Till now, the ITR filers who had submitted their ITR for FY 2024-25 ( AY 2025-26) are still waiting for the tax refund. A month has passed since many taxpayers submitted their income tax returns. However, no refund has been given to all such taxpayers. This year, the procedure of refund procedure seems to be slower than usual.

Taxpayers’ Responses on the Social Media Platform

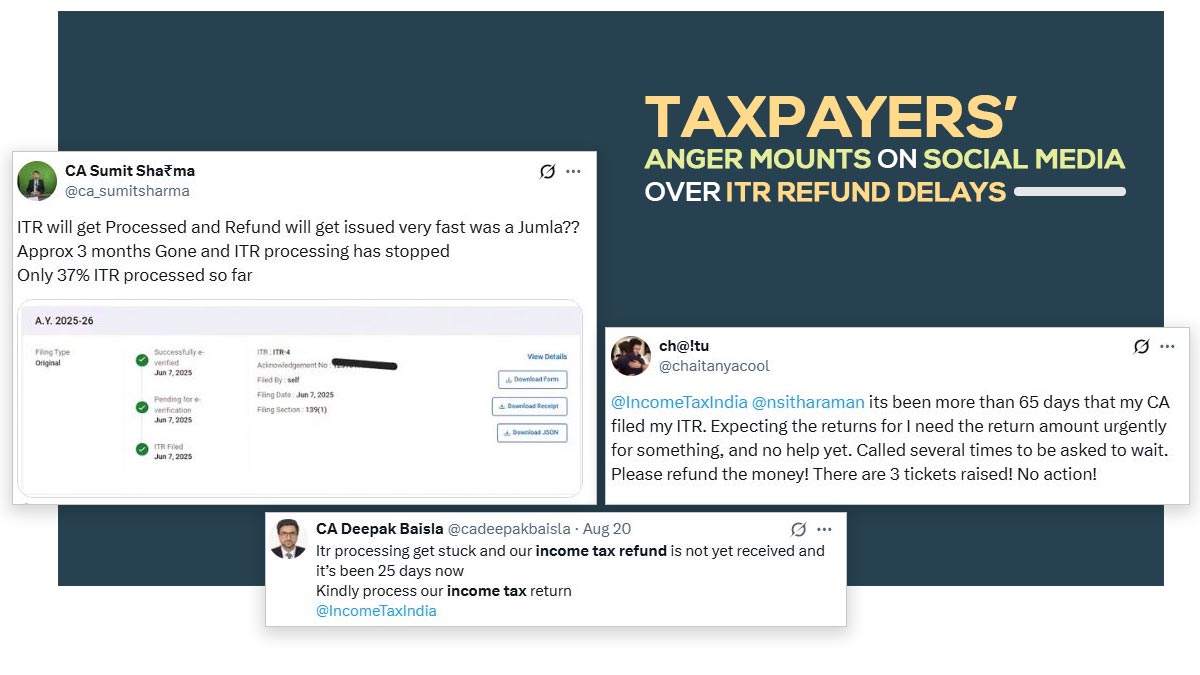

Users are reacting on the social media platform X. Some expressed that they have been waiting since June, and some specify that they require money for medical or personal emergencies, but the refunds are still pending.

Only around 37% of income tax returns (ITRs) have been processed, and progress seems to have slowed, Chartered Accountants expressed.

People have been waiting since June or July, with some requiring their refund urgently for emergencies.

Authorities have been accused of making public claims for faster refunds that don’t get shown in reality.

What is your experience? Has the refund arrived, or are you waiting for the same?

Delay in ITR Refund: Check Reason Here

It is usual to have a delay in the income tax refunds. You need to validate your filed ITR within 30 days. It can be performed with the support of using Aadhaar OTP, net banking, or by mailing a signed acknowledgement to the CPC in Bengaluru. Your return shall not be valid if you do not verify your return, and your refund will not be processed.

The other reason for delays in refunds is the incorrect bank details. Because of bank mergers and IFSC code changes, refunds can bounce if your linked account cannot accept the transfer. You will receive an email alert in this case. It could get resolved when you update your bank details under “My Bank Details” in your income tax profile and request a “refund reissue.”

Also, reasons like incomplete ITR e-verification, wrong account details, or outdated addresses could delay refunds.

Another time, a trivial delay can take place if taxpayers do not finish the e-verification procedure correctly, or there might be an incorrect account number entered, or an outdated mailing address available. The accuracy is then the preferred choice over speed for the tax department in which filters the incorrect claims before the disbursement of the refunds.

If the tax credit on your return doesn’t match your Form 26AS or Annual Information Statement, there is a chance of delayed refunds. Till you solve the same mismatch by raising a grievance with the CPC, the department can hold your refund.

Every single return faces scrutiny, whether it is firm validation of bank details, or the cross-matching of declared income with the incomes reported by deductors, TDS (Tax Deducted at Source), and advance tax payments made.

The discrepancy (if any), even the small mismatch between the shown amount in the return of the taxpayer and the reported amount from the employers, banks, or financial institutions, gives rise to a suspicion warranting further examination.

Read Also: Easy Guide to Check Income Tax Return (ITR) Status Online

Thus, it is recommended that taxpayers to file their return should not wait for the last day, September 15, as this could worsen delays with millions of returns waiting in line, ready to be processed.