAN towards the fiscal year. Moreover, inside the rectification version of Form 26AS, the details concerning the mentioned transaction like mutual fund unit buyings remittance and others shall be shown when the transaction will be more than the mentioned limit or in which the tax gets deducted. For example when the tax is deducted upon the interest obtained on the fixed deposit then the same shall be shown in Form 26AS.

AIS is more comprehensive. In the case of AIS, the transactions will be reflected irrespective of whether tax has been deducted or not. Despite the tax not deducted on the obtained interest on the fixed deposit, this shall be displayed in the AIS. The statement shall show TDS, TCS, sale, purchase of equity shares, mutual funds, dividend, interest income, and others. In AIS there is no specification of no certified limit towards the transactions. Hence despite you investing Rs 2000 in the mutual fund SIP, it shall be prompt in the AIS. More importantly, the AIS will show all the small and larger fiscal transactions completed through you that have been furnished through you and are specified through distinct financial entities to the income tax department. These specified compliance needs of these entities through law. Thus AIS will reveal all the financial transactions performed through you.

What is the Method that AIS Can Assist the Assessee?

The tax expert mentioned that the AIS has shown all the financial transactions like salary income, dividend income, interest income from saving/fixed deposits, sale and purchase of securities, and others via all these fiscal details it is simpler for an assessee to provide the true details to ITR. the assessee can prevent errors in the original transaction and the information furnished in the ITR.

Via equity shares when you obtain Rs 50 as a dividend from it then the financial transaction shall be shown in AIS. identical to it the TDS as well as TCS furnished with respect to the PAN in the fiscal year shall be shown in AIS said the tax expert.

AIS supports cross-checking of the information related to the financial transactions which are performed by the taxpayer and filed in the tax department. It shall assist you to find out the mismatch and filing the needed details in the ITR. For example, the dividend obtained through you in years 2020-21 is liable for the tax to you. Hence you are needed to furnish despite the amount as small as Rs 50 in an income tax return and furnish the tax upon the same. The AIS makes you memorise when you forget to report this Rs 50.

The income tax department provided that the value mentioned in the Taxpayer Information Summary (TIS) can be acknowledged during the furnishing of the income tax return. The concern is that the Income-tax return has been furnished and some of the details is not furnished in the Income-tax return, to show the true detail the return can be amended.

If there is any difference in the TDS/TCS details or the tax paid details concerning the tax payment which is shown in AIS upon the compliance portal then the assessee might be laid on the details shown on the TRACES portal towards the intention of furnishing the Income-tax return along with the additional tax compliance intention mentioned by the press release.

View Do’s & Don’t’s of New Annual Information Statement

| Do’s | Don’t |

|---|---|

| AIS utility must be the latest | Don’t implement the AIS JSON older version for the feedback preparation via utility |

| The information must be provided as feedback as per the AIS display | Be cautious while giving out feedback on AIS |

| Confirm the value as per the TIS for return pre-filing | Don’t spread the e-filing credentials |

| Regularly watch your AIS | – |

| View and use the AIS utility for giving feedback on high transactions. | – |

Summary of Cash Withdrawals Under New AIS

Combining details via distinct sources such as TDS, SFT, and others the government has made a new statement called an Annual information statement. A brief view of the details is available for assessee with ‘Annual Information Statement’, in the statement called ‘Taxpayers Information Summary’.

The article performs with one of the details that come under the ‘Annual Information Statement’ that is ‘Cash withdrawals’.

Information source towards the class in which the ‘Cash withdrawals’ under ‘Annual Information Statement’- The distinct source of information in context to the information category like cash withdrawals beneath ‘Annual Information Statement’ is mentioned in the table:

| Particulars | Source of Information |

|---|---|

| Cash withdrawals from the current account | The details concern to cash withdraws from the current account is filed via reporting entity through the statement of the financial Transaction – Form 61A [SFT-003]. The information mentioned beneath SFT-003 would be acknowledged under the Annual information statement. |

| The cash withdrawal via account excluding the current account | Cash withdrawals information via account excluding the current account is filed via reporting entity through the statement of the Financial Transaction – Form 61A [SFT-004]. The details which get filed under SFT-004 would opt beneath the Annual information statement. |

| Cash withdrawals | TDS would be deductible under the provision of section 194N of the income tax act for the withdrawal of the amount in cash more than the prescribed limit. As per that the deductor is entitled to file a TDS return in Form 26Q undergoing details of TDS deducted and amount later. The information made via deductor in Form 26Q would opt under the Annual information statement. |

Processing beneath Annual information statement towards the information category cash withdrawals:

Two Kinds of Specifications Available for AIS Process

- In the case of Statement of Financial Transaction (i.e., SFT) information reported in the account upon the grounds of the format i.e in which one bank account is reported through exceeding one individual (e.g. joint account holder) then these details would be shown in ‘Annual Information Statement’ of the concerned person as well as the with the kind relationship that would enable submission of feedback.

- A higher amount of cash withdrawals made in Form 61A or Form 26Q would be kept. In which the details with the lower amount of the cash withdrawals would be strike as the information is duplicate and is engaged in the additional information.

One Step Ahead Annual Information Statement from 26AS Form

The latest section 285BB has been incorporated in budget 2020-21 inside the income tax act to make the better Form 26AS towards the ‘Annual Information Statement’ that separates from the TDS/ TCS information shall consist of the complete details regarding the mentioned fiscal transactions a payment of taxes demand/ refund and pending/completed proceedings has been considered through the assessee inside the specific fiscal year which needs to be written in the ITR.

Mentioning that in the former year in May the IT council has mentioned that the amended Form 26AS consists of the details on the higher value of the financial transactions in the fiscal year, an action that indeed operates the voluntary compliance and simplicity of e-filing the IT returns.

Over the last months, the IT council ordered the additional list of information is to be available inside Form 26AS.

Formats to Download New Annual Information Statement

The disclosed details are processed to eliminate the identical details and the assessee shall be enabled to download the new AIS (Annual Information Statement) details inside the PDF, JSON, CSV formats. If the assessee seems that the details are not true which concerns the new people or year, identical and much more a facility is being furnished to submit the online feedback. Some days before, the government has updated the JSON utility for E-filing ITR forms along with the MAC utility.

Towards every assessee, a rectified TIS gets created that displays the average value towards the assessee for the simplicity of furnishing the return. TIS mentioned that the processed value is the value created post to the deduplication of the data upon the grounds of the pre-defined rules and originated value known as the value originated post to acknowledge the assessee’s feedback and processed value. When the feedback gets furnished on AIS through the assessee then the created details inside the TIS shall be automatically modernized in real-time.

Towards the concern, if there is a variation amid the TDS or TCS details or the information of the assessee furnished which is shown inside the Form 26AS on TRACES portal along with the TDS or TCS details or the information concerning to the tax payment which is shown in AIS upon the compliance portal the assessee might lay on the details shown upon the TRACES portal towards the concern of Income-tax return filing and towards the purpose of the additional tax compliance.

Process to Download JSON Format AIS via Offline Utility

- Step 1: Open the new income tax portal website on Browser – URL: https://www.incometax.gov.in/iec/foportal

- Step 2: Then log in to your personal account using your Aadhaar Number or PAN card

- Step 3: After logging, next click on the link ‘AIS’ under that the ‘Services’ tab option

- Step 4: Download the annual Information Statement utility on the tax portal from the resource section

- Step 5: Next download AIS as JSON from the AIS section & import JSON in the offline AIS utility

- Step 6: Submit your feedback about the AIS utility & export the feedback file

- Step 7: After the feedback file then upload the output file & you are done

- Step 8: The resource can also be referred to the section concerned documents and also the HELP section in case any query arises by visiting the AIS homepage and you can also make a quick call on 1800-103-4215 for a better resolution.

How to Download New AIS on ITR 2.0 Portal?

- Step 1 – Check into the latest income tax e-filing portal using the Aadhaar or PAN CARD & your password.

- Step 2 – Then Go to the ‘Services’ top section & click on ‘Annual Information Statement (AIS).

- Step 3 – Now to Download the statement of AIS in PDF format

- Step 4 – Choose either the PDF or the JSON option & click on ‘Download’.

- Step 4 – Click PDF & enter the right password.

- Step 5 – The password will be your PAN + your date of birth.

- Example: AAAAA0000A01011991

- Step 6 – After entering the password one can see all the information in your AIS. one can indeed upload the updates AIS through the identical method.

Download New AIS by Gen IT Software in PDF Format

See here complete information about view and downloading the new Annual Information Statement (AIS) via Gen Income tax software step by step. The SAG Infotech company has added more new features like AIS/TIS & Consolidated Reports in Gen ITR software for easy reporting and hassle-free compliance

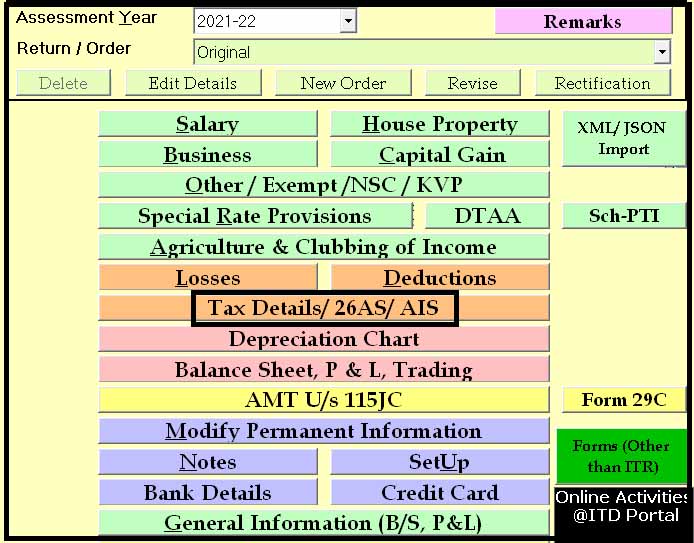

Step 1: Open the Gen IT software

Step 2: Go to ‘Income tax’ then click ‘computation’

Step 3: Now click on ‘Tax Details/ Form 26AS/ AIS’

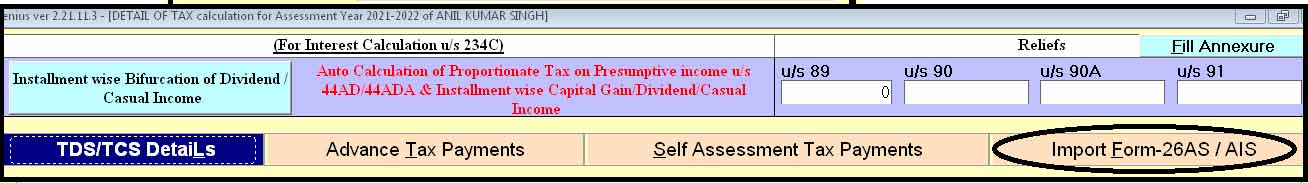

Step 4: Then move to cursor ‘Import Form 26AS and AIS’

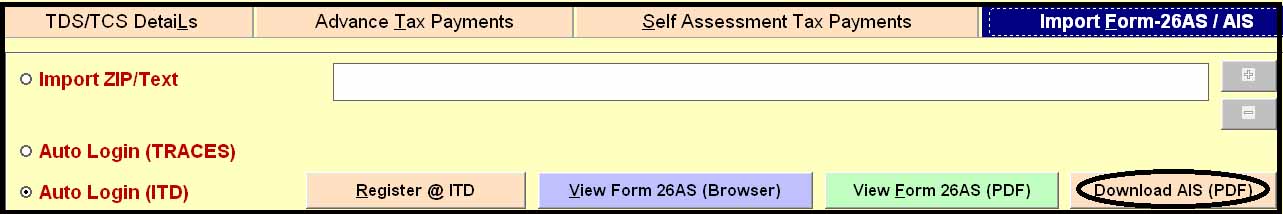

Step 5: Final to click ‘Download AIS’ in PDF format

There is no information as how to report discrepancies in the AIS while filing ITR and how to get AIS corrected. kindly guide.

Thanks.