Taxpayers must have to submit their certain Income tax Returns under the specified time span to escape fines. However, there are majorly two documents that one should require for filing their annual returns namely form 16 and form 26AS. These two documents are equivalent and should match in all ways to ensure that your Income Tax Return is perfect.

Know About TDS Certificate Form 16

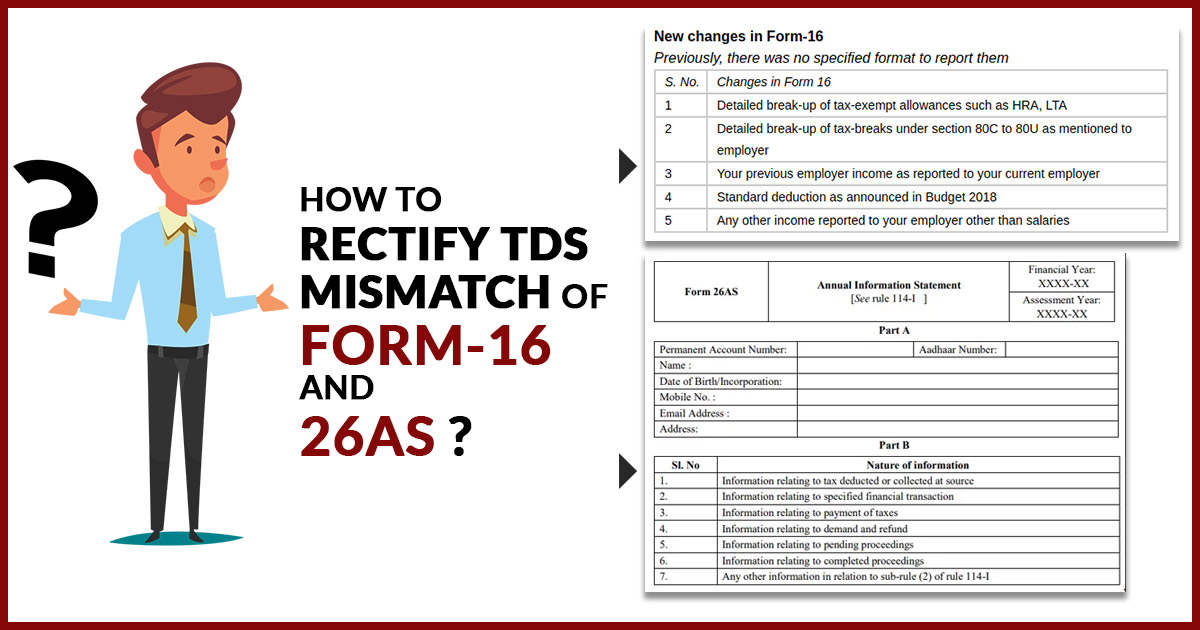

Form 16 is considered a TDS certificate published under section 203 of the Income Tax deducted at source by the employer and remitted by him/ her to the Income Tax Department. It has all the descriptions of how much tax the employer deducted and when it was submitted to the Income Tax department.

Tax Collected Source Form 26AS

Form 26 AS will equip information considering the tax deducted at source (TDS), and tax collected at source (TCS). This form indulges info on tax deducted from your income by deductors, details of the tax collected by collectors, advance tax paid by the taxpayer, self-assessment tax payments, regular assessment tax installed by the taxpayers (Permanent Account Number holders) details of the refund gained by you meanwhile the financial year, and details of the High- value Transactions in order of shares, mutual fund, etc.

TDS Mismatch Causes Between Form 26AS & Form 16

If you received a mismatch of TDS Form 26AS and Form 16/16A, you might prior want to find out the mistake that resulted. It will assist you in making the right steps towards correcting and disparities. For this, you need to prior differentiate both forms and see which entries are not showing in Form 26AS.

Here are the common mistakes that led to TDS mismatch :

- The person decreasing TDS has not filed a TDS return

- The altered amount is specified in the TDS return

- Incorrect PAN number of employee stated by the deductor

- Incorrect PAN and TAN numbers of the deductor mentioned

- Incorrect Challan identification number of the TDS payment quoted in the TDS Return

- Incorrect Assessment year mentioned in TDS Return

- Any detail of TDS payment ignored from the TDS return

- Challan -wise appendix in the TDS Statement does not state details of the employee like name or gender

- Wrong or excess TDS declared in the return

Proper Solution of TDS Mismatch in Form 16 & Form 26AS

The time you differentiate the forms and find out the mistakes, you should inform the person responsible for decreasing TDS from your income, i.e. your employer. In case the reason for the mismatch is an error from your employer’s side, it is easier and faster for them to make corrections. The employer has to file an amended TDS return. Make sure that the details are right in the revised TDS return to ignore the mismatch.

Read Also: Due Dates for E-Filing of TDS/TCS Return

If you get a notice from the Income Tax department regarding a tax credit mismatch, then you can counter it online via the Income-Tax e-filing portal. You are required to select ‘Taxpayer is rectifying data for Tax Credit Mismatch only’ via the options and fill in the accurate details.

Filing of the repeated TDS Return will take time, and even afterwards the repeated version is filed, it takes more time for the rectification to reflect in Form 26AS systematically. To file your income tax return online, Form 26AS can be penetrated from your Income Tax e-filing account.

In my case, the TDS is reflected in Form 26AS, but when I file my returns with the form3, it is not picked up ans shows TDS 0