A series of tax orders issued under GST notification No. 56/2023–Central Tax, dated 28.12.2023, has been quashed by the Madras High Court, which found the notification to be arbitrary, ultra vires, and void.

The impugned notification, issued u/s 168A of the CGST Act, 2017, could not validly extend the limitation period for issuing orders u/s 73 without any exceptional circumstances, Justice Krishnan Ramasamy cited.

The Court said that Section 168A permits such extension for cases of exceptional circumstances like war, epidemic, or natural disaster, and there is no occurrence out of them at the time of the issuance of Notification No. 56/2023.

The court relied on its ruling in Tata Play Ltd., which specifies the illegality of Notification Nos. 9 and 56 of 2023 issued u/s 168A of the CGST Act. The Court in Tata Play ruled that the benefit of exclusion of the period from 15.03.2020 to 28.02.2022, as ordered by the Apex Court under Article 142, cannot be nullified or shortened by any executive notification. Notification No. 56/2023, which tried to override this benefit and redefine the limitation, was therefore declared legally unsustainable.

The Madras High Court, applying the same decision, said that the notification was not applicable to legally revive the time-restricted proceedings.

Both the assessment orders issued in Form GST DRC-07 and the legality of the notification itself have been contested by the applicants, claiming that their rights under Articles 14, 19(1)(g), and 21 of the Constitution were infringed.

As per that, the Madras High Court declared that GST notification No. 56/2023 dated 28.12.2023 is breached and not legal. For the cases where the assessment or adjudication orders were contested, the court asked that these orders be considered as show cause notices permitting to filing of the objections within 8 weeks from the uploading date of the web copy of the order, post which the authorities would be required to pass the fresh orders after hearing.

Likewise, where the contest was to a notice, 8 weeks have been furnished before the applicant to answer. The batch of writ petitions has been disposed of by the court with these directions without charging costs, and closed the related miscellaneous petitions.

For setting aside the impugned orders, the state asked a pre-condition, quoting the long pendency of earlier petitions. The Madras high court refused the request, citing that previous similar cases had been remitted without any condition by a coordinate bench. It mentioned that the problem of levying the norms may be acknowledged in the upcoming matters.

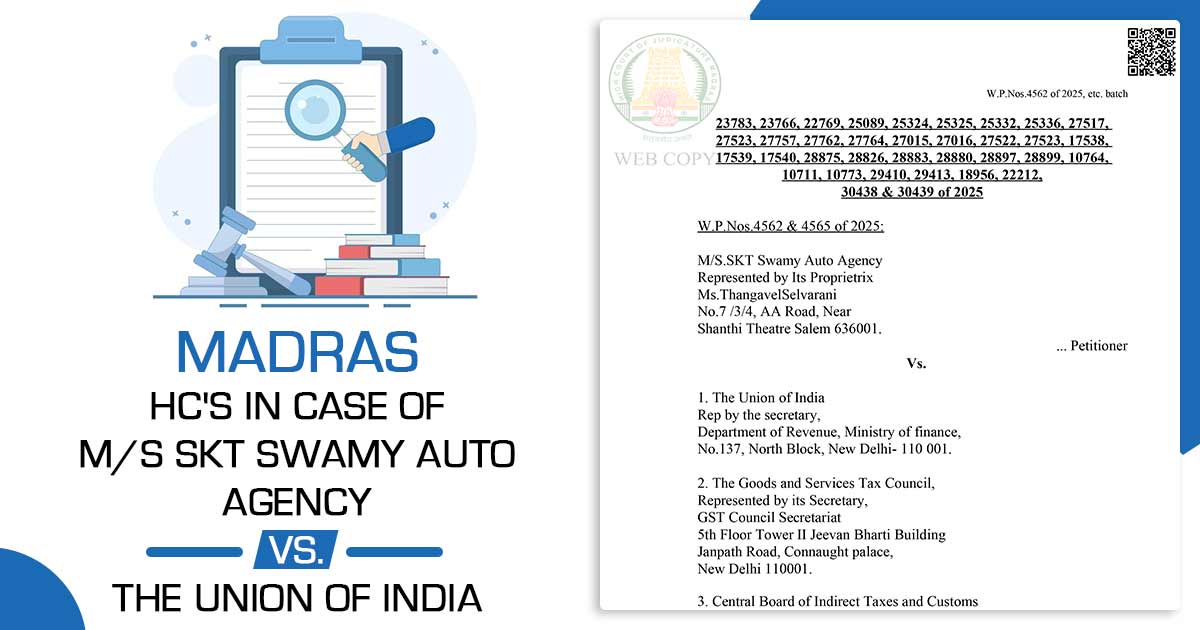

| Case Title | M/S SKT Swamy Auto Agency vs. The Union of India |

| Case No. | W.P.Nos.4562 & 4565 of 2025 |

| For Petitioner | Shanthi Theatre Salem |

| For Respondent | The Deputy State Officer Gugai Salem 1 Salem |

| Madras High Court | Read Order |